Global talent agency and entertainment company Endeavor (NYSE:EDR) missed analysts' expectations in Q1 CY2024, with revenue up 15.9% year on year to $1.85 billion. It made a GAAP loss of $0.46 per share, down from its profit of $0.03 per share in the same quarter last year.

Is now the time to buy Endeavor? Find out by accessing our full research report, it's free.

Endeavor (EDR) Q1 CY2024 Highlights:

- Revenue: $1.85 billion vs analyst estimates of $1.87 billion (small miss)

- EPS: -$0.46 vs analyst estimates of $0.23 (-$0.69 miss)

- Gross Margin (GAAP): 54.4%, in line with the same quarter last year

- Market Capitalization: $7.99 billion

“This quarter, Endeavor benefited from brisk demand for our sports and entertainment content, live events, and premium experiences,” said Ariel Emanuel, CEO, Endeavor.

Owner of the UFC, WWE, and a client roster including Christian Bale, Endeavor (NYSE:EDR) is a diversified global entertainment, sports, and content company known for its talent representation and involvement in the entertainment industry.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

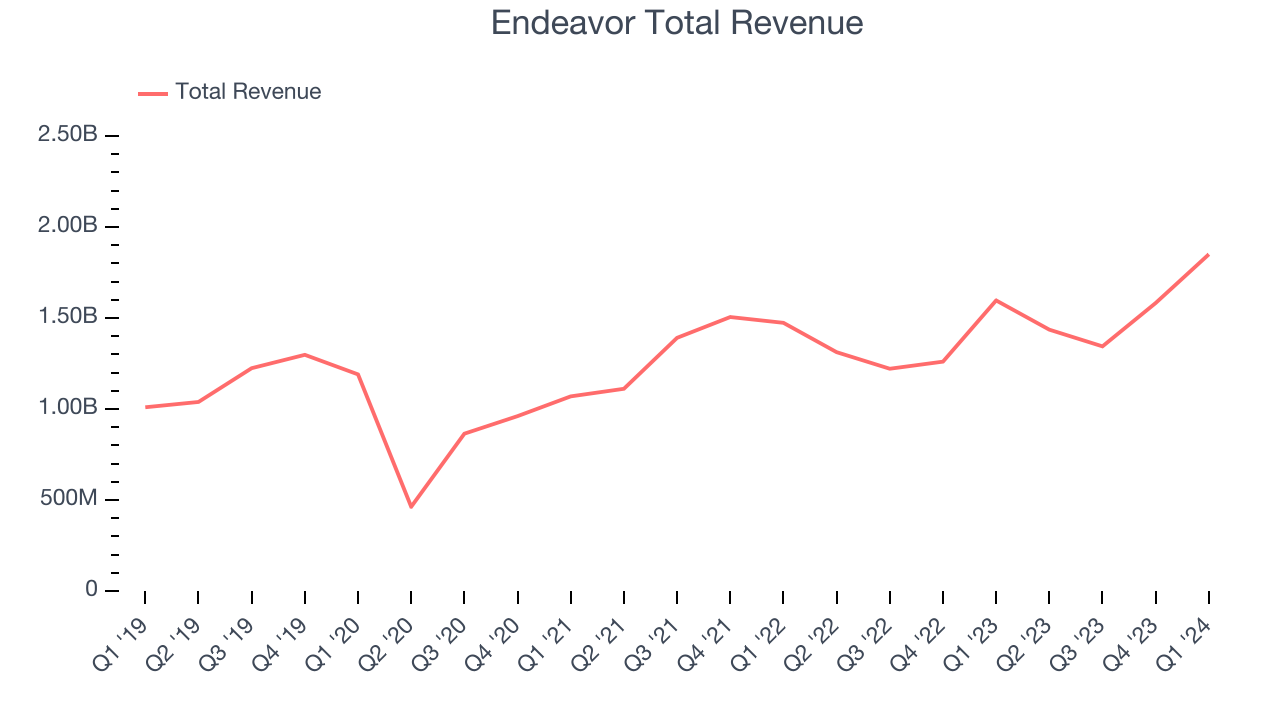

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Endeavor's annualized revenue growth rate of 6.9% over the last four years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Endeavor's annualized revenue growth of 6.5% over the last two years aligns with its four-year revenue growth, suggesting the company's demand has been stable.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Endeavor's annualized revenue growth of 6.5% over the last two years aligns with its four-year revenue growth, suggesting the company's demand has been stable.

We can dig even further into the company's revenue dynamics by analyzing its three most important segments: Events, Sports, and Representation, which are 40.3%, 37%, and 18.7% of revenue. Over the last two years, Endeavor's Sports revenue (UFC, Euroleague) averaged 40.5% year-on-year growth while its Events (live events) and Representation (WME talent agency, IMG Models) revenues averaged 3.8% and 8.6% declines.

This quarter, Endeavor's revenue grew 15.9% year on year to $1.85 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 27.1% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

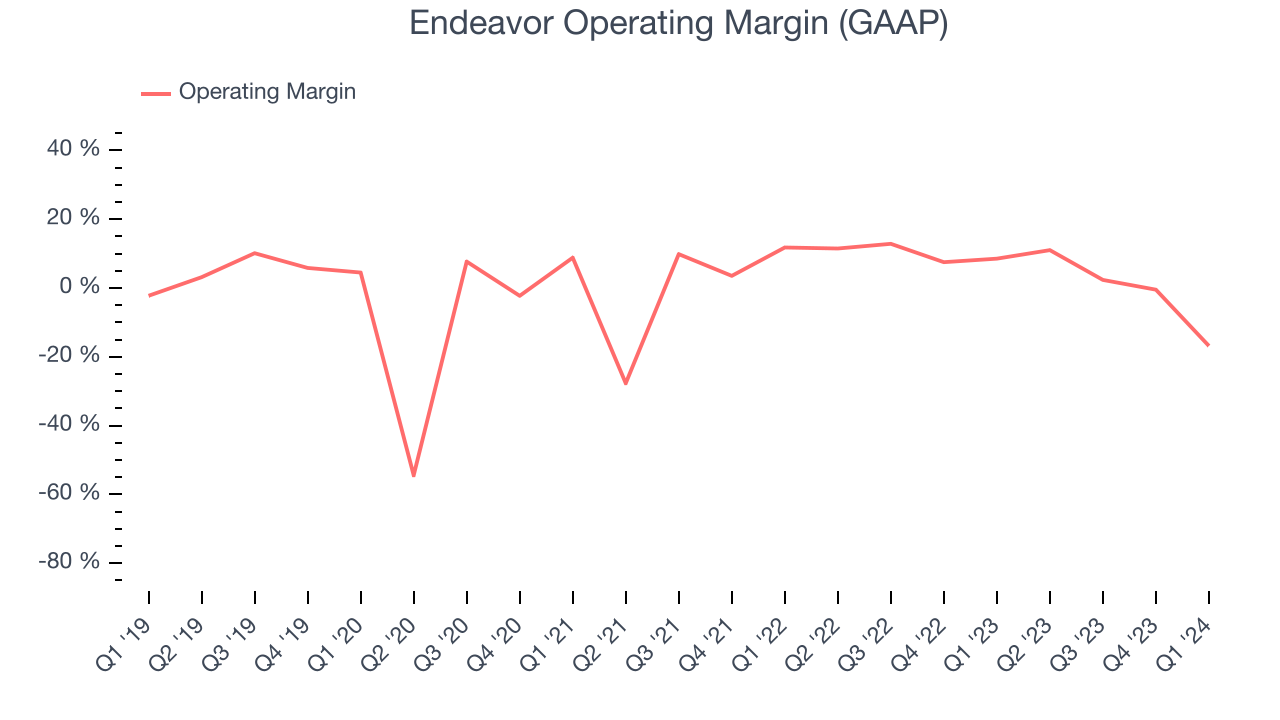

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Endeavor was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.5% has been paltry for a consumer discretionary business.

This quarter, Endeavor generated an operating profit margin of negative 16.8%, down 25.4 percentage points year on year.

Over the next 12 months, Wall Street expects Endeavor to become profitable. Analysts are expecting the company’s LTM operating margin of negative 2.1% to rise to positive 11.5%.Key Takeaways from Endeavor's Q1 Results

We struggled to find many strong positives in these results. Its operating margin missed and its EPS fell short of Wall Street's estimates. Overall, this was a mediocre quarter for Endeavor. The stock is flat after reporting and currently trades at $26.53 per share.

So should you invest in Endeavor right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.