Search software company Elastic (NYSE:ESTC) reported Q1 CY2024 results topping analysts' expectations, with revenue up 19.7% year on year to $335 million. The company expects next quarter's revenue to be around $344 million, in line with analysts' estimates. It made a non-GAAP profit of $0.21 per share, down from its profit of $0.22 per share in the same quarter last year.

Is now the time to buy Elastic? Find out by accessing our full research report, it's free.

Elastic (ESTC) Q1 CY2024 Highlights:

- Revenue: $335 million vs analyst estimates of $329.8 million (1.6% beat)

- EPS (non-GAAP): $0.21 vs analyst estimates of $0.20 (5.6% beat)

- Revenue Guidance for Q2 CY2024 is $344 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2025 is $1.47 billion at the midpoint, in line with analyst expectations and implying 16.3% growth (vs 18.5% in FY2024)

- Gross Margin (GAAP): 73.8%, in line with the same quarter last year

- Free Cash Flow of $60.1 million, up 17.1% from the previous quarter

- Net Revenue Retention Rate: 110%, up from 109% in the previous quarter

- Customers: 21,000, up from 20,800 in the previous quarter

- Billings: $446.4 million at quarter end, up 24.8% year on year

- Market Capitalization: $10.31 billion

“Elastic delivered another strong quarter and a great finish to the fiscal year,” said Ash Kulkarni, CEO.

Started by Shay Banon as a search engine for his wife's growing list of recipes at Le Cordon Bleu cooking school in Paris, Elastic (NYSE:ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

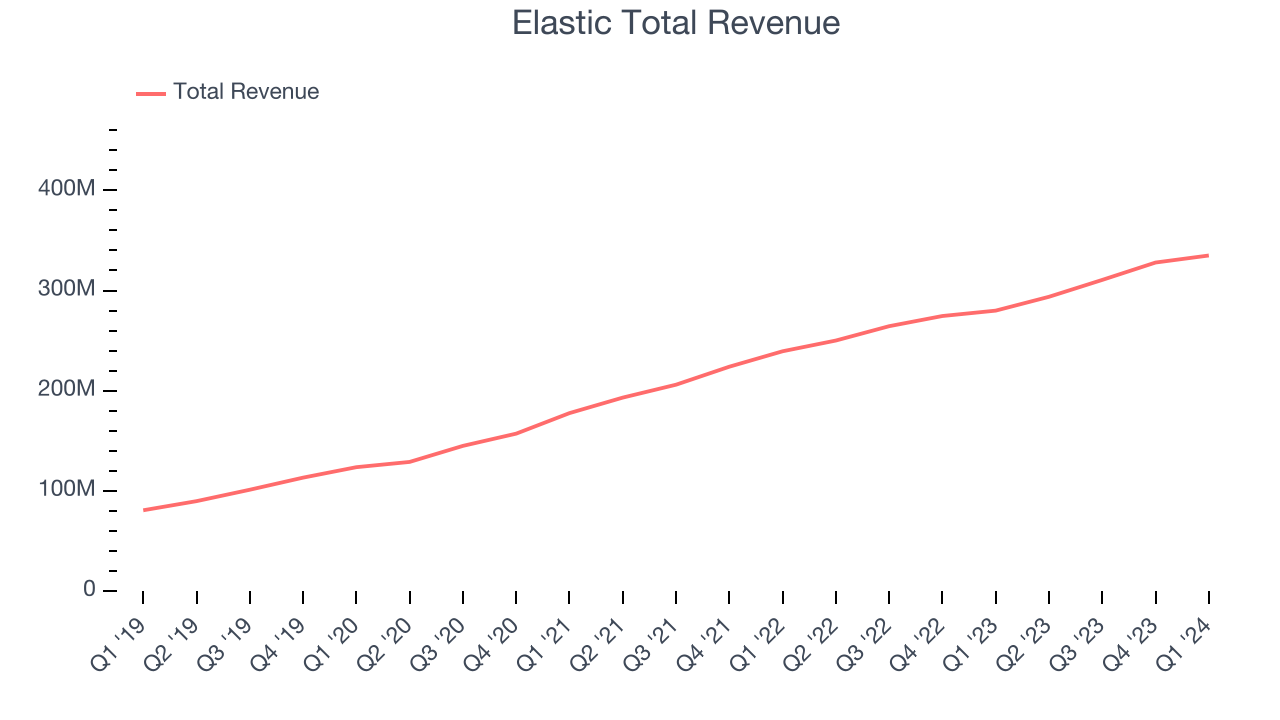

Sales Growth

As you can see below, Elastic's revenue growth has been strong over the last three years, growing from $177.6 million in Q4 2021 to $335 million this quarter.

This quarter, Elastic's quarterly revenue was once again up 19.7% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $7.04 million in Q1 compared to $17.35 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Elastic is expecting revenue to grow 17.1% year on year to $344 million, in line with the 17.5% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.47 billion at the midpoint, growing 16.3% year on year compared to the 18.6% increase in FY2024.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

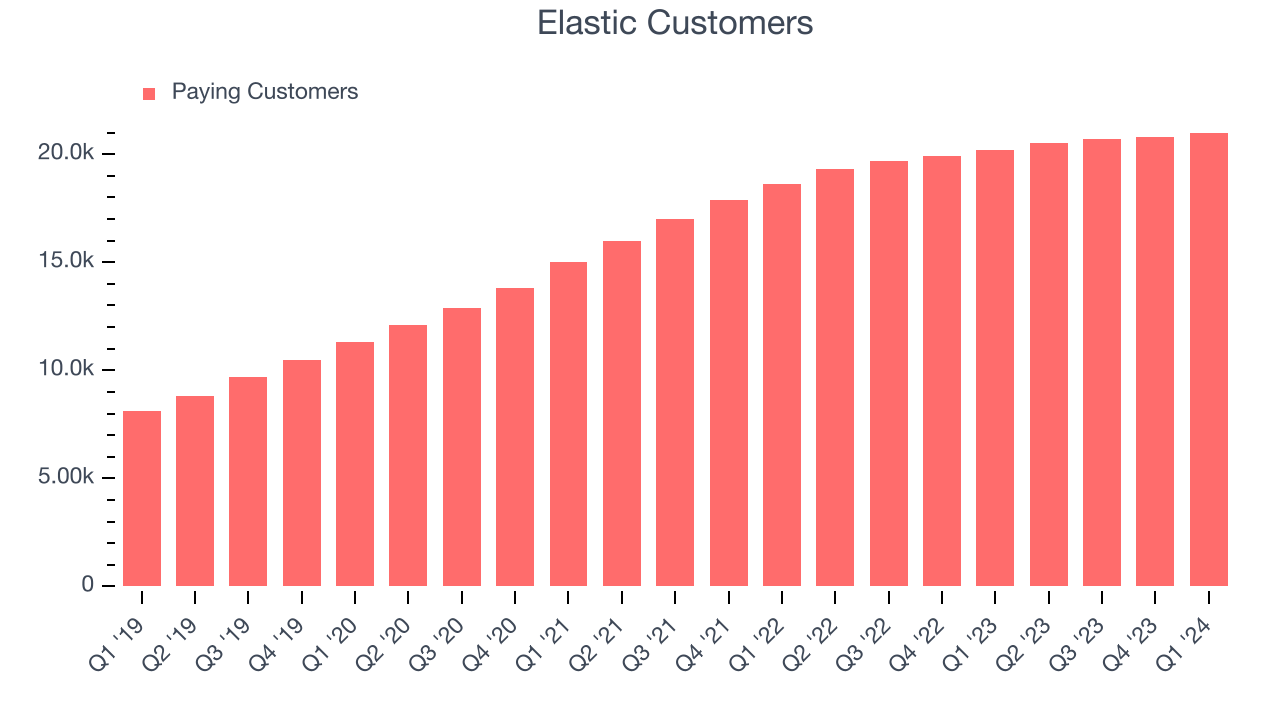

Customer Growth

Elastic reported 21,000 customers at the end of the quarter, an increase of 200 from the previous quarter. That's a little better customer growth than last quarter and in line with what we've seen in past quarters, demonstrating that the company has the sales momentum required to drive continued growth. We've no doubt shareholders will take this as an indication that Elastic's go-to-market strategy is running smoothly.

Key Takeaways from Elastic's Q1 Results

We were impressed by how strongly Elastic blew past analysts' billings and EPS expectations this quarter. We were also glad its customer growth accelerated. On the other hand, its full-year revenue guidance missed analysts' expectations. Overall, this quarter's results still seemed fairly positive and shareholders should feel optimistic. The stock is up 5.7% after reporting and currently trades at $98.50 per share.

Elastic may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.