Personal care company Edgewell Personal Care (NYSE:EPC) missed analysts' expectations in Q1 CY2024, with revenue flat year on year at $599.4 million. It made a non-GAAP profit of $0.88 per share, improving from its profit of $0.57 per share in the same quarter last year.

Is now the time to buy Edgewell Personal Care? Find out by accessing our full research report, it's free.

Edgewell Personal Care (EPC) Q1 CY2024 Highlights:

- Revenue: $599.4 million vs analyst estimates of $606.4 million (1.2% miss)

- EPS (non-GAAP): $0.88 vs analyst estimates of $0.72 (21.9% beat)

- Full year guidance for EPS (non-GAAP): $2.90 at the midpoint vs analyst estimates of $2.78 (4.3% beat)

- Gross Margin (GAAP): 43.1%, up from 40.4% in the same quarter last year

- Free Cash Flow of $117.5 million is up from -$79.4 million in the previous quarter

- Organic Revenue was up 0.1% year on year

- Market Capitalization: $1.88 billion

"In a challenging and somewhat volatile operating environment, our second quarter results reflect strong gross margin expansion that fueled significant adjusted EBITDA and earnings per share growth. Organic net sales growth included a double-digit increase in our Right-to-Win portfolio, driven by our market-leading Sun Care and Grooming businesses. Our International markets continued to deliver accelerated growth, with a healthy combination of both price and volume gains. Importantly, we delivered over 300-basis points of adjusted gross margin expansion, underpinned by disciplined execution of both our cost productivity and strategic revenue management efforts," said Rod Little, Edgewell's President and Chief Executive Officer.

Boasting brands such as Banana Boat, Schick, and Skintimate, Edgewell Personal Care (NYSE:EPC) sells personal care products in the skin and sun care, shave, and feminine care categories.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Edgewell Personal Care carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Edgewell Personal Care can still achieve high growth rates because its revenue base is not yet monstrous.

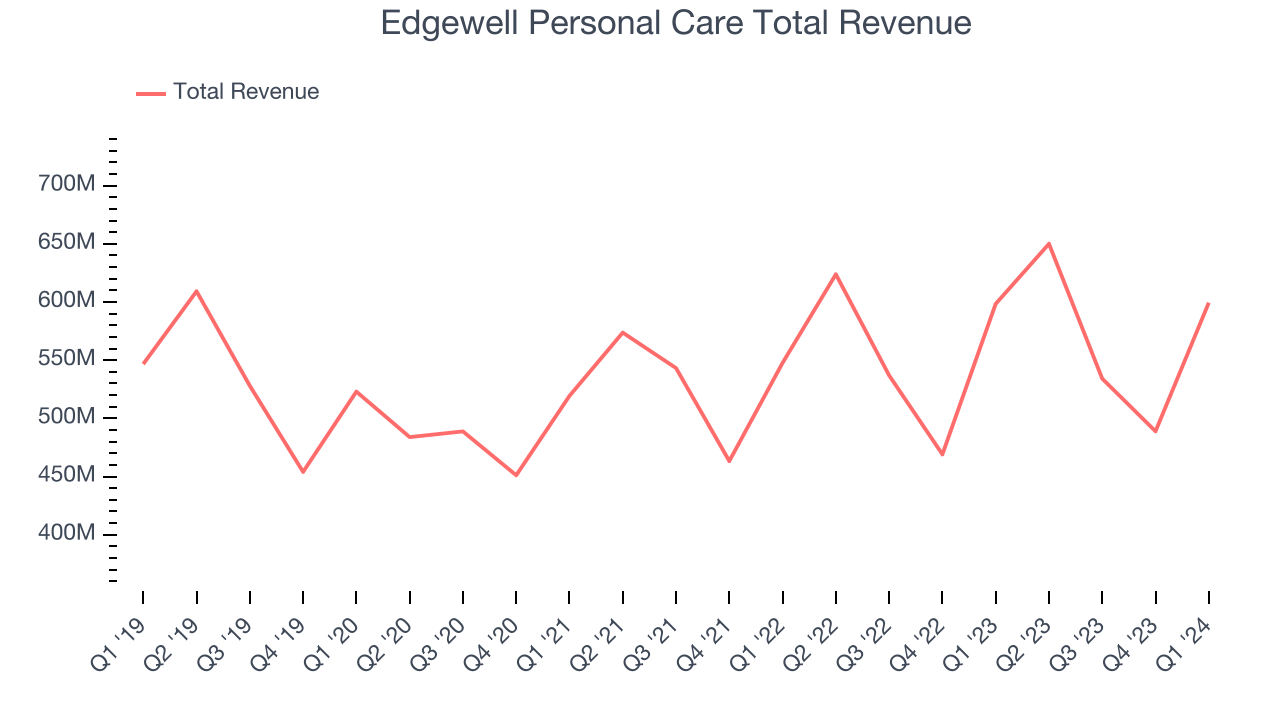

As you can see below, the company's annualized revenue growth rate of 5.4% over the last three years was weak for a consumer staples business.

This quarter, Edgewell Personal Care's revenue grew 0.2% year on year to $599.4 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 2.6% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

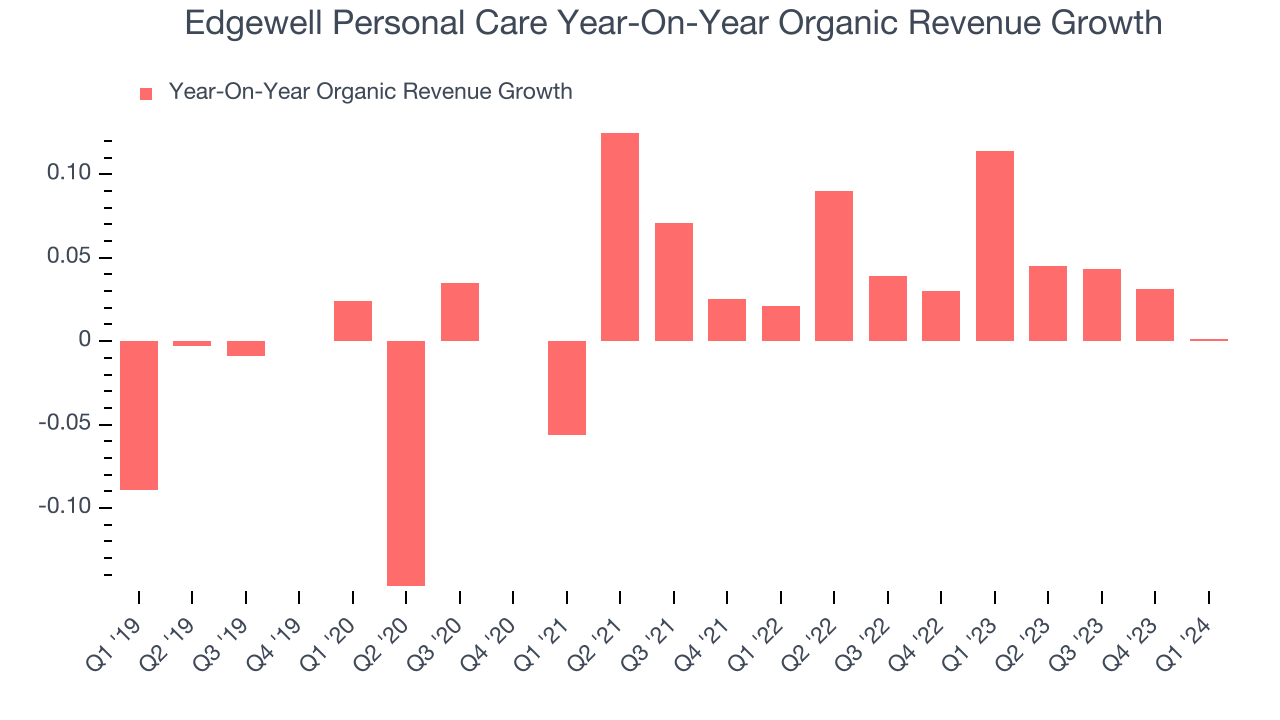

The demand for Edgewell Personal Care's products has generally risen over the last two years but lagged behind the broader sector. On average, the company's organic sales have grown by 4.9% year on year.

In the latest quarter, Edgewell Personal Care's year on year organic revenue growth was flat. By the company's standards, this growth was a meaningful deceleration from the 11.4% year-on-year increase it posted 12 months ago. We'll be watching Edgewell Personal Care closely to see if it can reaccelerate growth.

Key Takeaways from Edgewell Personal Care's Q1 Results

We enjoyed seeing Edgewell Personal Care exceed analysts' EPS expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its organic revenue unfortunately missed analysts' expectations and its revenue missed Wall Street's estimates. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $37.61 per share.

So should you invest in Edgewell Personal Care right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.