Beauty products company Estée Lauder (NYSE:EL) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 5% year on year to $3.94 billion. It made a non-GAAP profit of $0.97 per share, improving from its profit of $0.47 per share in the same quarter last year.

Estée Lauder (EL) Q1 CY2024 Highlights:

- Revenue: $3.94 billion vs analyst estimates of $3.91 billion (small beat)

- EPS (non-GAAP): $0.97 vs analyst estimates of $0.50 (95.7% beat)

- EPS (non-GAAP) Guidance for Q2 CY2024 is $0.24 at the midpoint, well below analyst estimates of $0.75 (revenue guidance for the period also missed)

- EPS (non-GAAP) Guidance for full 2024 is $2.19 at the midpoint, below analyst estimates of $2.25

- Gross Margin (GAAP): 71.9%, up from 69.1% in the same quarter last year

- Free Cash Flow of $359 million, down 67.7% from the previous quarter

- Organic Revenue was up 5.9% year on year

- Market Capitalization: $52.59 billion

Named after its founder, who was an entrepreneurial woman from New York with a passion for skincare, Estée Lauder (NYSE:EL) is a one-stop beauty shop with products in skincare, fragrance, makeup, sun protection, and men’s grooming.

In addition to its namesake brand, the company also goes to market with the Clinique, MAC, Bobbi Brown, and La Mer brands. While there are differences between the brands, the unifying theme is quality and elegance.

Estée Lauder caters to a broad spectrum of beauty enthusiasts, but their core customer is a more affluent adult woman. This woman isn’t afraid to pay a premium for trusted brands and wants beauty products that are effective. To meet her needs, the company maintains an air of exclusivity through a combination of aspirational marketing, thoughtful distribution, and product innovation.

Estée Lauder's products are most commonly found in upscale department stores like Nordstrom (NYSE:JWN) and Bloomingdale's as well as specialty beauty retailers such as Ulta Beauty (NASDAQ:ULTA) and Sephora. The company also strategically places its products in luxury boutiques and upscale spas to maintain its premium image. On the other hand, Estée Lauder will generally not be found in drugstores, lower-tier department stores, or discount chains.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors that offer a wide range of beauty and cosmetics products include L’Oreal (ENXTPA:OR), Coty (NYSE:COTY), Proctor & Gamble (NYSE:PG), and private company Revlon.Sales Growth

Estée Lauder is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

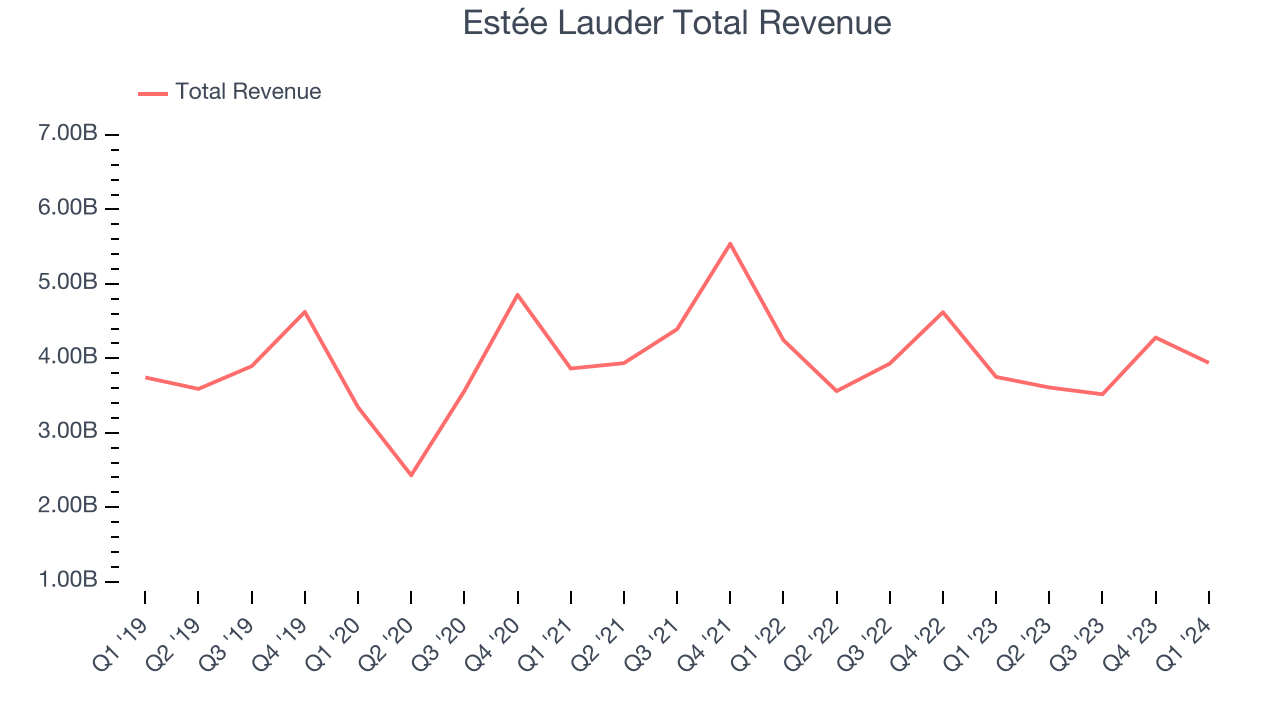

As you can see below, the company's annualized revenue growth rate of 1.4% over the last three years was weak for a consumer staples business.

This quarter, Estée Lauder grew its revenue by 5% year on year, and its $3.94 billion in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 9.6% over the next 12 months, an acceleration from this quarter.

Organic Revenue Growth

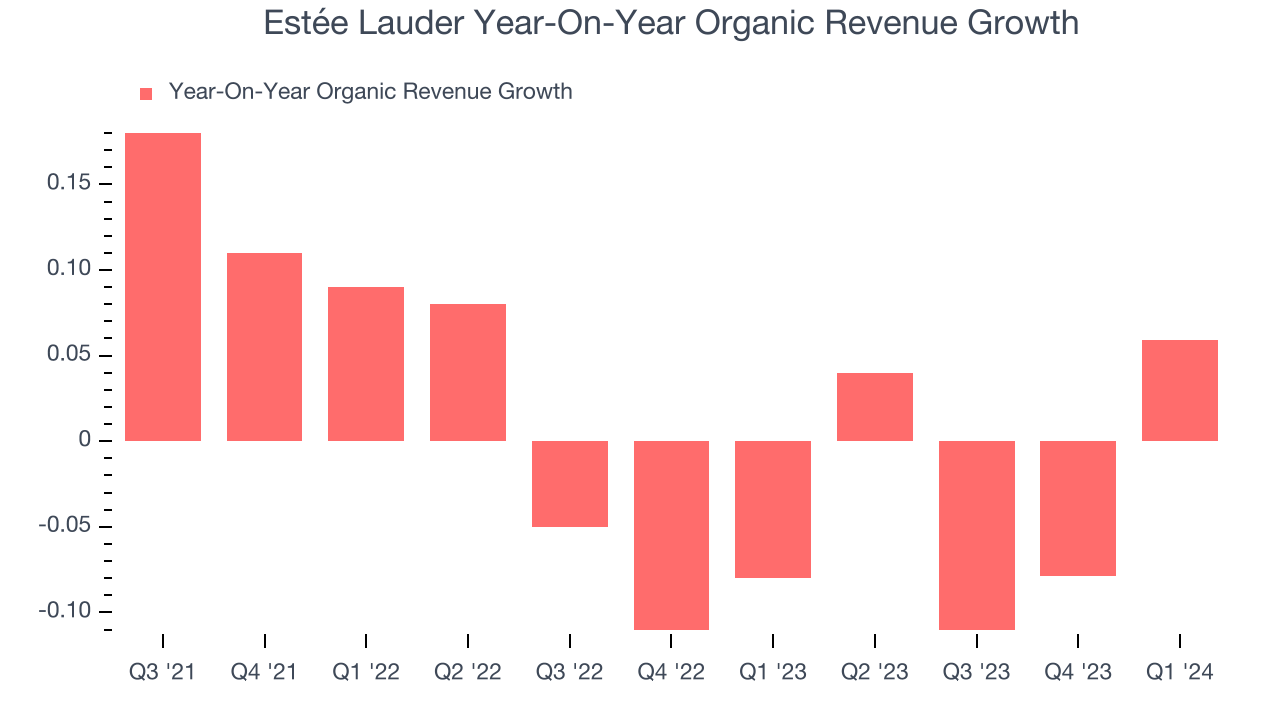

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

Estée Lauder's demand has been falling over the last eight quarters, and on average, its organic sales have declined by 3.1% year on year.

In the latest quarter, Estée Lauder's organic sales rose 5.9% year on year. This growth was a well-appreciated turnaround from the 8% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Gross Margin & Pricing Power

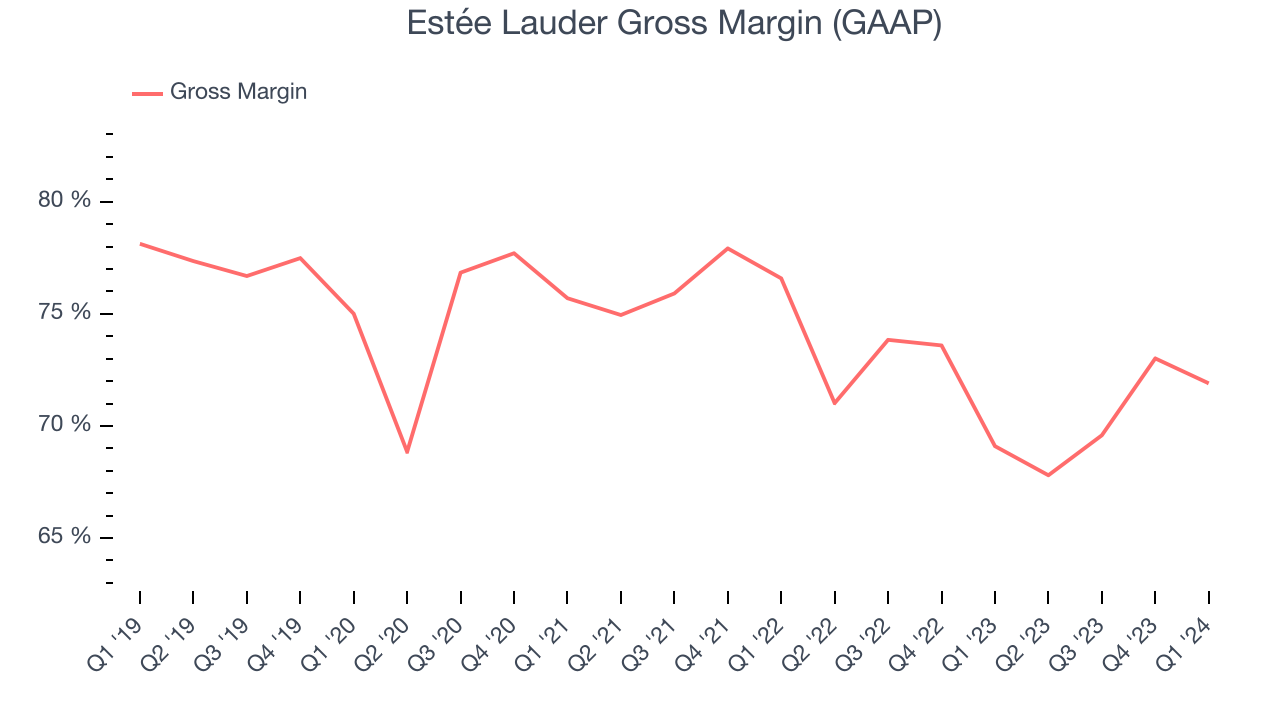

All else equal, we prefer higher gross margins. They usually indicate that a company sells more differentiated products and commands stronger pricing power.

This quarter, Estée Lauder's gross profit margin was 71.9%, up 2.8 percentage points year on year. That means for every $1 in revenue, only $0.28 went towards paying for raw materials, production of goods, and distribution expenses.

Estée Lauder has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 71.4% gross margin over the last two years. Its margin, however, has been trending down over the last year, averaging 1.8% year-on-year decreases each quarter. If this trend continues, it could suggest a more competitive environment.

Operating Margin

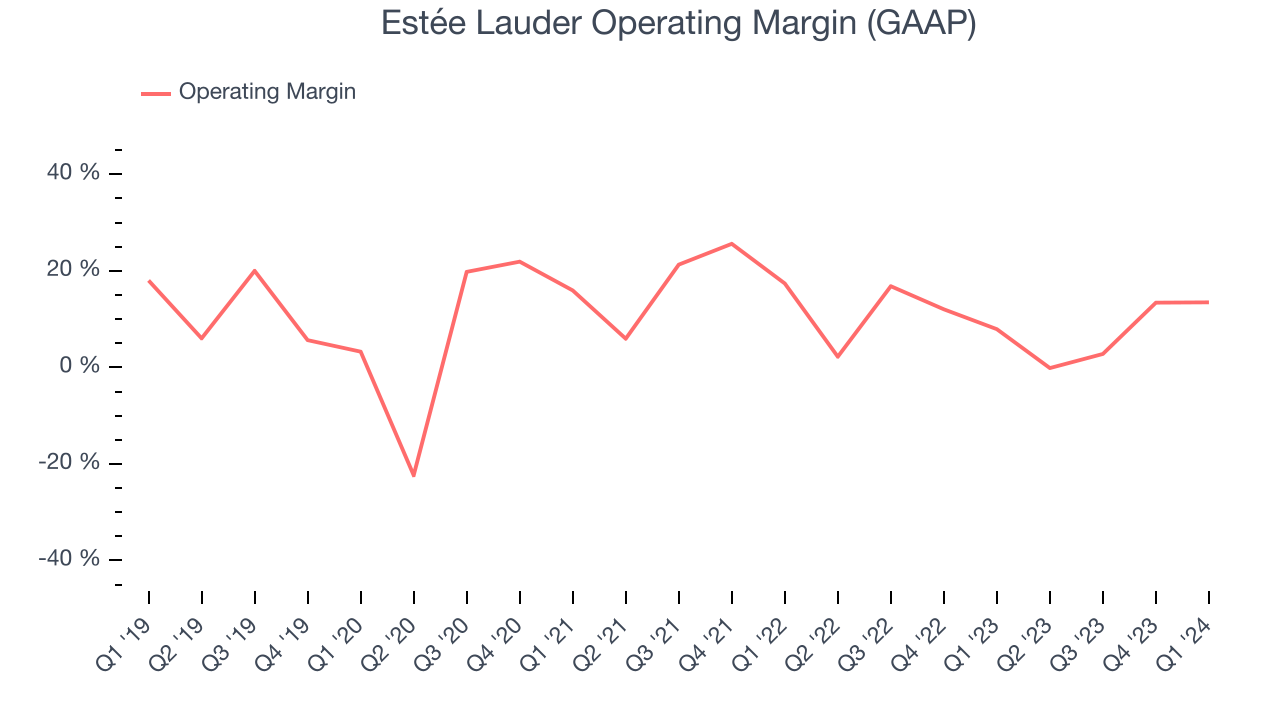

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, Estée Lauder generated an operating profit margin of 13.5%, up 5.6 percentage points year on year. This increase was encouraging, and we can infer Estée Lauder was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, Estée Lauder has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 8.9%, higher than the broader consumer staples sector. However, Estée Lauder's margin has declined by 2.2 percentage points on average over the last year. Although this isn't the end of the world, investors are likely hoping for better results in the future.

Zooming out, Estée Lauder has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 8.9%, higher than the broader consumer staples sector. However, Estée Lauder's margin has declined by 2.2 percentage points on average over the last year. Although this isn't the end of the world, investors are likely hoping for better results in the future. EPS

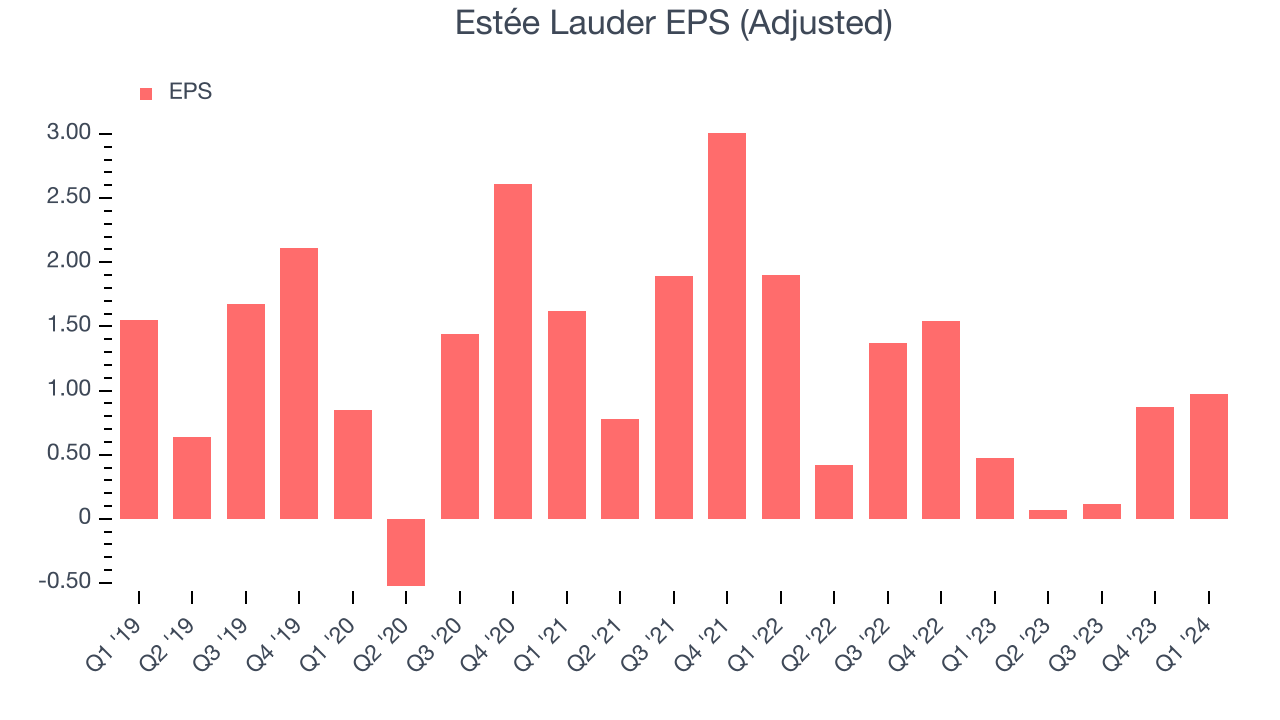

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Estée Lauder reported EPS at $0.97, up from $0.47 in the same quarter a year ago. This print beat Wall Street's estimates by 95.7%.

Between FY2021 and FY2024, Estée Lauder's EPS dropped 60.7%, translating into 26.7% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 99.4% year-on-year increase in EPS.

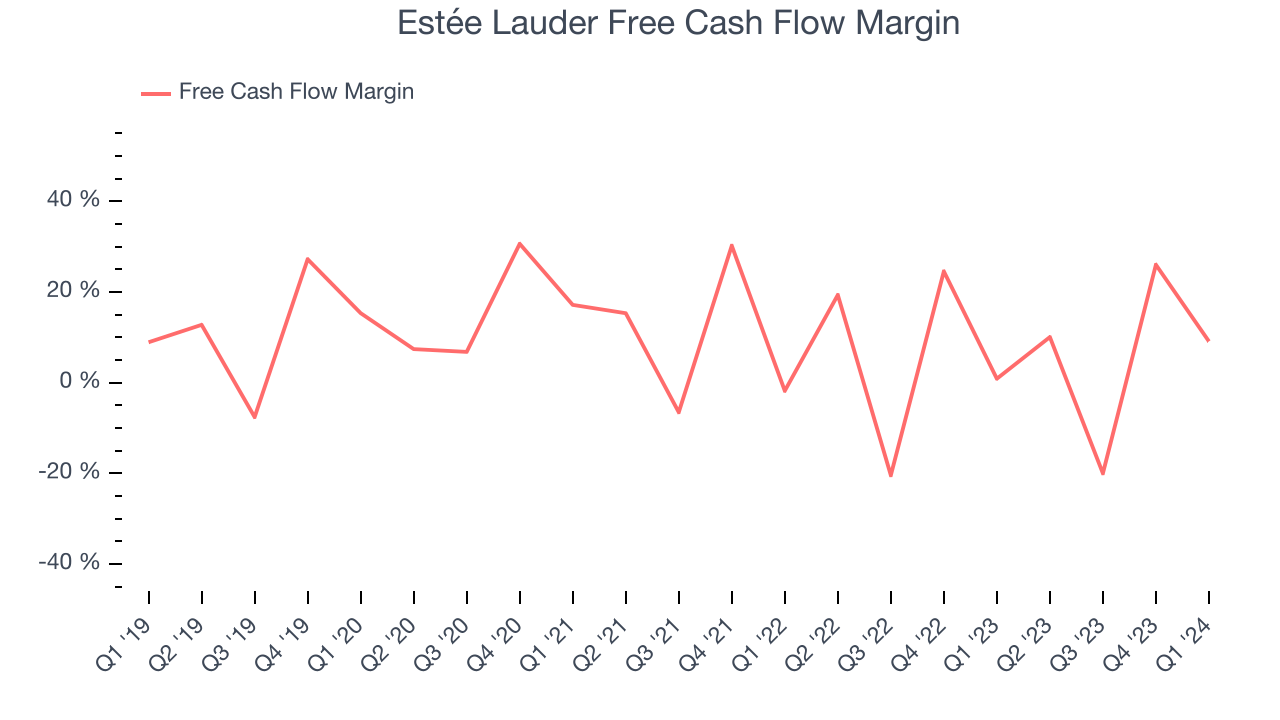

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Estée Lauder's free cash flow came in at $359 million in Q1, up 988% year on year. This result represents a 9.1% margin.

Over the last two years, Estée Lauder has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 7%, slightly better than the broader consumer staples sector. Furthermore, its margin has been flat, showing that the company's cash flows are relatively stable.

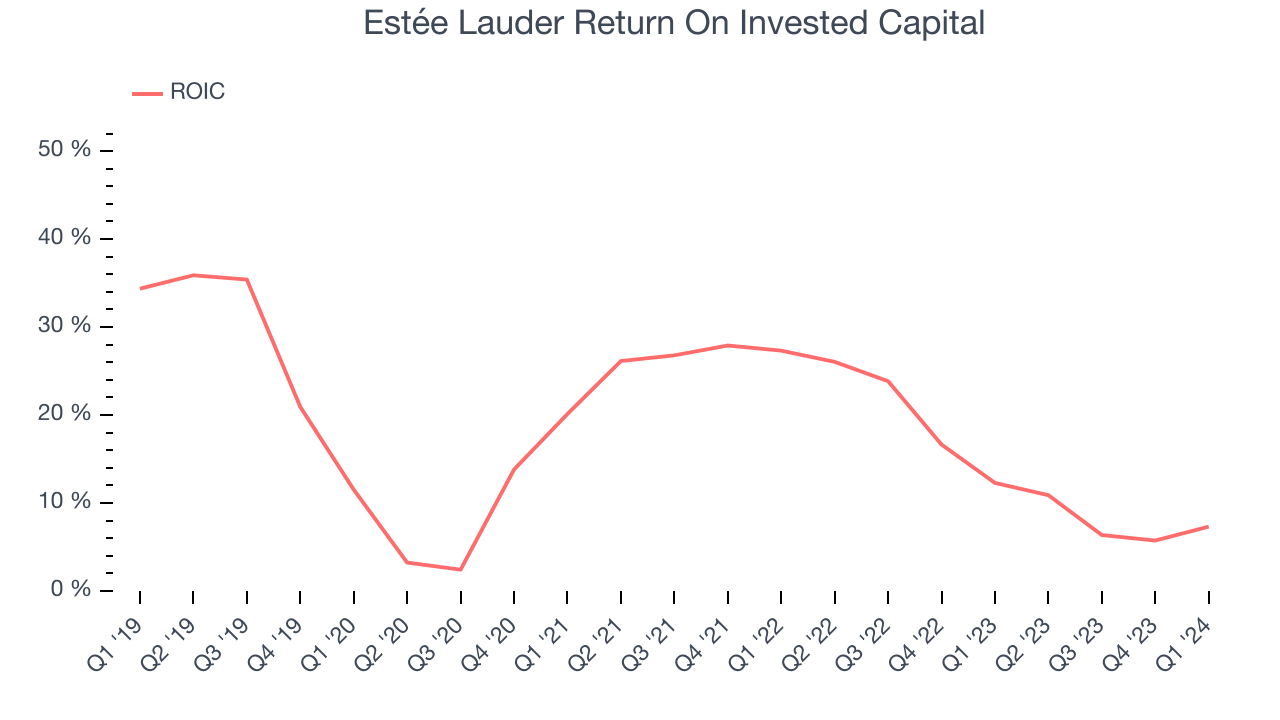

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Estée Lauder's five-year average ROIC was 15.7%, higher than most consumer staples companies. Just as you’d like your investment dollars to generate returns, Estée Lauder's invested capital has produced solid profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Estée Lauder's ROIC averaged 6 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Estée Lauder reported $3.70 billion of cash and $9.34 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $2.10 billion of EBITDA over the last 12 months, we view Estée Lauder's 2.7x net-debt-to-EBITDA ratio as safe. We also see its $109 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Estée Lauder's Q1 Results

We liked how Estée Lauder beat analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. On the other hand, its revenue and earnings forecast for next quarter missed analysts' expectations. Full-year earnings guidance also missed Wall Street's estimates. Overall, this quarter's results were fine, but guidance is dragging the stock down. Specifically, the stock is down 5.6% after reporting, trading at $138.5 per share.

Is Now The Time?

Estée Lauder may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Estée Lauder isn't a bad business. Although its revenue growth has been weak over the last three years, its growth over the next 12 months is expected to be higher. And while its declining EPS over the last three years makes it hard to trust, its impressive gross margins are a wonderful starting point for the overall profitability of the business.

Estée Lauder's price-to-earnings ratio based on the next 12 months is 36.3x. There are things to like about Estée Lauder and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $162.16 per share right before these results (compared to the current share price of $138.50).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.