Wrapping up Q3 earnings, we look at the numbers and key takeaways for the personal care stocks, including e.l.f. (NYSE:ELF) and its peers.

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 13 personal care stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.5% while next quarter’s revenue guidance was 16.1% below.

Thankfully, share prices of the companies have been resilient as they are up 6.6% on average since the latest earnings results.

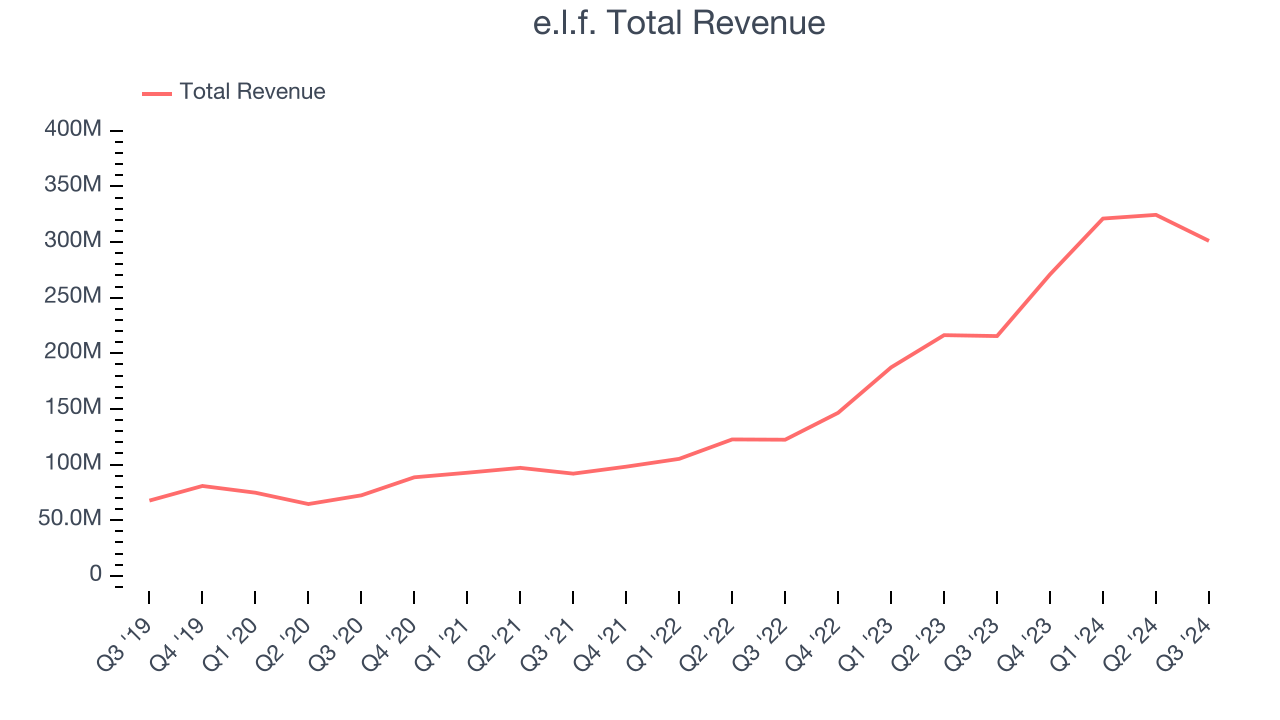

e.l.f. (NYSE:ELF)

e.l.f. Beauty (NYSE:ELF), which stands for ‘eyes, lips, face’, offers high-quality beauty products at accessible price points.

e.l.f. reported revenues of $301.1 million, up 39.7% year on year. This print exceeded analysts’ expectations by 4%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EPS and EBITDA estimates.

“Q2 marked another quarter of consistent, category-leading growth. In Q2, we delivered 40% net sales growth, fueled by 195 basis points of market share gains in the U.S. and 91% net sales growth internationally,” said Tarang Amin, e.l.f.

e.l.f. scored the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 17.3% since reporting and currently trades at $122.24.

Is now the time to buy e.l.f.? Access our full analysis of the earnings results here, it’s free.

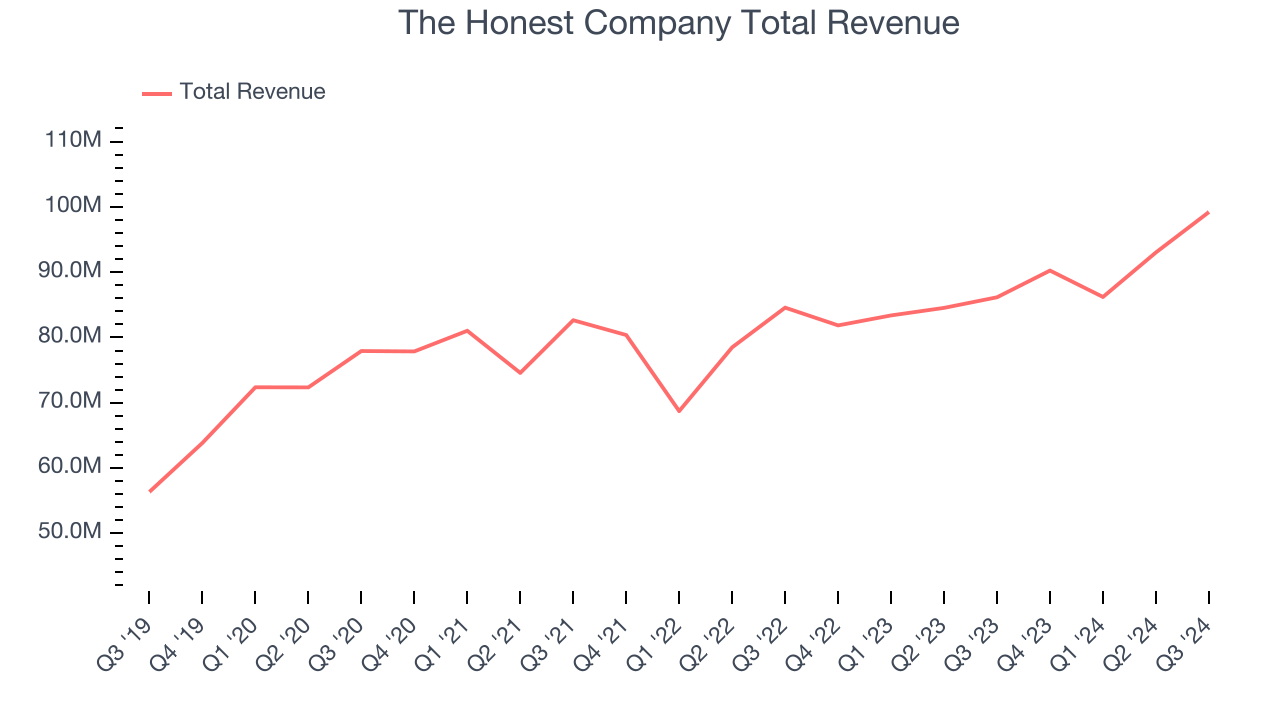

Best Q3: The Honest Company (NASDAQ:HNST)

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ:HNST) sells diapers and wipes, skin care products, and household cleaning products.

The Honest Company reported revenues of $99.24 million, up 15.2% year on year, outperforming analysts’ expectations by 6.9%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates.

The Honest Company delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 35.6% since reporting. It currently trades at $6.51.

Is now the time to buy The Honest Company? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Nu Skin (NYSE:NUS)

With person-to-person marketing and sales rather than selling through retail stores, Nu Skin (NYSE:NUS) is a personal care and dietary supplements company that engages in direct selling.

Nu Skin reported revenues of $430.1 million, down 13.8% year on year, falling short of analysts’ expectations by 2.5%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Interestingly, the stock is up 8.5% since the results and currently trades at $6.99.

Read our full analysis of Nu Skin’s results here.

BeautyHealth (NASDAQ:SKIN)

Operating in the emerging beauty health category, the appropriately named BeautyHealth (NASDAQ:SKIN) is a skincare company best known for its Hydrafacial product that cleanses and hydrates skin.

BeautyHealth reported revenues of $78.8 million, down 19.1% year on year. This result surpassed analysts’ expectations by 2.6%. More broadly, it was a mixed quarter as it also logged a solid beat of analysts’ EBITDA estimates but full-year revenue guidance missing analysts’ expectations significantly.

The stock is down 11.2% since reporting and currently trades at $1.51.

Read our full, actionable report on BeautyHealth here, it’s free.

USANA (NYSE:USNA)

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE:USNA) manufactures and sells nutritional, personal care, and skincare products.

USANA reported revenues of $200.2 million, down 6.2% year on year. This result lagged analysts' expectations by 2.7%. It was a slower quarter as it also produced full-year revenue guidance slightly missing analysts’ expectations.

The stock is up 17.2% since reporting and currently trades at $40.34.

Read our full, actionable report on USANA here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.