Encompass Health currently trades at $100.30 per share and has shown little upside over the past six months, posting a middling return of 3.8%. However, the stock is beating the S&P 500’s 1.4% decline during that period.

Is there a buying opportunity in Encompass Health, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the relative momentum, we're cautious about Encompass Health. Here are two reasons why we avoid EHC and a stock we'd rather own.

Why Is Encompass Health Not Exciting?

With a network of 161 specialized facilities across 37 states and Puerto Rico, Encompass Health (NYSE:EHC) operates inpatient rehabilitation hospitals that help patients recover from strokes, hip fractures, and other debilitating conditions.

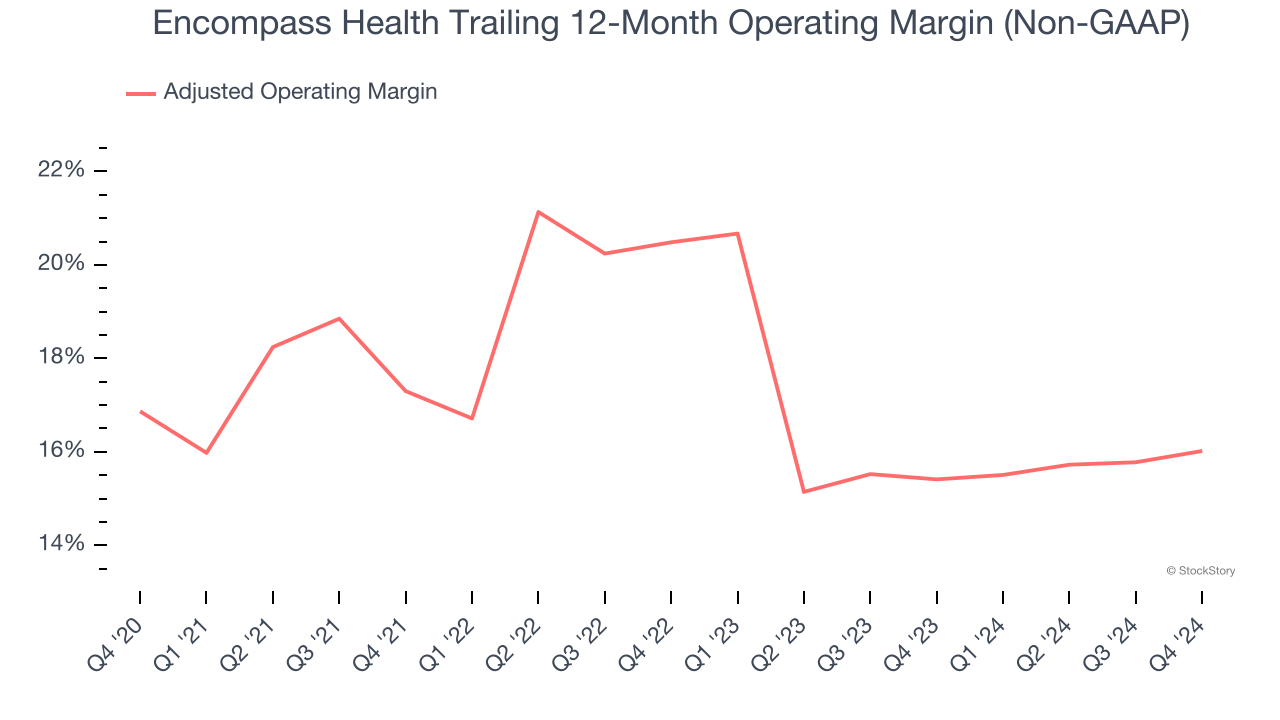

1. Shrinking Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Looking at the trend in its profitability, Encompass Health’s adjusted operating margin decreased by 4.5 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 16%.

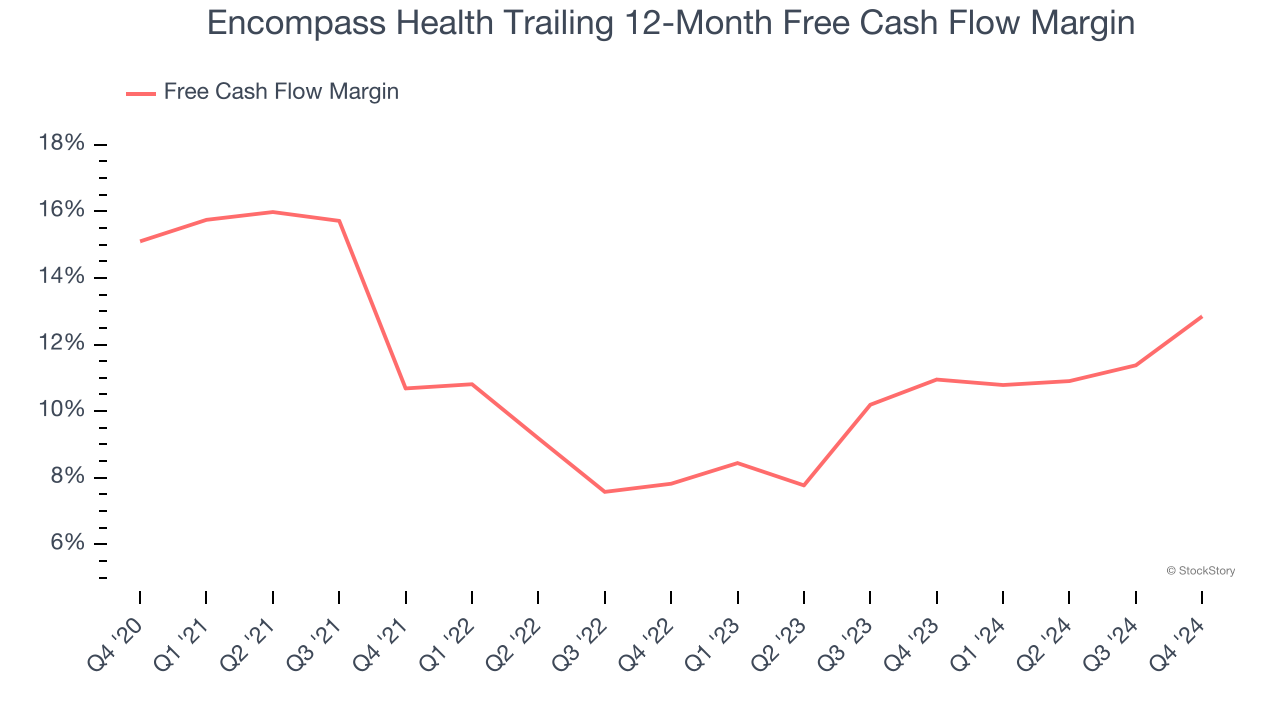

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Encompass Health’s margin dropped by 2.3 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Encompass Health’s free cash flow margin for the trailing 12 months was 12.8%.

Final Judgment

Encompass Health isn’t a terrible business, but it doesn’t pass our bar. Following its recent outperformance amid a softer market environment, the stock trades at 21.3× forward price-to-earnings (or $100.30 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Encompass Health

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.