Figs (NYSE:FIGS) Surprises With Q1 Sales But Stock Drops

Anthony Lee 2024/05/09 4:05 pm EDT

Healthcare apparel company Figs (NYSE:FIGS) beat analysts' expectations in Q1 CY2024, with revenue flat year on year at $119.3 million. It made a non-GAAP profit of $0.01 per share, down from its profit of $0.01 per share in the same quarter last year.

Figs (FIGS) Q1 CY2024 Highlights:

- Revenue: $119.3 million vs analyst estimates of $117.4 million (1.6% beat)

- EPS (non-GAAP): $0.01 vs analyst estimates of $0 ($0.01 beat)

- Gross Margin (GAAP): 68.9%, down from 71.3% in the same quarter last year

- Free Cash Flow of $11.12 million, down 18.5% from the previous quarter

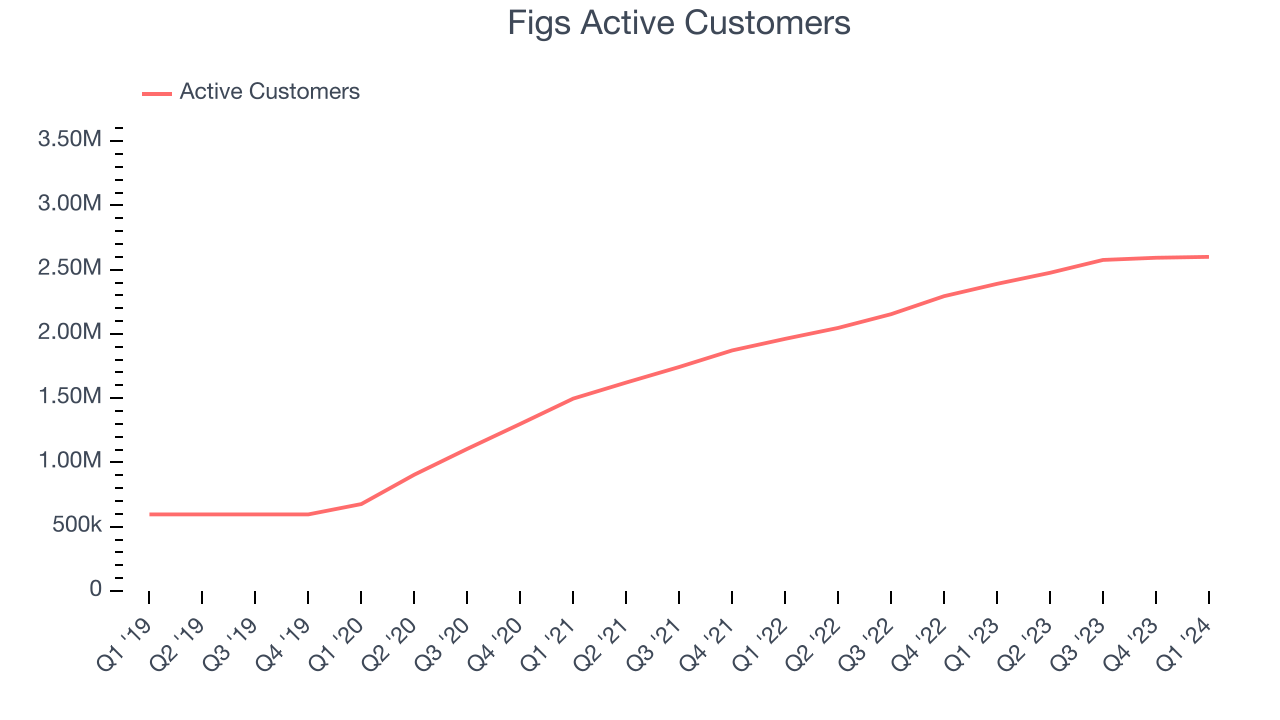

- Active Customers: 2.6 million

- Market Capitalization: $876.3 million

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Before Figs, most medical scrubs were unisex, uncomfortable, and lacked style. Figs changed this by introducing scrubs that not only met the practical demands of healthcare professionals but also provided a modern, tailored fit and aesthetic appeal. This focus on design, comfort, and functionality quickly resonated with medical professionals.

The company's product line includes scrubs, lab coats, and other medical apparel accessories designed for men and women, and could expand its offerings into adjacent areas over time. Figs’s products stand out due to their proprietary fabric technology, which is antimicrobial, wrinkle-resistant, moisture-wicking, and highly durable.

Figs operates on a direct-to-consumer model, primarily selling its products online, allowing the company to maintain control over its brand experience, customer service, and pricing strategy. The direct-to-consumer model also enables Figs to build a community with its customer base bolstered by engagement through social media and other digital platforms.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Figs's primary competitors include Dickies Medical (owned by VF Corp NYSE:VFC) and private companies Cherokee Uniforms, Barco Uniforms, Scrubs & Beyond, and Medline Industries.Sales Growth

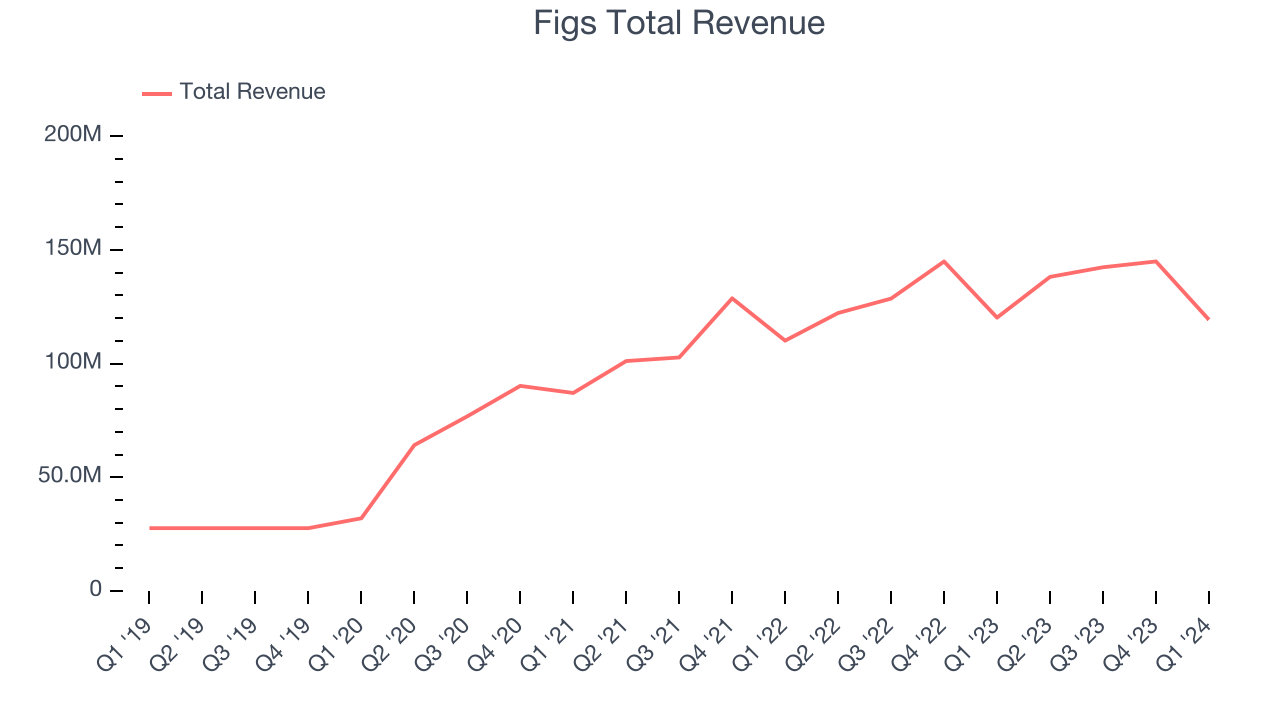

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Figs's annualized revenue growth rate of 47.6% over the last four years was incredible for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Figs's recent history shows its momentum has slowed as its annualized revenue growth of 10.9% over the last two years is below its four-year trend.

We can better understand the company's revenue dynamics by analyzing its number of active customers, which reached 2.6 million in the latest quarter. Over the last two years, Figs's active customers averaged 19.6% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's monetization of its consumers has fallen.

This quarter, Figs's $119.3 million of revenue was flat year on year but beat Wall Street's estimates by 1.6%. Looking ahead, Wall Street expects revenue to decline 1.7% over the next 12 months, a deceleration from this quarter.

Operating Margin

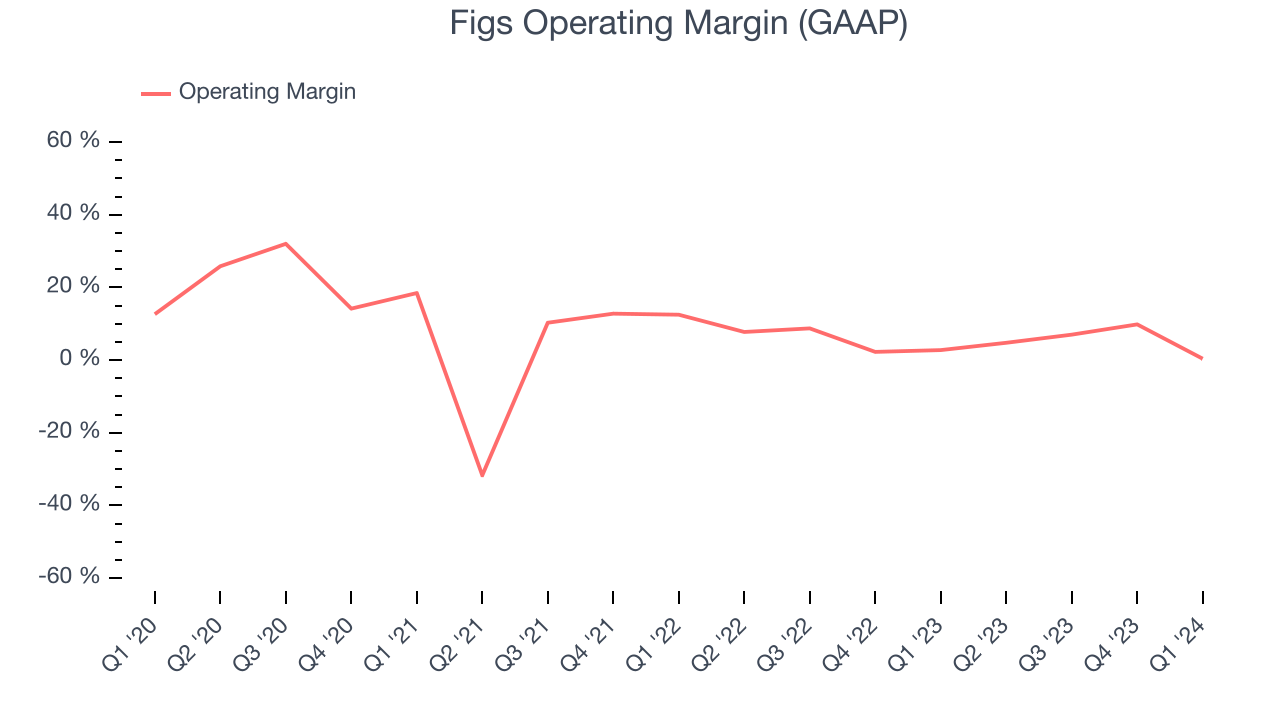

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Figs was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer discretionary business, producing an average operating margin of 5.5%.

This quarter, Figs generated an operating profit margin of 0.4%, down 2.4 percentage points year on year.

Over the next 12 months, Wall Street expects Figs to become less profitable. Analysts are expecting the company’s LTM operating margin of 5.7% to decline to 3.3%.EPS

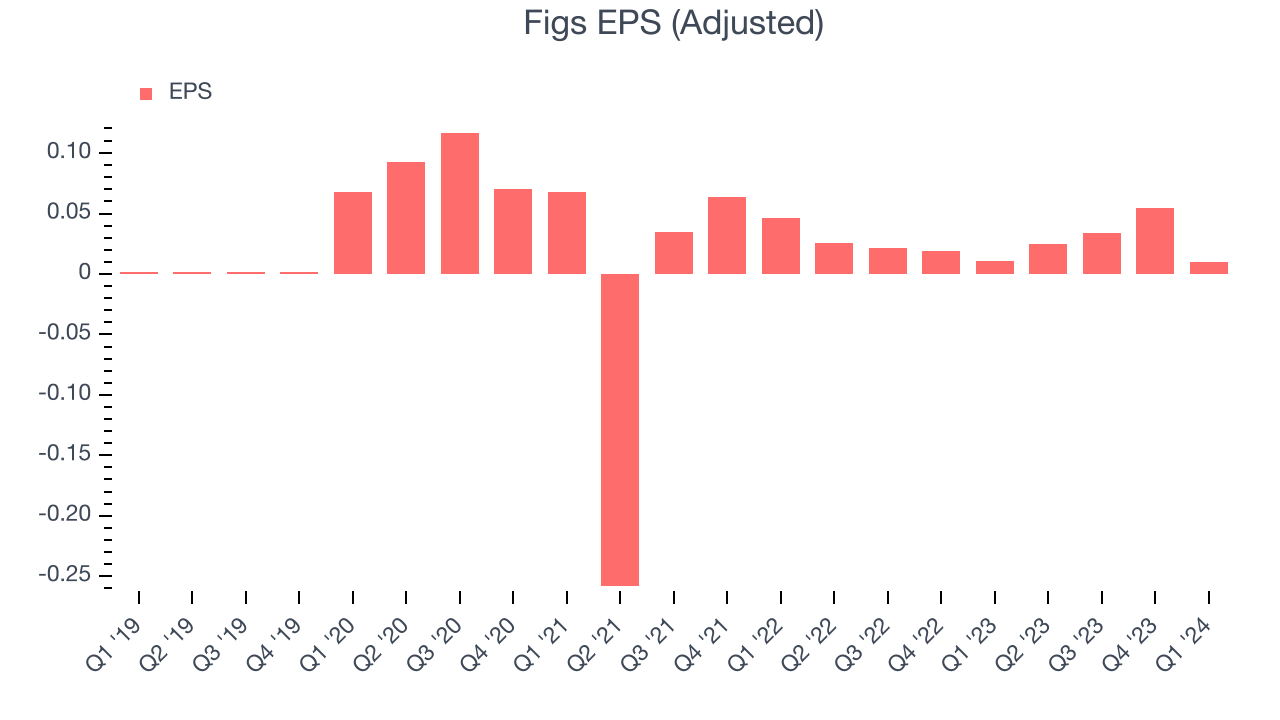

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last four years, Figs's EPS grew 68.3%, translating into a solid 13.9% compounded annual growth rate. This performance, however, is worse than its 47.6% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

Figs's operating margin has declined 12.3 percentage points over the last four years, leading to lower profitability and earnings. Taxes and interest expenses can also affect EPS, but they don't tell us as much about a company's fundamentals.In Q1, Figs reported EPS at $0.01, down from $0.01 in the same quarter last year. Despite falling year on year, this print easily cleared analysts' estimates. Over the next 12 months, Wall Street expects Figs to perform poorly. Analysts are projecting its LTM EPS of $0.12 to shrink to break even.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

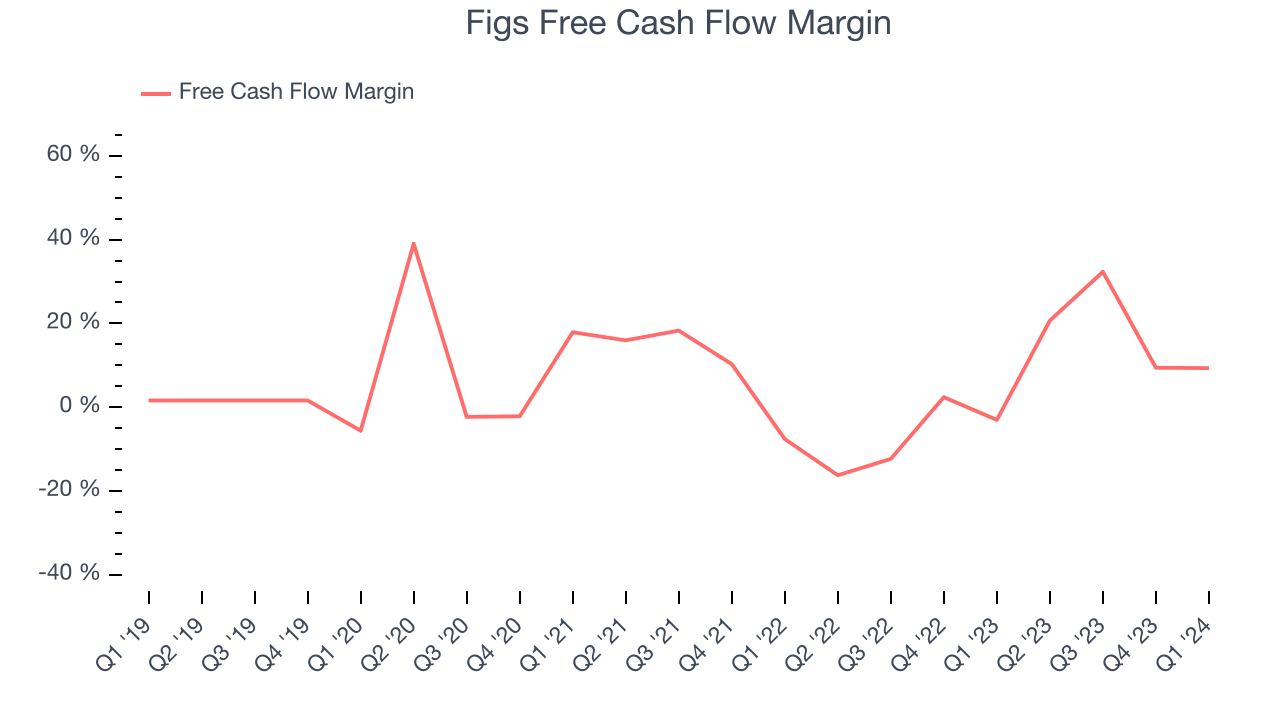

Over the last two years, Figs has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 6%, subpar for a consumer discretionary business.

Figs's free cash flow came in at $11.12 million in Q1, equivalent to a 9.3% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to cash flow positive this quarter. Over the next year, analysts predict Figs's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 18.2% will decrease to 2.5%.

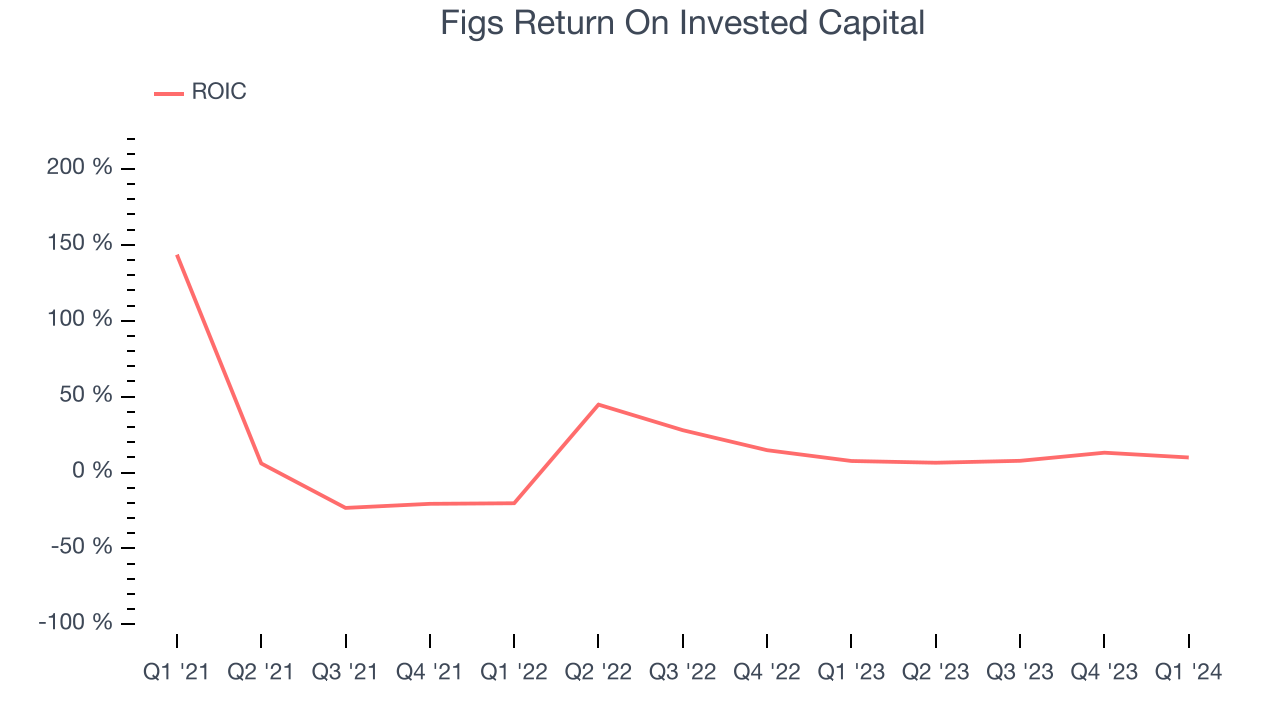

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Figs's five-year average return on invested capital was negative 0.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Figs is a profitable, well-capitalized company with $259.2 million of cash and $58.29 million of debt, meaning it could pay back all its debt tomorrow and still have $200.9 million of cash on its balance sheet. This net cash position gives Figs the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Figs's Q1 Results

It was great to see Figs beat analysts' revenue, operating margin, and EPS expectations this quarter. We were also glad it raised its full-year revenue guidance, though that came at the price of a downgraded EBITDA margin outlook. Zooming out, we think this was an impressive quarter, but the EBITDA forecast likely upset the market. The stock is down 8.5% after reporting and currently trades at $5.15 per share.

Is Now The Time?

Figs may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Figs, we'll be cheering from the sidelines. Although its revenue growth has been exceptional over the last four years, its projected EPS for the next year is lacking. And while its growth in active customers has been healthy, the downside is its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

Figs's price-to-earnings ratio based on the next 12 months is 66.3x. While we've no doubt one can find things to like about Figs, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $6.25 per share right before these results (compared to the current share price of $5.15).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.