Outdoor lifestyle and recreational products company Solo Brands (NYSE:DTC) fell short of analysts' expectations in Q4 FY2023, with revenue down 16.2% year on year to $165.3 million. On the other hand, the company's outlook for the full year was close to analysts' estimates with revenue guided to $500 million at the midpoint. It made a non-GAAP profit of $0.13 per share, down from its profit of $0.33 per share in the same quarter last year.

Solo Brands (DTC) Q4 FY2023 Highlights:

- Revenue: $165.3 million vs analyst estimates of $166.1 million (0.5% miss)

- EPS (non-GAAP): $0.13 vs analyst expectations of $0.17 (22.6% miss)

- Management's revenue guidance for the upcoming financial year 2024 is $500 million at the midpoint, in line with analyst expectations and implying 1.1% growth (vs -1.2% in FY2023)

- Gross Margin (GAAP): 58.3%, down from 59.8% in the same quarter last year

- Free Cash Flow of $21.11 million is up from -$16.11 million in the previous quarter

- Market Capitalization: $139.4 million

Started through a Kickstarter campaign, Solo Brands (NYSE:DTC) is a provider of outdoor and recreational products.

The company was born in 2011 when founders Jeff and Spencer Jan recognized a gap in the market for affordable and high-quality fire pits. With this insight, the duo created its flagship product, the Solo Stove, a smokeless and portable fire pit.

Through several acquisitions, Solo Brands now encompasses various brands, including Solo Stove, Chubbies, Isle, and Oru Kayak. Each brand caters to different outdoor activities with products like outdoor stoves, casual apparel, paddle boards, and foldable kayaks.

Solo Brands's revenue is primarily generated through direct-to-consumer sales through its e-commerce platforms. This approach not only streamlines the purchasing process but also fosters strong customer engagement and brand loyalty, enabling Solo Brands to effectively gather feedback and personalize the customer experience. Select Solo Brands products can also be found at specialty retailers.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the outdoor and recreation space include YETI Holdings (NYSE:YETI), Clarus (NASDAQ:CLAR), and Johnson Outdoors (NASDAQ:JOUT).Sales Growth

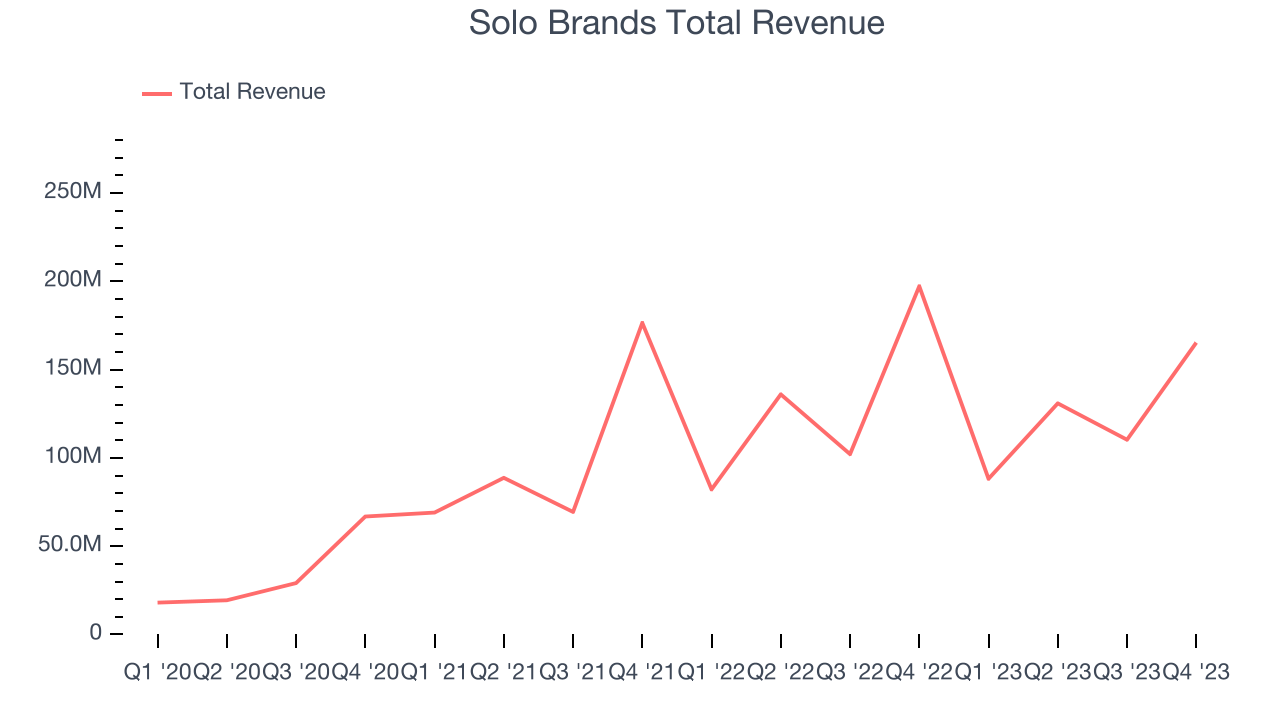

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Solo Brands's annualized revenue growth rate of 54.8% over the last three years was incredible for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Solo Brands's recent history shows its momentum has slowed as its annualized revenue growth of 10.7% over the last two years is below its three-year trend.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Solo Brands's recent history shows its momentum has slowed as its annualized revenue growth of 10.7% over the last two years is below its three-year trend.

This quarter, Solo Brands missed Wall Street's estimates and reported a rather uninspiring 16.2% year-on-year revenue decline, generating $165.3 million of revenue. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

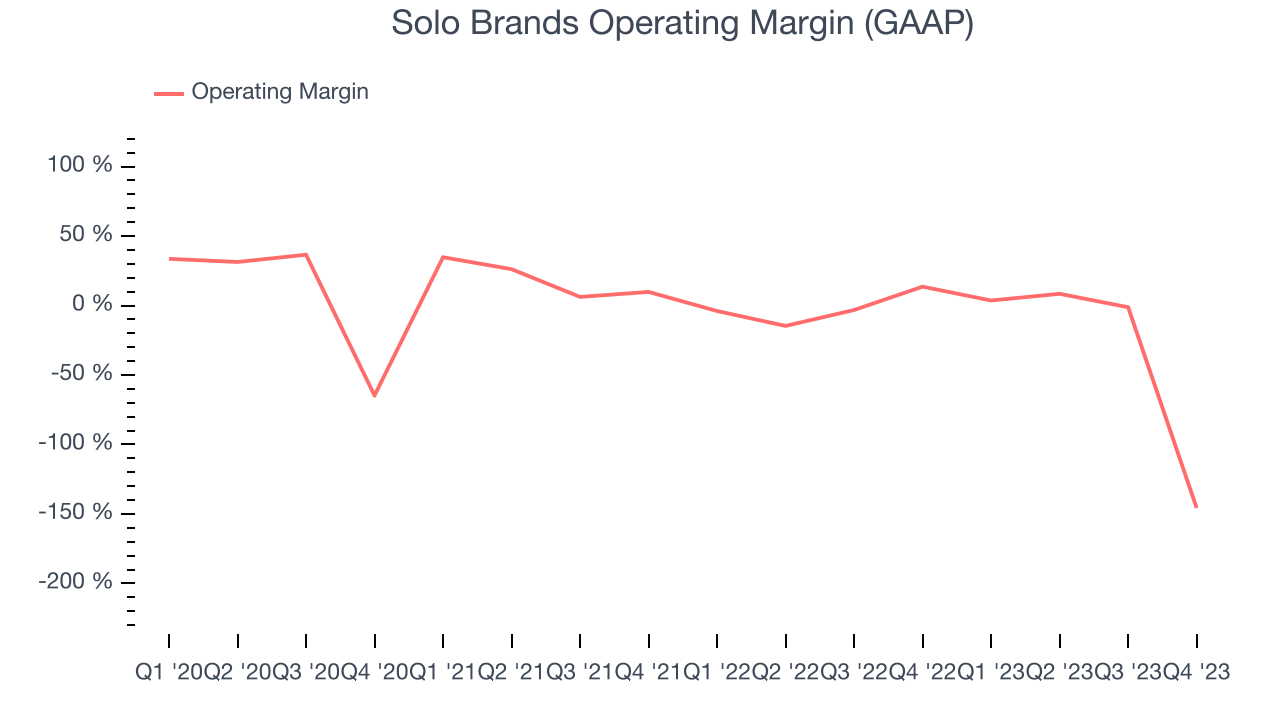

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Solo Brands's high expenses have contributed to an average operating margin of negative 22.5%.

This quarter, Solo Brands generated an operating profit margin of negative 146%, down 159.2 percentage points year on year.

Over the next 12 months, Wall Street expects Solo Brands to become profitable. Analysts are expecting the company’s LTM operating margin of negative 46.1% to rise to positive 13.4%.EPS

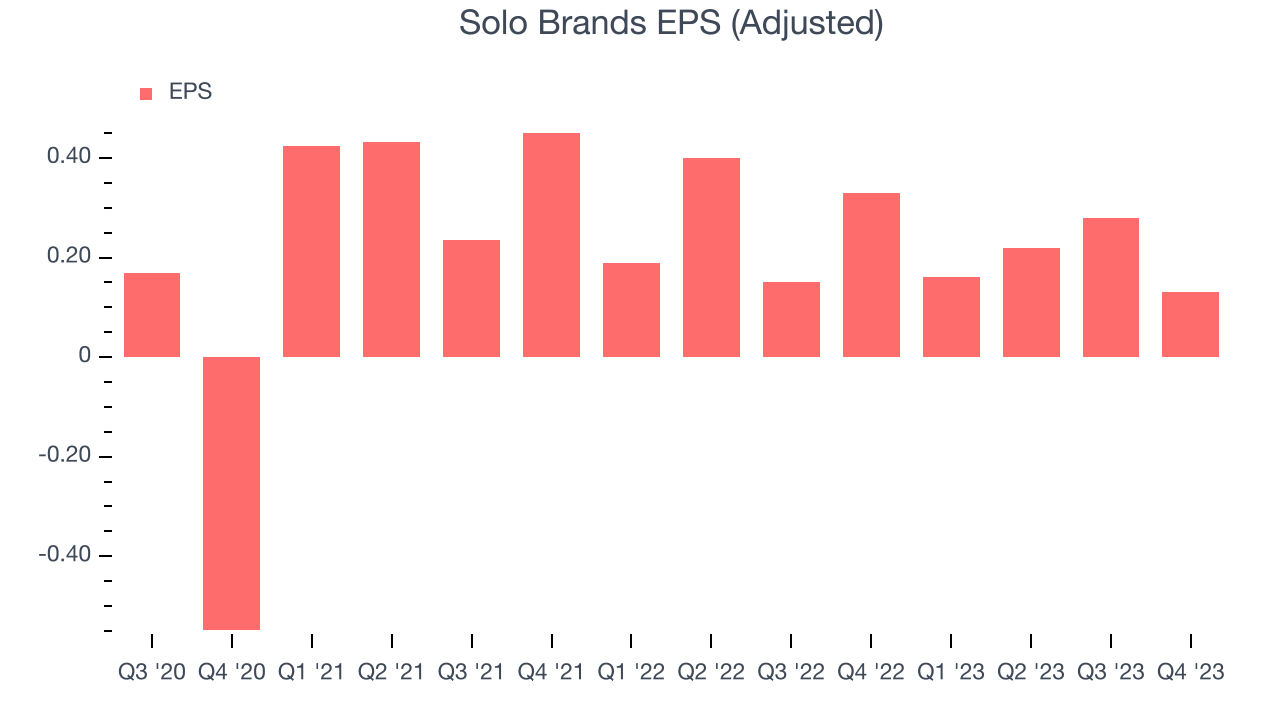

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last three years, Solo Brands cut its earnings losses and improved its EPS by 45.6% each year. This performance, however, is worse than its 54.8% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals. Solo Brands's operating margin has declined 80.9 percentage points over the last three years, leading to lower profitability and earnings. Taxes and interest expenses can also affect EPS, but they don't tell us as much about a company's fundamentals.

In Q4, Solo Brands reported EPS at $0.13, down from $0.33 in the same quarter a year ago. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Solo Brands to perform poorly. Analysts are projecting its LTM EPS of $0.79 to shrink by 17.8% to $0.65.

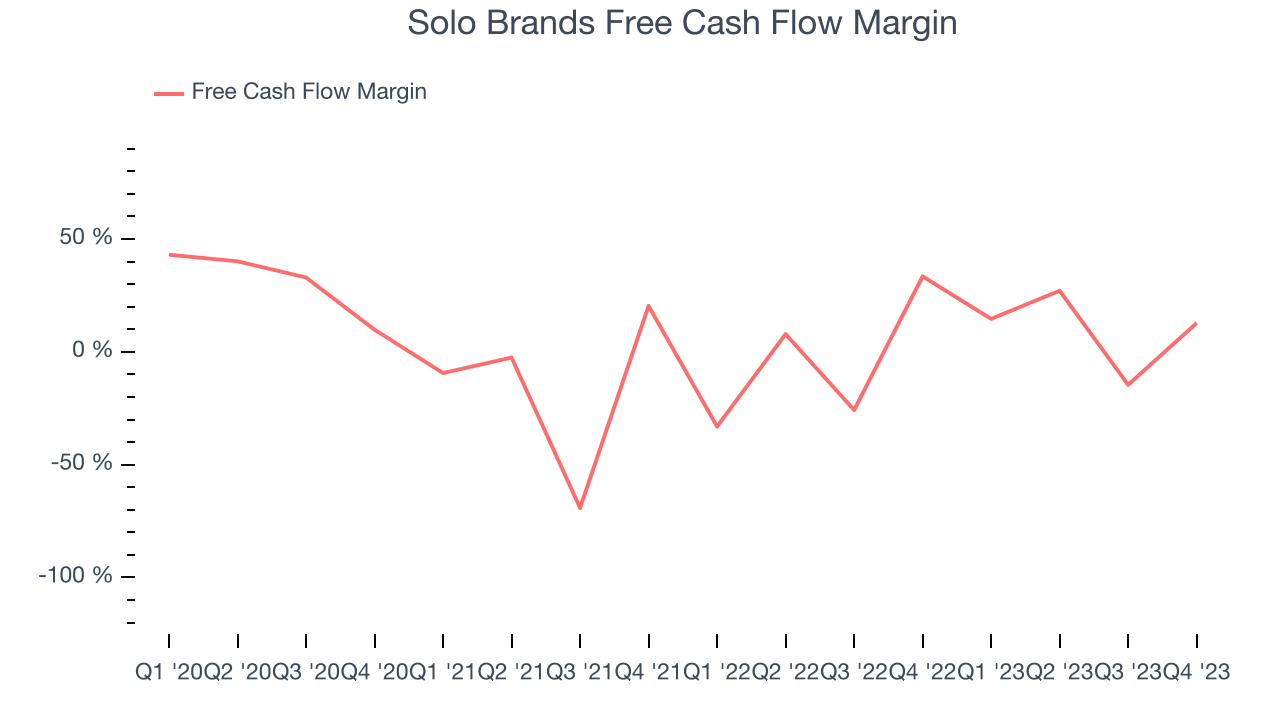

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Solo Brands has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 7.6%, subpar for a consumer discretionary business.

Solo Brands's free cash flow came in at $21.11 million in Q4, equivalent to a 12.8% margin and down 68% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Solo Brands's five-year average return on invested capital was negative 6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Key Takeaways from Solo Brands's Q4 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS fell short of Wall Street's estimates as it launched fewer new products than in the same quarter last year - management suggested this has historically been a driver of revenue growth. Its full-year 2024 EBITDA margin guidance also fell short of estimates. Overall, the results could have been better. The stock is up 1.7% after reporting and currently trades at $2.45 per share.

Is Now The Time?

Solo Brands may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Solo Brands, we'll be cheering from the sidelines. Although its revenue growth has been exceptional over the last three years, its projected EPS for the next year is lacking. And while its EPS growth over the last three years has been fantastic, the downside is its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

Solo Brands's price-to-earnings ratio based on the next 12 months is 3.7x. While the price is reasonable and there are some things to like about Solo Brands, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $4.71 per share right before these results (compared to the current share price of $2.45).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.