Restaurant company Darden (NYSE:DRI) missed Wall Street’s revenue expectations in Q3 CY2024 with sales flat year on year at $2.76 billion. Its GAAP profit of $1.74 per share was also 5.5% below analysts’ consensus estimates.

Is now the time to buy Darden? Find out by accessing our full research report, it’s free.

Darden (DRI) Q3 CY2024 Highlights:

- Revenue: $2.76 billion vs analyst estimates of $2.8 billion (1.5% miss)

- EPS: $1.74 vs analyst expectations of $1.84 (5.5% miss)

- EPS (GAAP) guidance for the full year is $9.50 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 20.4%, in line with the same quarter last year

- EBITDA Margin: 14.2%, in line with the same quarter last year

- Free Cash Flow Margin: 4.6%, similar to the same quarter last year

- Locations: 2,040 at quarter end, up from 1,998 in the same quarter last year

- Same-Store Sales fell 1.1% year on year (5% in the same quarter last year)

- Market Capitalization: $18.92 billion

"We operate in a very dynamic, competitive industry and we have proven we can successfully navigate challenging environments due to our strategy," said Darden President & CEO Rick Cardenas.

Started in 1968 as the famous seafood joint, Red Lobster, Darden (NYSE:DRI) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

Darden is one of the most widely recognized restaurant chains in the world and benefits from brand equity, giving it customer loyalty and more influence over purchasing decisions.

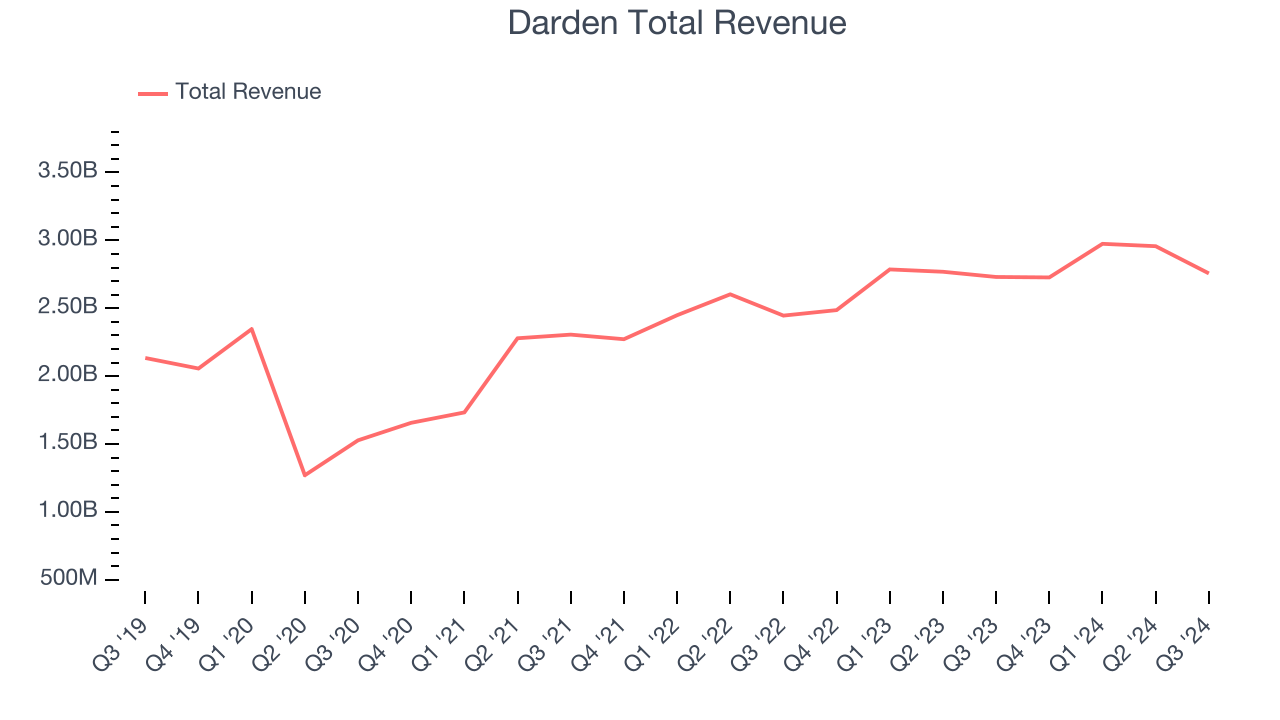

As you can see below, the company’s annualized revenue growth rate of 5.9% over the last five years was tepid, but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Darden’s revenue grew 1% year on year to $2.76 billion, falling short of Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 5% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

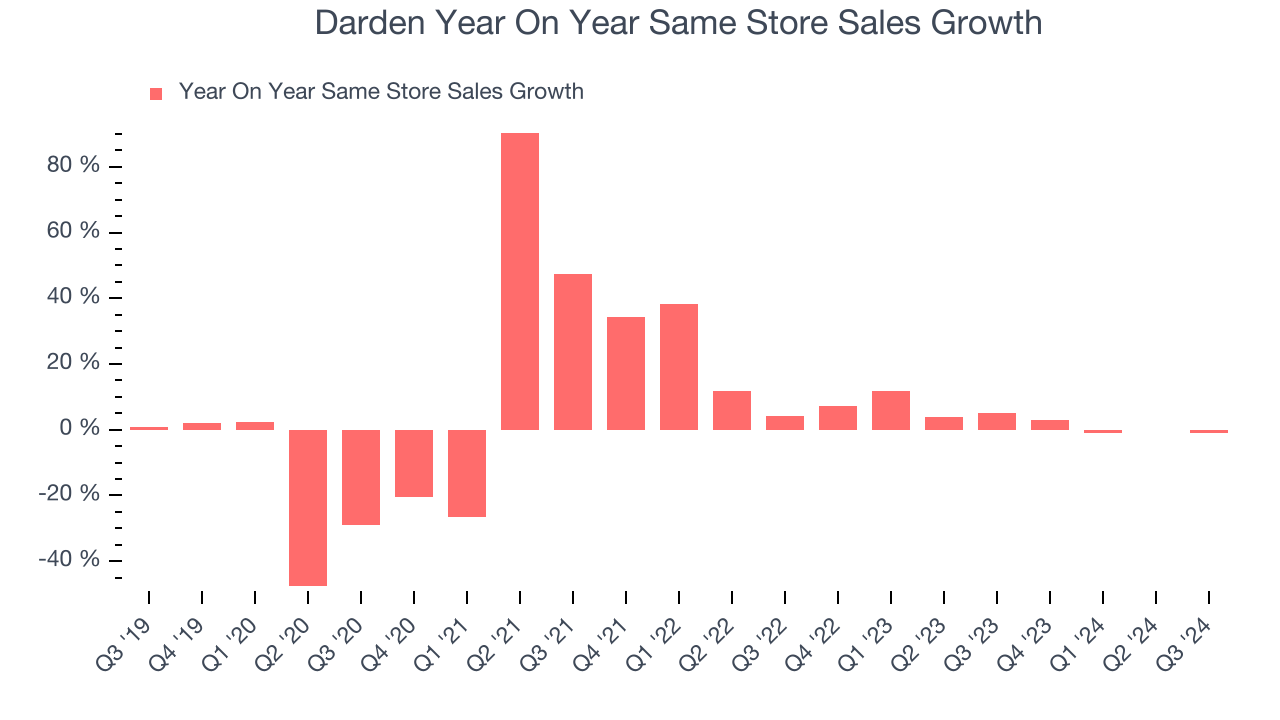

Darden’s demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company’s same-store sales have grown by 3.6% year on year. With positive same-store sales growth amid an increasing number of restaurants, Darden is reaching more diners and growing sales.

In the latest quarter, Darden’s same-store sales fell 1.1% year on year. This decline was a reversal from the 5% year-on-year increase it posted 12 months ago. We’ll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Darden’s Q3 Results

Darden's revenue and EPS unfortunately missed Wall Street analysts’ expectations. EPS guidance for the full year was in line with expectations, though, which is a little bit of a bright spot given the weak quarter. The stock traded down 2.4% to $155.40 immediately following the results.

Darden’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock.We cover that in our actionable full research report which you can read here, it’s free.