Casino gaming technology company Everi (NYSE:EVRI) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 5.5% year on year to $189.3 million. It made a GAAP profit of $0.05 per share, down from its profit of $0.30 per share in the same quarter last year.

Everi (EVRI) Q1 CY2024 Highlights:

- Revenue: $189.3 million vs analyst estimates of $188.8 million (small beat)

- EPS: $0.05 vs analyst estimates of $0.16 (-$0.11 miss)

- Gross Margin (GAAP): 80.9%, in line with the same quarter last year

- Free Cash Flow of $13.96 million, down 29.6% from the previous quarter

- Market Capitalization: $678.2 million

Formed between the 2015 merger of Global Cash Access and Multimedia Games, Everi (NYSE:EVRI) is a producer of games and financial infrastructure for the casino and hospitality industries.

The company was founded in 1998 as Global Cash Access, a manufacturer of casino ATMs, and rebranded to Everi following its acquisition of Multimedia Games, a developer of casino games. Today, Everi offers games and payment infrastructure (fintech) to its customers, who are mostly North American tribal and commercial casino operators.

Everi's games segment produces video and mechanical reel slot machines, historical horse racing games, and mobile casino games (iGaming). The company's slot machines and horse racing products are physical machines that are sold to casinos on either a revenue share agreement or a one-off basis. Everi’s slot machines historically made up a bulk of the company's gaming revenue while horse racing is a new product line that was acquired via its May 2022 acquisition of Intuicode Gaming.

For products sold on revenue share agreements, casino customers are free to place the machines wherever they'd like on the casino floor and can remove them if they underperform, meaning Everi would generate no revenue. To mitigate this risk, the company will occasionally pay placement fees to casinos to guarantee a spot on the floor for a designated period, typically a few years.

In its fintech segment, Everi sells ATMs, loyalty kiosks, mobile wallet infrastructure, and regulatory software for KYC (know your customer) and AML (anti-money laundering) to casinos. The lion’s share of fintech revenue originates from transaction fees when casino patrons fund their digital accounts or withdraw cash, meaning Everi must increase the number of transactions on its platform to grow.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Competitors in the gaming and casino technology industry include PlayAGS (NYSE:AGS), Light & Wonder (NASDAQ:LNW), and Inspired Entertainment (NASDAQ:INSE).Sales Growth

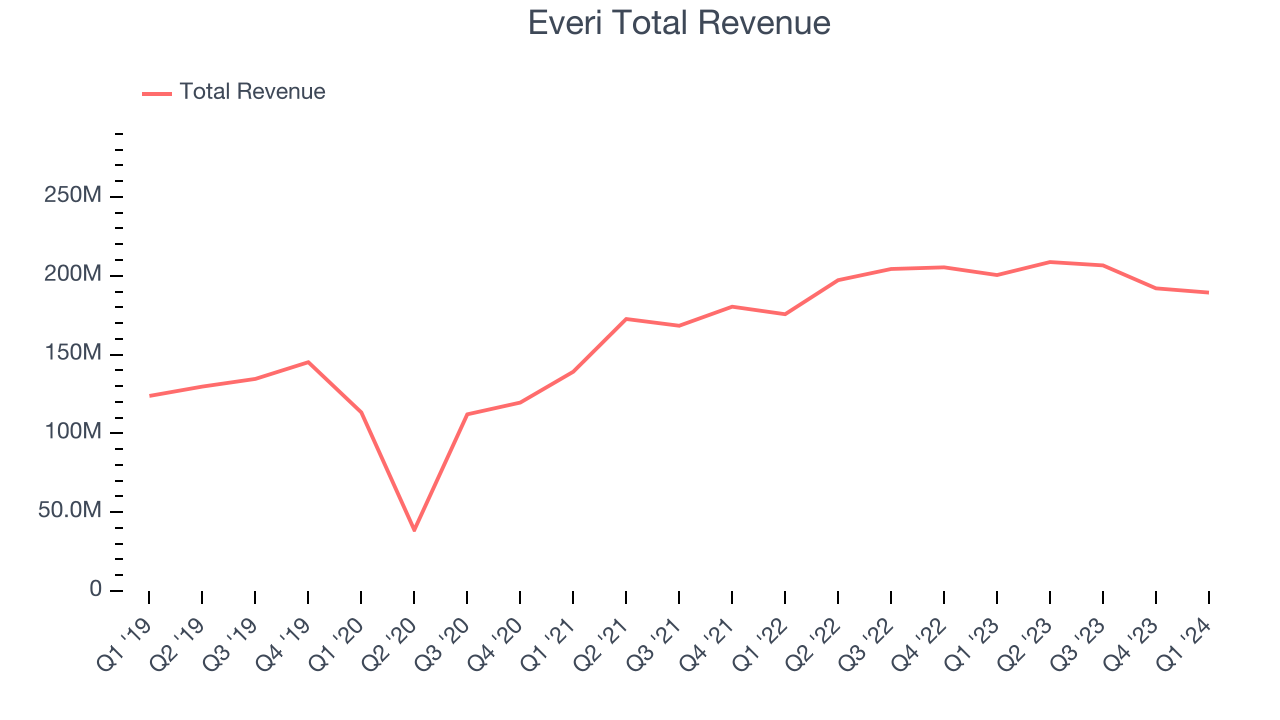

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Everi's annualized revenue growth rate of 10.6% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Everi's recent history shows the business has slowed as its annualized revenue growth of 6.9% over the last two years is below its five-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Everi's recent history shows the business has slowed as its annualized revenue growth of 6.9% over the last two years is below its five-year trend.

We can dig even further into the company's revenue dynamics by analyzing its most important segment, Gaming. Over the last two years, Everi's Gaming revenue (slot machines, iGaming) averaged 4.4% year-on-year declines. This segment has lagged the company's overall sales.

This quarter, Everi reported a rather uninspiring 5.5% year-on-year revenue decline to $189.3 million of revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.2% over the next 12 months, an acceleration from this quarter.

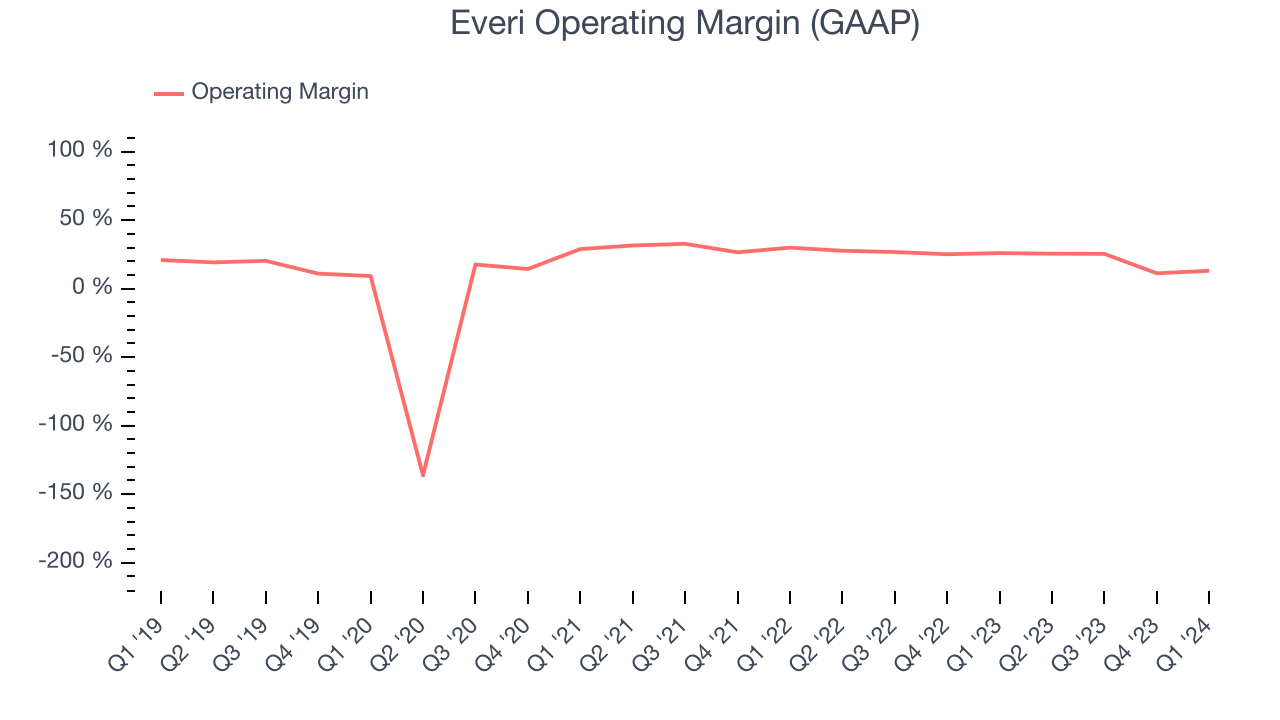

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Everi has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer discretionary business, boasting an average operating margin of 22.7%.

In Q1, Everi generated an operating profit margin of 13.1%, down 12.9 percentage points year on year.

Over the next 12 months, Wall Street expects Everi to become more profitable. Analysts are expecting the company’s LTM operating margin of 19.1% to rise to 22.4%.EPS

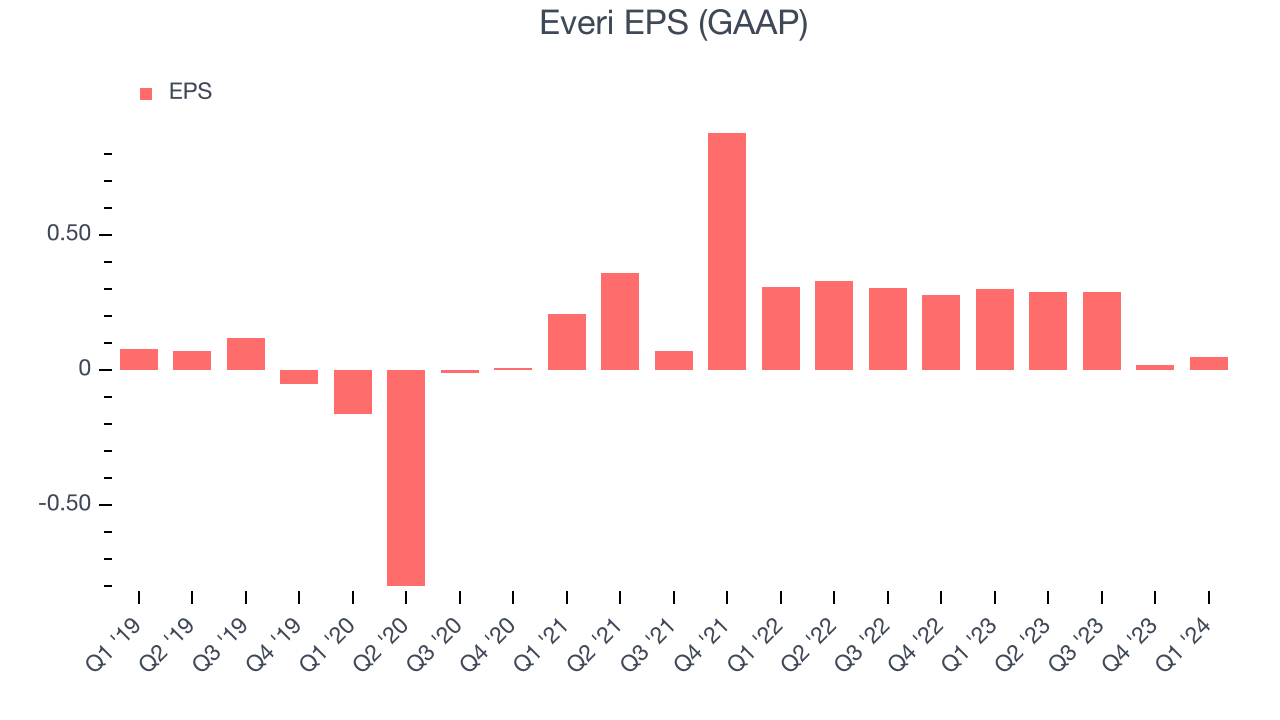

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Everi's EPS grew 242%, translating into an astounding 27.9% compounded annual growth rate.

In Q1, Everi reported EPS at $0.05, down from $0.30 in the same quarter last year. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Everi to grow its earnings. Analysts are projecting its LTM EPS of $0.65 to climb by 39.1% to $0.90.

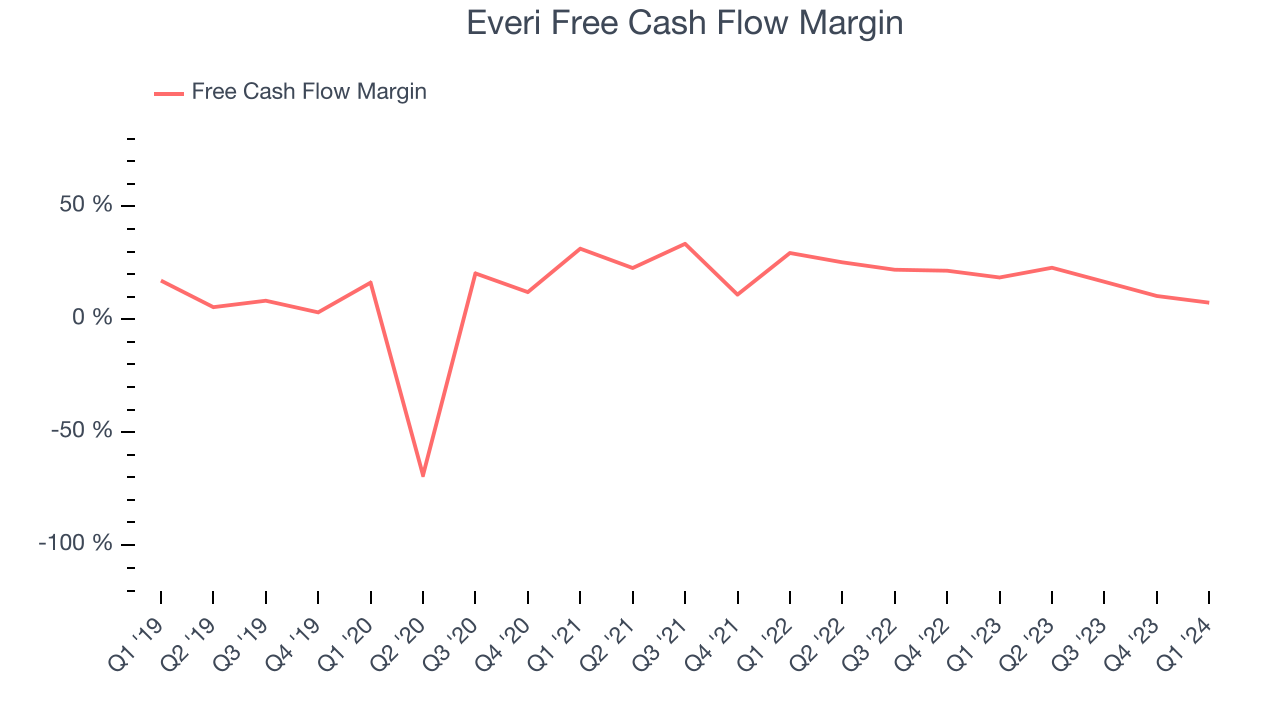

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Everi has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 18.2%, quite impressive for a consumer discretionary business.

Everi's free cash flow came in at $13.96 million in Q1, equivalent to a 7.4% margin and down 62.4% year on year.

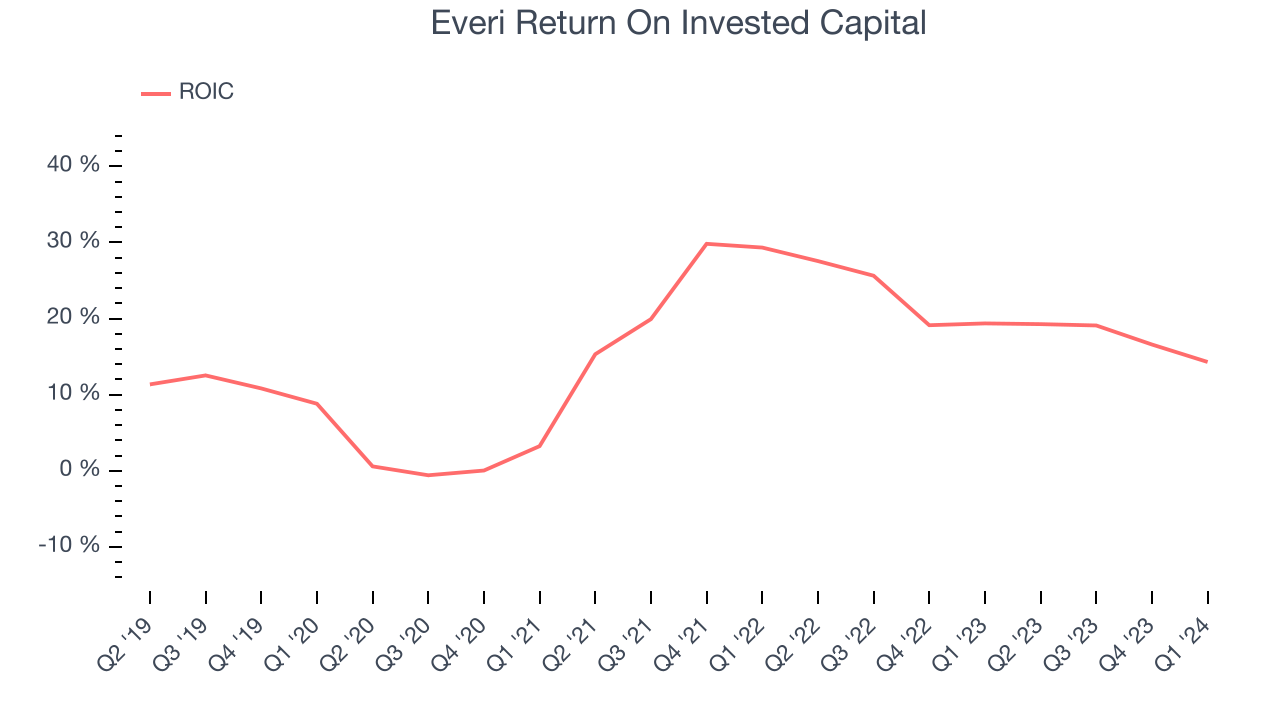

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Everi's five-year average return on invested capital was 15%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, Everi's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Everi's ROIC averaged 10.8 percentage point increases. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Everi reported $268.6 million of cash and $969.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $354.8 million of EBITDA over the last 12 months, we view Everi's 2.0x net-debt-to-EBITDA ratio as safe. We also see its $40.92 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Everi's Q1 Results

We struggled to find many strong positives in these results. Its Gaming revenue missed as the launch of its new gaming cabinet is progressing slower than anticipated, contributing to its worse-than-expected EPS and operating margin. On top of that, Everi lowered its full-year EBITDA guidance and now expects it to be down year on year as part of the Gaming segment headwinds. Overall, this was a bad quarter for Everi. The company is down 3% on the results and currently trades at $7.85 per share.

Is Now The Time?

Everi may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Everi is a solid business. Although its revenue growth has been a little slower over the last five years with analysts expecting growth to slow from here, its projected EPS for the next year implies the company's fundamentals will improve. On top of that, its EPS growth over the last five years has been fantastic.

Everi's price-to-earnings ratio based on the next 12 months is 8.3x. There are definitely things to like about Everi, and looking at the consumer discretionary landscape right now, it seems to be trading at a pretty interesting price.

Wall Street analysts covering the company had a one-year price target of $12.60 per share right before these results (compared to the current share price of $7.85), implying they saw upside in buying Everi in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.