Search software company Elastic (NYSE:ESTC) reported Q4 FY2021 results that beat analyst expectations, with revenue up 43.6% year on year to $177.6 million. Elastic made a GAAP loss of $43.3 million, down on its loss of $31.1 million, in the same quarter last year.

Is now the time to buy Elastic? Get early access to our full analysis of the earnings results here

Elastic (NYSE:ESTC) Q4 FY2021 Highlights:

- Revenue: $177.6 million vs analyst estimates of $158.8 million (11.7% beat)

- EPS (non-GAAP): -$0.08 vs analyst estimates of -$0.16

- Revenue guidance for Q1 2022 is $172 million at the midpoint, above analyst estimates of $165.5 million

- Management's revenue guidance for upcoming financial year 2022 is $785 million at the midpoint, predicting 29% growth (vs 47.1% in FY2021)

- Free cash flow was negative -$3.07 million, down from positive free cash flow of $18.3 million in previous quarter

- Net Revenue Retention Rate: 130%, in line with previous quarter

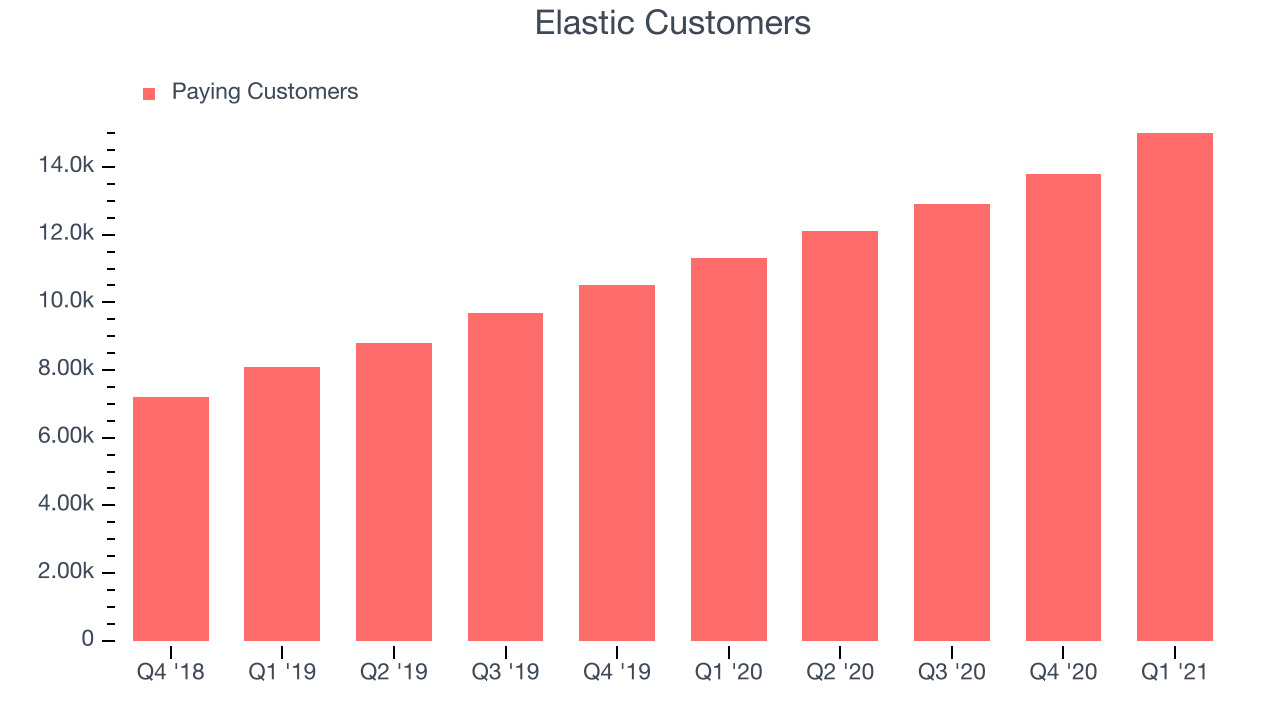

- Customers: 15,000, up from 13,800 in previous quarter

- Gross Margin (GAAP): 74.2%, up from 73.2% previous quarter

- Updated valuation: Elastic is up at $124 and accounting for the revenue added in Q4 it now trades at 17.5x price-to-sales (LTM), compared to 18.8x just before the results.

“We had a strong fourth quarter capping off an exceptional year, due in large part to the continued adoption of Elastic Cloud and broad-based demand for our enterprise search, observability, and security solutions,” said Shay Banon, Elastic founder, and chief executive officer.

Betting On Search

Founded in 2012 in Netherlands, Elastic (NYSE:ESTC) helps companies integrate search into their products. Building your own search engine is hard and even the biggest companies want to focus their energy elsewhere. Elastic offers a set of software products that ingest and store data from any source, in any format, and perform search, machine learning and analysis.

For example Uber is using Elastic to power the systems that locate nearby riders and drivers, Ebay is using it to help users find what they want to buy and Facebook is using it to power search in their help centre. Elastic is one of the companies that have been benefiting from the growth of the overall internet economy and has lately started expanding the use of their data processing technology from enterprise search into cloud-infrastructure monitoring and network security monitoring products.

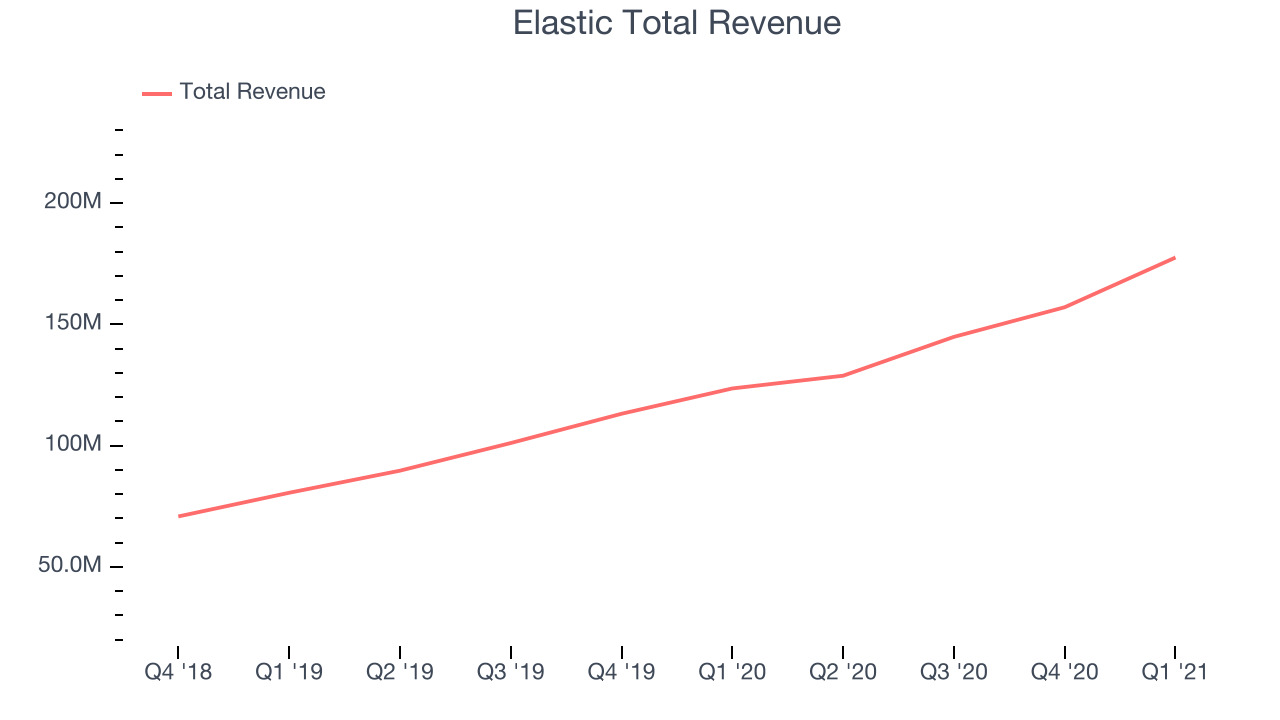

As you can see below, Elastic's revenue growth has been impressive over the last twelve months, growing from $123.6 million to $177.6 million.

And unsurprisingly, this was another great quarter for Elastic with revenue up an absolutely stunning 43.6% year on year. On top of that, revenue increased $20.4 million quarter on quarter, a very strong improvement on the $12.2 million increase in Q3 2021, and a sign of acceleration of growth.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 80% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Free Can Be A Good Business

Elastic’s business model is based on a combination of open source and proprietary software and the company uses the open source part to power their distribution strategy. It is really easy to start using Elastic and developers can download limited version of the software straight away for free, without speaking to any sales people. Over time, if the software proves itself and the need for it expands inside an organization, it is easy to upgrade to paid licence.

You can see below that Elastic reported 15,000 customers at the end of the quarter, an increase of 1,200 on last quarter. That is quite a bit better customer growth than last quarter and quite a bit above the typical customer growth we have seen lately, demonstrating that the business itself has good sales momentum. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is working very well.

Key Takeaways from Elastic's Q4 Results

Sporting a market capitalisation of $10.6 billion, more than $400.8 million in cash and operating free cash flow positive over the last twelve months, we're confident that Elastic has the resources it needs to pursue a high growth business strategy.

We were impressed by how strongly Elastic outperformed analysts’ revenue expectations this quarter. And we were also excited to see the really strong revenue growth. On the other hand, the revenue guidance for next year indicates a slowdown in growth to 29%, down from 47%. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. Elastic seemed like a compelling growth stock before these results and despite the high the market expectations we expect it to stay in that category going forward.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.