Fresh produce company Dole (NYSE:DOLE) missed analysts' expectations in Q4 CY2023, with revenue up 1.5% year on year to $2.07 billion. It made a non-GAAP profit of $0.16 per share, down from its profit of $0.18 per share in the same quarter last year.

Dole (DOLE) Q4 CY2023 Highlights:

- Revenue: $2.07 billion vs analyst estimates of $2.17 billion (4.7% miss)

- EPS (non-GAAP): $0.16 vs analyst estimates of $0.10 ($0.06 beat)

- Gross Margin (GAAP): 7.3%, down from 7.4% in the same quarter last year

- Free Cash Flow of $123.4 million, up 51.6% from the previous quarter

- Market Capitalization: $1.09 billion

Cherished for its delicious, world-famous pineapples and Hawaiian roots, Dole (NYSE:DOLE) is a global agricultural company specializing in fresh fruits and vegetables.

The company was founded in 1901 as the Hawaiian Pineapple Company by James Dole, the “Pineapple King”. Dole’s enterprise was acquired by Castle & Cooke in 1961, who diversified it into other areas of the food industry, and it was once again bought in 1985 by entrepreneur and businessman David Murdock, whose involvement marked a turning point in the company's history.

Murdock recognized Dole’s potential for global growth and aggressively expanded its operations, transforming it into a multi-national corporation. Today, Dole is one of the world's largest producers and distributors of fresh fruits and vegetables, and its portfolio includes not only pineapples but also bananas, strawberries, salads, and more.

To maintain its complex operations, Dole leverages its well-established network of farms, packing facilities, and distribution centers spanning multiple continents, including North America, Latin America, Europe, Asia, and Africa. This extensive supply chain allows Dole to source fresh produce from different regions, ensuring a year-round supply of fruits and vegetables. Few competitors can match Dole's global presence and logistical capabilities.

The company partners with grocery stores, supermarkets, and convenience stores to sell its products. It also supplies restaurants, hotels, and catering companies with fresh produce.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Competitors in the fresh produce category include Calavo Growers (NASDAQGS:CVGW), Fresh Del Monte (NYSE:FDP), and Mission Produce (NASDAQGS:AVO) along with private companies Chiquita Brands International and Sunkist Growers.Sales Growth

Dole is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

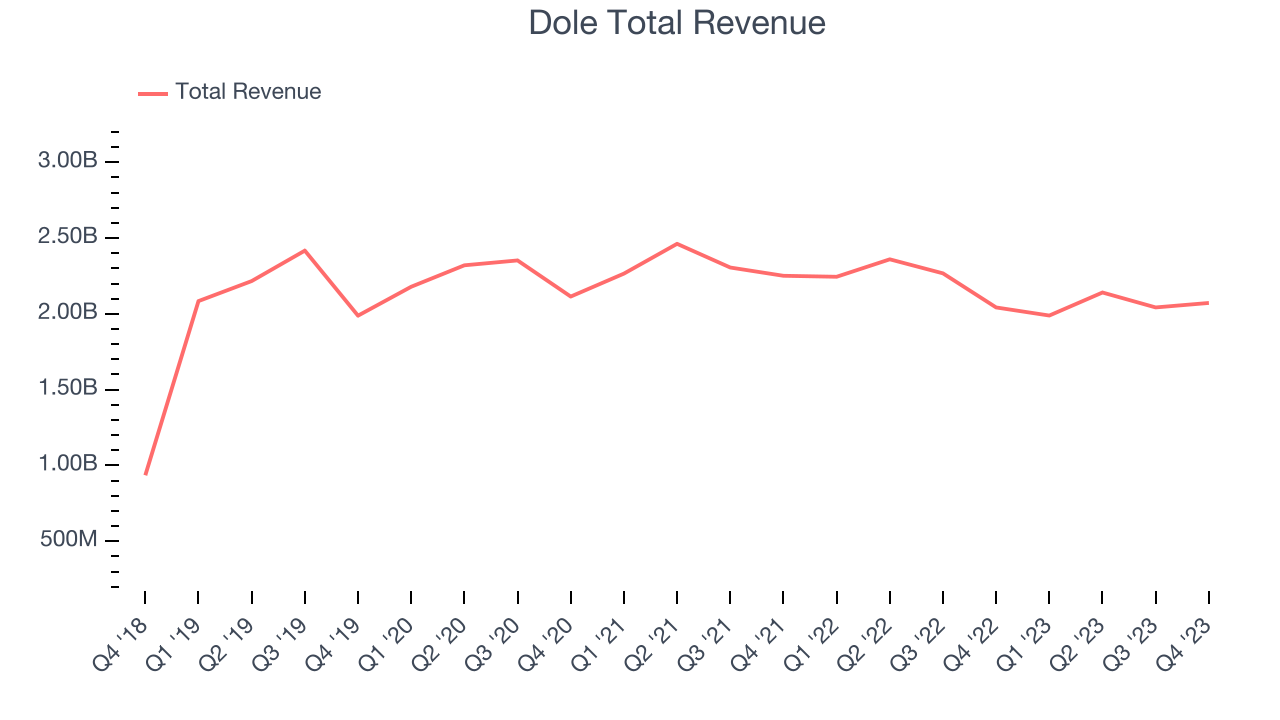

As you can see below, the company's revenue has declined over the last three years, dropping 2.8% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Dole's revenue grew 1.5% year on year to $2.07 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 6.4% over the next 12 months, an acceleration from this quarter.

Gross Margin & Pricing Power

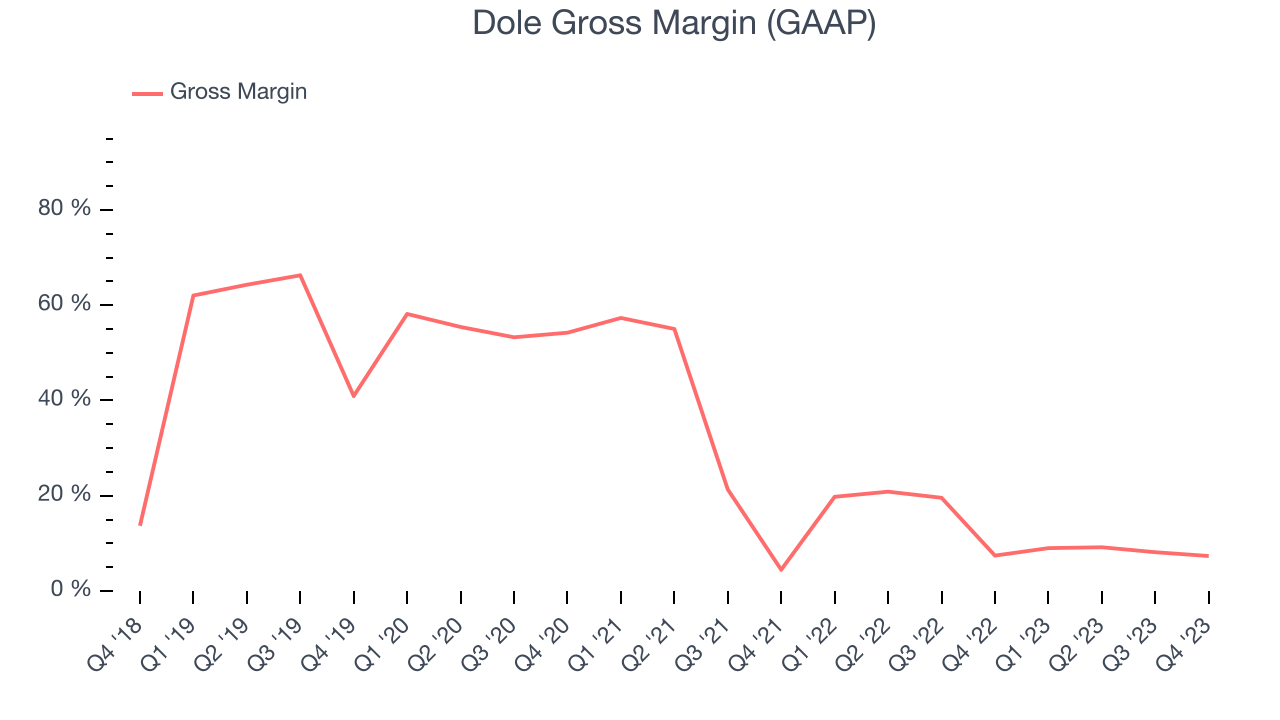

Dole's gross profit margin came in at 7.3% this quarter, in line with the same quarter last year. That means for every $1 in revenue, a chunky $0.93 went towards paying for raw materials, production of goods, and distribution expenses.

Dole has poor unit economics for a consumer staples company, leaving it with little room for error if things go awry. As you can see above, it's averaged a paltry 13% gross margin over the last two years. Its margin has also been trending down over the last year, averaging 42.5% year-on-year decreases each quarter. If this trend continues, it could suggest a more competitive environment where Dole has diminishing pricing power and less favorable input costs (such as raw materials).

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

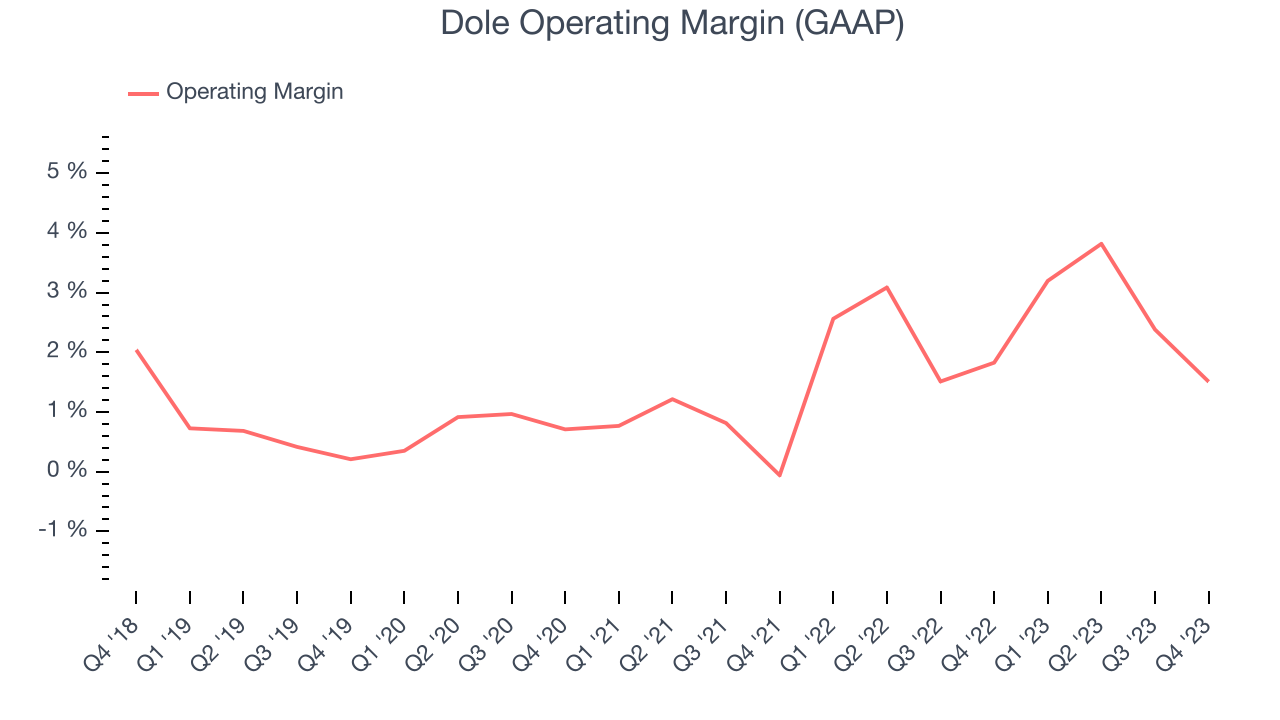

In Q4, Dole generated an operating profit margin of 1.5%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Dole was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 2.5%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.

Zooming out, Dole was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 2.5%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.EPS

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

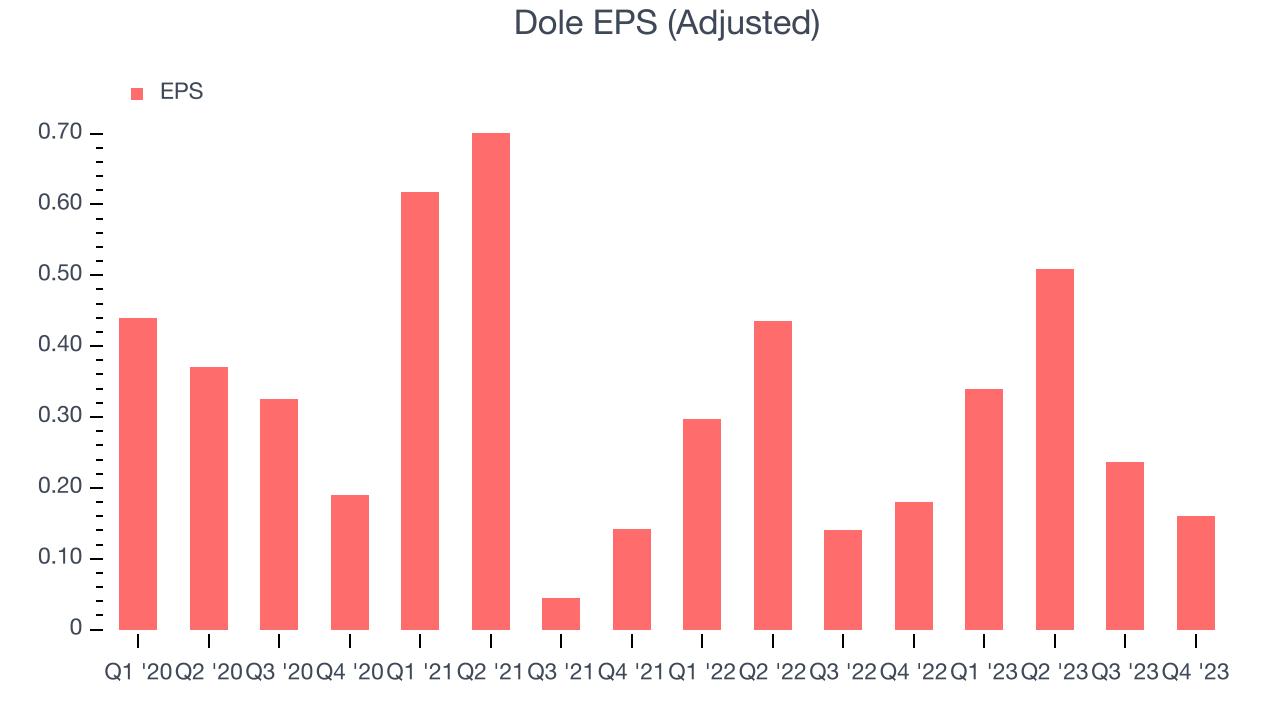

In Q4, Dole reported EPS at $0.16, down from $0.18 in the same quarter a year ago. This print beat Wall Street's estimates by 54.8%.

Between FY2020 and FY2023, Dole's EPS dropped 5.9%, translating into 2% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 8.3% year-on-year increase in EPS.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

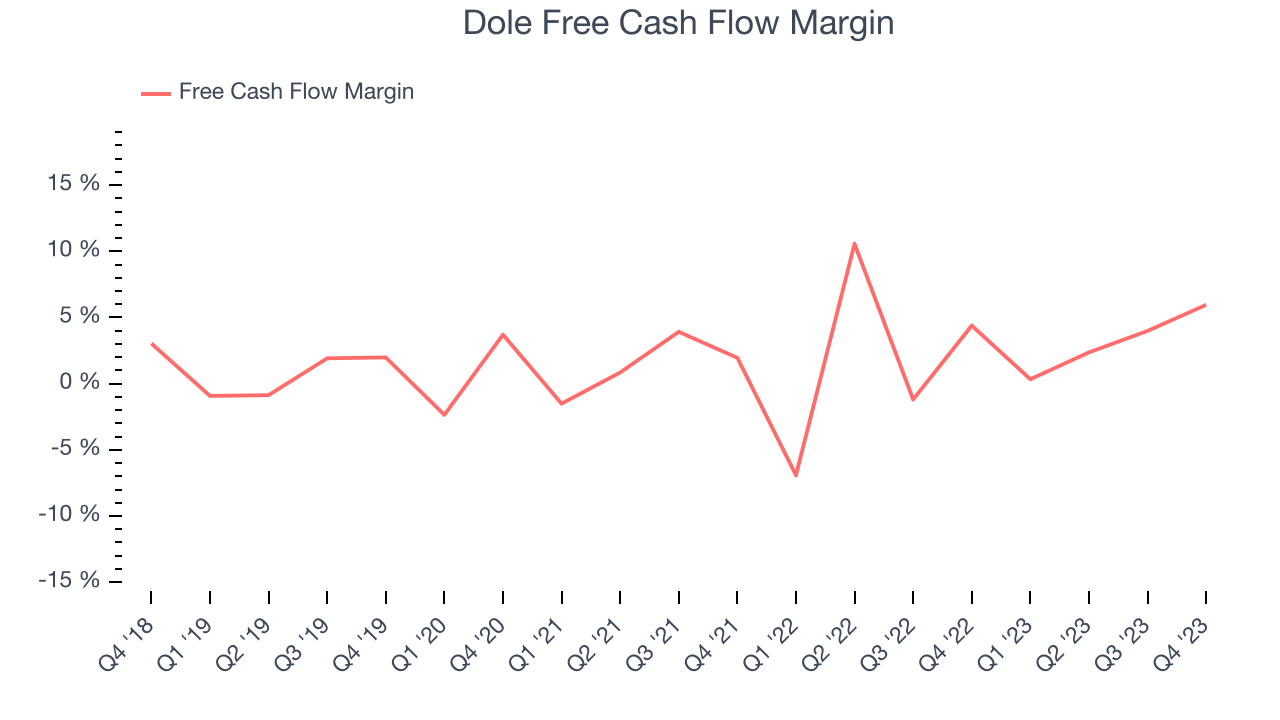

Dole's free cash flow came in at $123.4 million in Q4, up 37.6% year on year. This result represents a 6% margin.

Over the last eight quarters, Dole has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 2.4%, subpar for a consumer staples business. However, its margin has averaged year-on-year increases of 1.4 percentage points over the last 12 months. Continued momentum should improve its cash flow prospects.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

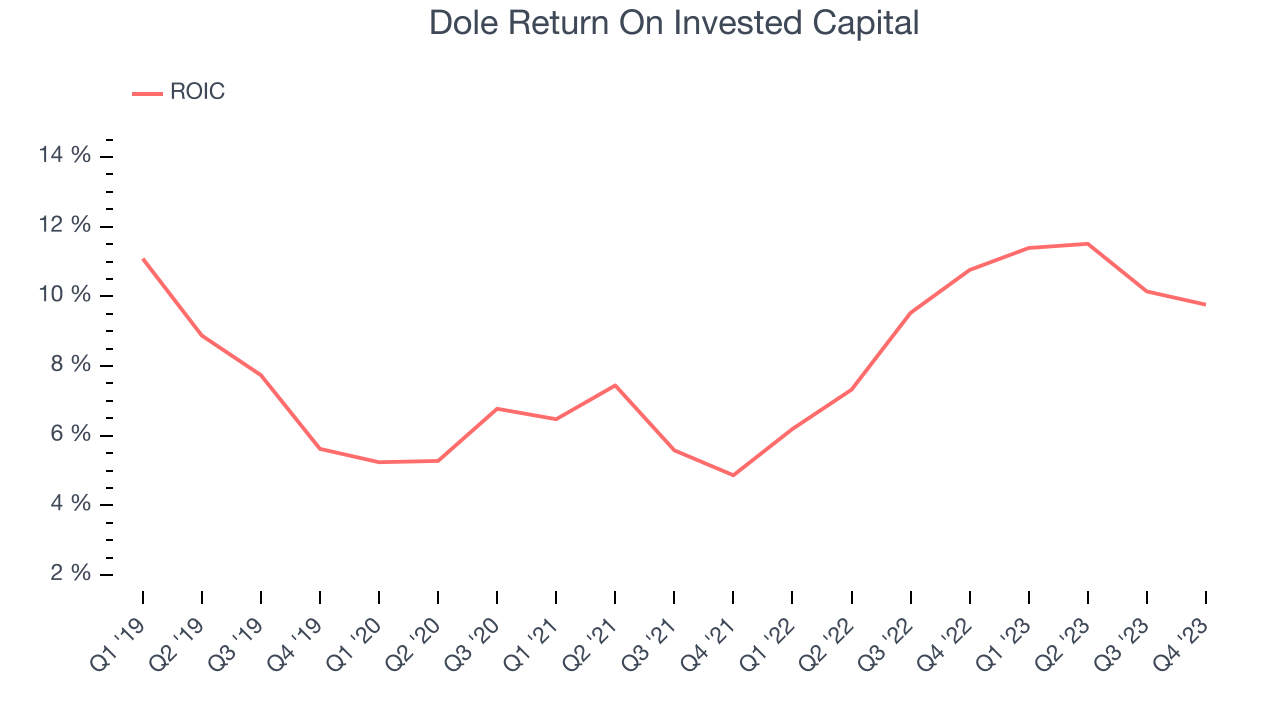

Dole's five-year average ROIC was 7.8%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Dole's ROIC averaged 5 percentage point increases. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Dole reported $275.6 million of cash and $856.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $339.9 million of EBITDA over the last 12 months, we view Dole's 1.7x net-debt-to-EBITDA ratio as safe. We also see its $71.03 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Dole's Q4 Results

We were impressed by how significantly Dole blew past analysts' EPS expectations this quarter. We were also happy its operating margin narrowly outperformed Wall Street's estimates. On the other hand, its revenue unfortunately missed analysts' expectations and its gross margin missed Wall Street's estimates. Overall, this was a mixed quarter for Dole. The stock is flat after reporting and currently trades at $11.38 per share.

Is Now The Time?

When considering an investment in Dole, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for all companies serving consumers, but in the case of Dole, we'll be cheering from the sidelines. Its revenue has declined over the last three years, but at least growth is expected to increase in the short term. And while its well-known brand makes it a household name consumers consistently turn to, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses. On top of that, its operating margins are below average compared to other consumer staples companies.

Dole's price-to-earnings ratio based on the next 12 months is 8.5x. While there are some things to like about Dole and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $15.57 per share right before these results (compared to the current share price of $11.38).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.