Search software company Elastic (NYSE:ESTC) reported results in line with analyst expectations in Q3 FY2023 quarter, with revenue up 22.6% year on year to $274.6 million. However, guidance for the next quarter was less impressive, coming in at $277 million at the midpoint, being 2.34% below analyst estimates. Elastic made a GAAP loss of $72.6 million, down on its loss of $56.7 million, in the same quarter last year.

Is now the time to buy Elastic? Access our full analysis of the earnings results here, it's free.

Elastic (ESTC) Q3 FY2023 Highlights:

- Revenue: $274.6 million vs analyst estimates of $273.4 million (small beat)

- EPS (non-GAAP): $0.17 vs analyst estimates of $0.05 ($0.12 beat)

- Revenue guidance for Q4 2023 is $277 million at the midpoint, below analyst estimates of $283.6 million

- Free cash flow of $6.97 million, down 32.3% from previous quarter

- Net Revenue Retention Rate: 120%, down from 125% previous quarter

- Customers: 19,900, up from 19,700 in previous quarter

- Gross Margin (GAAP): 72.6%, in line with same quarter last year

“We grew total revenue by 27% in constant currency while managing our business with discipline to deliver stronger than expected non-GAAP operating margin,” said Ash Kulkarni, CEO, Elastic.

Started by Shay Banon as a search engine for his wife's growing list of recipes at Le Cordon Bleu cooking school in Paris, Elastic (NYSE:ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

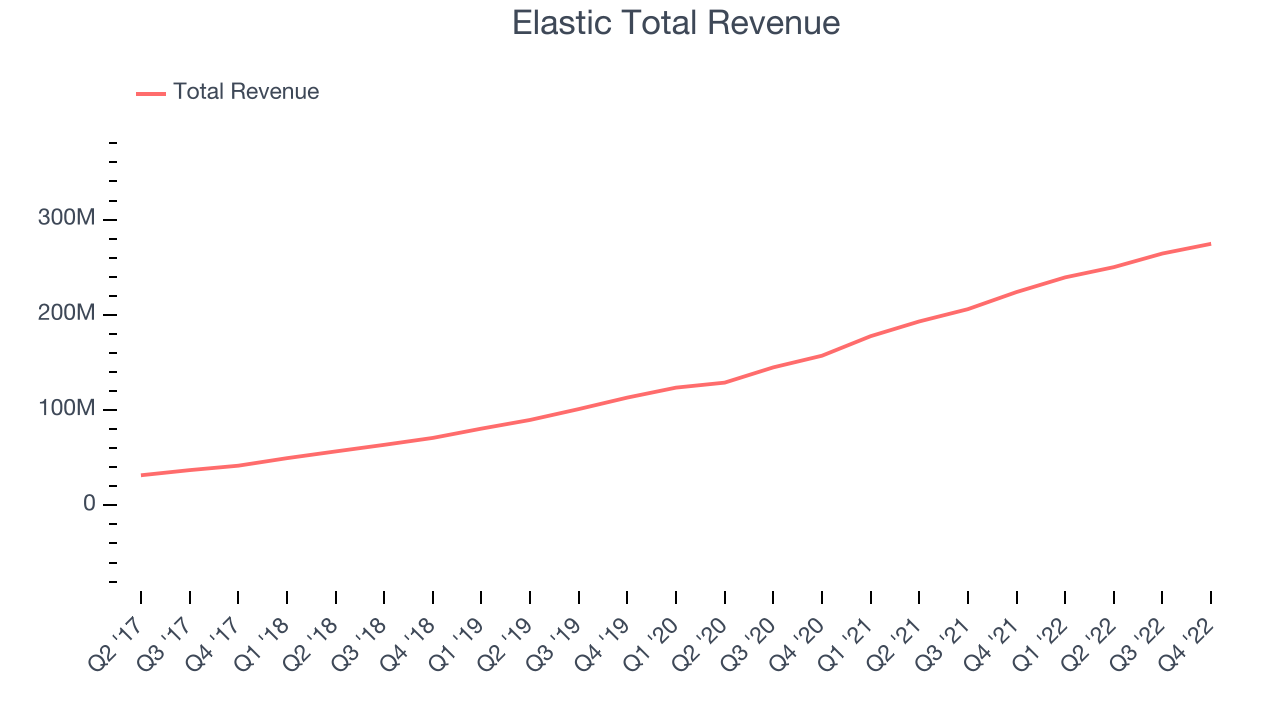

Sales Growth

As you can see below, Elastic's revenue growth has been very strong over the last two years, growing from quarterly revenue of $157.1 million in Q3 FY2021, to $274.6 million.

This quarter, Elastic's quarterly revenue was once again up a very solid 22.6% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $10.2 million in Q3, compared to $14.3 million in Q2 2023. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Guidance for the next quarter indicates Elastic is expecting revenue to grow 15.7% year on year to $277 million, slowing down from the 34.8% year-over-year increase in revenue the company had recorded in the same quarter last year. Ahead of the earnings results the analysts covering the company were estimating sales to grow 20.4% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

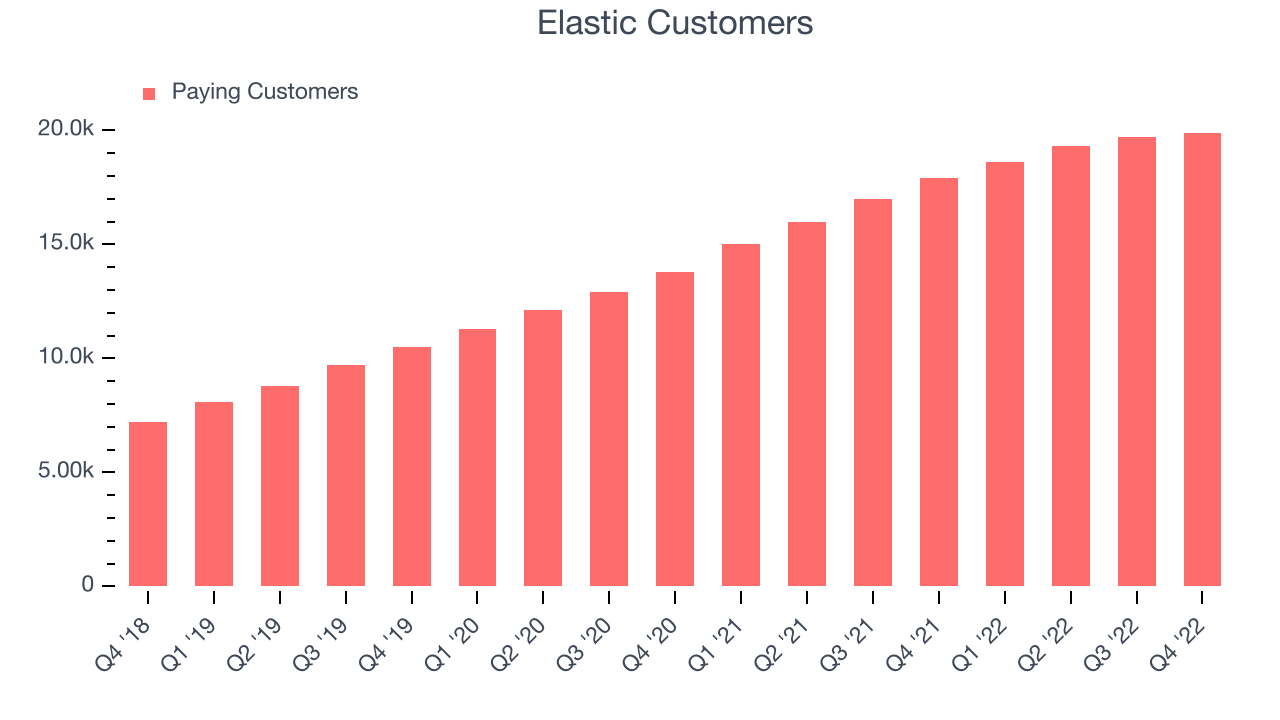

Customer Growth

You can see below that Elastic reported 19,900 customers at the end of the quarter, an increase of 200 on last quarter. That is a little slower customer growth than what we are used to seeing lately, suggesting that the customer acquisition momentum is slowing a little bit.

Key Takeaways from Elastic's Q3 Results

With a market capitalization of $5.52 billion Elastic is among smaller companies, but its more than $877.7 million in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

It was nice that Elastic improved their gross margin, even if just slightly. That feature of these results really stood out as a positive. On the other hand, it was unfortunate to see that the revenue guidance for the next quarter missed analysts' expectations and there was a slowdown in customer growth. Overall, it seems to us that this was a complicated quarter for Elastic. The company is down 8.9% on the results and currently trades at $53.2 per share.

Elastic may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.