Application performance monitoring software provider Dynatrace (NYSE:DT) announced better-than-expected results in the Q4 FY2021 quarter, with revenue up 30.5% year on year to $196.5 million. Dynatrace made a GAAP profit of $26.9 million, down on its profit of $46.7 million, in the same quarter last year.

Is now the time to buy Dynatrace? Get early access to our full analysis of the earnings results here

Dynatrace (NYSE:DT) Q4 FY2021 Highlights:

- Revenue: $196.5 million vs analyst estimates of $191.7 million (2.5% beat)

- EPS (non-GAAP): $0.15 vs analyst estimates of $0.14 (9.3% beat)

- Revenue guidance for Q1 2022 is $203 million at the midpoint, above analyst estimates of $197.2 million

- Management's revenue guidance for upcoming financial year 2022 is $892.5 million at the midpoint, predicting 26.8% growth (vs 28.8% in FY2021)

- Free cash flow of $85.6 million, up 15.6% from previous quarter

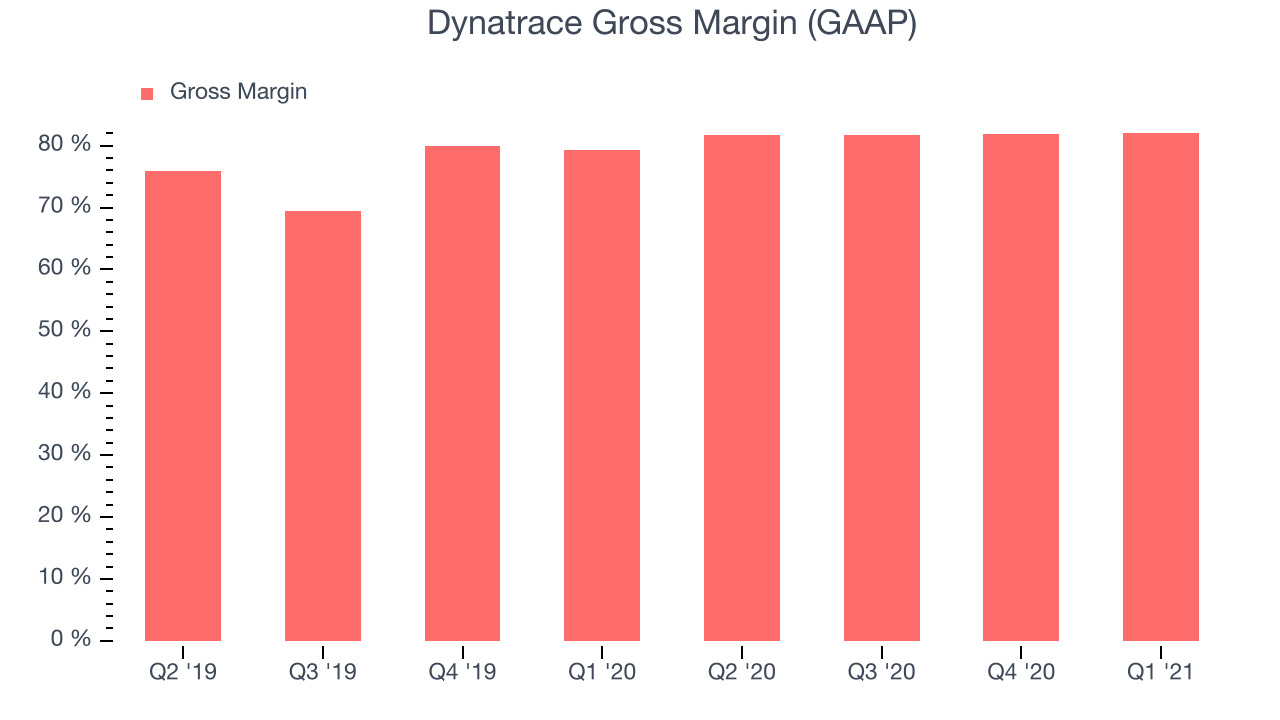

- Gross Margin (GAAP): 82%, in line with previous quarter

“Dynatrace’s strong fourth quarter performance capped off an excellent year exceeding guidance across all our key operating metrics led by ARR growth of 35% year-over-year” stated John Van Siclen, Chief Executive Officer. “As digital transformation and cloud-first initiatives continue to accelerate, our unique value proposition combining modern cloud observability with powerful AIOps capabilities continues to resonate with customers. Looking forward to fiscal 2022, we will continue to invest in growth to take advantage of the large and growing market opportunity we have in front of us.”

The Early Days Of Application Performance Monitoring

Dynatrace was founded in Austria back in 2005, but was acquired by Compuware that same year. In 2014 Dynatrace gained its independence again, under the leadership of John van Siclen, its previous and subsequent CEO. Dynatrace (NYSE:DT) software allows large companies to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Dynatrace is essentially a monitoring system that aims to detect any performance issues in a company's technology (for example, their booking systems) before inefficiencies or bottlenecks end up impacting customers. It can use artificial intelligence to automatically identify (or at least guess at) the root cause of a problem. On top of that, Dynatrace can help automate mitigation procedures where necessary, ensuring a timely reaction to any problems.

Dynatrace gives visibility across a computing environment, whether cloud or on premise, and sees how everything is connected. This allows an AI engine to provide causation-based answers and proactive, actionable insights. The more customers Dynatrace serves the better its system can become, and the more CTOs will trust its brand. That's important, since it faces a number of competitors in the performance monitoring space, such as Datadog (NASDAQ:DDOG) and New Relic (NYSE:NEWR). One attractive aspect of the Dynatrace business model is that it charges based on usage of the monitoring software, so its revenue should grow with the increasing complexity of its customers' technology.

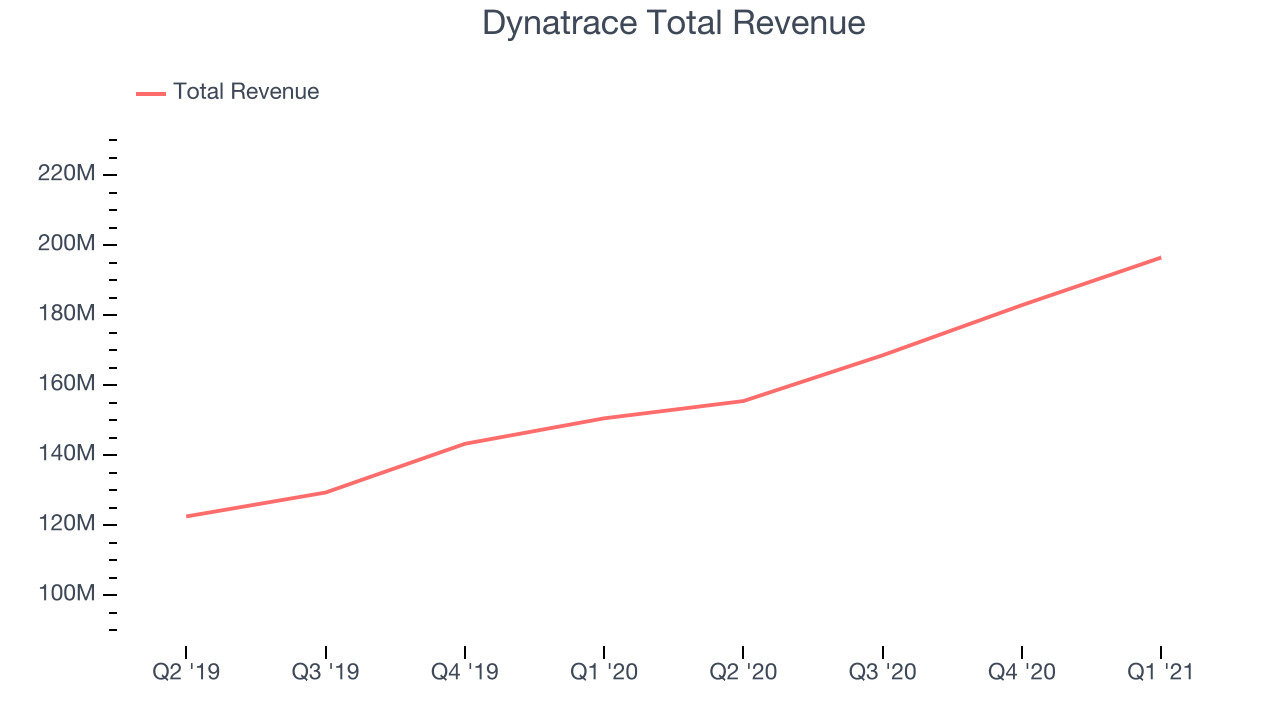

As you can see below, Dynatrace's revenue growth has been strong over the last twelve months, growing from $150.5 million to $196.5 million.

This was a standout quarter for Dynatrace, with the quarterly revenue up an absolutely stunning 30.5% year on year, which is above average for the company. Quarter on quarter the revenue increased by $13.5 million in Q4, which was in line with Q3 2021. This steady quarter-on-quarter growth shows the company is able to maintain a strong growth trajectory. In investing, the past matters mostly as an indicator of the future. It is useful to know what are the analysts projecting for Dynatrace and whether they are likely to upgrade their price targets after these results. You can easily find that out on our platform. Click here to get early access.

High Margin Recurring Revenue

The beauty of a software as a service business model is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Dynatrace has historically charged license fees, but most of its revenue is either high margin subscription revenue, or lower margin service revenue. A lower proportion of service revenue means implementing the product is easier, and generally allows a higher overall gross profit margin.

Dynatrace's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 82% in Q4. That means that for every $1 in revenue the company had $0.82 left to spend on developing new products, marketing & sales and the general administrative overhead. Trending up over the last year this is a great gross margin, that allows companies like Dynatrace to fund large investments in product and sales during periods of rapid growth and be profitable when they reach maturity.

Key Takeaways from Dynatrace's Q4 Results

With market capitalisation of $12.8 billion, more than $324.9 million in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

We enjoyed the positive outlook Dynatrace provided for the next quarter’s revenue. And we were also glad that the revenue guidance for the next year looks positive. Overall, we think this was a strong quarter, that should leave shareholders feeling very positive. While the market has high expectations of Dynatrace we think it will continue to stand out as one of the best quality SaaS stocks, even more so than before.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.