Footwear and apparel retailer Foot Locker (NYSE:FL) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 1.4% year on year to $1.96 billion. Its non-GAAP profit of $0.33 per share was 18.4% below analysts’ consensus estimates.

Is now the time to buy Foot Locker? Find out by accessing our full research report, it’s free.

Foot Locker (FL) Q3 CY2024 Highlights:

- Revenue: $1.96 billion vs analyst estimates of $2.00 billion (1.4% year-on-year decline, 2.1% miss)

- Adjusted EPS: $0.33 vs analyst expectations of $0.40 (18.4% miss)

- Adjusted EBITDA: $63 million vs analyst estimates of $116 million (3.2% margin, 45.7% miss)

- Management lowered its full-year Adjusted EPS guidance to $1.25 at the midpoint, a 21.9% decrease

- Operating Margin: 0.6%, down from 2.4% in the same quarter last year

- Free Cash Flow was -$81 million, down from $26 million in the same quarter last year

- Locations: 2,450 at quarter end, down from 2,607 in the same quarter last year

- Same-Store Sales rose 2.4% year on year (-8% in the same quarter last year)

- Market Capitalization: $2.29 billion

Mary Dillon, President and Chief Executive Officer, said, "Our team's continued focus on execution drove positive comparable sales trends and meaningful gross margin expansion in the quarter. However, our third quarter top- and bottom-line performance fell short of our expectations. Consumer spending trends softened following the peak Back-to-School period in August, and the promotional environment was more elevated than anticipated. At the same time, we continued to demonstrate progress with our Lace Up Plan, including further cementing our leadership position at the heart of basketball and sneaker culture. In the quarter, we continued the rollout of our Foot Locker 'Home Court' experience in collaboration with Nike and Jordan Brand, and we also announced a multi-year partnership with the legendary Chicago Bulls franchise."

Company Overview

Known for store associates whose uniforms resemble those of referees, Foot Locker (NYSE:FL) is a specialty retailer that sells athletic footwear, clothing, and accessories.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

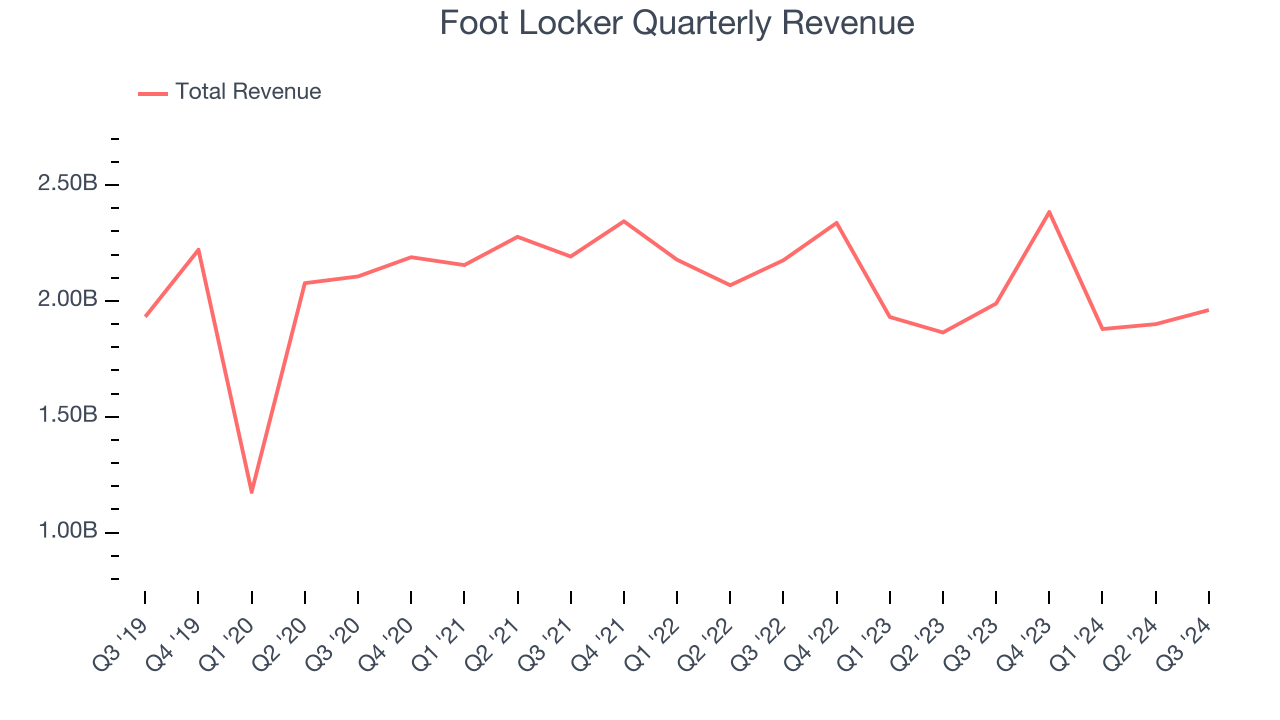

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Foot Locker is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Foot Locker struggled to increase demand as its $8.12 billion of sales for the trailing 12 months was close to its revenue five years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it closed stores and observed lower sales at existing, established locations.

This quarter, Foot Locker missed Wall Street’s estimates and reported a rather uninspiring 1.4% year-on-year revenue decline, generating $1.96 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months, similar to its five-year rate. Although this projection indicates its newer products will fuel better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

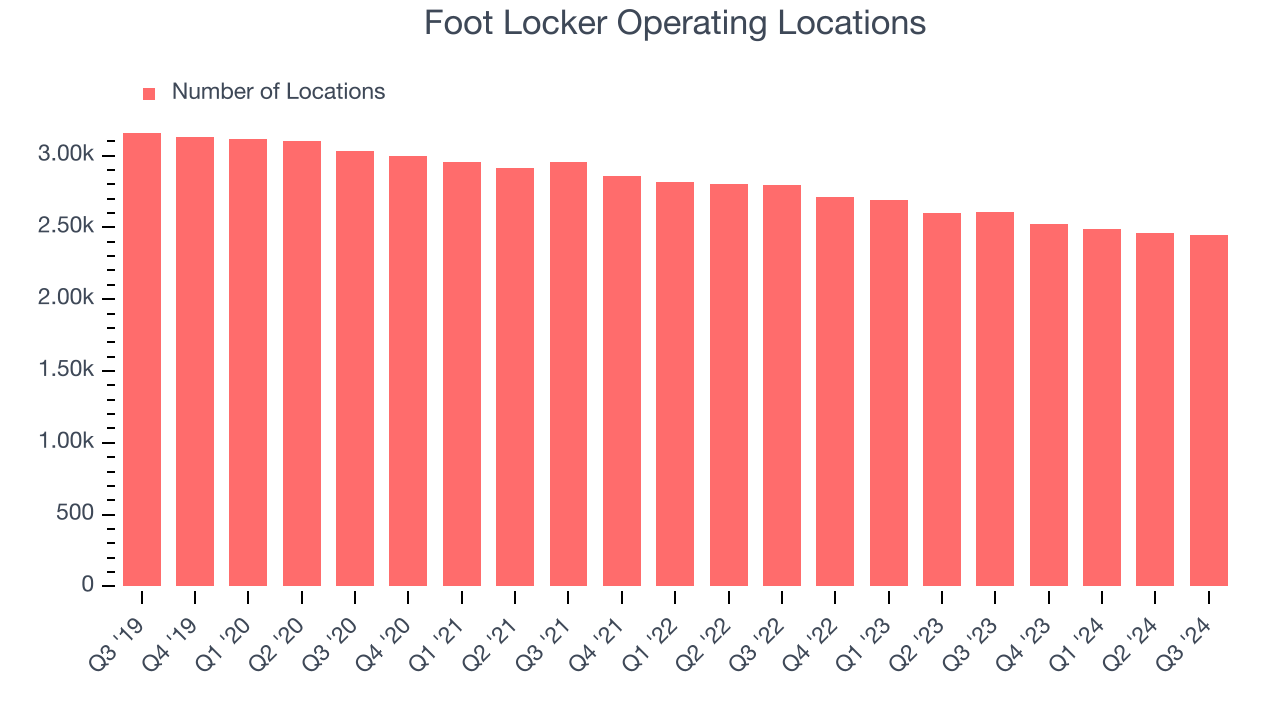

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Foot Locker listed 2,450 locations in the latest quarter and has generally closed its stores over the last two years, averaging 6.1% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

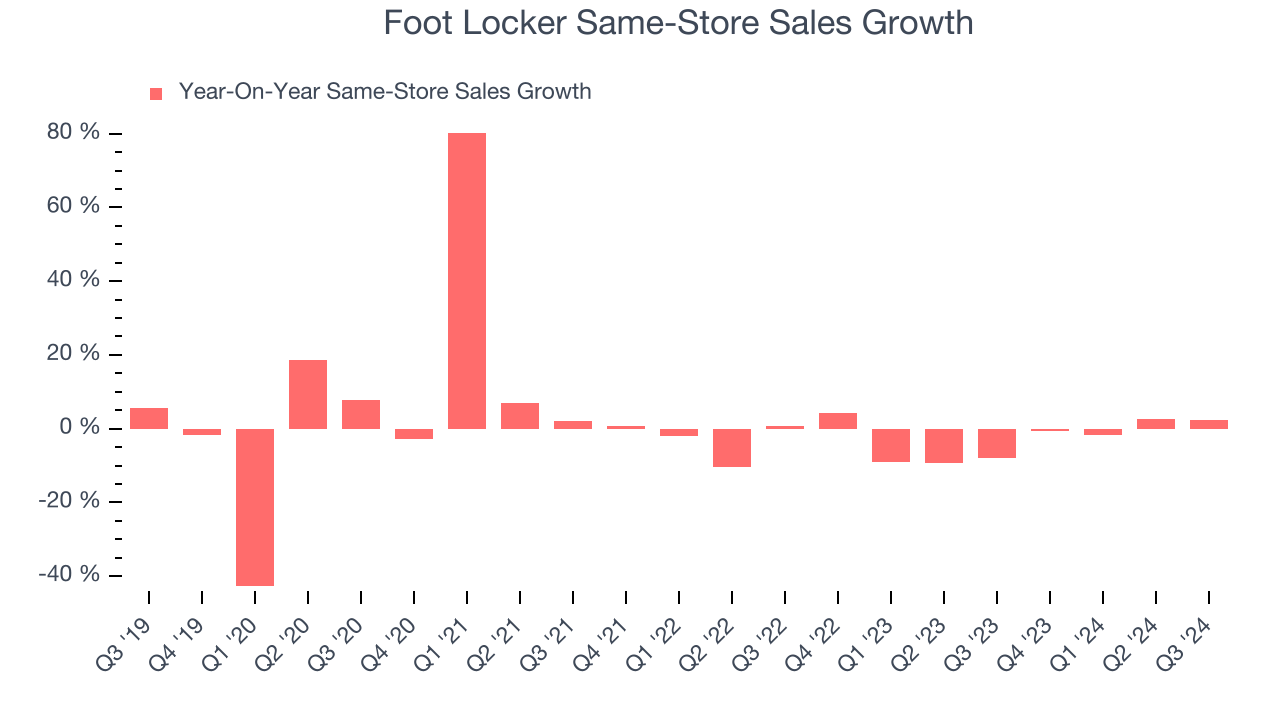

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Foot Locker’s demand has been shrinking over the last two years as its same-store sales have averaged 2.5% annual declines. This performance isn’t ideal, and Foot Locker is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Foot Locker’s same-store sales rose 2.4% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Foot Locker’s Q3 Results

We struggled to find many resounding positives in these results. Revenue and EPS in the quarter missed. Its full-year EPS guidance also missed significantly. Overall, this was a weaker quarter. The stock traded down 7.1% to $22.45 immediately following the results.

Foot Locker may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.