Fast-food pizza chain Domino’s (NYSE:DPZ) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 5.9% year on year to $1.08 billion. It made a GAAP profit of $3.58 per share, improving from its profit of $2.93 per share in the same quarter last year.

Domino's (DPZ) Q1 CY2024 Highlights:

- Revenue: $1.08 billion vs analyst estimates of $1.08 billion (small beat)

- EPS: $3.58 vs analyst estimates of $3.40 (5.4% beat)

- Gross Margin (GAAP): 28.7%, up from 26.6% in the same quarter last year

- Free Cash Flow of $103.3 million, down 15.8% from the previous quarter

- Same-Store Sales were up 5.6% year on year

- Store Locations: 20,755 at quarter end, increasing by 747 over the last 12 months

- Market Capitalization: $17.38 billion

Founded by two brothers in Michigan, Domino’s (NYSE:DPZ) is a globally recognized pizza chain known for its creative marketing and fast delivery.

The legendary brand was started in 1960 when Tom and James Monaghan purchased a small pizza store called DomiNick's. To fund the acquisition, Tom, an avid car collector and college student, raised capital by selling his prized collection.

Since then, Domino’s has evolved into a pizza powerhouse and expanded its menu to include specialty pizzas, lava cakes, and its delicious Bread Twists, which are “the best thing since sliced bread”.

Its success can be attributed to its innovative marketing and focus on delivering pizzas quickly. Some iconic stunts include its infamous “The Noid” mascot, the antihero and saboteur of quality, and delivery promise of “30 minutes or less”, which became a hallmark of the company's commitment to speed and customer satisfaction.

Domino’s true differentiator, however, is its dense network of stores and technology. The company’s “fortressing” strategy, which involves opening many stores in a concentrated area, improves delivery times and brand awareness, while its advanced computerized system streamlines ordering, empowering customers to know exactly when a pizza is assembled, put in the oven, and ultimately ready for pickup or delivery in their mobile app. These investments have enabled Domino’s to become the number one pizza brand by market share.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Fast-food pizza competitors include public companies Papa John’s (NASDAQ:PZZA) and Pizza Hut (owned by Yum! Brands, NYSE:YUM) as well as private company Little Caesars.Sales Growth

Domino's is one of the larger restaurant chains in the industry and benefits from a strong brand, giving it customer mindshare and influence over purchasing decisions.

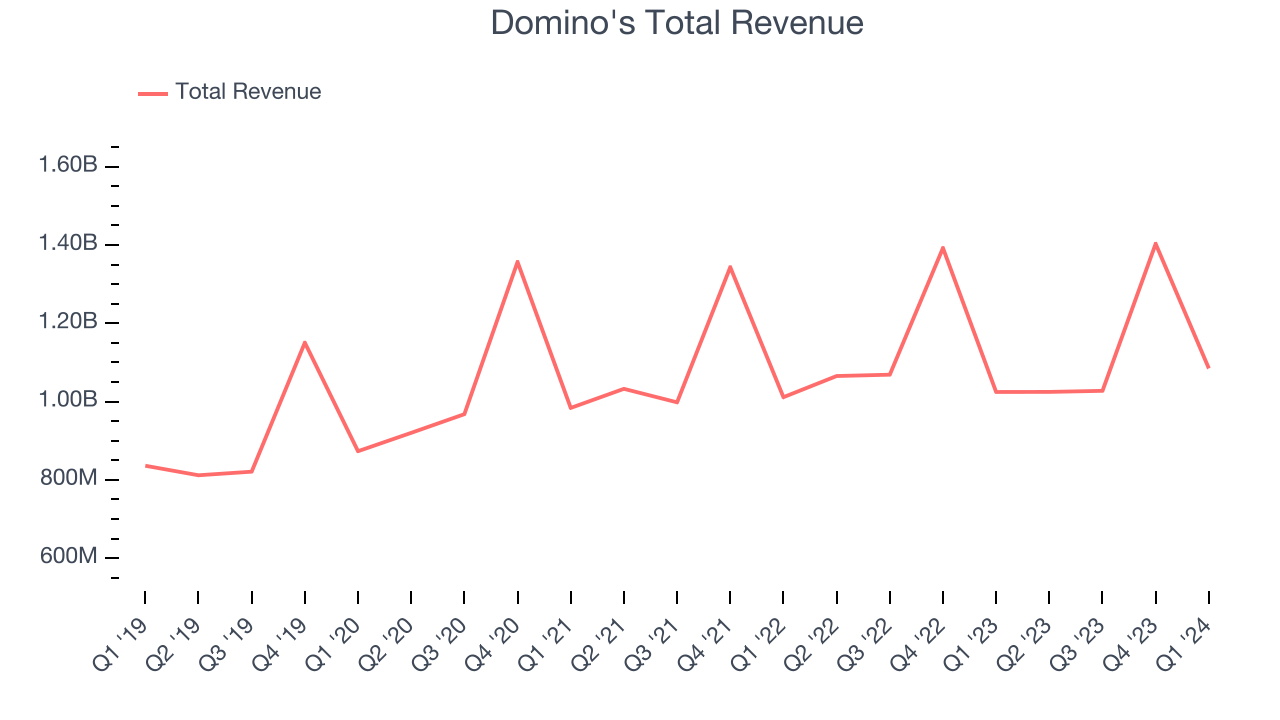

As you can see below, the company's annualized revenue growth rate of 5.4% over the last five years was weak , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Domino's grew its revenue by 5.9% year on year, and its $1.08 billion in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 7.4% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

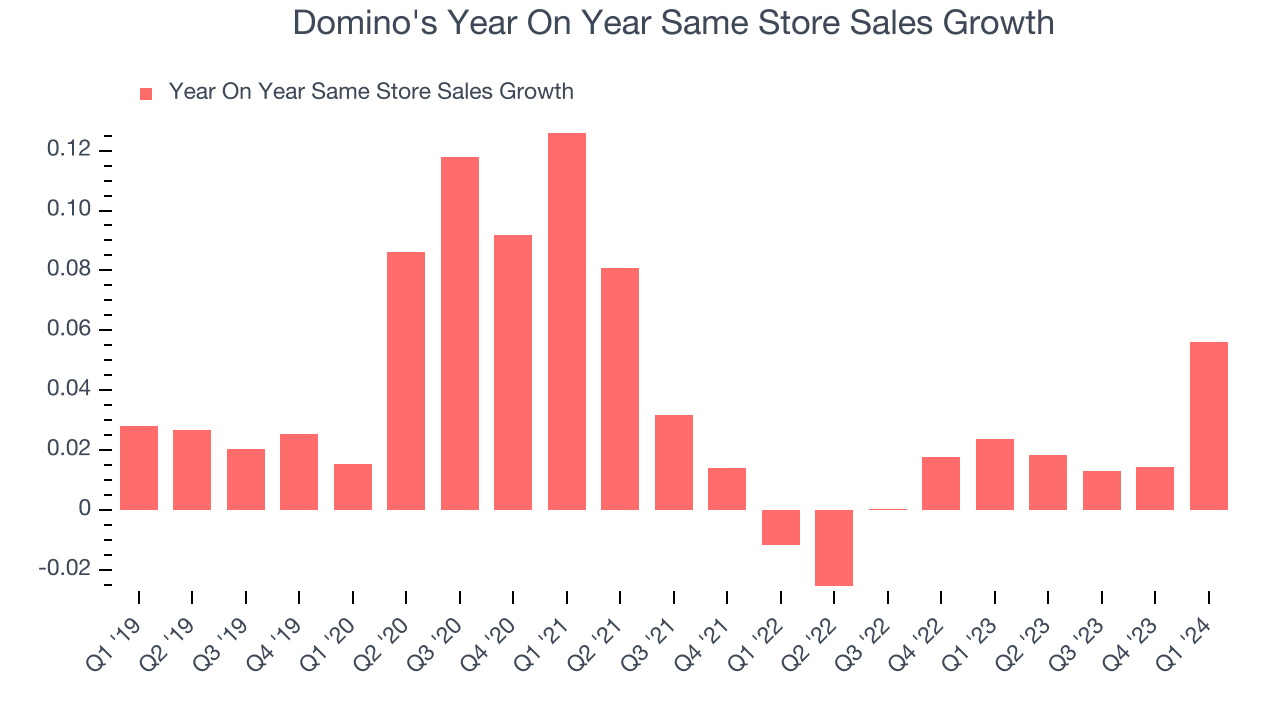

Domino's demand within its existing restaurants has been relatively stable over the last eight quarters but fallen behind the broader sector. On average, the company's same-store sales have grown by 1.5% year on year. With positive same-store sales growth amid an increasing number of restaurants, Domino's is reaching more diners and growing sales.

In the latest quarter, Domino's same-store sales rose 5.6% year on year. This growth was an acceleration from the 2.4% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Number of Stores

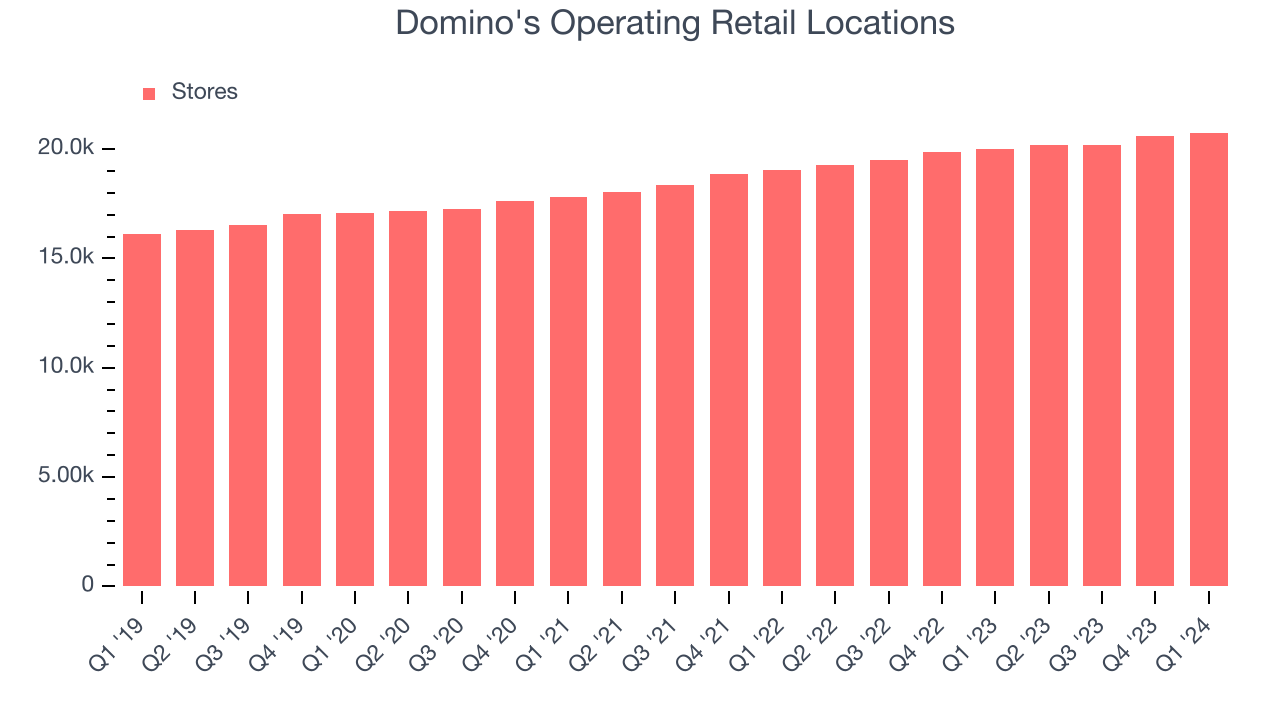

When a chain like Domino's is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Domino's restaurant count increased by 747, or 3.7%, over the last 12 months to 20,755 locations in the most recently reported quarter.

Over the last two years, Domino's has rapidly opened new restaurants, averaging 4.9% annual increases in new locations. This growth is among the fastest in the restaurant sector. Analyzing a restaurant's location growth is important because expansion means Domino's has more opportunities to feed customers and generate sales.

Gross Margin & Pricing Power

Gross profit margins are an important measure of a restaurant's pricing power and differentiation, whether it be the dining experience or quality and taste of food.

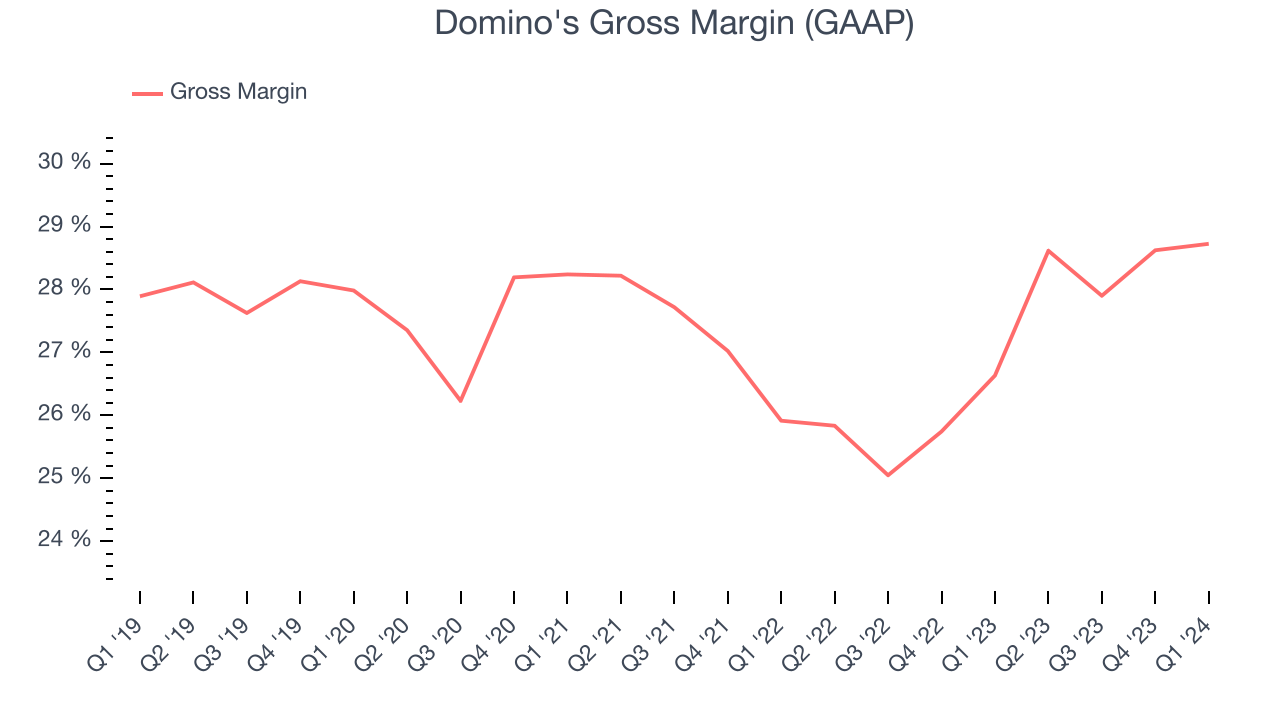

Domino's gross profit margin came in at 28.7% this quarter. up 2.1 percentage points year on year. This means the company makes $0.27 for every $1 in revenue before accounting for its operating expenses.

Domino's unit economics are higher than the typical restaurant company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see above, it's averaged a decent 27.1% gross margin over the last eight quarters. Its margin has also been trending up over the last 12 months, averaging 10.3% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more stable input costs (such as ingredients and transportation expenses).

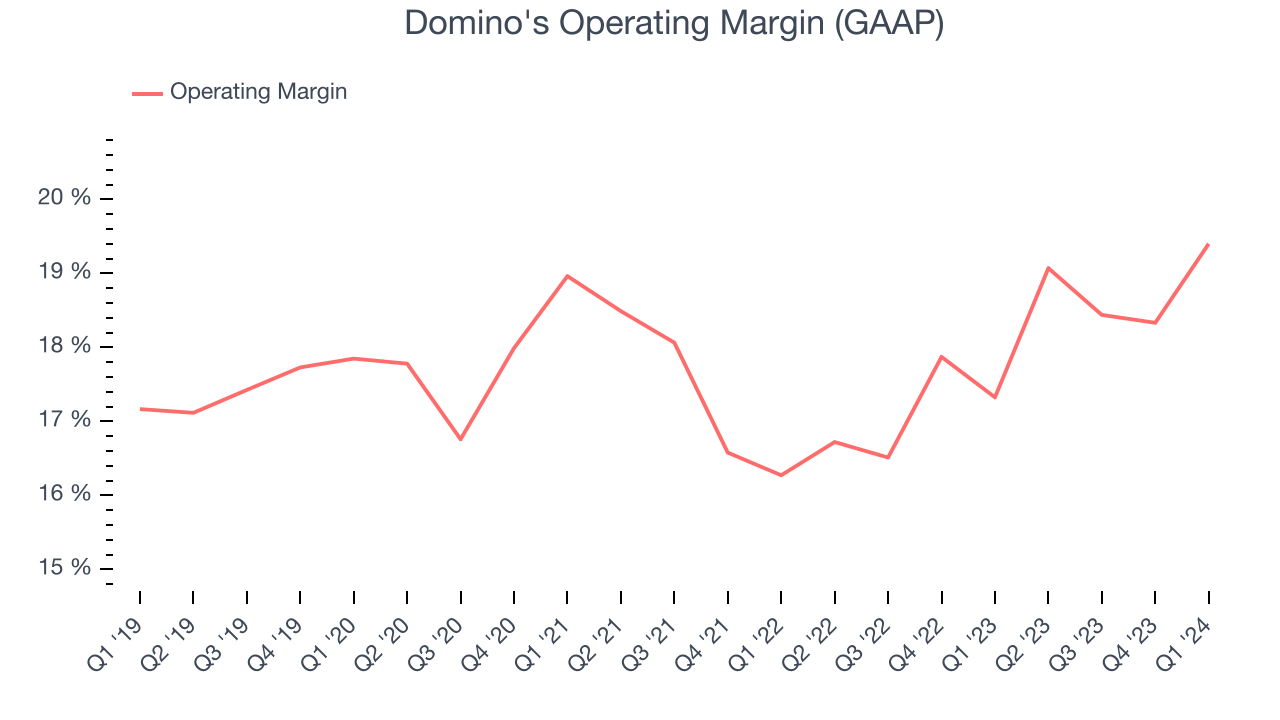

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Domino's generated an operating profit margin of 19.4%, up 2.1 percentage points year on year. This increase was encouraging and driven by stronger pricing power or lower ingredient/transportation costs, as indicated by the company's larger rise in gross margin.

Zooming out, Domino's has exercised operational efficiency over the last eight quarters. The company has demonstrated it can be one of the more profitable businesses in the restaurant sector, boasting an average operating margin of 18%. On top of that, its margin has improved, on average, by 1.6 percentage points each year, a great sign for shareholders.

Zooming out, Domino's has exercised operational efficiency over the last eight quarters. The company has demonstrated it can be one of the more profitable businesses in the restaurant sector, boasting an average operating margin of 18%. On top of that, its margin has improved, on average, by 1.6 percentage points each year, a great sign for shareholders. EPS

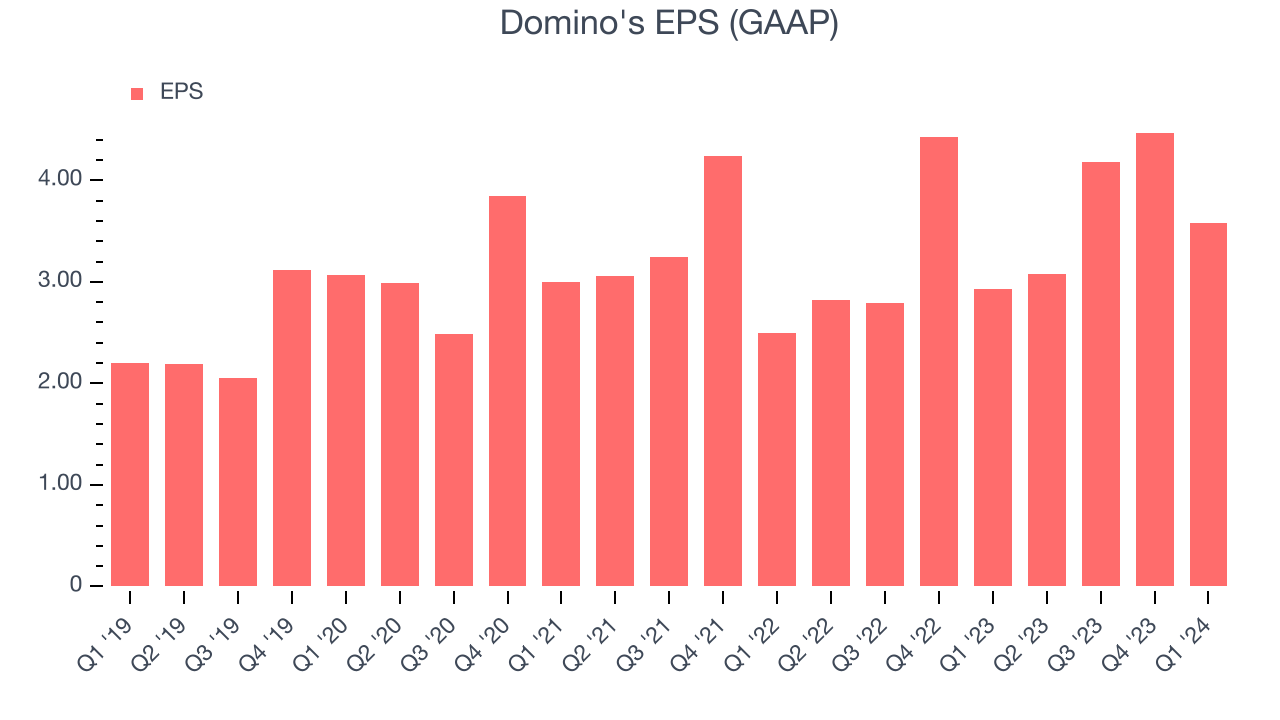

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Domino's reported EPS at $3.58, up from $2.93 in the same quarter a year ago. This print beat Wall Street's estimates by 5.4%.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 6% year-on-year increase in EPS.

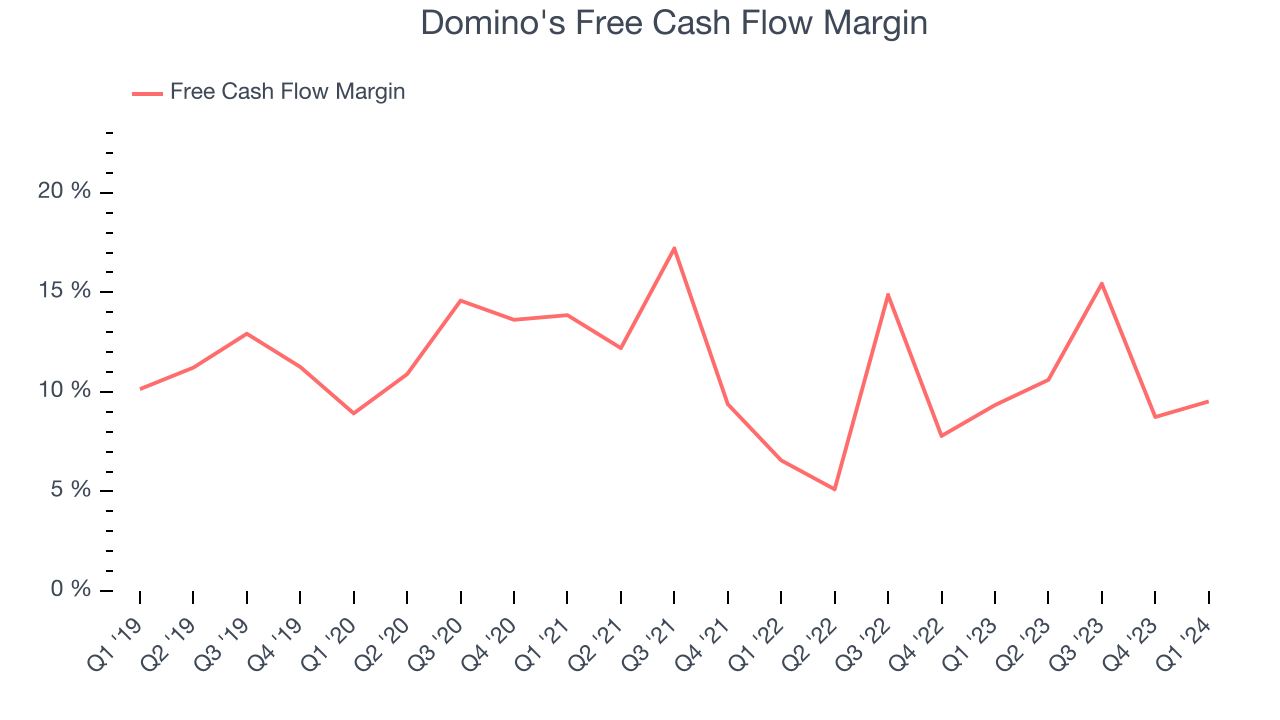

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Domino's free cash flow came in at $103.3 million in Q1, up 8% year on year. This result represents a 9.5% margin.

Over the last two years, Domino's has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 10%, quite impressive for a restaurant business. Furthermore, its margin has averaged year-on-year increases of 1.7 percentage points. This likely pleases the company's investors.

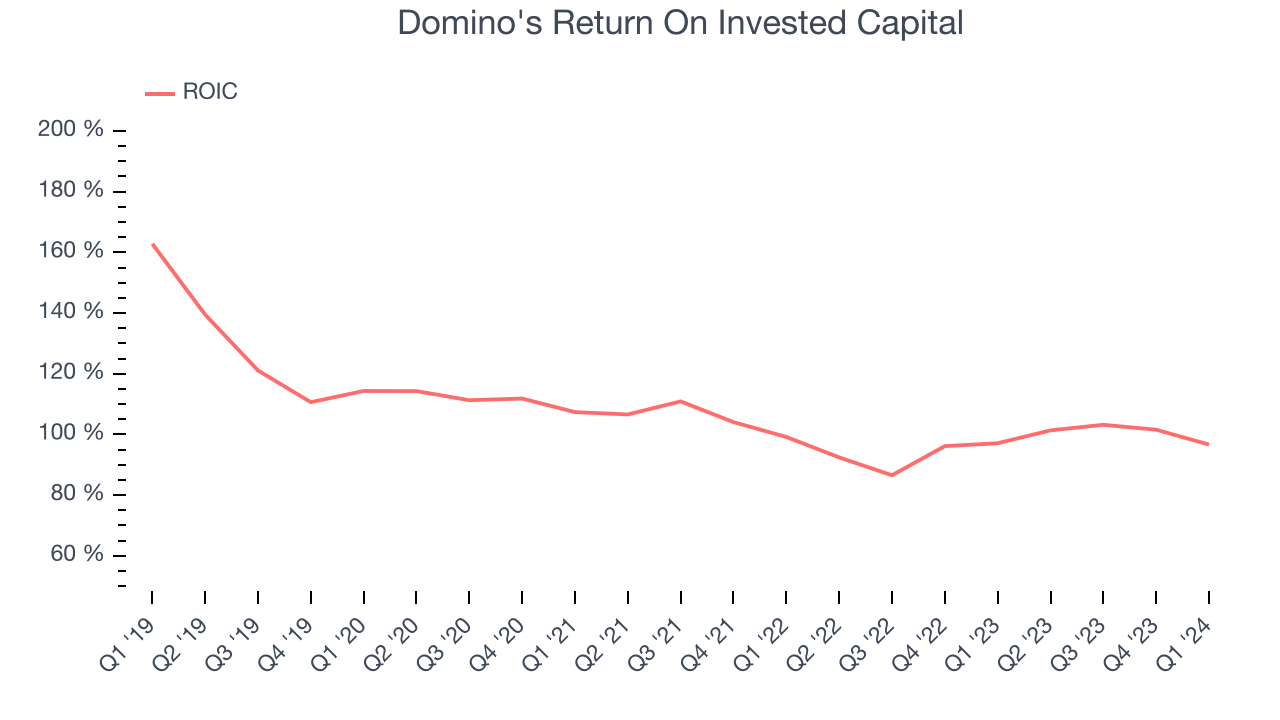

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Domino's five-year average ROIC was 97.6%, placing it among the best restaurant companies. Just as you’d like your investment dollars to generate returns, Domino's invested capital has produced excellent profits.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Domino's $5.20 billion of debt exceeds the $203.9 million of cash on its balance sheet. Furthermore, its 5x net-debt-to-EBITDA ratio (based on its EBITDA of $934.8 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Domino's could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Domino's can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Domino's Q1 Results

It was good to see Domino's beat analysts' revenue expectations this quarter. We were also happy its EPS narrowly outperformed Wall Street's estimates. The company maintained its long-term guidance. Overall, this was a solid quarter for Domino's. The stock is up 4.3% after reporting and currently trades at $521.11 per share.

Is Now The Time?

Domino's may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Domino's isn't a bad business. Although its revenue growth has been a little slower over the last five years, its growth over the next 12 months is expected to be higher. And while its poor same-store sales performance has been a headwind, its new restaurant openings have increased its brand equity.

Domino's price-to-earnings ratio based on the next 12 months is 30.8x. All that said, the state of its balance sheet makes us somewhat uncomfortable. We recommend investors interested in the company wait until it reduces its leverage or increases its profits before getting involved.

Wall Street analysts covering the company had a one-year price target of $496.77 per share right before these results (compared to the current share price of $521.11).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.