Search software company Elastic (NYSE:ESTC) reported Q2 CY2024 results topping analysts’ expectations, with revenue up 18.3% year on year to $347.4 million. On the other hand, next quarter’s revenue guidance of $354 million was less impressive, coming in 1.9% below analysts’ estimates. It made a non-GAAP profit of $0.35 per share, improving from its profit of $0.25 per share in the same quarter last year.

Is now the time to buy Elastic? Find out by accessing our full research report, it’s free.

Elastic (ESTC) Q2 CY2024 Highlights:

- Revenue: $347.4 million vs analyst estimates of $344.6 million (small beat)

- Adjusted Operating Income: $37.19 million vs analyst estimates of $32.17 million (15.6% beat)

- EPS (non-GAAP): $0.35 vs analyst estimates of $0.25 (38.1% beat)

- The company dropped its revenue guidance for the full year to $1.44 billion at the midpoint from $1.47 billion, a 2.3% decrease

- EPS (non-GAAP) guidance for the full year is $1.54 at the midpoint, beating analyst estimates by 8.2%

- Gross Margin (GAAP): 73.6%, in line with the same quarter last year

- Free Cash Flow Margin: 15%, down from 17.9% in the previous quarter

- Net Revenue Retention Rate: 112%, up from 110% in the previous quarter

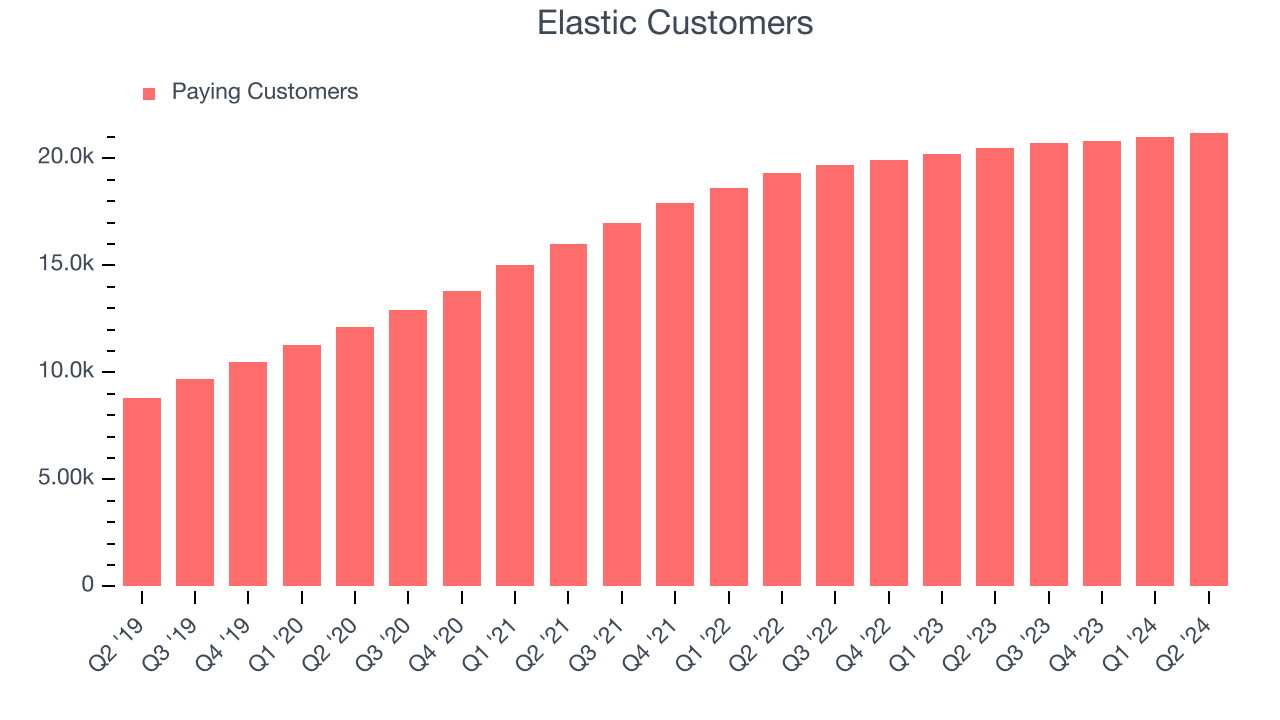

- Customers: 21,200, up from 21,000 in the previous quarter

- Billings: $278.1 million at quarter end, up 5.1% year on year

- Market Capitalization: $10.58 billion

“We delivered solid first quarter results, outperforming the high end of our guidance for both revenue and profitability, and we continued to see strong adoption of our GenAI offerings. However, we had a slower start to the year with the volume of customer commitments impacted by segmentation changes that we made at the beginning of the year, which are taking longer than expected to settle. We have been taking steps to address this, but it will impact our revenue this year,” said Ash Kulkarni, Chief Executive Officer, Elastic.

Started by Shay Banon as a search engine for his wife's growing list of recipes at Le Cordon Bleu cooking school in Paris, Elastic (NYSE:ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Sales Growth

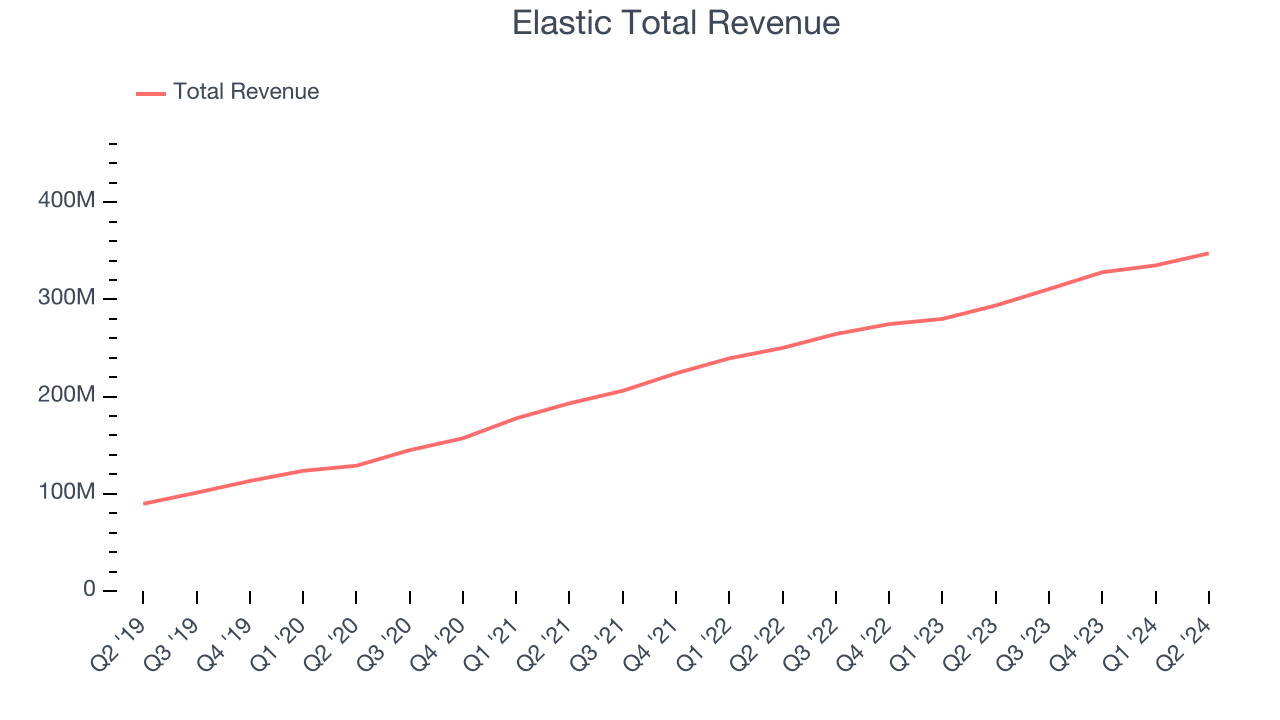

As you can see below, Elastic’s 25.2% annualized revenue growth over the last three years has been solid, and its sales came in at $347.4 million this quarter.

This quarter, Elastic’s quarterly revenue was once again up 18.3% year on year. We can see that Elastic’s revenue increased by $12.42 million quarter on quarter, which is a solid improvement from the $7.04 million increase in Q1 CY2024. This acceleration of growth was a great sign.

Next quarter’s guidance suggests that Elastic is expecting revenue to grow 14% year on year to $354 million, slowing down from the 17.5% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 16.1% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Customer Growth

Elastic reported 21,200 customers at the end of the quarter, an increase of 200 from the previous quarter. That’s in line with the customer growth we’ve observed over the last couple of quarters, suggesting that the company can maintain its current sales momentum.

Key Takeaways from Elastic’s Q2 Results

It was great to see Elastic improve its net revenue retention this quarter. On the other hand, its full-year revenue guidance was below expectations and its revenue guidance for next quarter missed Wall Street’s estimates. Overall, this was a weaker quarter, and for a company where topline growth is an area of intense focus, the revenue guidance is disappointing and weighing on shares. The stock traded down 24.3% to $78.50 immediately after reporting.

Elastic may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.