Digital media measurement and analytics provider DoubleVerify (NYSE:DV) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 28.9% year on year to $172.2 million. On the other hand, next quarter's revenue guidance of $138 million was less impressive, coming in 6.2% below analysts' estimates. It made a GAAP profit of $0.19 per share, improving from its profit of $0.17 per share in the same quarter last year.

DoubleVerify (DV) Q4 FY2023 Highlights:

- Revenue: $172.2 million vs analyst estimates of $171.7 million (small beat)

- EPS: $0.19 vs analyst estimates of $0.13 (47% beat)

- Revenue Guidance for Q1 2024 is $138 million at the midpoint, below analyst estimates of $147 million (adjusted EBITDA guidance for the period also missed expectations)

- Management's revenue guidance for the upcoming financial year 2024 is $696 million at the midpoint, missing analyst estimates by 1.7% and implying 21.6% growth (vs 26.4% in FY2023) (adjusted EBITDA guidance for the period also missed expectations)

- Free Cash Flow of $47.36 million, up 53.3% from the previous quarter

- Gross Margin (GAAP): 82.6%, in line with the same quarter last year

- Market Capitalization: $7.06 billion

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE:DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

The advertising industry continues to shift from traditional mediums to an expanding array of digital channels and platforms. Digital advertisers have historically relied on inconsistent, self-reported data from a large number of publishers, social media platforms and programmatic ad servers to understand how and where their ad budgets are being spent. The need to understand where ads are being served has accelerated in recent years as more and more objectionable content and ad fraud have found their way into the online advertising ecosystem.

DoubleVerify’s solution is an independent third party measurement provider which big brands can use to track and optimize the performance of their digital advertising dollars. The company’s DV Authentic Ad metric measures whether a digital ad is displayed in a fraud-free, brand-safe environment and is fully viewable in the intended geography. DoubleVerify’s customers can use this metric in real time, allowing advertisers to use the data to improve the efficiency of their advertising campaigns. Central to DoubleVerify’s competitive advantage is its integration across all the major platforms across the entire digital advertising ecosystem, and platforms from social, video, mobile in-app and connected TVs.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

DoubleVerify’s competitors include large vendors such as Adobe (NASDAQ:ADBE), and Salesforce.com (NYSE:CRM), along with Oracle’s Moat and Grapeshot (NYSE:ORCL), and Integral Ad Science (NASDAQ:IAS). Smaller private companies that compete directly include White Ops and OpenSlate.

Sales Growth

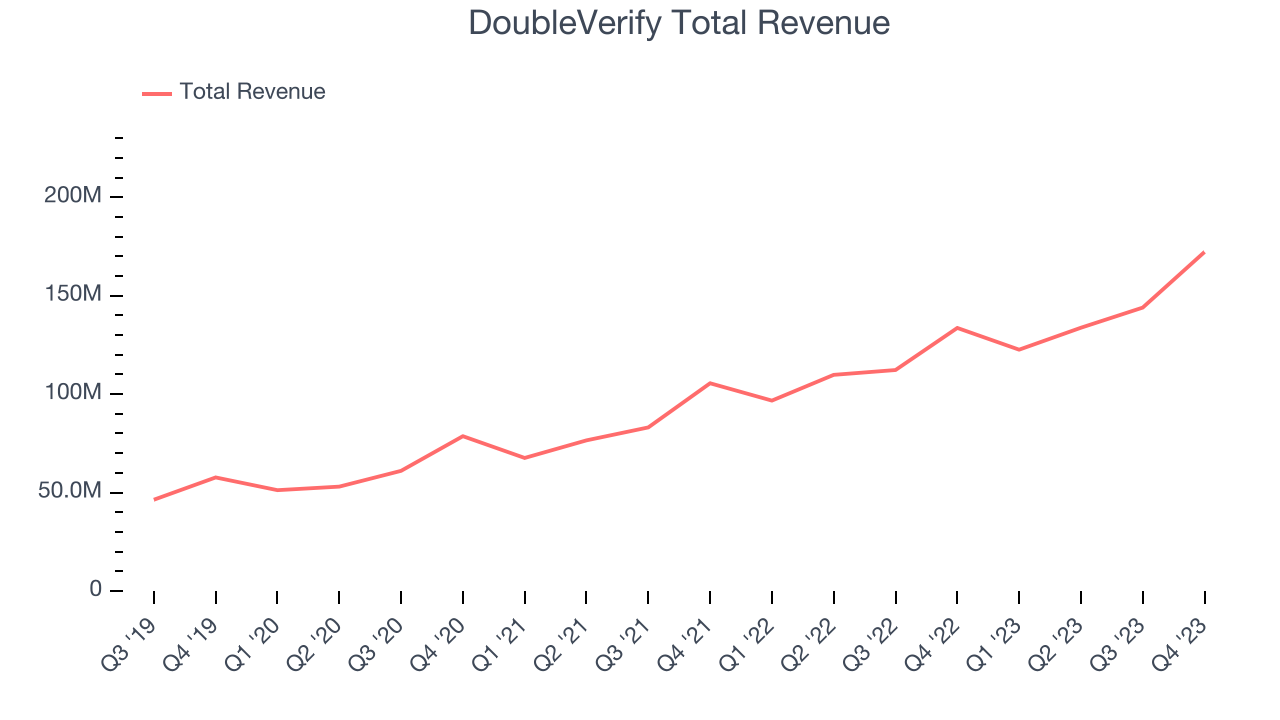

As you can see below, DoubleVerify's revenue growth has been very strong over the last two years, growing from $105.5 million in Q4 FY2021 to $172.2 million this quarter.

This quarter, DoubleVerify's quarterly revenue was once again up a very solid 28.9% year on year. On top of that, its revenue increased $28.26 million quarter on quarter, a very strong improvement from the $10.23 million increase in Q3 2023. This is a sign of acceleration of growth and great to see.

Next quarter's guidance suggests that DoubleVerify is expecting revenue to grow 12.6% year on year to $138 million, slowing down from the 26.7% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $696 million at the midpoint, growing 21.6% year on year compared to the 26.6% increase in FY2023.

Profitability

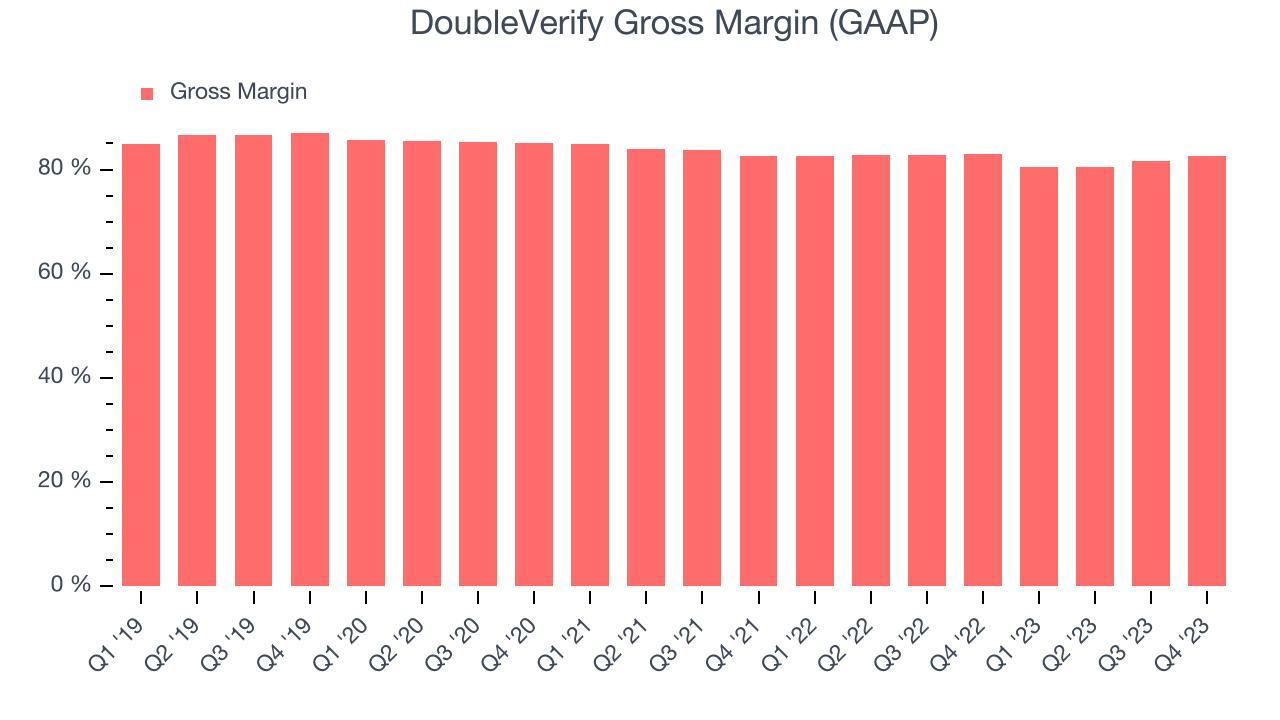

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. DoubleVerify's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 82.6% in Q4.

That means that for every $1 in revenue the company had $0.83 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, DoubleVerify's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

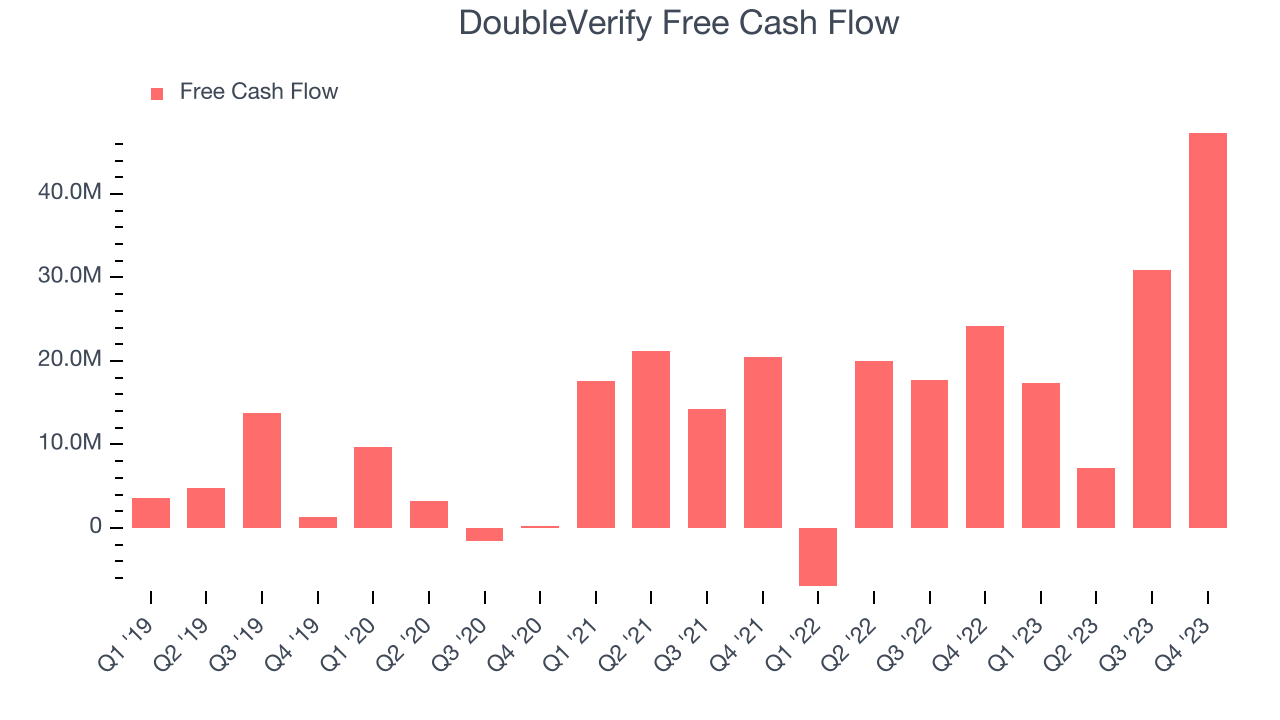

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. DoubleVerify's free cash flow came in at $47.36 million in Q4, up 95.4% year on year.

DoubleVerify has generated $102.7 million in free cash flow over the last 12 months, a solid 17.9% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from DoubleVerify's Q4 Results

Revenue in the quarter beat slightly, and gross margin improved this quarter. On the other hand, next quarter and full-year revenue as well as adjusted EBITDA guidance were both below expectations. Competitor Integral Ad Science (NASDAQ: IAS) also gave weak guidance yesterday and spoke of pricing competition and concessions in the industry, stoking fears of price wars and a deflationary environment. DV's quarter certainly is fanning those flames rather than putting the market at ease. Overall, this was a mediocre quarter for DoubleVerify. The company is down 19.5% on the results and currently trades at $31.59 per share.

Is Now The Time?

DoubleVerify may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are numerous reasons why we think DoubleVerify is one of the best software as service companies out there. While we'd expect growth rates to moderate from here, its . Additionally, its very efficient customer acquisition hints at the potential for strong profitability, and its impressive gross margins indicate excellent business economics.

The market is certainly expecting long-term growth from DoubleVerify given its price-to-sales ratio based on the next 12 months is 9.7x. But looking at the tech landscape today, DoubleVerify's qualities as one of the best businesses really stand out and we still like it at this price, despite the higher multiple.

Wall Street analysts covering the company had a one-year price target of $43.17 per share right before these results (compared to the current share price of $31.59), implying they saw upside in buying DoubleVerify in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.