Search software company Elastic (NYSE:ESTC) reported Q3 FY2024 results exceeding Wall Street analysts' expectations, with revenue up 19.4% year on year to $328 million. The company expects next quarter's revenue to be around $329 million, in line with analysts' estimates. It made a non-GAAP profit of $0.36 per share, improving from its profit of $0.17 per share in the same quarter last year.

Elastic (ESTC) Q3 FY2024 Highlights:

- Revenue: $328 million vs analyst estimates of $320.8 million (2.2% beat)

- EPS (non-GAAP): $0.36 vs analyst estimates of $0.32 (13.5% beat)

- Revenue Guidance for Q4 2024 is $329 million at the midpoint, roughly in line with what analysts were expecting (operating margin guidance was also roughly in line)

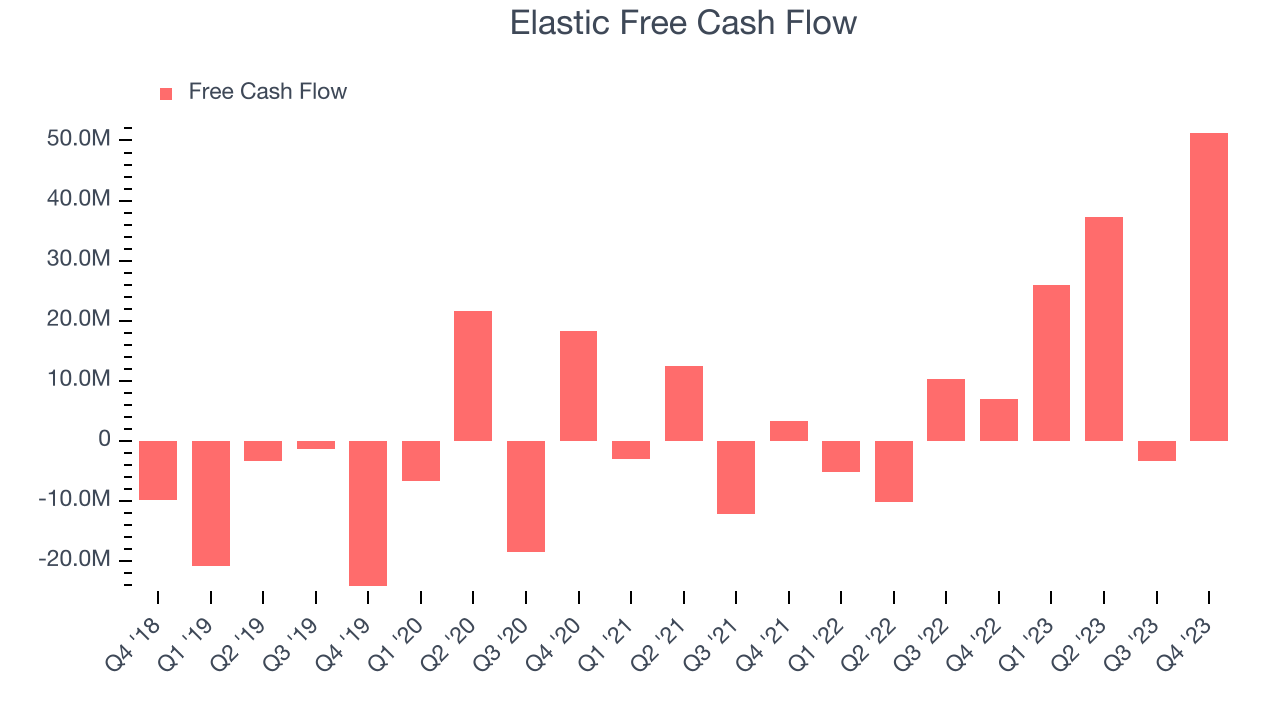

- Free Cash Flow of $51.31 million is up from -$3.28 million in the previous quarter

- Net Revenue Retention Rate: 109%, in line with the previous quarter

- Customers: 20,800, up from 20,700 in the previous quarter

- Gross Margin (GAAP): 74.2%, up from 72.7% in the same quarter last year

- Market Capitalization: $12.92 billion

Started by Shay Banon as a search engine for his wife's growing list of recipes at Le Cordon Bleu cooking school in Paris, Elastic (NYSE:ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

Building your own search engine is hard and even the biggest companies want to focus their energy elsewhere. Elastic offers a set of software products that ingest and store data from any source, in any format, and perform search, machine learning, and analysis.

For example Uber is using Elastic to power the systems that locate nearby riders and drivers, eBay is using it to help users find what they want to buy and Facebook is using it to power search in their help centre. Elastic is one of the companies that have been benefiting from the growth of the overall internet economy and has lately started expanding the use of their data processing technology from enterprise search into cloud-infrastructure monitoring and network security monitoring products.

Elastic’s business model is based on a combination of open source and proprietary software and the company uses the open-source part to power their distribution strategy. It is really easy to start using Elastic and developers can download limited versions of the software straight away for free, without speaking to any salespeople. Over time, if the software proves itself and the need for it expands inside an organization, it is easy to upgrade to a paid license.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Elastic competes in a segment that includes companies such as Yext (NYSE:YEXT), Lucidworks, and Splunk (NASDAQ:SPLK).

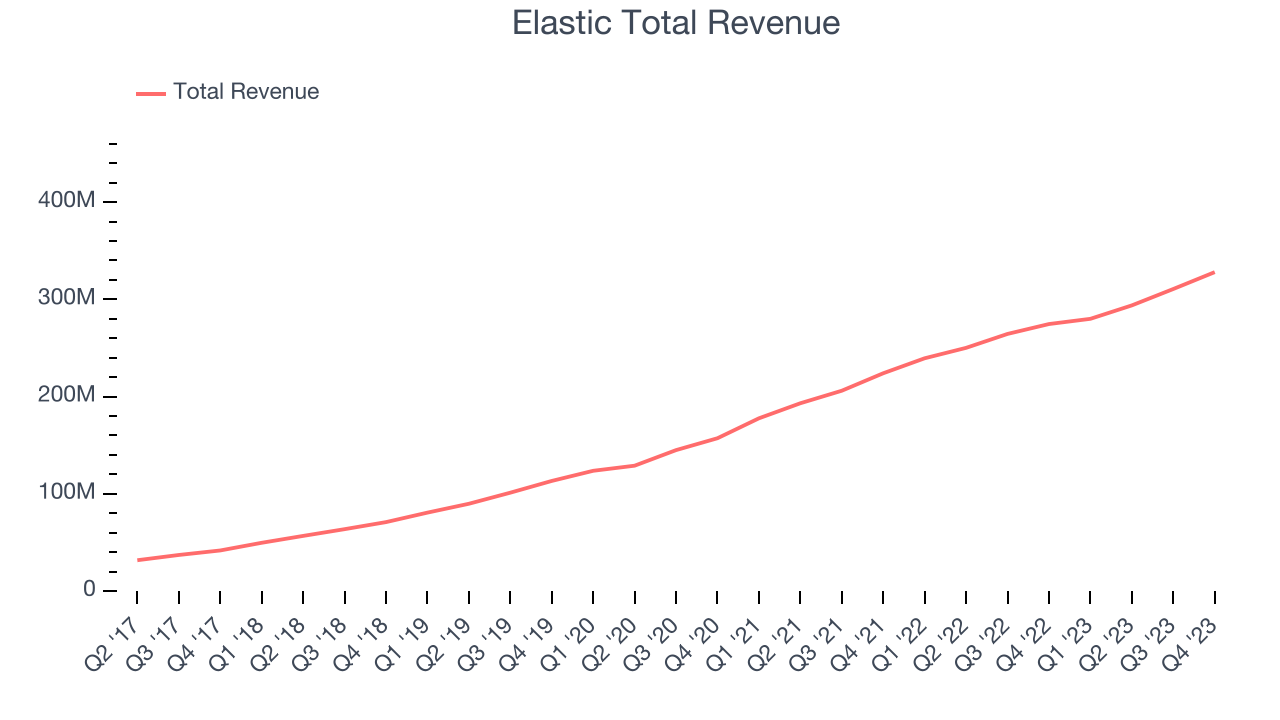

Sales Growth

As you can see below, Elastic's revenue growth has been strong over the last two years, growing from $223.9 million in Q3 FY2022 to $328 million this quarter.

This quarter, Elastic's quarterly revenue was once again up 19.4% year on year. We can see that Elastic's revenue increased by $17.35 million in Q3, which was roughly the same growth rate observed in Q2 2024. This steady quarter-on-quarter growth shows that the company can maintain its paced growth trajectory.

Next quarter's guidance suggests that Elastic is expecting revenue to grow 17.5% year on year to $329 million, in line with the 17% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 16.6% over the next 12 months before the earnings results announcement.

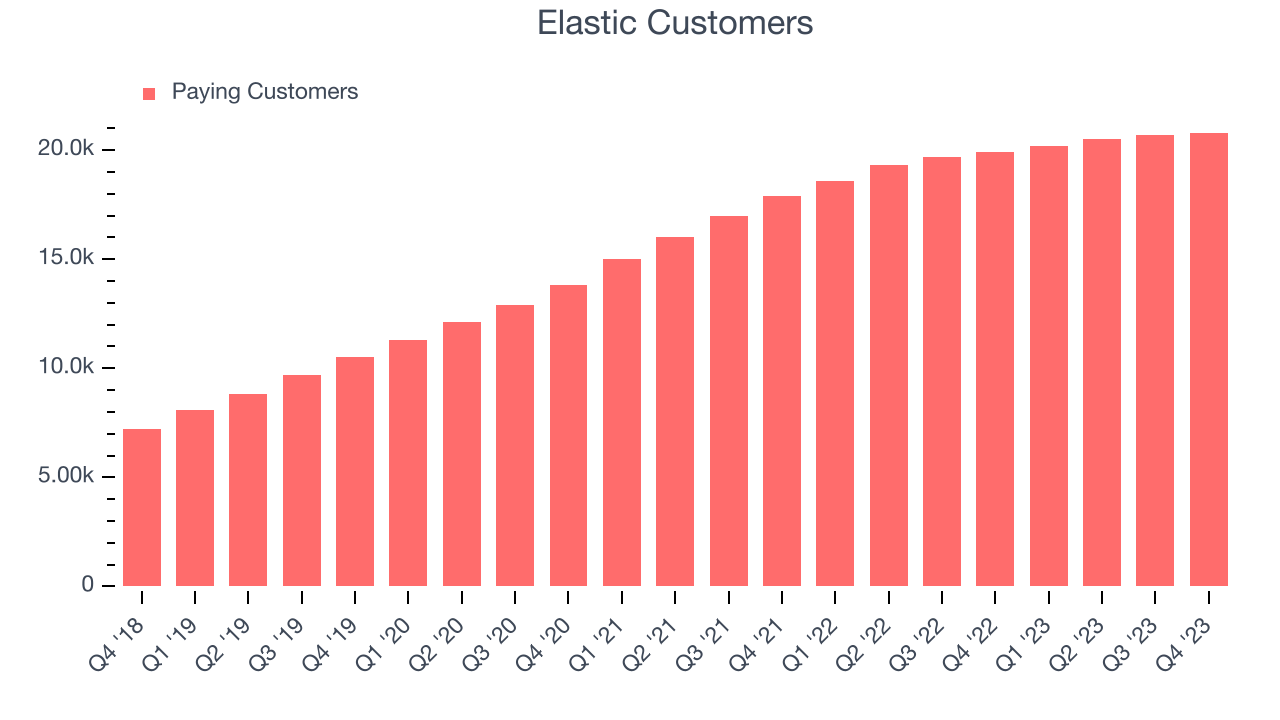

Customer Growth

Elastic reported 20,800 customers at the end of the quarter, an increase of 100 from the previous quarter. , suggesting that the company's customer acquisition momentum is slowing.

Product Success

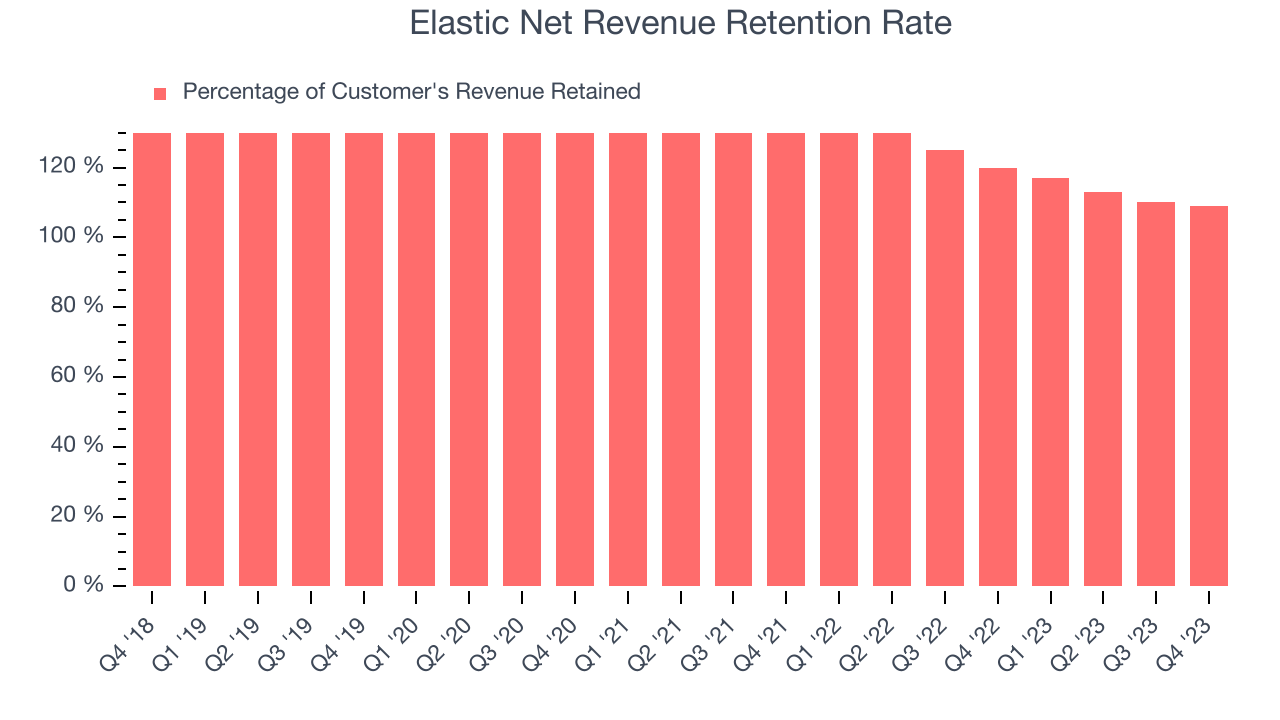

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Elastic's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 109% in Q3. This means that even if Elastic didn't win any new customers over the last 12 months, it would've grown its revenue by 9%.

Despite falling over the last year, Elastic still has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

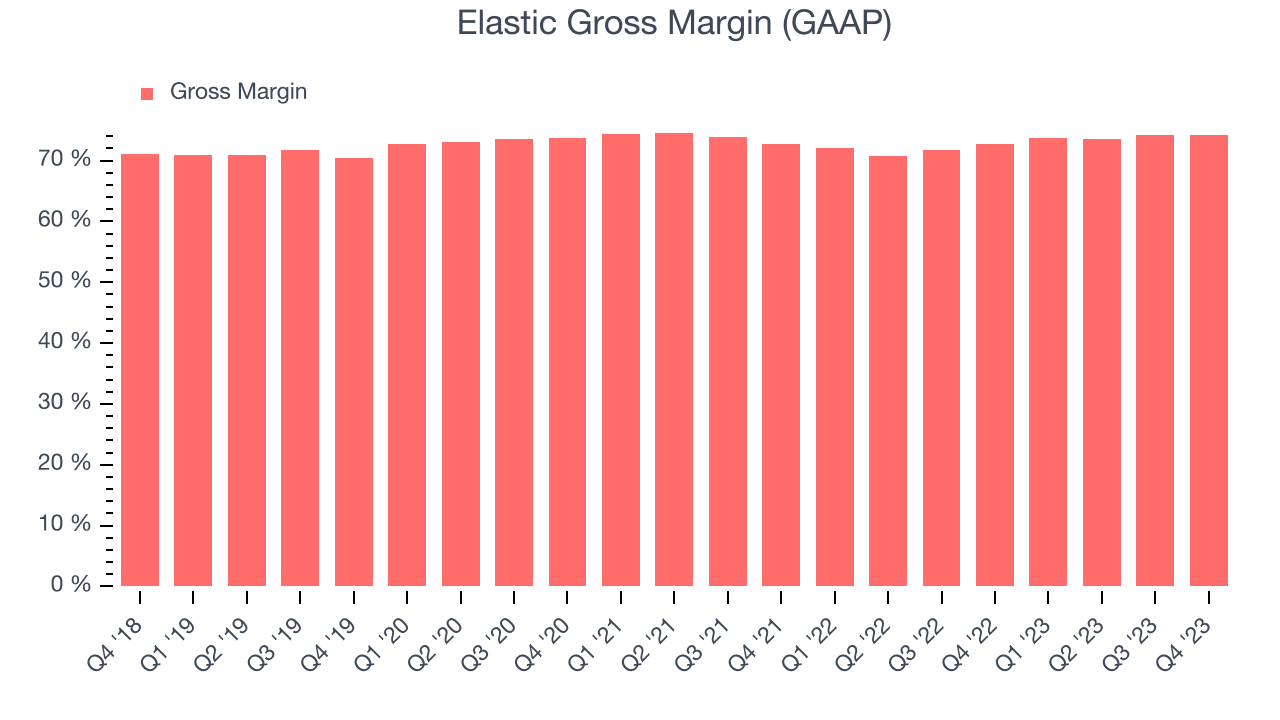

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Elastic's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 74.2% in Q3.

That means that for every $1 in revenue the company had $0.74 left to spend on developing new products, sales and marketing, and general administrative overhead. Elastic's gross margin is around the average of a typical SaaS businesses. It's encouraging to see its gross margin remain stable, indicating that Elastic is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Elastic's free cash flow came in at $51.31 million in Q3, up 636% year on year.

Elastic has generated $111.1 million in free cash flow over the last 12 months, or 9.2% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Elastic's Q3 Results

Revenue outperformed Wall Street's estimates. On the other hand, its customer growth slowed and retention rates continue to decline. Guidance was generally fine, with revenue and adjusted operating margin guidance in line with to above expectations. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. Investors were likely expecting more, and the stock is down 14% after reporting, trading at $114.9 per share.

Is Now The Time?

When considering an investment in Elastic, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Elastic is a good business. We'd expect growth rates to moderate from here. On top of that, its customers spend noticeably more each year, which is great to see and its strong gross margins suggest it can operate profitably and sustainably.

The market is certainly expecting long-term growth from Elastic given its price-to-sales ratio based on the next 12 months is 9.9x. There's definitely a lot of things to like about Elastic and looking at the tech landscape right now, it seems that it doesn't trade at an unreasonable price point.

Wall Street analysts covering the company had a one-year price target of $121.09 per share right before these results (compared to the current share price of $114.90), implying they saw upside in buying Elastic in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.