Application performance monitoring software provider Dynatrace (NYSE:DT) reported results ahead of analysts' expectations in Q2 CY2024, with revenue up 19.9% year on year to $399.2 million. The company expects next quarter's revenue to be around $405.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.33 per share, improving from its profit of $0.27 per share in the same quarter last year.

Is now the time to buy Dynatrace? Find out by accessing our full research report, it's free.

Dynatrace (DT) Q2 CY2024 Highlights:

- Revenue: $399.2 million vs analyst estimates of $392.4 million (1.7% beat)

- Adjusted Operating Income: $114.3 million vs analyst estimates of $106.2 million (7.5% beat)

- EPS (non-GAAP): $0.33 vs analyst estimates of $0.29 (12.5% beat)

- Revenue Guidance for Q3 CY2024 is $405.5 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $1.65 billion at the midpoint

- Gross Margin (GAAP): 81.3%, down from 82.4% in the same quarter last year

- Free Cash Flow of $227.4 million, up 87.5% from the previous quarter

- Market Capitalization: $12.07 billion

"We are pleased with our first quarter performance, which once again exceeded guidance across all our key metrics,” said Rick McConnell, Chief Executive Officer of Dynatrace.

Founded in Austria in 2005, Dynatrace (NYSE:DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Cloud Monitoring

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

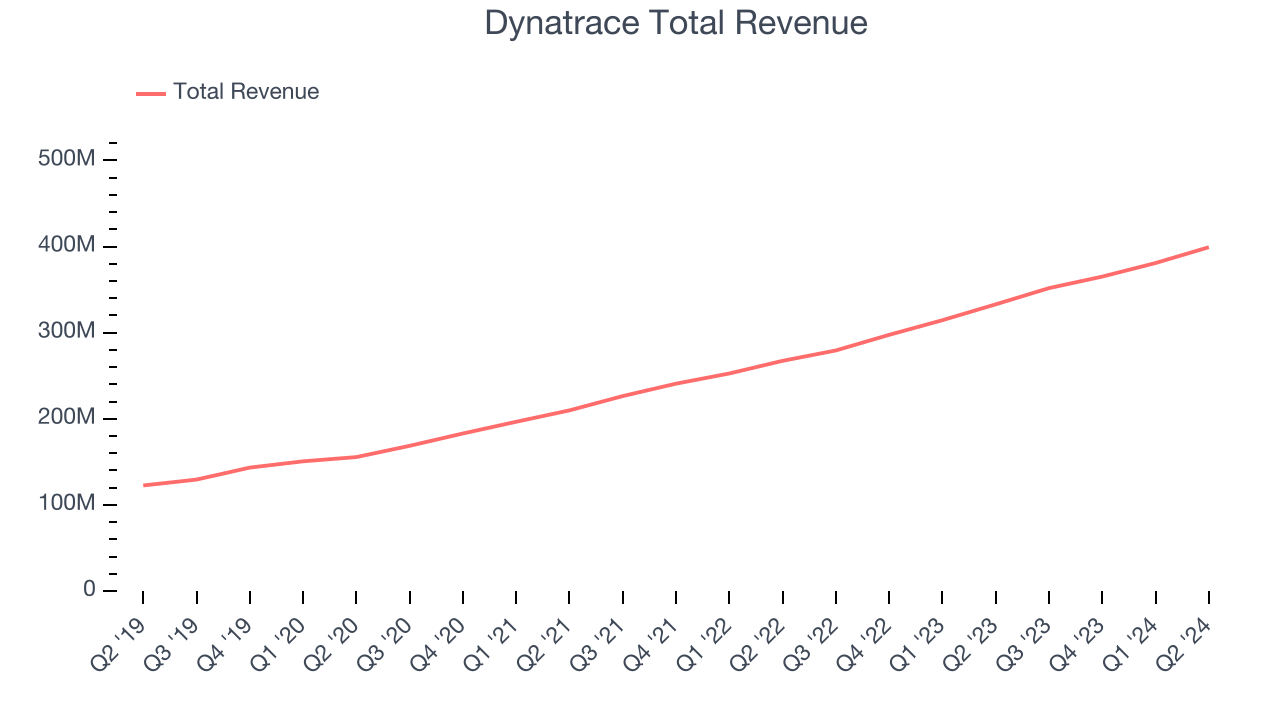

Sales Growth

As you can see below, Dynatrace's 25.5% annualized revenue growth over the last three years has been solid, and its sales came in at $399.2 million this quarter.

This quarter, Dynatrace's quarterly revenue was once again up 19.9% year on year. We can see that Dynatrace's revenue increased by $18.37 million in Q2, up from $15.75 million in Q1 CY2024. While we've no doubt some investors were looking for higher growth, it's good to see that quarterly revenue is re-accelerating.

Next quarter's guidance suggests that Dynatrace is expecting revenue to grow 15.3% year on year to $405.5 million, slowing down from the 25.9% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 14.7% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

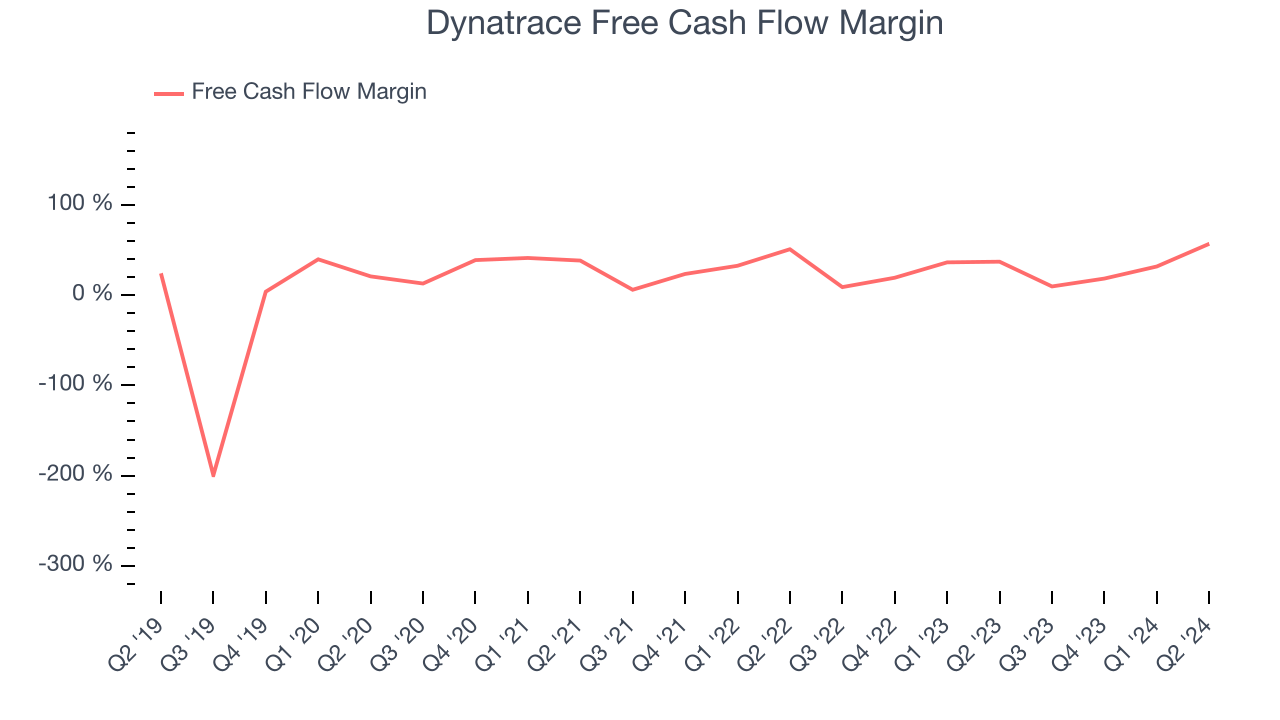

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Dynatrace has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company's free cash flow margin was among the best in the software sector, averaging an eye-popping 30.1% over the last year.

Dynatrace's free cash flow clocked in at $227.4 million in Q2, equivalent to a 57% margin. This quarter's result was good as its margin was 19.8 percentage points higher than in the same quarter last year. Its cash profitability was also above its one-year level, and we hope the company can build on this trend.

Over the next year, analysts predict Dynatrace's cash conversion will fall. Their consensus estimates imply its free cash flow margin of 30.1% for the last 12 months will decrease to 24.8%.

Key Takeaways from Dynatrace's Q2 Results

It was encouraging to see Dynatrace narrowly top analysts' revenue and operating profit expectations this quarter. Next quarter and full year guidance for revenue and operating profit were both roughly in line with expectations, showing that the company is on track. Overall, this was a solid quarter for Dynatrace. The stock traded up 8.8% to $44.06 immediately after reporting.

So should you invest in Dynatrace right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.