Personal care company Edgewell Personal Care (NYSE:EPC) reported results in line with analysts' expectations in Q2 CY2024, with revenue flat year on year at $647.8 million. It made a non-GAAP profit of $1.22 per share, improving from its profit of $0.99 per share in the same quarter last year.

Is now the time to buy Edgewell Personal Care? Find out by accessing our full research report, it's free.

Edgewell Personal Care (EPC) Q2 CY2024 Highlights:

- Revenue: $647.8 million vs analyst estimates of $649.7 million (small miss)

- EPS (non-GAAP): $1.22 vs analyst estimates of $1.01 (20.9% beat)

- EPS (non-GAAP) guidance for the full year is $3 at the midpoint, beating analyst estimates by 3.1%

- Gross Margin (GAAP): 44.3%, up from 43% in the same quarter last year

- Free Cash Flow of $88.6 million, down 24.6% from the previous quarter

- Organic Revenue was flat year on year (4.5% in the same quarter last year)

- Market Capitalization: $1.87 billion

"Our third quarter results reflected robust gross margin accretion leading to substantial adjusted EBITDA and earnings per share growth. Amidst a competitive and dynamic market landscape, organic net sales growth featured continued strength in our Right-to-Win portfolio, propelled by our industry-leading Sun Care and Grooming businesses. Our international businesses sustained their momentum, achieving significant growth through a balanced mix of pricing and volume improvements. Crucially, we achieved over 160-basis points of adjusted gross margin accretion, driven by our steadfast commitment to cost productivity and strategic revenue management initiatives," stated Rod Little, Edgewell's President and Chief Executive Officer.

Boasting brands such as Banana Boat, Schick, and Skintimate, Edgewell Personal Care (NYSE:EPC) sells personal care products in the skin and sun care, shave, and feminine care categories.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Edgewell Personal Care carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Edgewell Personal Care can still achieve high growth rates because its revenue base is not yet monstrous.

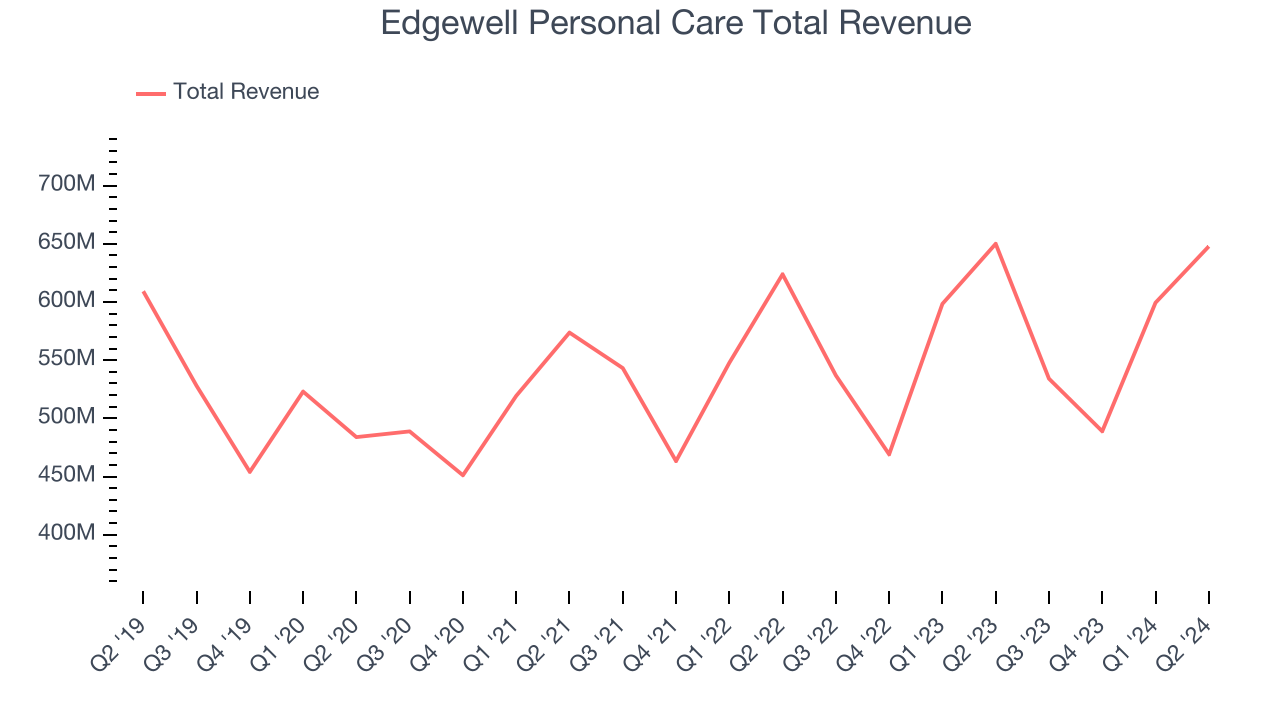

As you can see below, the company's annualized revenue growth rate of 3.7% over the last three years was sluggish for a consumer staples business.

This quarter, Edgewell Personal Care missed Wall Street's estimates and reported a rather uninspiring 0.3% year-on-year revenue decline, generating $647.8 million in revenue. Looking ahead, Wall Street expects sales to grow 2.4% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Organic Revenue Growth

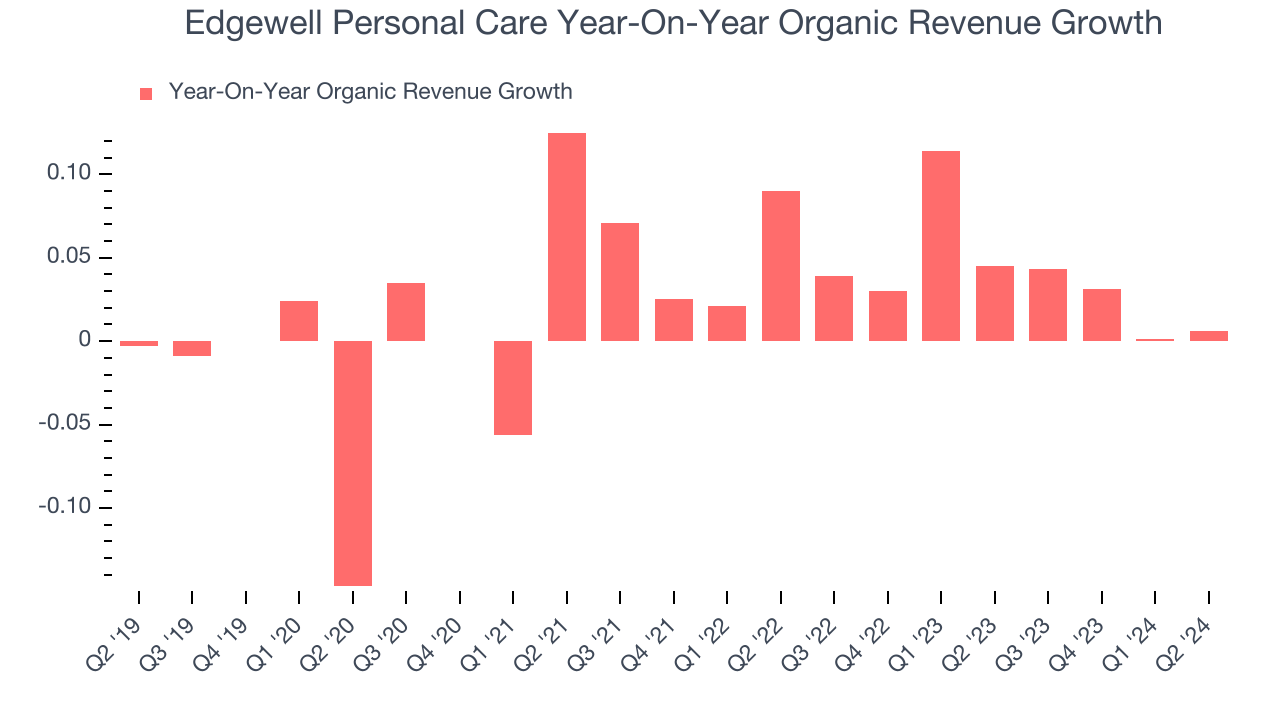

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

The demand for Edgewell Personal Care's products has generally risen over the last two years but lagged behind the broader sector. On average, the company's organic sales have grown by 3.9% year on year.

In the latest quarter, Edgewell Personal Care's year on year organic revenue growth was flat. By the company's standards, this growth was a meaningful deceleration from the 4.5% year-on-year increase it posted 12 months ago. We'll be watching Edgewell Personal Care closely to see if it can reaccelerate growth.

Key Takeaways from Edgewell Personal Care's Q2 Results

We enjoyed seeing Edgewell Personal Care exceed analysts' EPS expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its organic revenue unfortunately missed analysts' expectations. Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on track. The stock traded up 2.3% to $38.50 immediately after reporting.

So should you invest in Edgewell Personal Care right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.