Application performance monitoring software provider Dynatrace (NYSE:DT) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 21.1% year on year to $380.8 million. The company expects next quarter's revenue to be around $392 million, in line with analysts' estimates. It made a non-GAAP profit of $0.30 per share, down from its profit of $0.31 per share in the same quarter last year.

Is now the time to buy Dynatrace? Find out by accessing our full research report, it's free.

Dynatrace (DT) Q1 CY2024 Highlights:

- Revenue: $380.8 million vs analyst estimates of $375.5 million (1.4% beat)

- Operating profit (non-GAAP): $95.1 million vs analyst estimates of $88.4 million (7.6% beat)

- EPS (non-GAAP): $0.30 vs analyst estimates of $0.27 (11% beat)

- Revenue Guidance for Q2 CY2024 is $392 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2025 is $1.65 billion at the midpoint, missing analyst estimates by 2% and implying 15.4% growth (vs 23.6% in FY2024); however, full year operating profit (non-GAAP) guidance of $464 million ahead of analyst estimates of $459 million

- Gross Margin (GAAP): 81.1%, down from 82.3% in the same quarter last year

- Free Cash Flow of $121.3 million, up 68.4% from the previous quarter

- Market Capitalization: $13.74 billion

“Dynatrace delivered a strong finish to fiscal 2024. Our fourth quarter results exceeded guidance across all key operating metrics, fueled in part by a record number of 7-figure deals closed in the quarter,” said Rick McConnell, Chief Executive Officer.

Founded in Austria in 2005, Dynatrace (NYSE:DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Cloud Monitoring

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

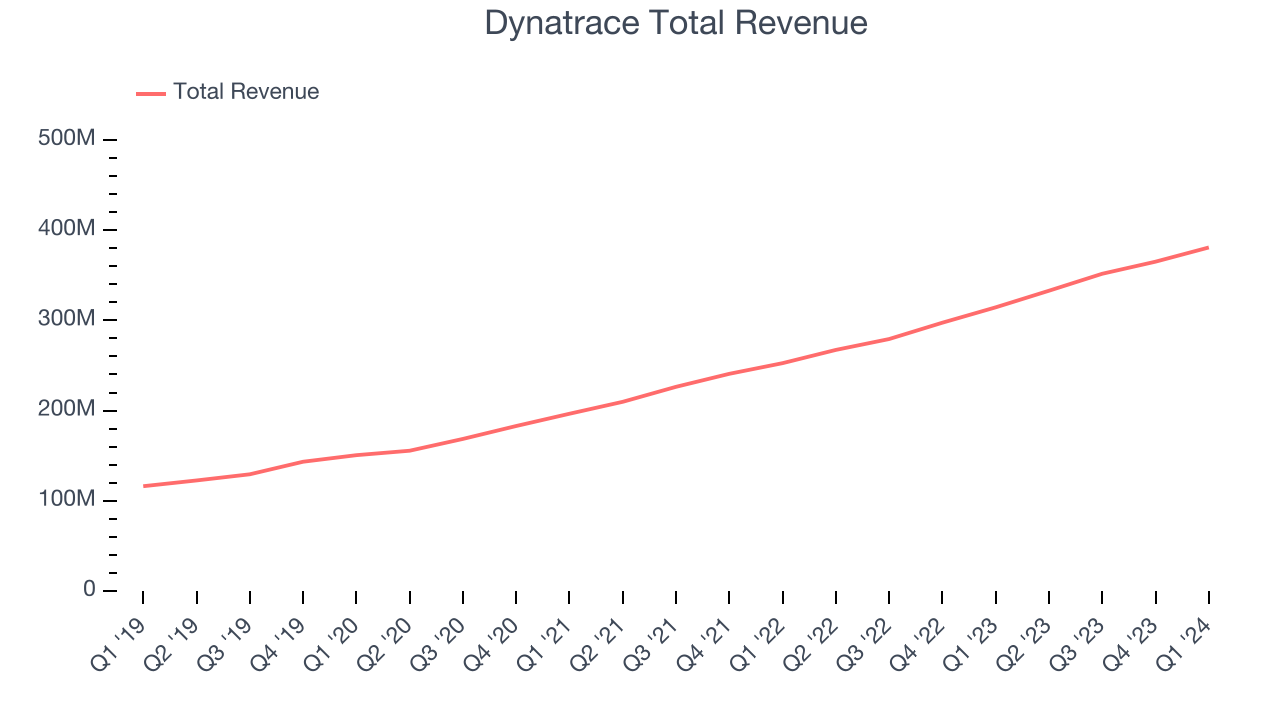

Sales Growth

As you can see below, Dynatrace's revenue growth has been strong over the last three years, growing from $196.5 million in Q4 2021 to $380.8 million this quarter.

This quarter, Dynatrace's quarterly revenue was once again up a very solid 21.1% year on year. On top of that, its revenue increased $15.75 million quarter on quarter, a solid improvement from the $13.4 million increase in Q4 CY2023. Thankfully, that's a slight acceleration of growth.

Next quarter's guidance suggests that Dynatrace is expecting revenue to grow 17.8% year on year to $392 million, slowing down from the 24.5% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.65 billion at the midpoint, growing 15.4% year on year compared to the 23.5% increase in FY2024.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

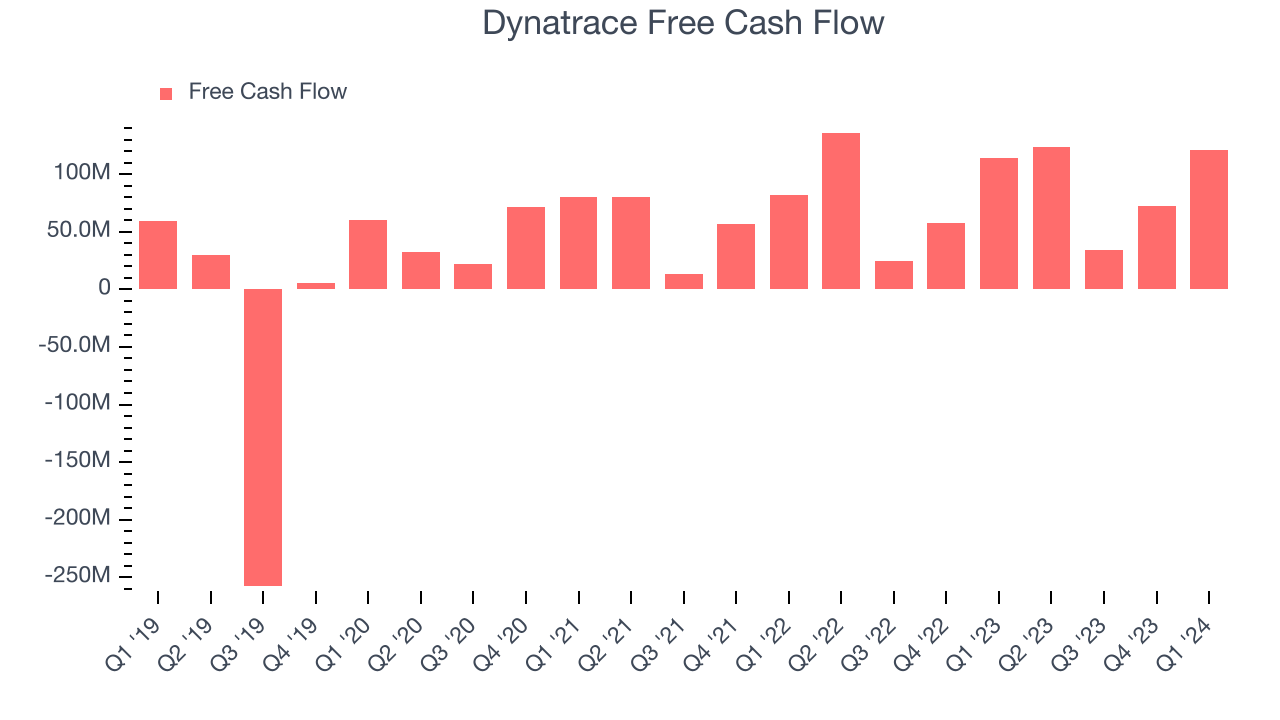

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Dynatrace's free cash flow came in at $121.3 million in Q1, up 5.9% year on year.

Dynatrace has generated $351 million in free cash flow over the last 12 months, an impressive 24.5% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from Dynatrace's Q1 Results

It was encouraging to see Dynatrace narrowly top analysts' revenue expectations this quarter. Operating profit beat by a more convincing amount, adding to the good news. On the other hand, its full-year revenue guidance was below expectations and its revenue guidance for next year suggests a slowdown in demand. Blunting the impact of that was the fact that full year operating profit came in ahead of expectations, show that while topline growth may be a little slower, it's at least more profitable. Overall, the results were very good for the quarter, with mixed guidance. The company is down 3.5% on the results and currently trades at $44.8 per share.

Dynatrace may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.