Over the past six months, Ford has fallen to $11.12 per share. Shareholders have lost 9.8% of their capital, which is highly disappointing because the S&P 500 has climbed 11.2%. This may have investors wondering how to approach the situation.

Is now the time to buy Ford, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Despite the more favorable entry price, we're swiping left on Ford for now. Here are three reasons why we avoid F and one stock we'd rather own.

Why Do We Think Ford Will Underperform?

Established to make automobiles accessible to a broader segment of the population, Ford (NYSE:F) designs, manufactures, and sells a variety of automobiles, trucks, and electric vehicles.

1. Weak Sales Volumes Indicate Waning Demand

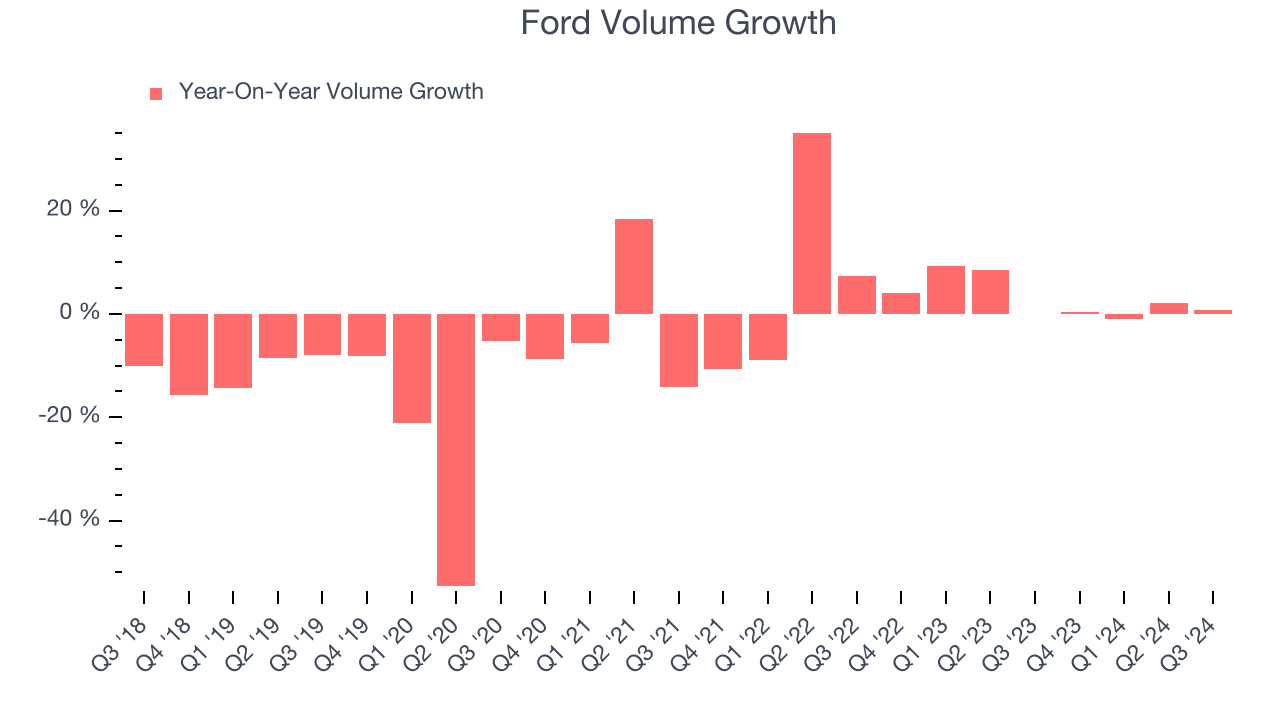

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful industrials company as there’s a ceiling to what customers will pay.

Ford’s vehicles sold came in at 1.1 million in the latest quarter, and over the last two years, its year-on-year growth averaged 3%. This performance was underwhelming and suggests it might have to lower prices or develop new products to accelerate growth - neither scenario is ideal at this stage because they can hinder near-term profitability.

2. Free Cash Flow Margin Dropping

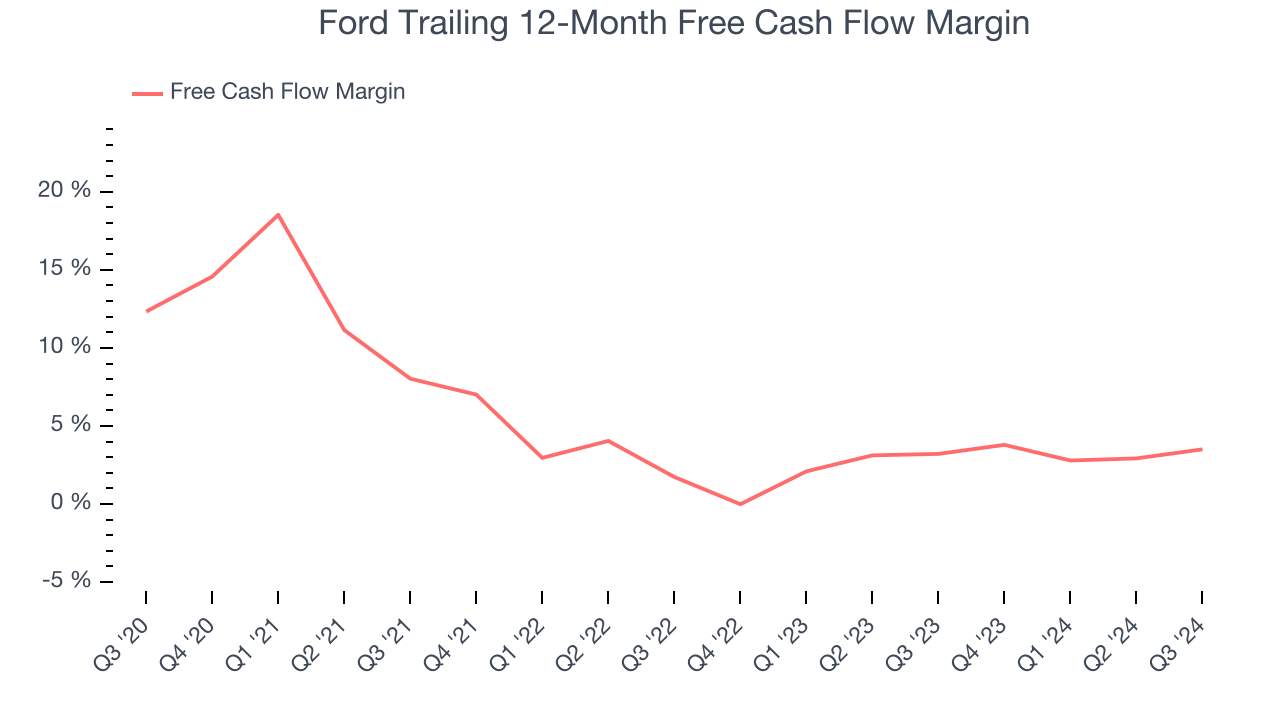

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Ford’s margin dropped by 8.8 percentage points over the last five years. If this trend continues, it could signal it’s becoming a more capital-intensive business. Ford’s free cash flow margin for the trailing 12 months was 3.5%.

3. High Debt Levels Increase Risk

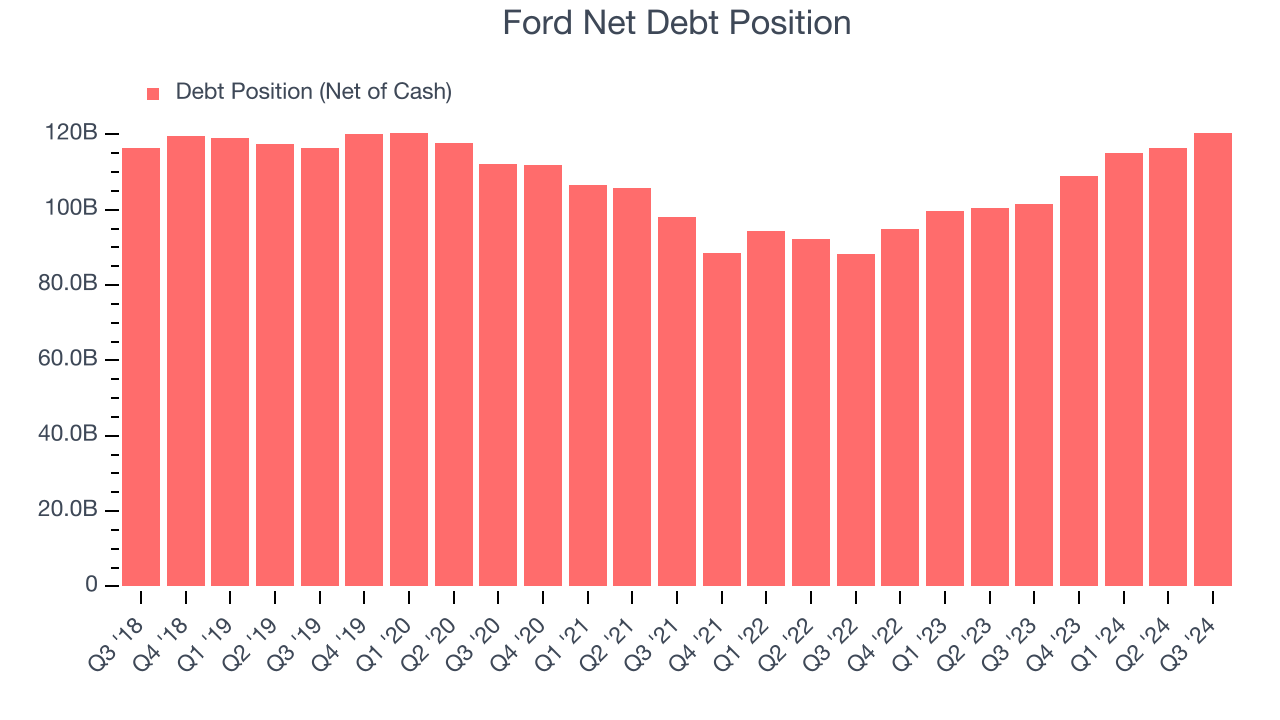

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Ford’s $157.3 billion of debt exceeds the $36.91 billion of cash on its balance sheet. Furthermore, its 8x net-debt-to-EBITDA ratio (based on its EBITDA of $15.24 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Ford could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Ford can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Ford doesn’t pass our quality test. After the recent drawdown, the stock trades at 5.8x forward price-to-earnings (or $11.12 per share). While this valuation could be reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere in the market. We’d suggest taking a look at CrowdStrike, the most entrenched endpoint security platform.

Stocks We Would Buy Instead of Ford

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our 9 Best Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.