Application performance monitoring software provider Dynatrace (NYSE:DT) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 21.1% year on year to $380.8 million. The company expects next quarter's revenue to be around $392 million, in line with analysts' estimates. It made a non-GAAP profit of $0.30 per share, down from its profit of $0.31 per share in the same quarter last year.

Dynatrace (DT) Q1 CY2024 Highlights:

- Revenue: $380.8 million vs analyst estimates of $375.5 million (1.4% beat)

- Operating profit (non-GAAP): $95.1 million vs analyst estimates of $88.4 million (7.6% beat)

- EPS (non-GAAP): $0.30 vs analyst estimates of $0.27 (11% beat)

- Revenue Guidance for Q2 CY2024 is $392 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2025 is $1.65 billion at the midpoint, missing analyst estimates by 2% and implying 15.4% growth (vs 23.6% in FY2024); however, full year operating profit (non-GAAP) guidance of $464 million ahead of analyst estimates of $459 million

- Gross Margin (GAAP): 81.1%, down from 82.3% in the same quarter last year

- Free Cash Flow of $121.3 million, up 68.4% from the previous quarter

- Market Capitalization: $13.74 billion

Founded in Austria in 2005, Dynatrace (NYSE:DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Dynatrace is essentially a monitoring system that aims to detect performance issues in a company's technology (for example, their booking systems) before inefficiencies or bottlenecks end up impacting customers. It can use artificial intelligence to automatically identify (or at least guess at) the root cause of a problem. On top of that, Dynatrace can help automate mitigation procedures where necessary, ensuring a timely reaction to any problem.

Dynatrace was acquired by Compuware the same year it was founded. In 2014, it gained its independence again, under the leadership of John van Siclen, its previous and subsequent CEO.

Dynatrace gives engineers visibility across the whole computing environment, whether cloud or on-premise, and allows them to see how everything is connected. This also allows an AI engine to provide causation-based answers and proactive, actionable insights.

Cloud Monitoring

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

Dynatrace faces a number of competitors in the performance monitoring space, both large corporations, such as Datadog (NASDAQ:DDOG), Splunk (NASDAQ:SPLK), New Relic (NYSE:NEWR) and up and coming startups, such as Better Stack.

Sales Growth

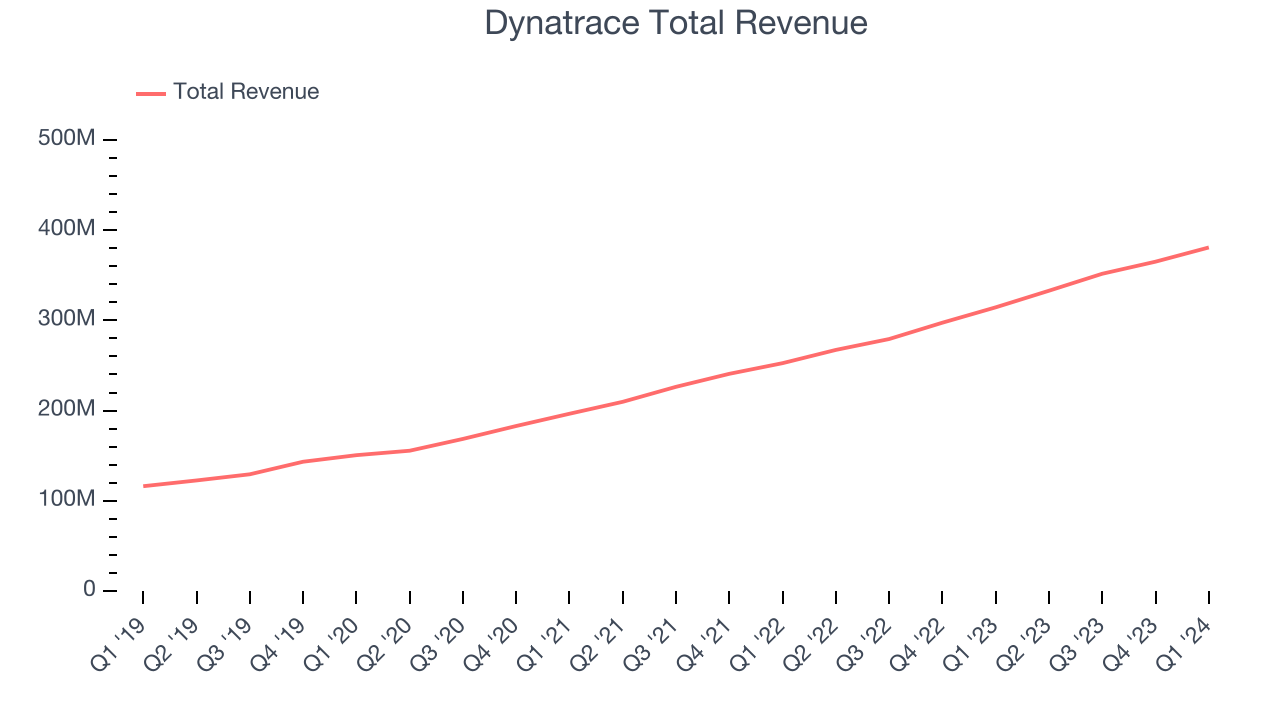

As you can see below, Dynatrace's revenue growth has been strong over the last three years, growing from $196.5 million in Q4 2021 to $380.8 million this quarter.

This quarter, Dynatrace's quarterly revenue was once again up a very solid 21.1% year on year. On top of that, its revenue increased $15.75 million quarter on quarter, a solid improvement from the $13.4 million increase in Q4 CY2023. Thankfully, that's a slight acceleration of growth.

Next quarter's guidance suggests that Dynatrace is expecting revenue to grow 17.8% year on year to $392 million, slowing down from the 24.5% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.65 billion at the midpoint, growing 15.4% year on year compared to the 23.5% increase in FY2024.

Profitability

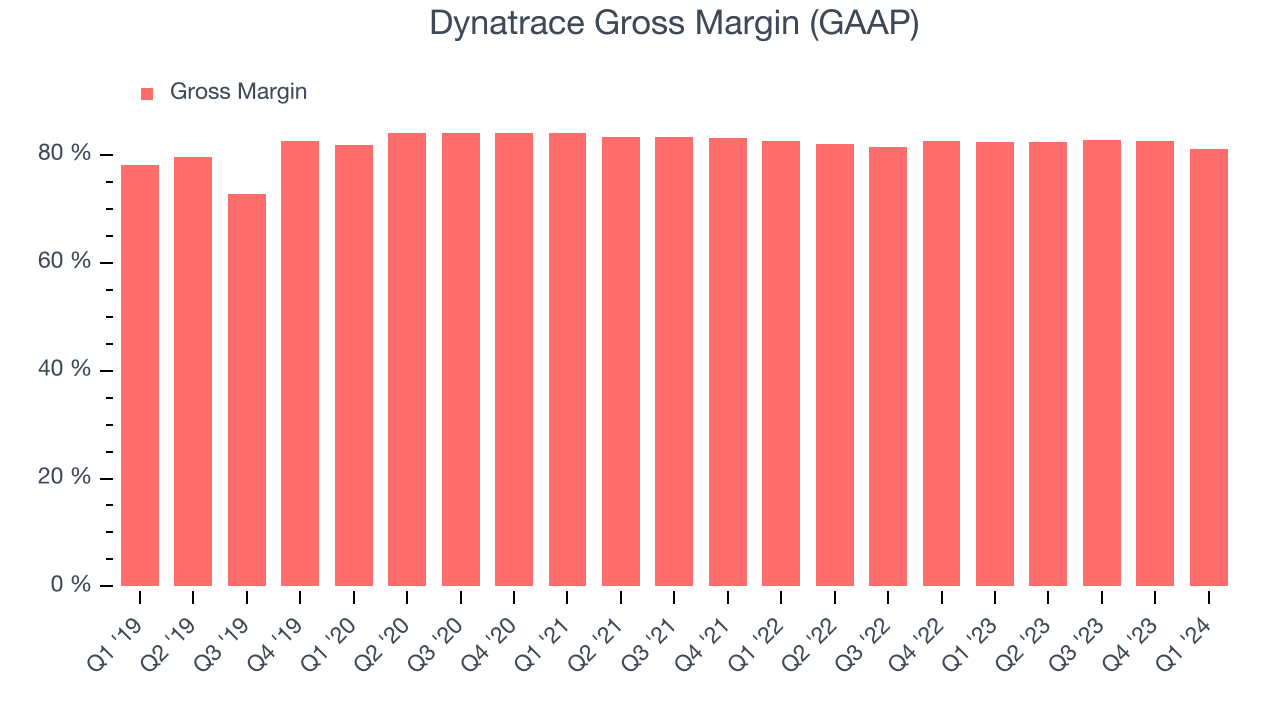

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Dynatrace's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 81.1% in Q1.

That means that for every $1 in revenue the company had $0.81 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite its recent drop, Dynatrace still has an excellent gross margin that allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

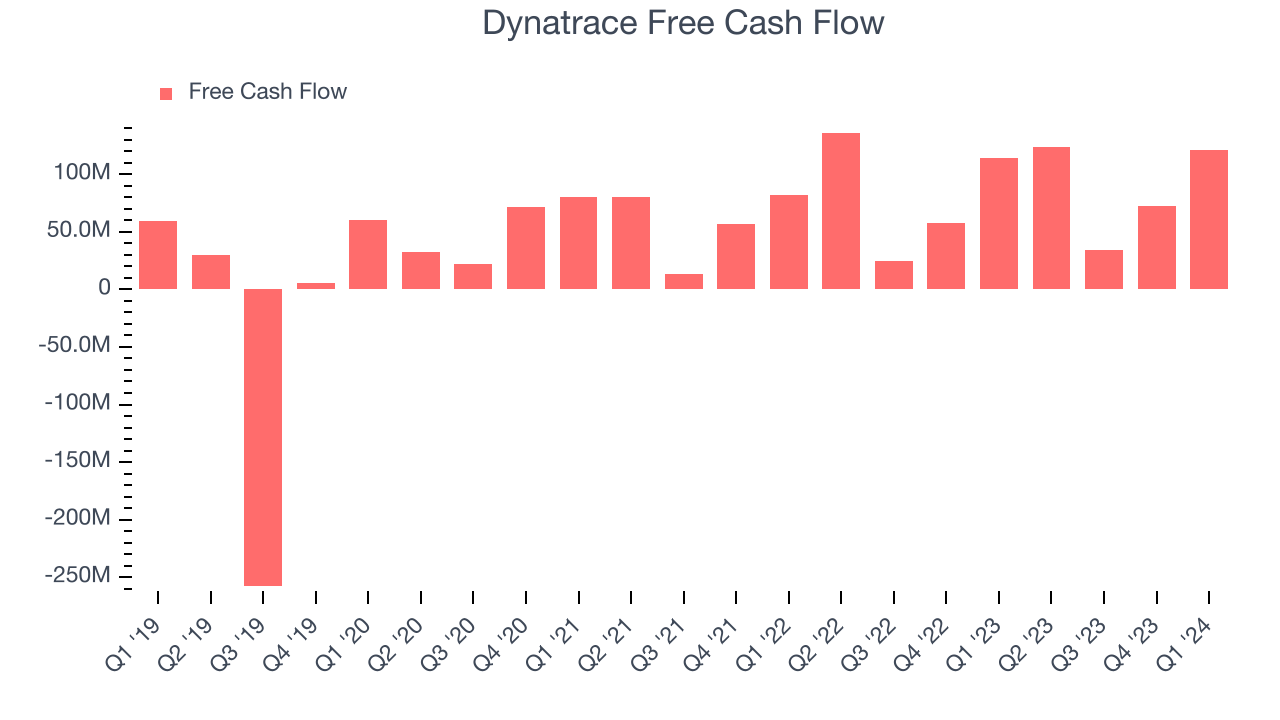

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Dynatrace's free cash flow came in at $121.3 million in Q1, up 5.9% year on year.

Dynatrace has generated $351 million in free cash flow over the last 12 months, an impressive 24.5% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from Dynatrace's Q1 Results

It was encouraging to see Dynatrace narrowly top analysts' revenue expectations this quarter. Operating profit beat by a more convincing amount, adding to the good news. On the other hand, its full-year revenue guidance was below expectations and its revenue guidance for next year suggests a slowdown in demand. Blunting the impact of that was the fact that full year operating profit came in ahead of expectations, show that while topline growth may be a little slower, it's at least more profitable. Overall, the results were very good for the quarter, with mixed guidance. The company is down 3.5% on the results and currently trades at $44.8 per share.

Is Now The Time?

Dynatrace may have had a decent quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Dynatrace is a great business. While we'd expect growth rates to moderate from here, its revenue growth has been strong over the last three years. Additionally, its impressive gross margins indicate excellent business economics, and its bountiful generation of free cash flow empowers it to invest in growth initiatives.

The market is certainly expecting long-term growth from Dynatrace given its price-to-sales ratio based on the next 12 months is 8.3x. But looking at the tech landscape today, Dynatrace's qualities stand out. We still like the stock at this price, despite the higher multiple.

Wall Street analysts covering the company had a one-year price target of $61.64 right before these results (compared to the current share price of $44.80), implying they see short-term upside potential in Dynatrace.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.