As video conferencing stocks’ Q4 earnings season wraps, let's dig into this quarter's best and worst performers, including 8x8 (NYSE:EGHT) and its peers.

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

The 4 video conferencing stocks we track reported a weak Q4; on average, revenues were in line with analyst consensus estimates, while on average next quarter revenue guidance was 1.91% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows and video conferencing stocks have not been spared, with share prices down 18.6% since the previous earnings results, on average.

8x8 (NYSE:EGHT)

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

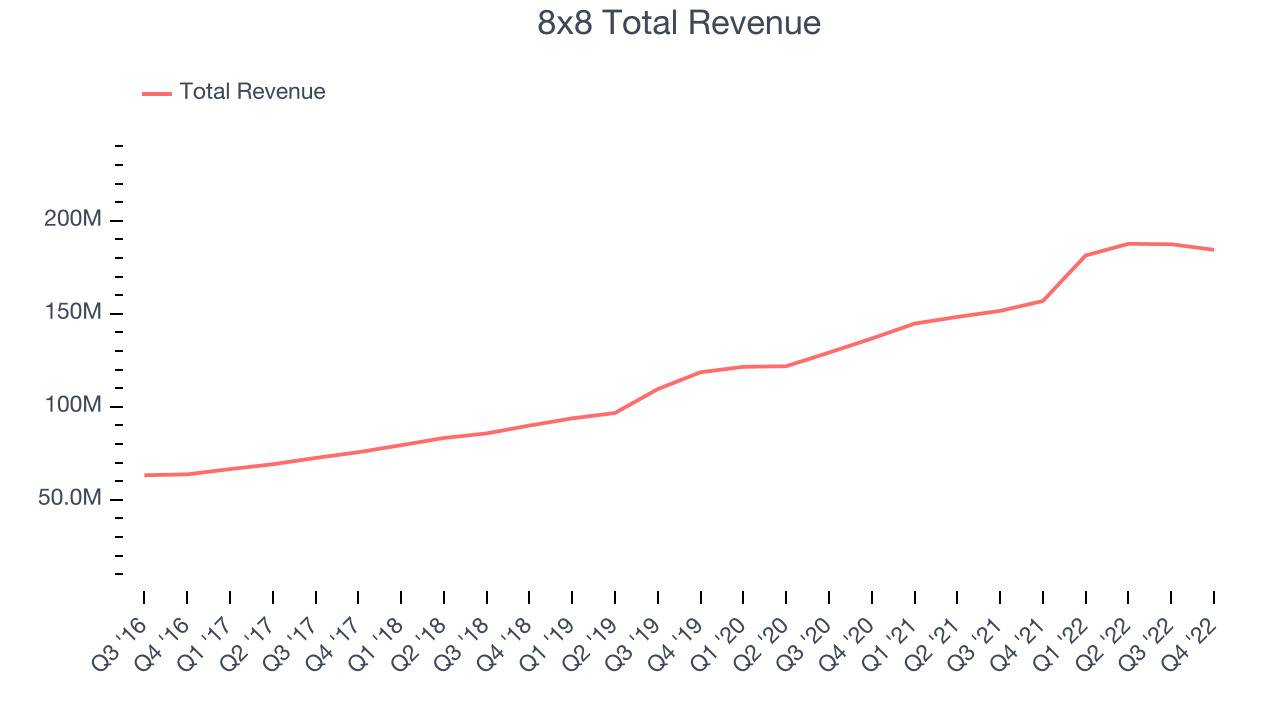

8x8 reported revenues of $184.4 million, up 17.5% year on year, missing analyst expectations by 0.91%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

"We continued to invest in innovation while reducing our service delivery costs and increasing operational efficiency across the organization," said Samuel Wilson, 8x8 Interim CEO.

8x8 delivered the weakest performance against analyst estimates of the whole group. The company added 18 enterprise customers paying more than $100,000 annually to a total of 1,309. The stock is down 20.2% since the results and currently trades at $4.

Read our full report on 8x8 here, it's free.

Best Q4: Five9 (NASDAQ:FIVN)

Started in 2001, Five9 (NASDAQ: FIVN) offers software as a service that makes it easier for companies to set up and efficiently run call centers, and offer more tailored customer support.

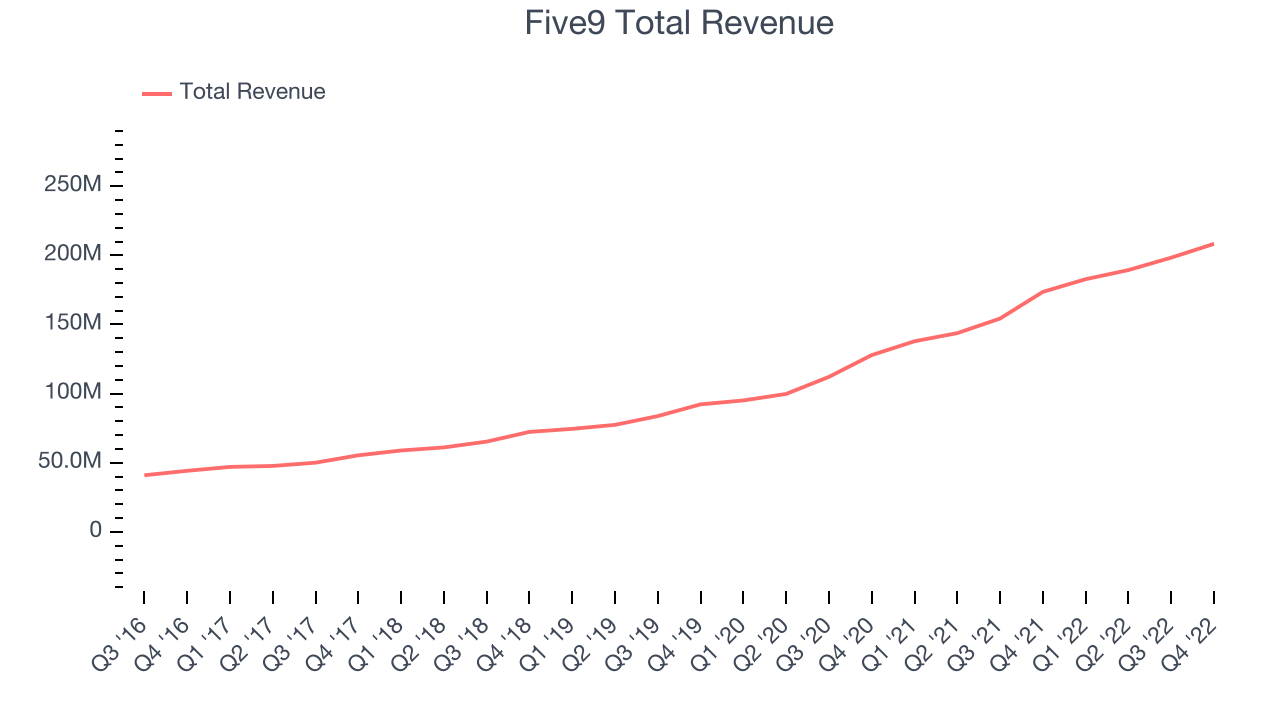

Five9 reported revenues of $208.3 million, up 20% year on year, beating analyst expectations by 1.92%. It was a slower quarter for the company, with underwhelming guidance for the next quarter and full year.

Five9 achieved the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The stock is down 16.3% since the results and currently trades at $68.25.

Is now the time to buy Five9? Access our full analysis of the earnings results here, it's free.

Weakest Q4: RingCentral (NYSE:RNG)

Founded in 1999 during the dot-com era, RingCentral (NYSE:RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

RingCentral reported revenues of $524.7 million, up 17% year on year, missing analyst expectations by 0.6%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

RingCentral had the weakest full year guidance update in the group. The stock is down 37.2% since the results and currently trades at $30.44.

Read our full analysis of RingCentral's results here.

Zoom Video (NASDAQ:ZM)

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Zoom Video reported revenues of $1.12 billion, up 4.33% year on year, beating analyst expectations by 1.55%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

Zoom Video had the slowest revenue growth among the peers. The company added 185 enterprise customers paying more than $100,000 annually to a total of 3,471. The stock is down 0.73% since the results and currently trades at $73.21.

Read our full, actionable report on Zoom Video here, it's free.

The author has no position in any of the stocks mentioned