Engineered products manufacturer ESCO (NYSE:ESE) fell short of analysts' expectations in Q2 CY2024, with revenue up 4.8% year on year to $260.8 million. The company's full-year revenue guidance of $1.03 billion at the midpoint also came in slightly below analysts' estimates. It made a GAAP profit of $1.13 per share, improving from its profit of $1.08 per share in the same quarter last year.

Is now the time to buy ESCO? Find out by accessing our full research report, it's free.

ESCO (ESE) Q2 CY2024 Highlights:

- Revenue: $260.8 million vs analyst estimates of $277.5 million (6% miss)

- EPS: $1.13 vs analyst expectations of $1.18 (4% miss)

- Gross Margin (GAAP): 39.6%, down from 40.8% in the same quarter last year

- EBITDA Margin: 21.2%, up from 17.9% in the same quarter last year

- Free Cash Flow of $27.57 million, up from $2.04 million in the previous quarter

- Market Capitalization: $2.90 billion

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE:ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Unfortunately, ESCO's 7.3% annualized revenue growth over the last five years was mediocre. This shows it couldn't expand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. ESCO's annualized revenue growth of 11.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, ESCO's revenue grew 4.8% year on year to $260.8 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 13.1% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

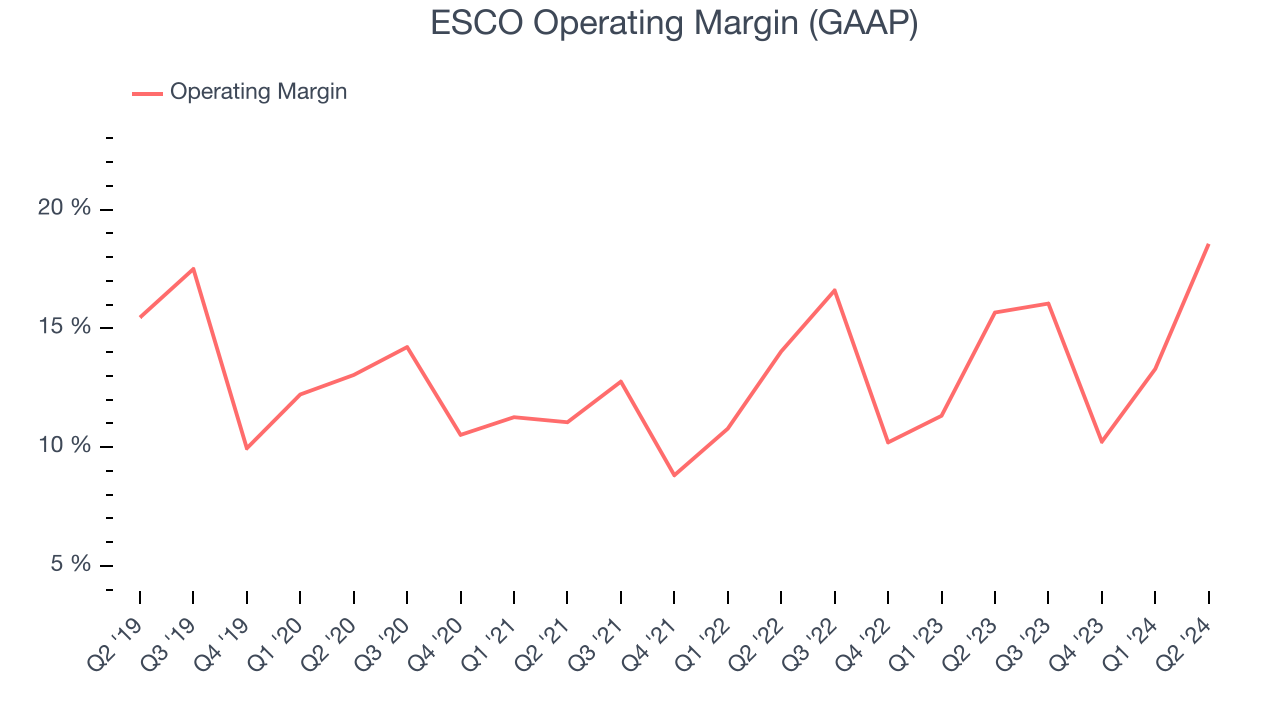

Operating Margin

ESCO has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.2%. This result isn't surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, ESCO's annual operating margin rose by 1.3 percentage points over the last five years, showing its efficiency has improved.

In Q2, ESCO generated an operating profit margin of 18.6%, up 2.9 percentage points year on year. This increase was encouraging, and since the company's gross margin actually decreased, we can assume it was recently more efficient because its operating expenses like sales, marketing, R&D, and administrative overhead grew slower than its revenue.

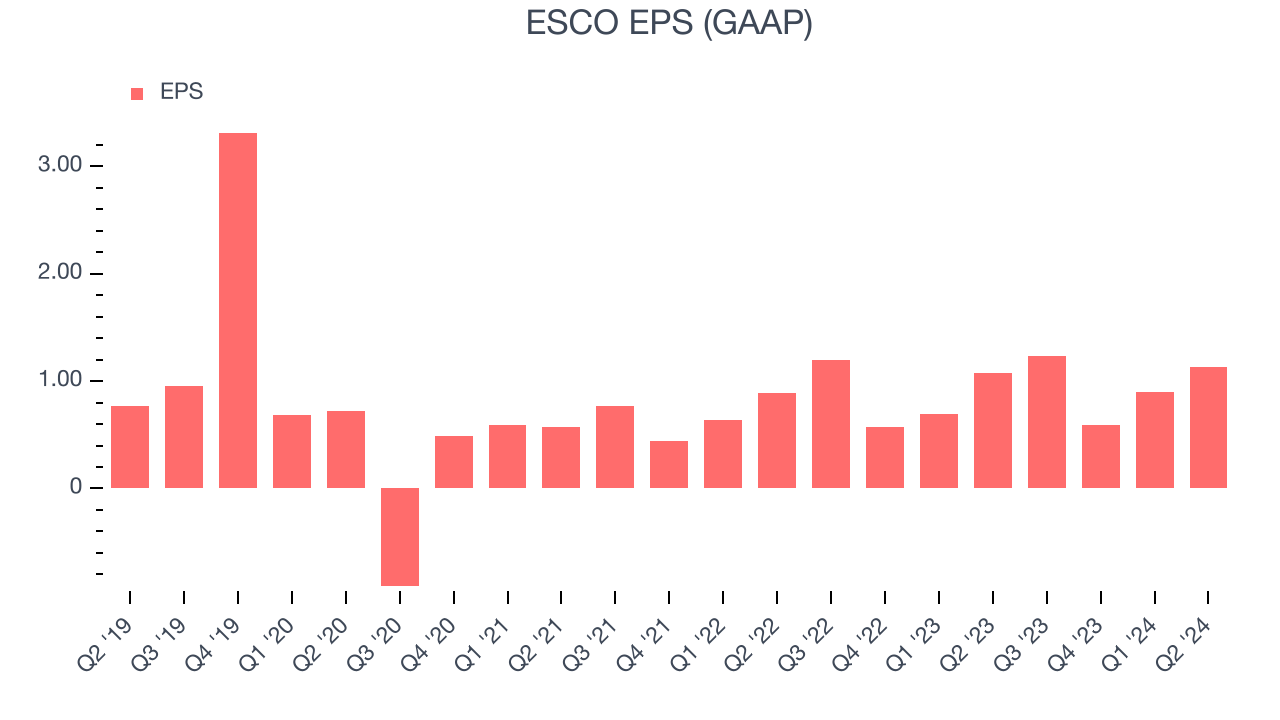

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

ESCO's EPS grew at an unimpressive 4.1% compounded annual growth rate over the last five years, lower than its 7.3% annualized revenue growth. However, its operating margin actually expanded during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. ESCO's two-year annual EPS growth of 18.6% was fantastic and topped its 11.4% two-year revenue growth.

In Q2, ESCO reported EPS at $1.13, up from $1.08 in the same quarter last year. Despite growing year on year, this print missed analysts' estimates. Over the next 12 months, Wall Street expects ESCO to grow its earnings. Analysts are projecting its EPS of $3.86 in the last year to climb by 21.8% to $4.70.

Key Takeaways from ESCO's Q2 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed and its EPS fell short of Wall Street's estimates. Overall, this was a mixed but overall mediocre quarter for ESCO. The stock remained flat at $112.22 immediately after reporting.

So should you invest in ESCO right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.