Looking back on cloud monitoring stocks' Q4 earnings, we examine this quarters’ best and worst performers, including Dynatrace (NYSE:DT) and its peers.

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical, and ever more complex. To solve the challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with visibility to troubleshoot the issues in real time.

The 5 cloud monitoring stocks we track reported a solid Q4; on average, revenues beat analyst consensus estimates by 4.71%, while on average next quarter revenue guidance was 2.47% above consensus. Technology stocks have been hit hard on fears of higher interest rates, but cloud monitoring stocks held their ground better than others, with share price down 2.6% since earnings, on average.

Weakest Q4: Dynatrace (NYSE:DT)

Founded in Austria in 2005, Dynatrace (NYSE:DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

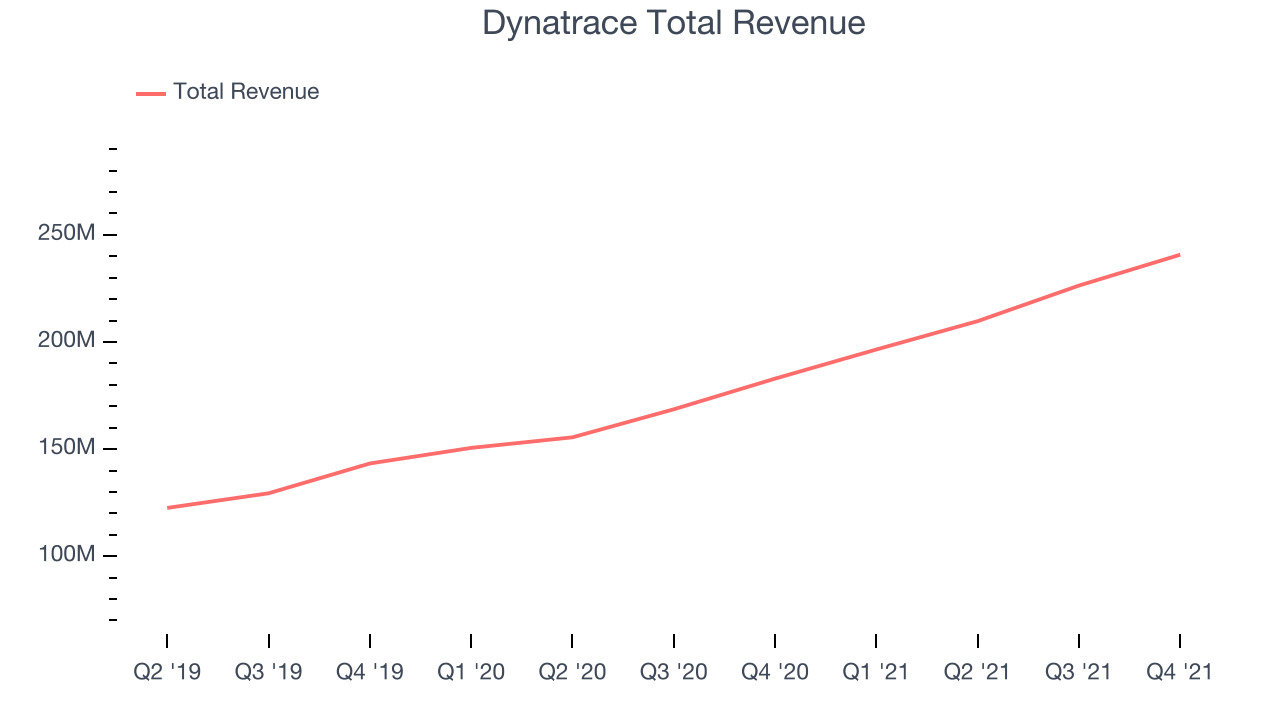

Dynatrace reported revenues of $240.7 million, up 31.6% year on year, beating analyst expectations by 2.67%. It was an ok quarter for the company, with a strong top line growth, and guidance for the next quarter in line with analysts' expectations.

"Having completed my first quarter as CEO, I am very pleased with our third quarter performance, beating the high end of guidance across our key operating metrics driven by new logo additions and continued net expansion rate above 120%,” said Rick McConnell, Chief Executive Officer.

Dynatrace delivered the weakest full year guidance update of the whole group. The stock is down 13.8% since the results, mainly due to the fears of increasing competition in the space, and currently trades at $48.50.

Is now the time to buy Dynatrace? Access our full analysis of the earnings results here, it's free.

Best Q4: Datadog (NASDAQ:DDOG)

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) is a software as a service platform that makes it easier to monitor cloud infrastructure and applications.

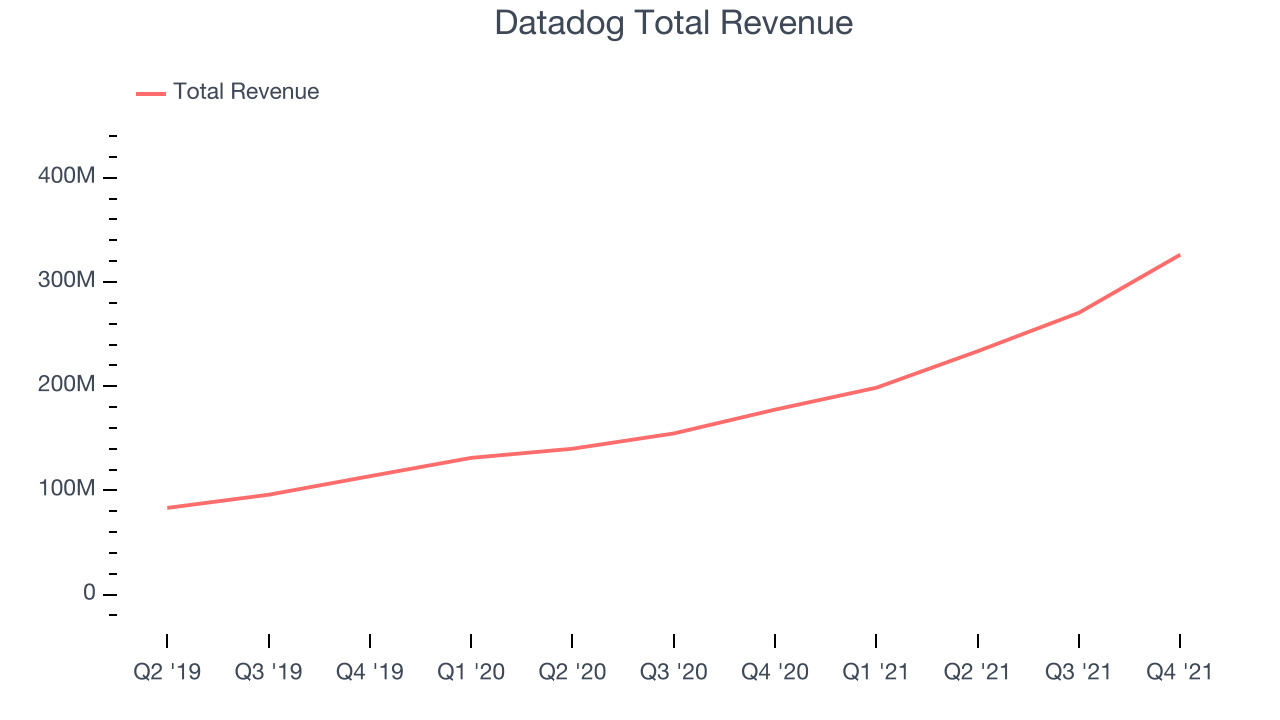

Datadog reported revenues of $326.1 million, up 83.7% year on year, beating analyst expectations by 11.9%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Datadog delivered the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 210 enterprise customers paying more than $100,000 annually to a total of 2,010. The stock is down 2.31% since the results and currently trades at $152.01.

Is now the time to buy Datadog? Access our full analysis of the earnings results here, it's free.

Sumo Logic (NASDAQ:SUMO)

Founded in 2010 by Christian Beegden who went from driving a cab in Germany to landing an internship at Amazon, Sumo Logic (NASDAQ:SUMO) is software as a service data analytics platform that helps companies get insight into what is happening in their servers and applications.

Sumo Logic reported revenues of $67 million, up 23.8% year on year, beating analyst expectations by 4.23%. It was a decent quarter for the company, with a strong guidance for the next year.

The stock is up 5.3% since the results and currently trades at $11.31.

Read our full analysis of Sumo Logic's results here.

PagerDuty (NYSE:PD)

Started by three former Amazon engineers, PagerDuty (NYSE:PD) is a software as a service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

PagerDuty reported revenues of $78.5 million, up 32.4% year on year, beating analyst expectations by 3.19%. It was a solid quarter for the company, with a full year guidance beating analysts' expectations and a positive outlook for the next quarter.

The company added 379 customers to a total of 14,865. The stock is up 35.6% since the results and currently trades at $36.50.

Read our full, actionable report on PagerDuty here, it's free.

New Relic (NYSE:NEWR)

With the name being an anagram of its founder, Lew Cirne, New Relic (NYSE:NEWR) makes a monitoring software that collects, scores, and analyses performance data about a client's IT stack.

New Relic reported revenues of $203.5 million, up 22.3% year on year, beating analyst expectations by 1.56%. It was a mixed quarter for the company, with a significant improvement in net revenue retention rate but a decline in gross margin.

New Relic had the weakest performance against analyst estimates and slowest revenue growth among the peers. The company added 53 enterprise customers paying more than $100,000 annually to a total of 1,064. The stock is down 37.7% since the results and currently trades at $67.69.

Read our full, actionable report on New Relic here, it's free.

The author has no position in any of the stocks mentioned