Personal care company Edgewell Personal Care (NYSE:EPC) missed analysts' expectations in Q1 CY2024, with revenue flat year on year at $599.4 million. It made a non-GAAP profit of $0.88 per share, improving from its profit of $0.57 per share in the same quarter last year.

Edgewell Personal Care (EPC) Q1 CY2024 Highlights:

- Revenue: $599.4 million vs analyst estimates of $606.4 million (1.2% miss)

- EPS (non-GAAP): $0.88 vs analyst estimates of $0.72 (21.9% beat)

- Full year guidance for EPS (non-GAAP): $2.90 at the midpoint vs analyst estimates of $2.78 (4.3% beat)

- Gross Margin (GAAP): 43.1%, up from 40.4% in the same quarter last year

- Free Cash Flow of $117.5 million is up from -$79.4 million in the previous quarter

- Organic Revenue was up 0.1% year on year

- Market Capitalization: $1.88 billion

Boasting brands such as Banana Boat, Schick, and Skintimate, Edgewell Personal Care (NYSE:EPC) sells personal care products in the skin and sun care, shave, and feminine care categories.

The company was founded in 2015 as a result of a spin-off from Energizer Holdings. While Edgewell is relatively new, its portfolio is comprised of several legacy brands, some of which date back over a century.

Edgewell goes to market through three product segments: sun and skin care, shave, and feminine care. Sun and skin care focus on sunscreens, lotions, and tanning products under brands such as Hawaiian Tropic. Shave products feature razor systems and disposable blades for men and women under brands such as Edge and Shave Guard. Feminine care offers tampons and related offerings under the Playtex and o.b. Brands.

The product portfolio is broad, so the Edgewell Personal Care customer is also broad. However, these customers generally are seeking high-quality personal care products at a reasonable price. Brands matter because they are signals of reliability, so this is another area where Edgewell wins.

Edgewell products enjoy broad distribution. Most supermarkets, drugstores and pharmacies, big-box retailers, and convenience stores carry one or more of the company’s brands. Because many of these brands are leaders in their categories, they also enjoy advantaged shelf placement as well.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors in the personal care market include Proctor & Gamble (NYSE:PG), Unilever (LSE:ULVR), and Kimberly-Clark (NYSE:KMB).Sales Growth

Edgewell Personal Care carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Edgewell Personal Care can still achieve high growth rates because its revenue base is not yet monstrous.

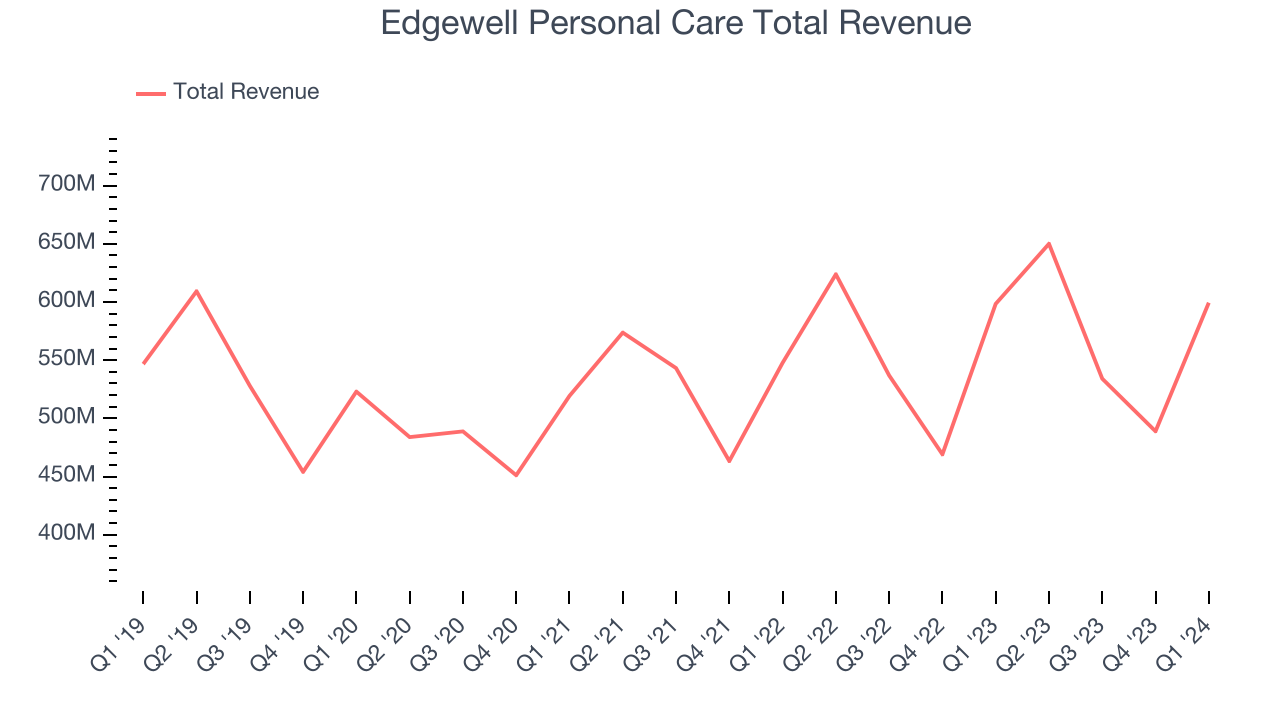

As you can see below, the company's annualized revenue growth rate of 5.4% over the last three years was weak for a consumer staples business.

This quarter, Edgewell Personal Care's revenue grew 0.2% year on year to $599.4 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 2.6% over the next 12 months, an acceleration from this quarter.

Organic Revenue Growth

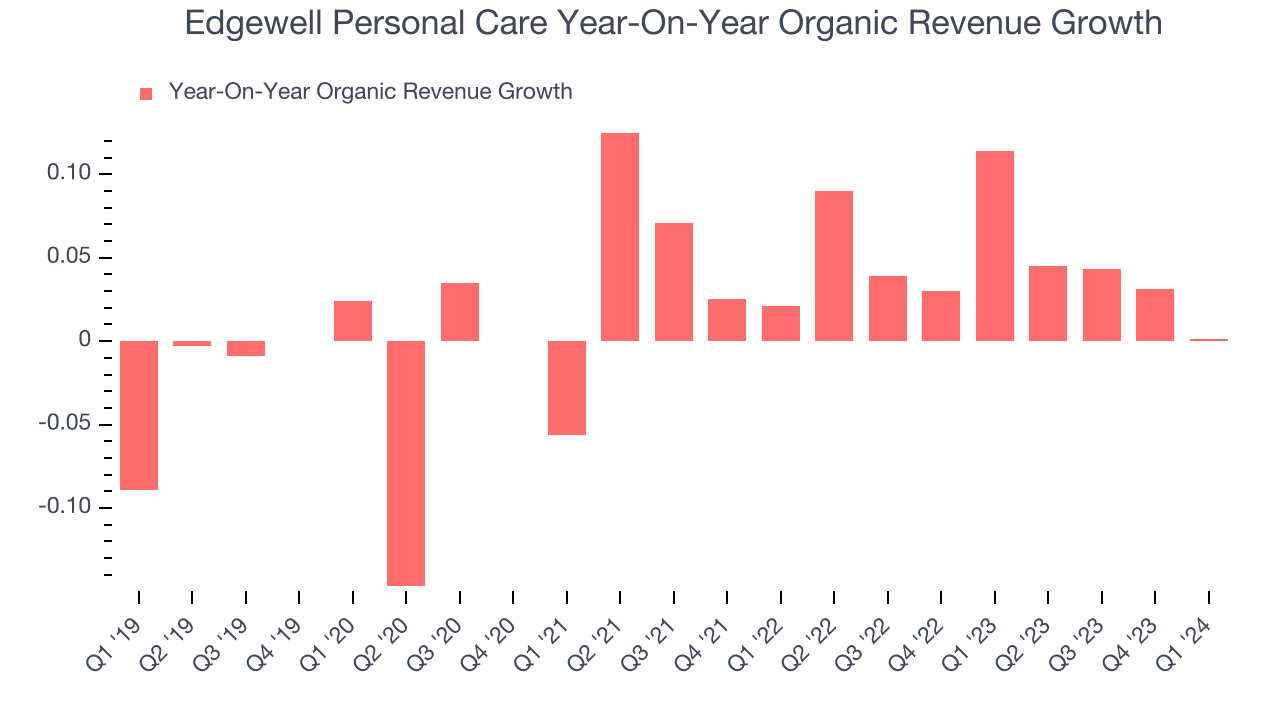

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

The demand for Edgewell Personal Care's products has generally risen over the last two years but lagged behind the broader sector. On average, the company's organic sales have grown by 4.9% year on year.

In the latest quarter, Edgewell Personal Care's year on year organic revenue growth was flat. By the company's standards, this growth was a meaningful deceleration from the 11.4% year-on-year increase it posted 12 months ago. We'll be watching Edgewell Personal Care closely to see if it can reaccelerate growth.

Gross Margin & Pricing Power

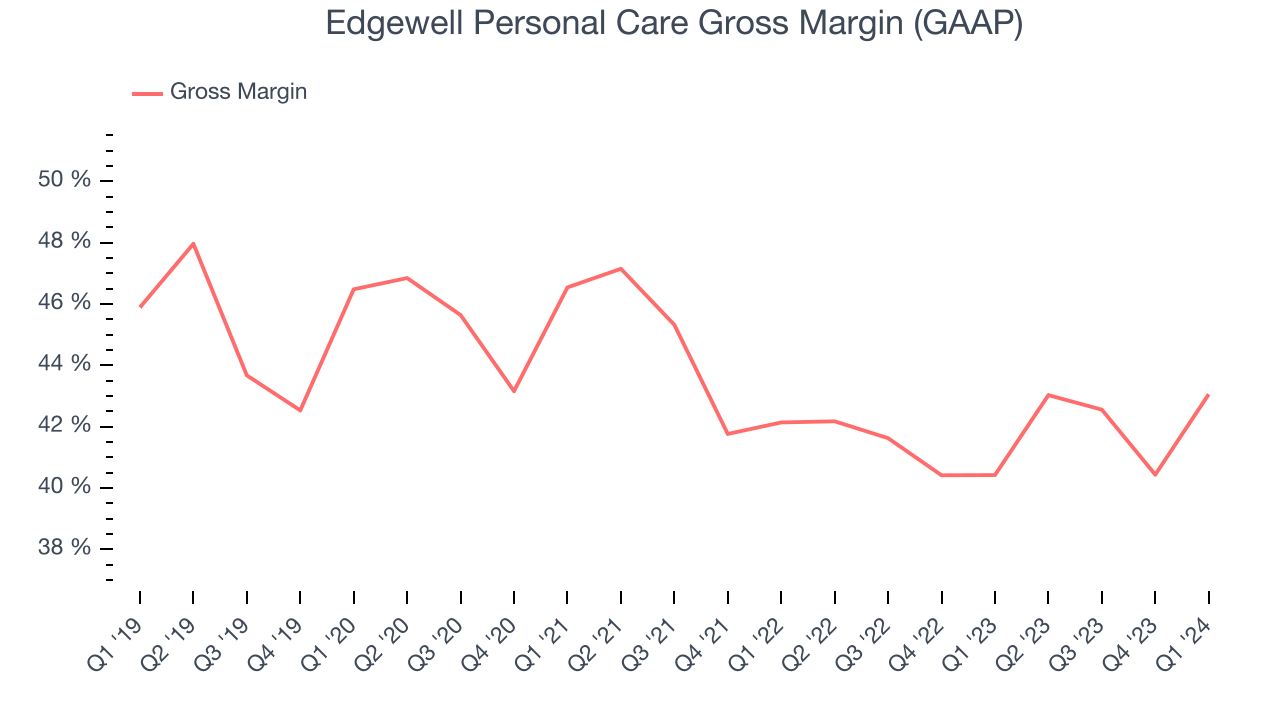

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

This quarter, Edgewell Personal Care's gross profit margin was 43.1%, up 2.6 percentage points year on year. That means for every $1 in revenue, $0.57 went towards paying for raw materials, production of goods, and distribution expenses.

Edgewell Personal Care has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see above, it's averaged a healthy 41.8% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 2.7% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

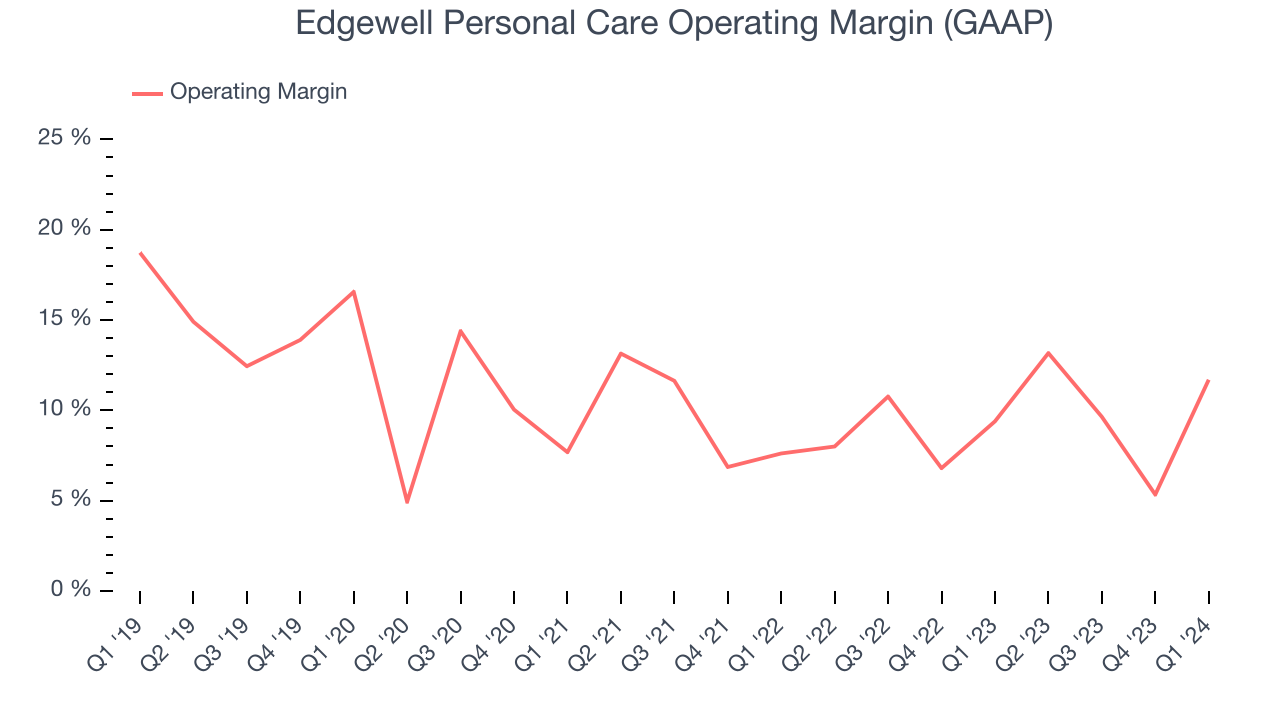

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

In Q1, Edgewell Personal Care generated an operating profit margin of 11.7%, up 2.3 percentage points year on year. This increase was encouraging, and we can infer Edgewell Personal Care had stronger pricing power and lower raw materials/transportation costs because its gross margin expanded more than its operating margin.

Zooming out, Edgewell Personal Care has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 9.5%, higher than the broader consumer staples sector. On top of that, its margin has risen by 1.5 percentage points on average over the last year, showing the company is improving its fundamentals.

Zooming out, Edgewell Personal Care has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 9.5%, higher than the broader consumer staples sector. On top of that, its margin has risen by 1.5 percentage points on average over the last year, showing the company is improving its fundamentals. EPS

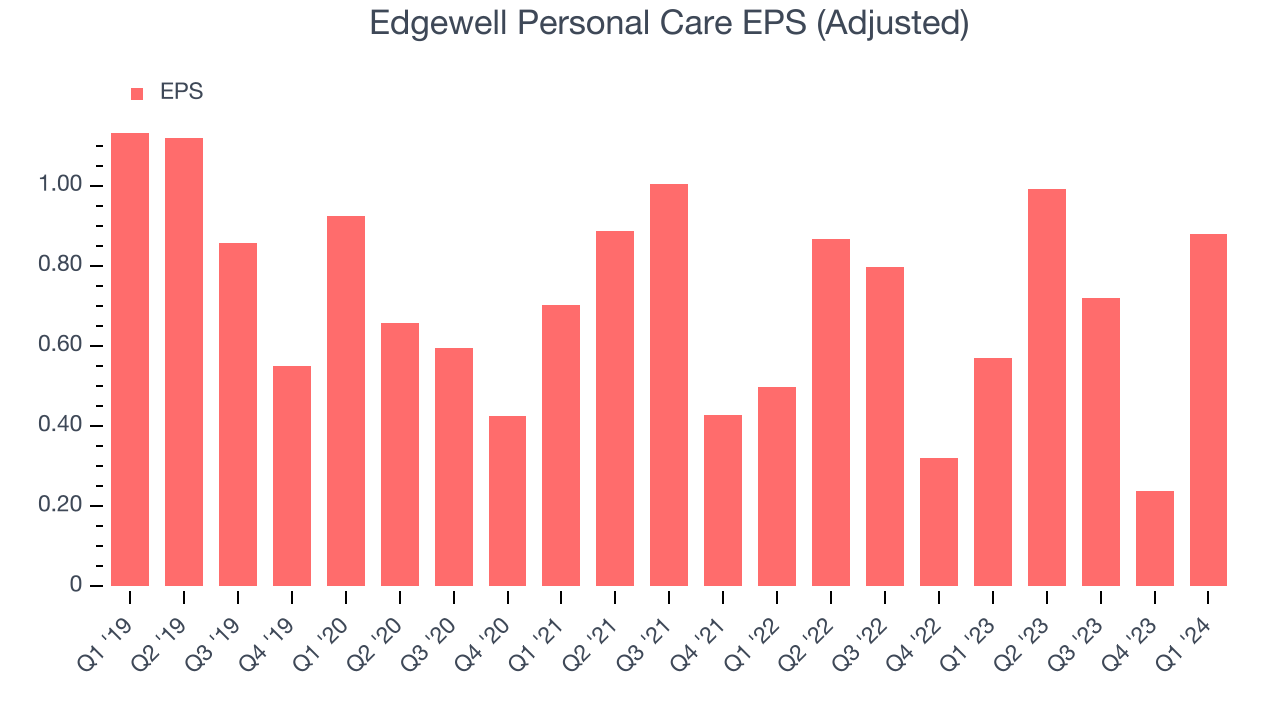

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Edgewell Personal Care reported EPS at $0.88, up from $0.57 in the same quarter a year ago. This print beat Wall Street's estimates by 21.9%.

Between FY2021 and FY2024, Edgewell Personal Care's EPS grew 18.9%, translating into a decent 5.9% compounded annual growth rate.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 3.5% year-on-year increase in EPS.

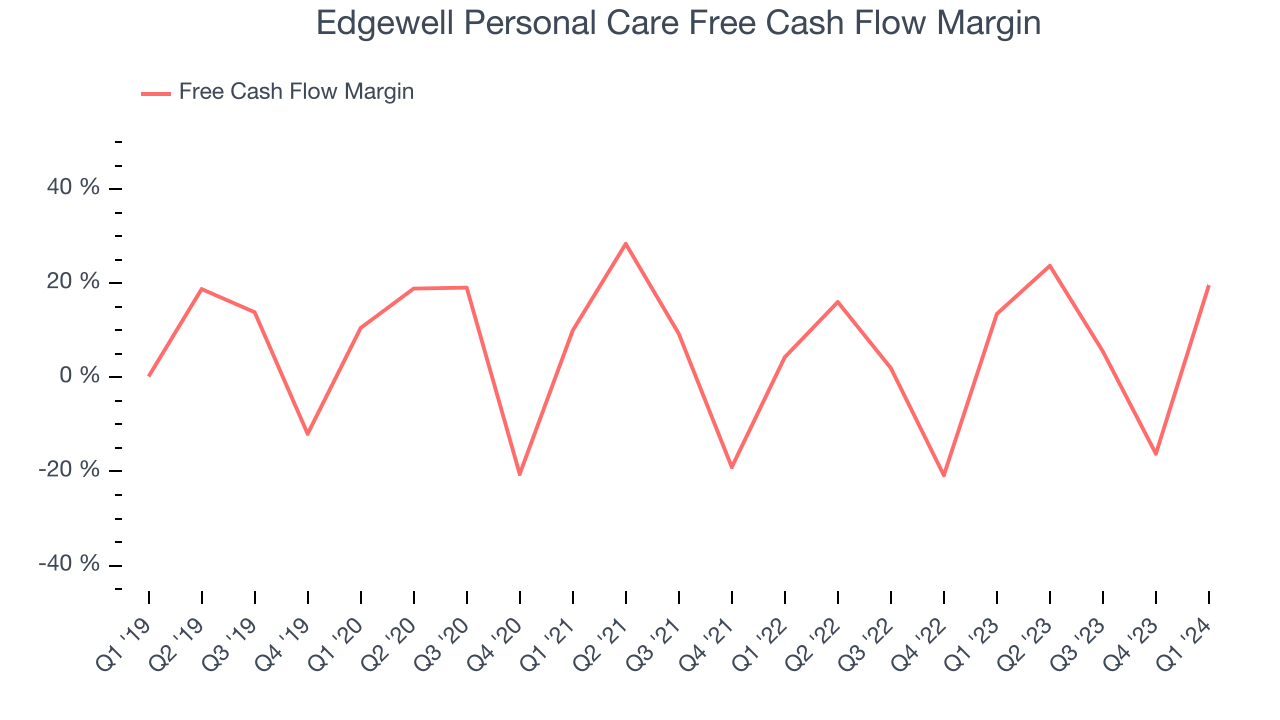

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Edgewell Personal Care's free cash flow came in at $117.5 million in Q1, up 45.6% year on year. This result represents a 19.6% margin.

Over the last two years, Edgewell Personal Care has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 7%, slightly better than the broader consumer staples sector. Furthermore, its margin has averaged year-on-year increases of 5.6 percentage points over the last 12 months. This likely pleases the company's investors.

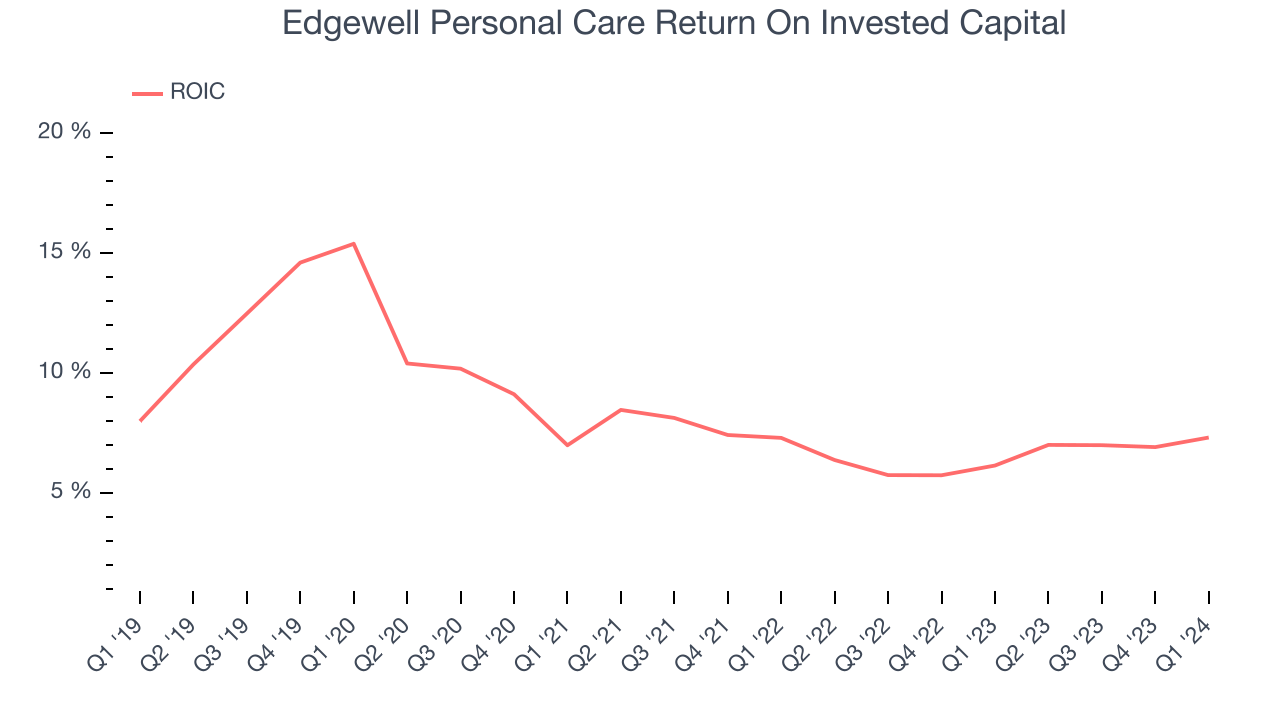

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Edgewell Personal Care's five-year average ROIC was 8.6%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Edgewell Personal Care's ROIC averaged 4.5 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Edgewell Personal Care's Q1 Results

We enjoyed seeing Edgewell Personal Care exceed analysts' EPS expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its organic revenue unfortunately missed analysts' expectations and its revenue missed Wall Street's estimates. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $37.6 per share.

Is Now The Time?

Edgewell Personal Care may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Edgewell Personal Care, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last three years, and analysts expect growth to deteriorate from here. And while its gross margins indicate a healthy starting point for the overall profitability of the business, the downside is its projected EPS for the next year is lacking. On top of that, its brand caters to a niche market.

Edgewell Personal Care's price-to-earnings ratio based on the next 12 months is 12.8x. While there are some things to like about Edgewell Personal Care and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $43.88 per share right before these results (compared to the current share price of $37.60).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.