Healthcare professional network Doximity (NYSE:DOCS) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 6.4% year on year to $118.1 million. The company expects next quarter's revenue to be around $120 million, in line with analysts' estimates. It made a non-GAAP profit of $0.25 per share, improving from its profit of $0.14 per share in the same quarter last year.

Doximity (DOCS) Q1 CY2024 Highlights:

- Revenue: $118.1 million vs analyst estimates of $116.4 million (1.4% beat)

- Adjusted EBITDA: $56.4 million handily beat expectations of $51.1 million (10.4% beat)

- EPS (non-GAAP): $0.25 vs analyst estimates of $0.20 ($0.05 beat)

- Revenue Guidance for Q2 CY2024 is $120 million at the midpoint, roughly in line with what analysts were expecting (adjusted EBITDA guidance also ahead)

- Management raised revenue guidance for the upcoming financial year 2025 to $512 million at the midpoint, below analysts' estimates; however, full year adjusted EBITDA guidance was also raised and is ahead of expectations

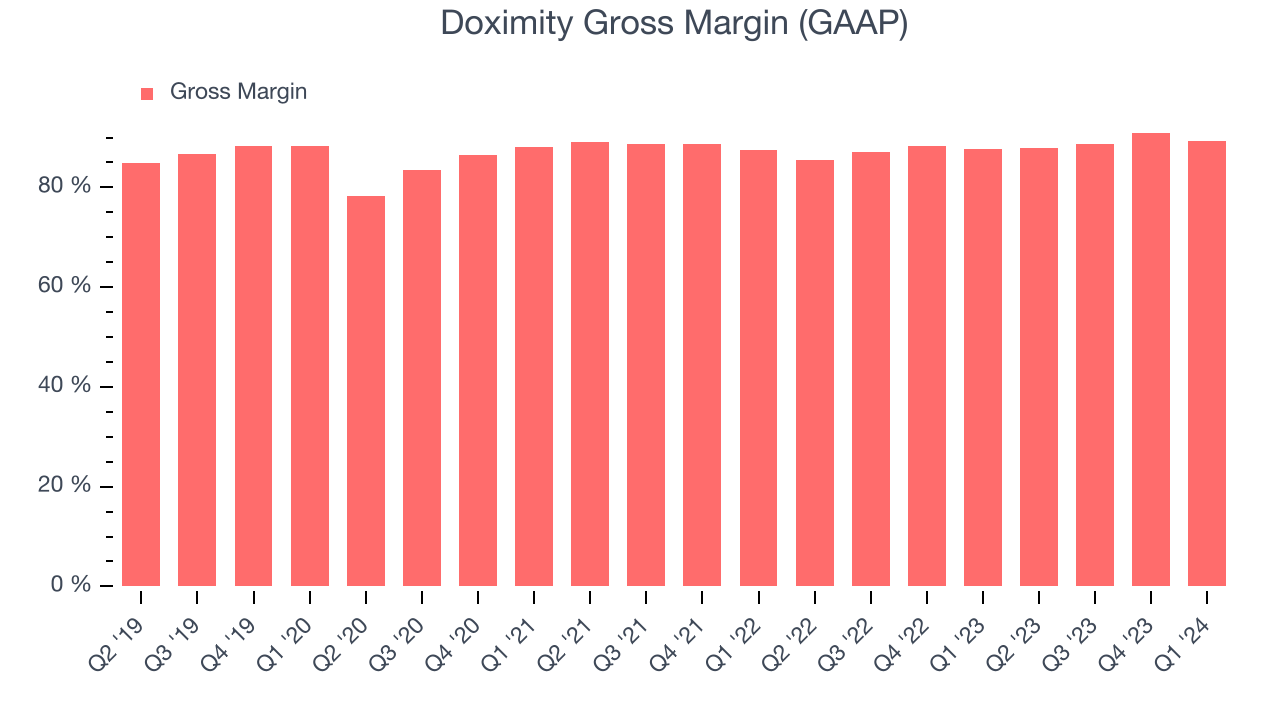

- Gross Margin (GAAP): 89.4%, up from 87.7% in the same quarter last year

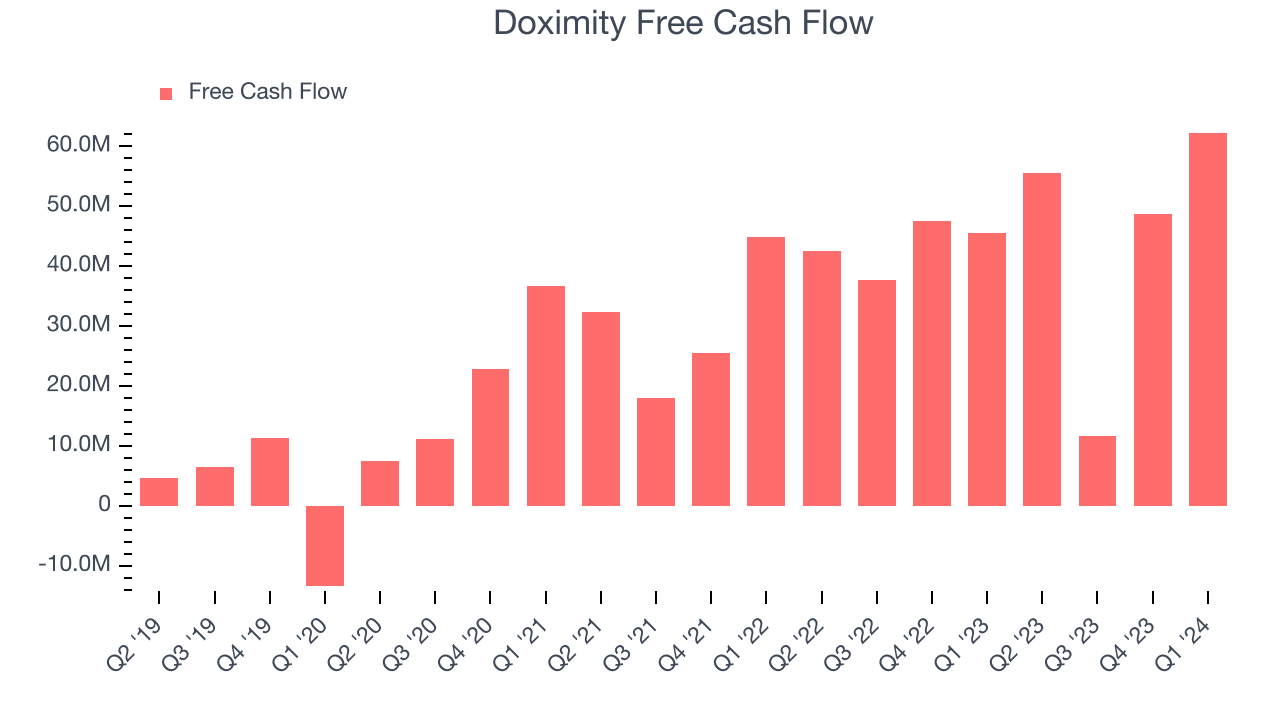

- Free Cash Flow of $62.31 million, up 27.9% from the previous quarter

- Market Capitalization: $4.45 billion

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading social network for U.S. medical professionals.

The U.S.healthcare system has lagged other sectors and industries in creating innovative technology solutions for basic issues. A primary example are electronic health records, which were mandated a decade ago, but still face interoperability issues. Additionally, doctors are challenged by fragmented knowledge bases which makes it difficult to stay on top of the latest developments in treatment and research, and it is often difficult to connect with top specialists around the country. Likewise, many pharmaceutical manufacturers and health systems don’t have a good source for targeted marketing campaigns or recruiting initiatives.

Doximity was created as a professional cloud-based platform to solve these issues, sort of a cross between LinkedIn and Salesforce.com. Membership for physicians is free, and Doximity provides workflow tools that enable them to collaborate with their colleagues, securely coordinate patient care, conduct virtual patient visits, stay up-to-date with the latest medical news and research, and manage their careers. With a majority of US doctors on the platform, Doximity has become the default US medical professional network, with network effects helping it to sustain its position.

The company’s business model is largely subscription based marketing, with large pharmaceutical companies and health care systems able to direct tailored content to an aggregated collection of specialists across any field. Other revenue generators include Dialer, Doximity’s Telehealth tool, and Hiring solutions, which are recruiting tools.

Healthcare And Life Sciences Software

The coronavirus pandemic has underscored the importance of high-quality health infrastructure in times of crisis. Coupled with intense competition between drugmakers and the growing volume of data in the health care sector, demand for data management solutions in the healthcare space is expected to remain strong in the years ahead.

Doximity’s competitors on the advertising side of the business include Microsoft’s LinkedIn (NASDAQ: MSFT), Facebook (NASDAQ: FB), along with Google (NASDAQ: GOOGL), and Twitter (NASDAQ: TWTR). On the telehealth side, Doximity’s chief rivals include American Well Corporation (NYSE: AMWL) and Teladoc Health (NYSE: TDOC).

Sales Growth

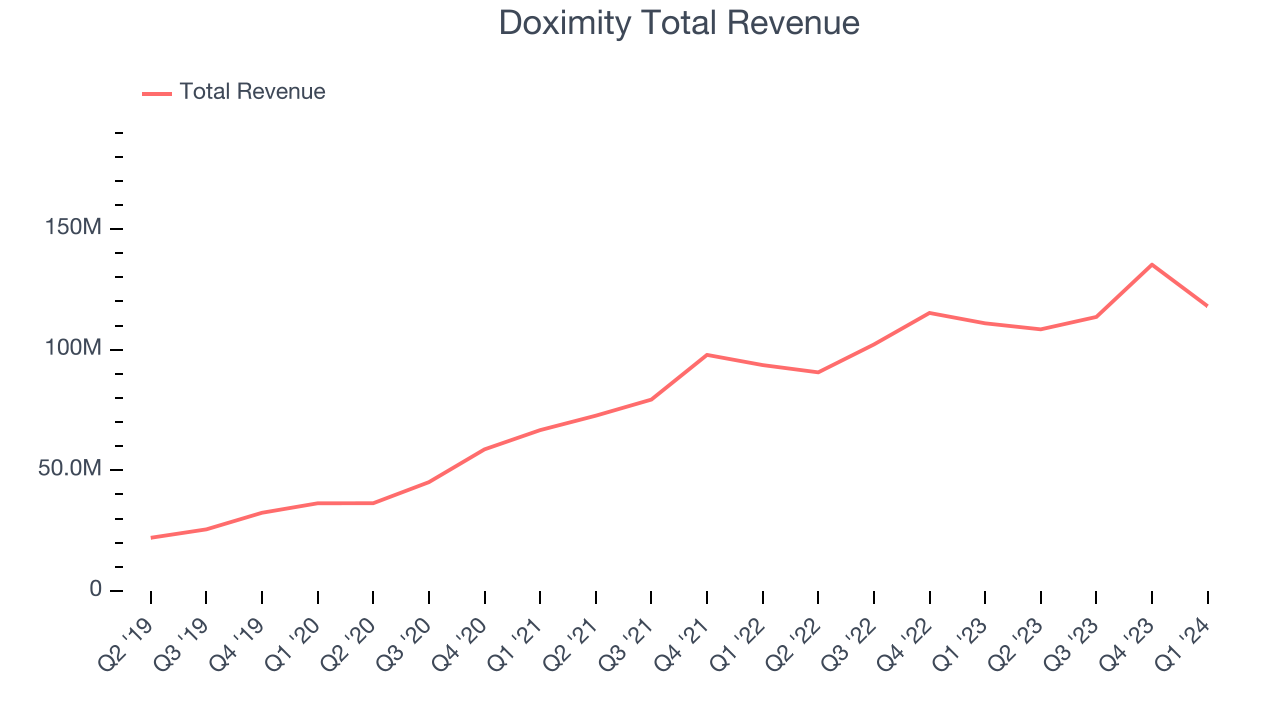

As you can see below, Doximity's revenue growth has been very strong over the last three years, growing from $66.69 million in Q4 2021 to $118.1 million this quarter.

Doximity's quarterly revenue was only up 6.4% year on year, which might disappoint some shareholders. On top of that, the company's revenue actually decreased by $17.23 million in Q1 compared to the $21.67 million increase in Q4 CY2023. Regardless, we aren't too concerned because Doximity's sales seem to follow a seasonal pattern and management is guiding for revenue to rebound in the coming quarter.

Next quarter's guidance suggests that Doximity is expecting revenue to grow 10.6% year on year to $120 million, slowing down from the 19.7% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $512 million at the midpoint, growing 7.7% year on year compared to the 13.5% increase in FY2024.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Doximity's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 89.4% in Q1.

That means that for every $1 in revenue the company had $0.89 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite its recent drop, Doximity still has an excellent gross margin that allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Doximity's free cash flow came in at $62.31 million in Q1, up 36.6% year on year.

Doximity has generated $178.3 million in free cash flow over the last 12 months, an eye-popping 37.5% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Doximity's Q1 Results

This was a beat and raise quarter. The company beat on revenue, adjusted EBITDA, and EPS in the quarter. Next quarter's revenue and adjusted EBITDA guidance both came in higher than Wall Street's estimates. Furthermore, the company raised its full year revenue and adjusted EBITDA guidance. Overall, this was a solid quarter for Doximity. The stock is flat after reporting and currently trades at $23.99 per share.

Is Now The Time?

When considering an investment in Doximity, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Doximity is a solid business. We'd expect growth rates to moderate from here, but its revenue growth has been strong over the last three years. And while its customer acquisition is less efficient than many comparable companies, the good news is its bountiful generation of free cash flow empowers it to invest in growth initiatives. On top of that, its impressive gross margins indicate excellent business economics.

Given its price-to-sales ratio of 9.2x based on the next 12 months, the market is certainly expecting long-term growth from Doximity. There are definitely things to like about Doximity, and there's no doubt it's a bit of a market darling, at least for some. But when comparing the company against the broader tech landscape, it seems there's a lot of good news already priced in.

Wall Street analysts covering the company had a one-year price target of $29.77 right before these results (compared to the current share price of $23.99).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.