Battery and lighting company Energizer (NYSE:ENR) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 3% year on year to $663.3 million. It made a non-GAAP profit of $0.72 per share, improving from its profit of $0.64 per share in the same quarter last year.

Energizer (ENR) Q1 CY2024 Highlights:

- Revenue: $663.3 million vs analyst estimates of $664 million (small miss)

- EPS (non-GAAP): $0.72 vs analyst estimates of $0.67 (7.1% beat)

- EPS (non-GAAP) Guidance for Q2 CY2024 is $0.65 at the midpoint, below analyst estimates of $0.71

- Gross Margin (GAAP): 38.2%, in line with the same quarter last year

- Free Cash Flow of $10.3 million, down 93.3% from the previous quarter

- Organic Revenue was down 2.7% year on year

- Market Capitalization: $2.11 billion

Masterminds behind the viral Energizer Bunny mascot, Energizer (NYSE:ENR) is one of the world's largest manufacturers of batteries.

The company’s roots can be traced to 1896 when American inventor Conrad Hubert patented the first flashlight, which utilized a dry cell battery. Over the next century, Hubert’s company would undergo a series of mergers. The Energizer we know today was born when it spun off from its parent company, Ralston Purina, in 2000, allowing it to focus exclusively on its battery and lighting businesses.

Energizer manufactures a wide range of batteries, including alkaline, lithium, rechargeable, and specialty batteries, that power devices in homes, workplaces, and on the go, from remote controls and flashlights to portable electronics and medical devices. Its brands, including Energizer and Eveready, are some of the most recognized globally thanks to their longevity, reliability, and consistent performance.

Beyond batteries, Energizer excels in providing high-quality lighting solutions. Their product lineup encompasses LED flashlights, lanterns, headlamps, and area lighting. These solutions offer brightness, durability, and energy efficiency, catering to outdoor enthusiasts and everyday illumination needs.

Energizer's products are distributed and enjoyed by consumers across the globe. It engages with customers through various channels, including retail partnerships and e-commerce platforms, and places a strong emphasis on eco-friendly options that contribute to reducing waste and conserving resources.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Competitors in the battery and lighting industry include AmazonBasics (owned by Amazon, NASDAQGS:AMZN), Duracell (owned by Proctor & Gamble, NYSE:PG), Panasonic (TSE:6752), and Sony (NYSE:SONY).Sales Growth

Energizer carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Energizer can still achieve high growth rates because its revenue base is not yet monstrous.

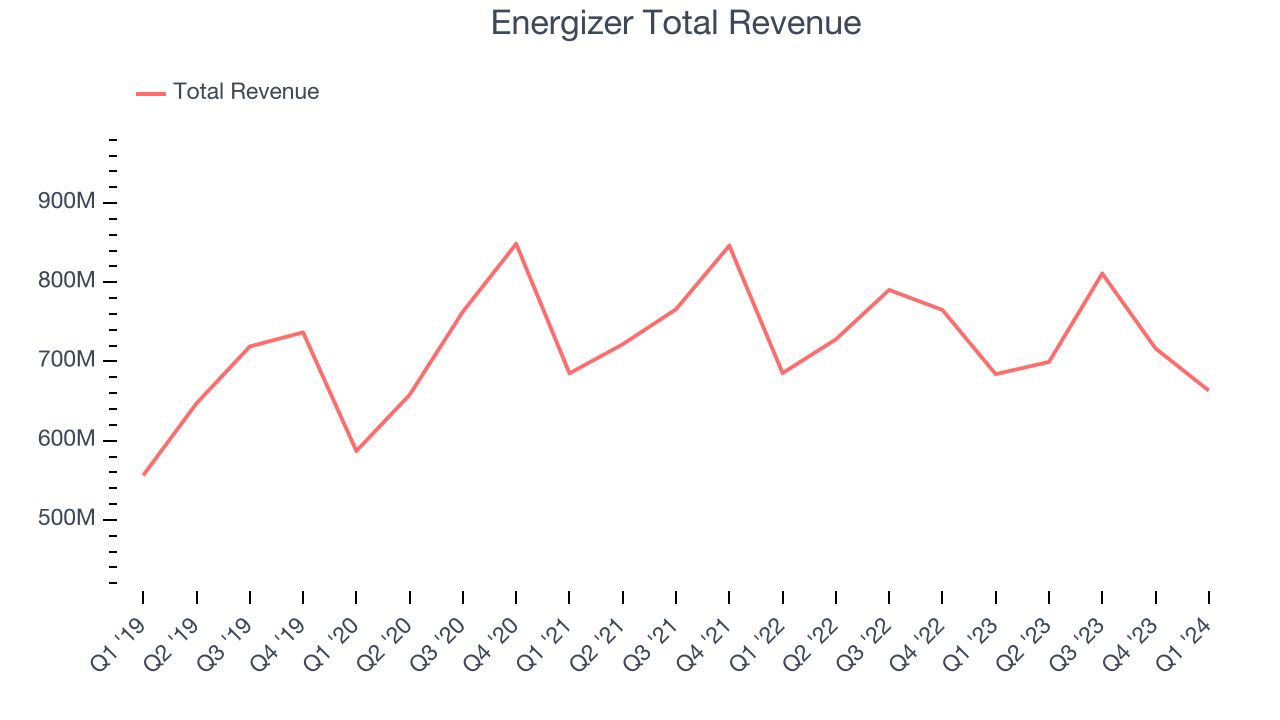

As you can see below, the company's revenue was flat over the last three years. This is poor for a consumer staples business.

This quarter, Energizer missed Wall Street's estimates and reported a rather uninspiring 3% year-on-year revenue decline, generating $663.3 million in revenue. Looking ahead, Wall Street expects sales to grow 1.7% over the next 12 months, an acceleration from this quarter.

Organic Revenue Growth

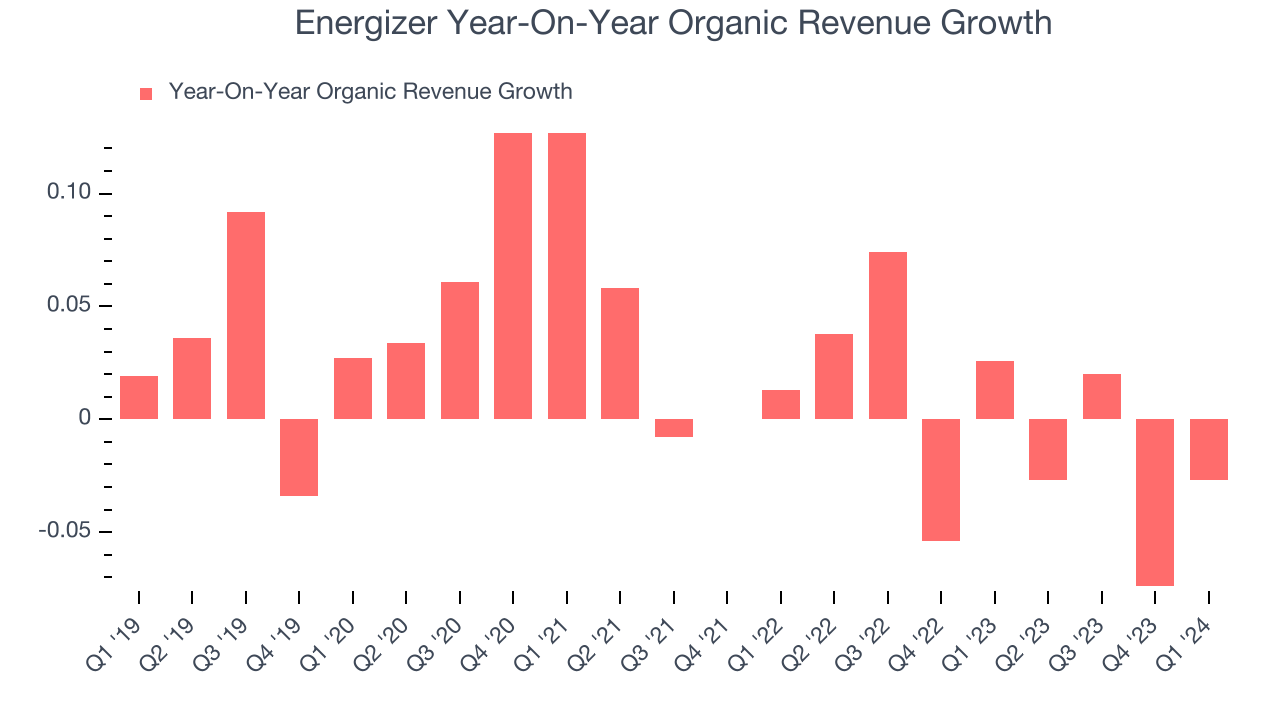

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

The demand for Energizer's products has barely risen over the last eight quarters. On average, the company's organic sales have been flat.

In the latest quarter, Energizer's organic sales fell 2.7% year on year. This decline was a reversal from the 2.6% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Gross Margin & Pricing Power

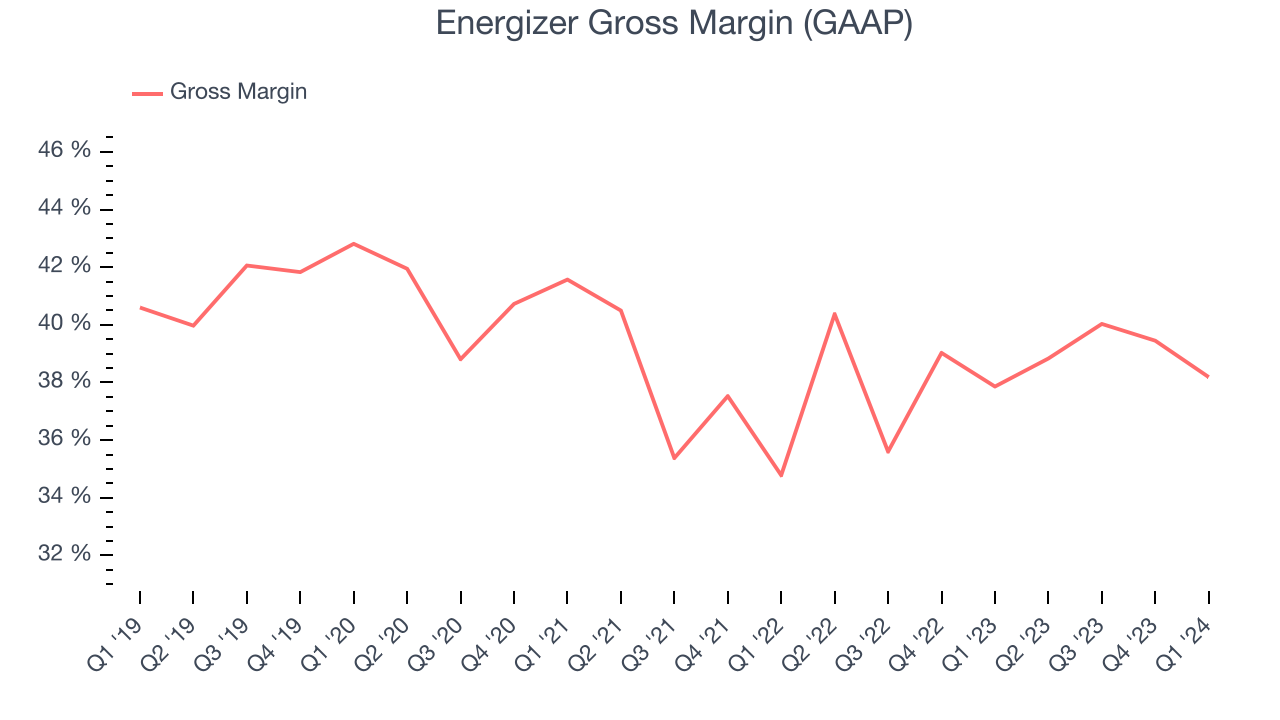

We prefer higher gross margins because they make it easier to generate more operating profits.

This quarter, Energizer's gross profit margin was 38.2%, in line with the same quarter last year. That means for every $1 in revenue, $0.62 went towards paying for raw materials, production of goods, and distribution expenses.

Energizer has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see above, it's averaged a healthy 38.7% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 2.6% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

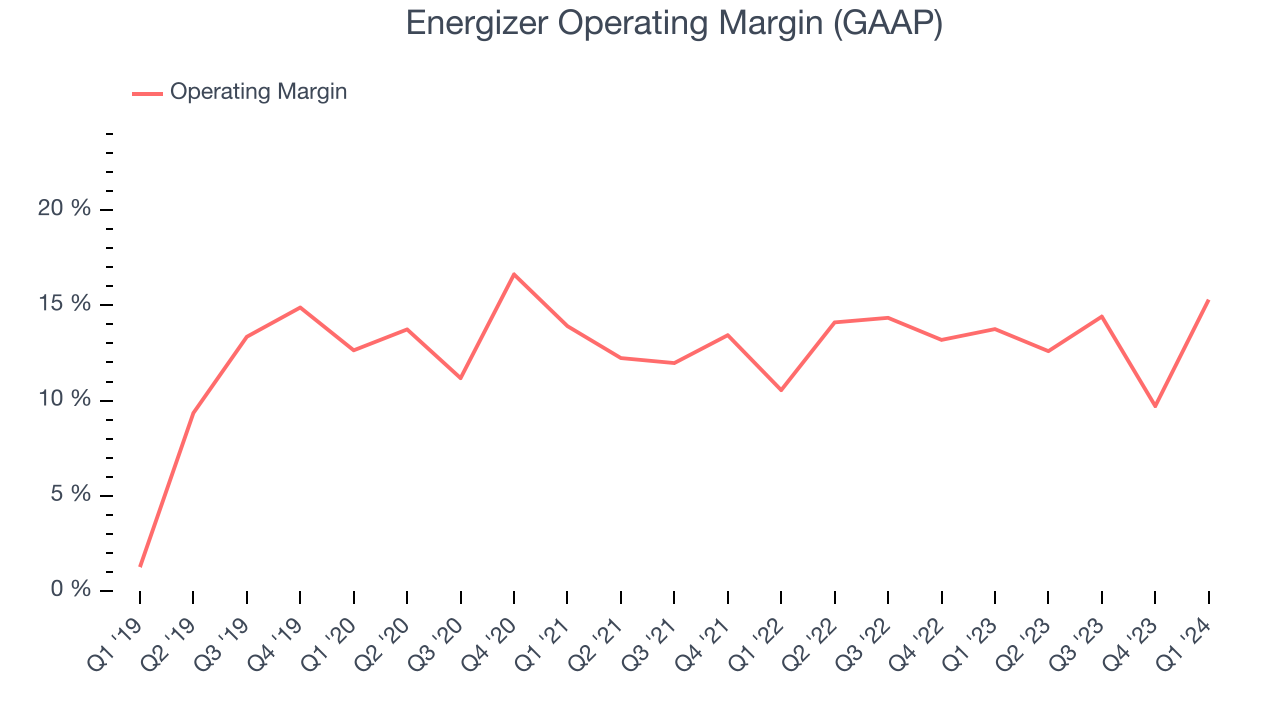

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

In Q1, Energizer generated an operating profit margin of 15.3%, up 1.5 percentage points year on year. This increase was encouraging, and we can infer Energizer was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, Energizer has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer staples business, producing an average operating margin of 13.4%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business.

Zooming out, Energizer has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer staples business, producing an average operating margin of 13.4%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. EPS

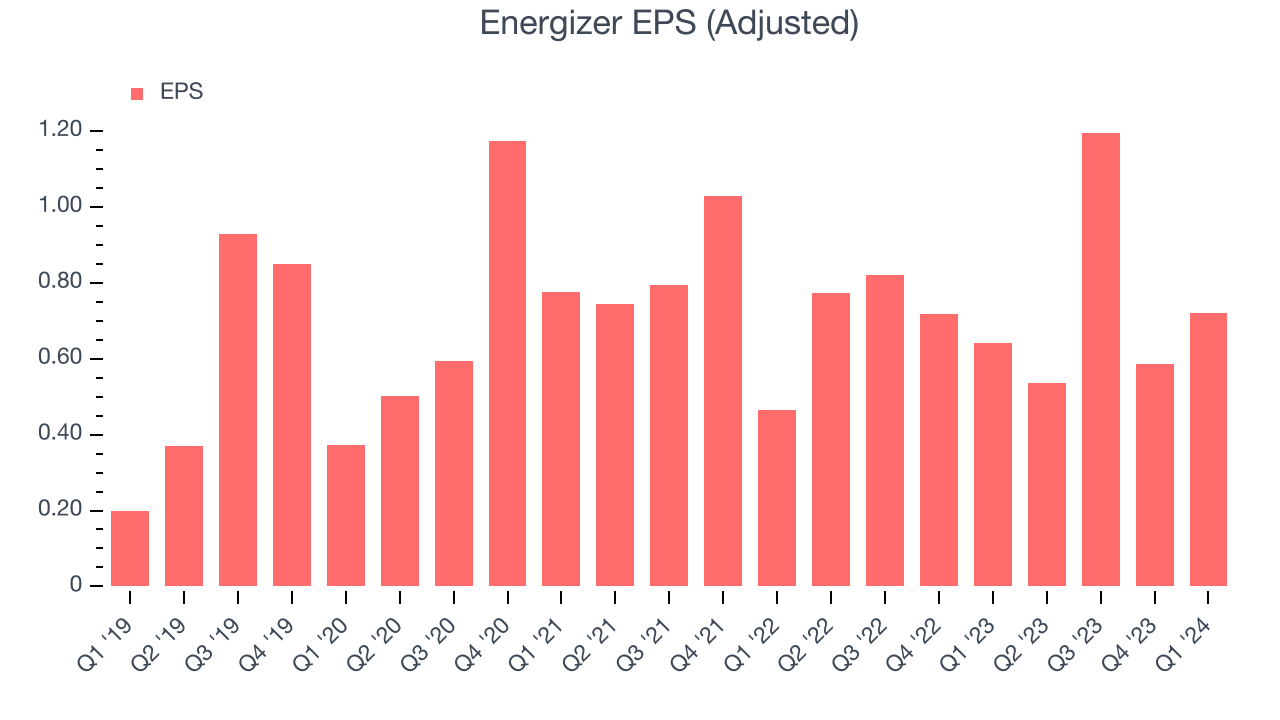

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Energizer reported EPS at $0.72, up from $0.64 in the same quarter a year ago. This print beat Wall Street's estimates by 7.1%.

Between FY2021 and FY2024, Energizer's EPS dropped 0.2%, translating into 0.1% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 12.6% year-on-year increase in EPS.

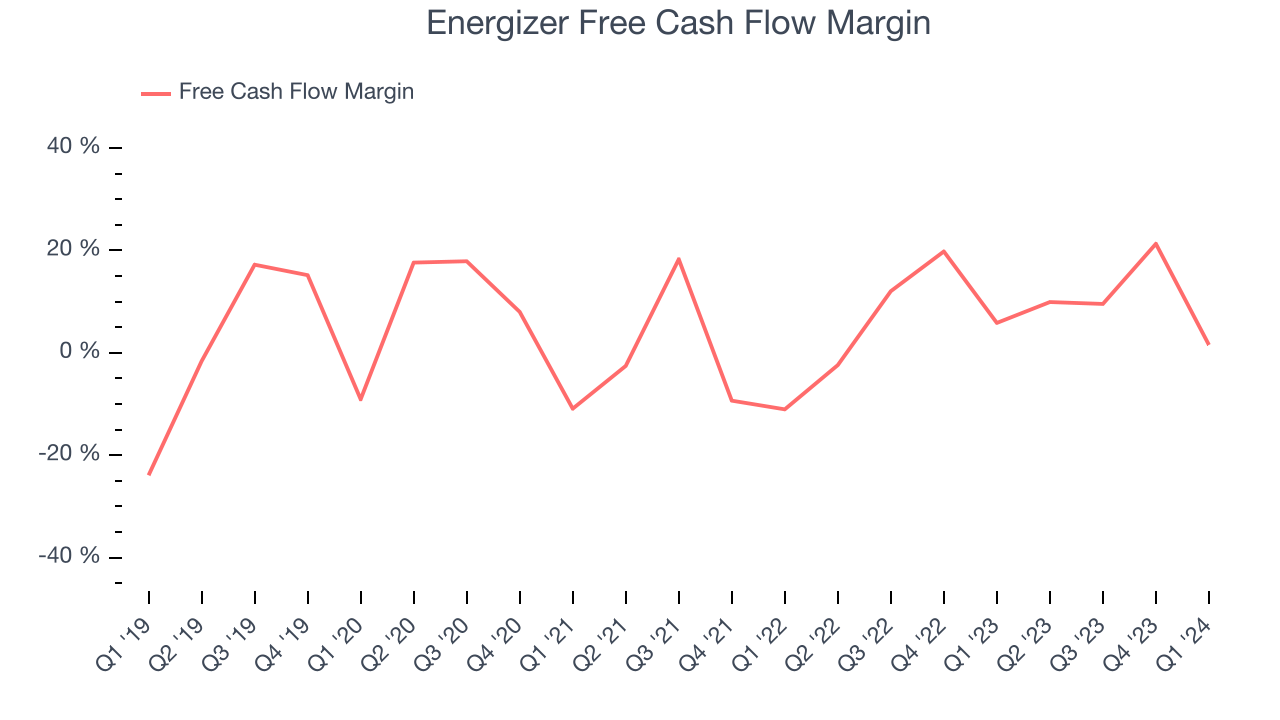

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Energizer's free cash flow came in at $10.3 million in Q1, down 74.3% year on year. This result represents a 1.6% margin.

Over the last eight quarters, Energizer has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 9.9%, above the broader consumer staples sector. Furthermore, its margin has averaged year-on-year increases of 1.6 percentage points over the last 12 months. This likely pleases the company's investors.

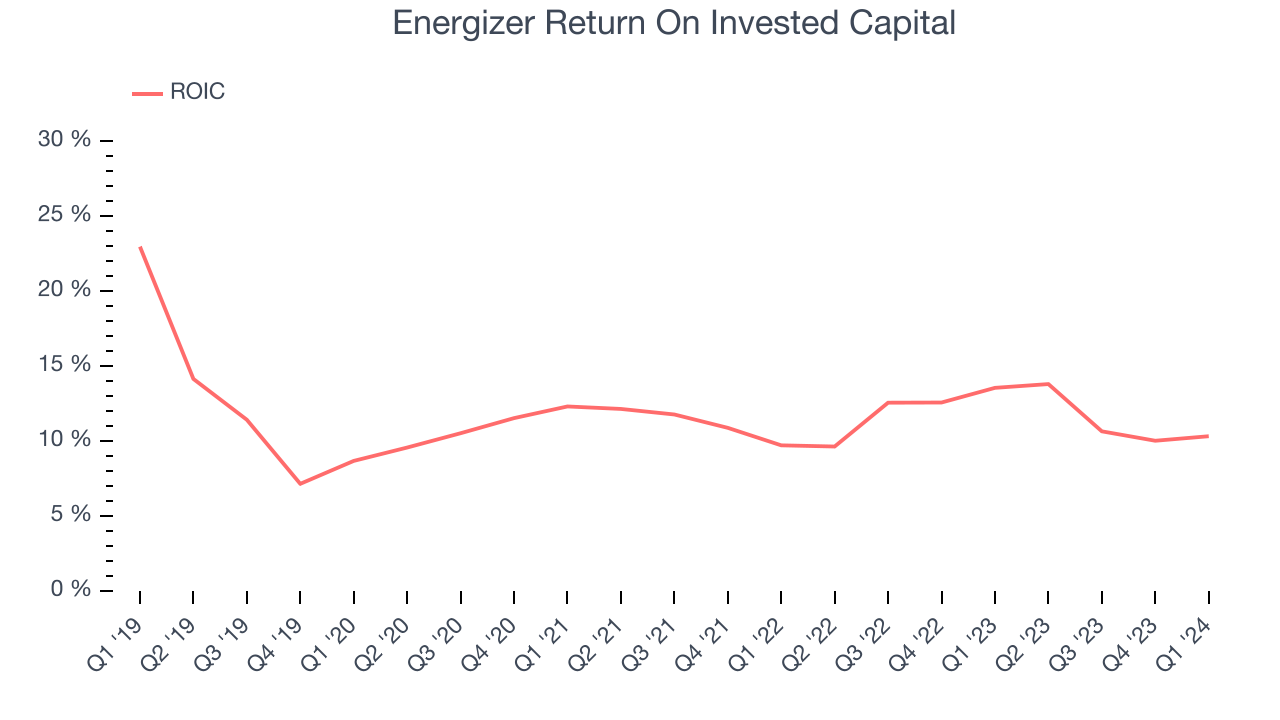

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Energizer's five-year average ROIC was 10.9%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, Energizer's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Energizer's ROIC averaged 1.4 percentage point increases. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Energizer's $3.32 billion of debt exceeds the $158.1 million of cash on its balance sheet. Furthermore, its 5x net-debt-to-EBITDA ratio (based on its EBITDA of $587.6 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Energizer could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Energizer can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Energizer's Q1 Results

It was encouraging to see Energizer slightly top analysts' EPS expectations this quarter. On the other hand, its organic revenue unfortunately missed analysts' expectations and its gross margin missed Wall Street's estimates. Overall, this was a mediocre quarter for Energizer. The stock is flat after reporting and currently trades at $29.45 per share.

Is Now The Time?

Energizer may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Energizer, we'll be cheering from the sidelines. Its revenue has declined over the last three years, but at least growth is expected to increase in the short term. And while its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cash cushion, unfortunately, its declining EPS over the last three years makes it hard to trust.

Energizer's price-to-earnings ratio based on the next 12 months is 8.6x. While there are some things to like about Energizer and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $33.67 per share right before these results (compared to the current share price of $29.45).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.