The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the apparel and footwear retail stocks have fared in Q2, starting with Foot Locker (NYSE:FL).

Apparel and footwear was once a category thought to be relatively safe from major e-commerce penetration because of the need to try on, touch, and feel products, but the category is now meaningfully transacted online. Everyone still needs clothes and shoes to go outside unless they want some curious (or horrified) looks. But this ongoing digitization is forcing apparel and footwear retailers–that once only had brick-and-mortar stores–to respond with omnichannel offerings. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stagnate, so the evolution of clothing and shoes sellers marches on.

The 20 apparel and footwear retail stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 1.93%, while on average next quarter revenue guidance was 0.82% under consensus. Tech stocks have been hit the hardest as investors start to value profits over growth, but apparel and footwear retail stocks held their ground better than others, with share prices down 0.78% since the previous earnings results, on average.

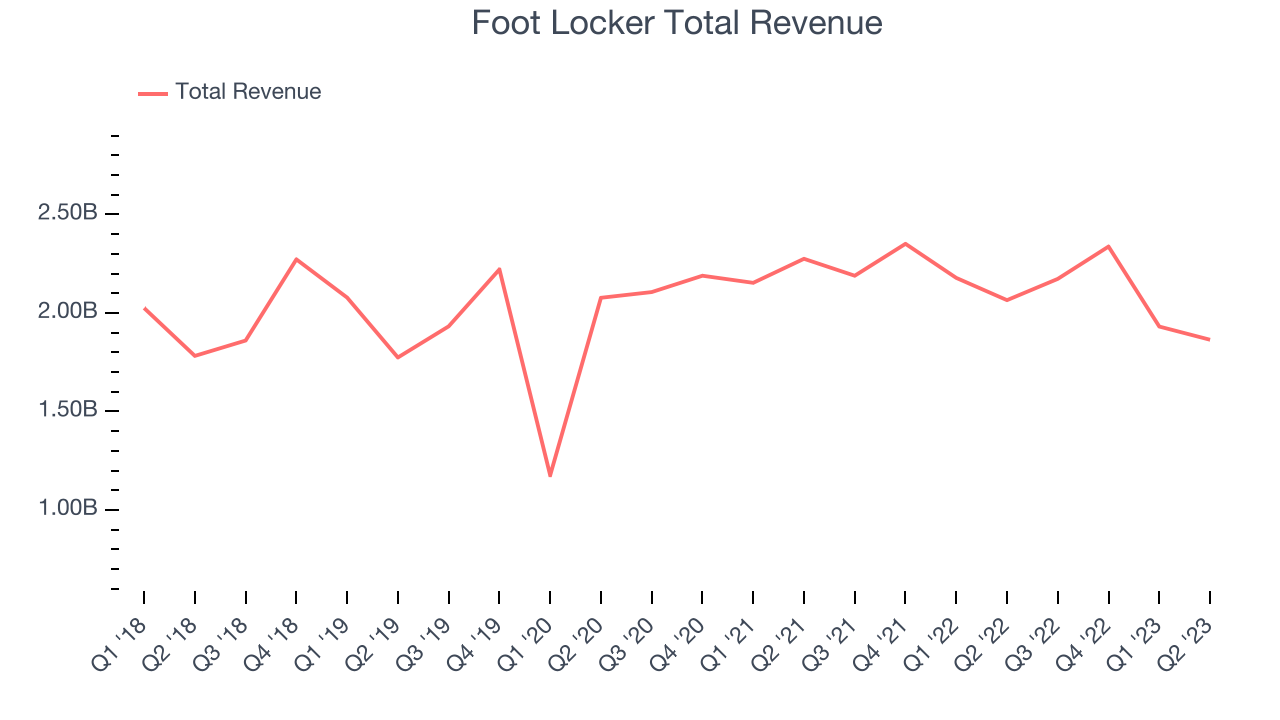

Foot Locker (NYSE:FL)

Known for store associates whose uniforms resemble those of referees, Foot Locker (NYSE:FL) is a specialty retailer that sells athletic footwear, clothing, and accessories.

Foot Locker reported revenues of $1.86 billion, down 9.73% year on year, missing analyst expectations by 0.98%. It was a weak quarter for the company, with a miss of analysts' revenue estimates. Foot Locker posted lower-than-expected margins (likely driven by markdowns on items to move merchandise) and paused its dividend to free up resources. Furthermore, it lowered its full-year revenue and EPS estimates again after doing the same during its Q1 earnings.

Mary Dillon, President and Chief Executive Officer, said, "Our second quarter was broadly in line with our expectations, despite the still-tough consumer backdrop. However, we did see a softening in trends in July and are adjusting our 2023 outlook to allow us to best compete for price-sensitive consumers, while still leaning into the strategic investments that drive our Lace Up plan. Importantly, we are continuing to make progress on our inventory levels and look to best position the business for the upcoming holiday season and into 2024. "

The stock is down 20.1% since the results and currently trades at $18.53.

Read our full report on Foot Locker here, it's free.

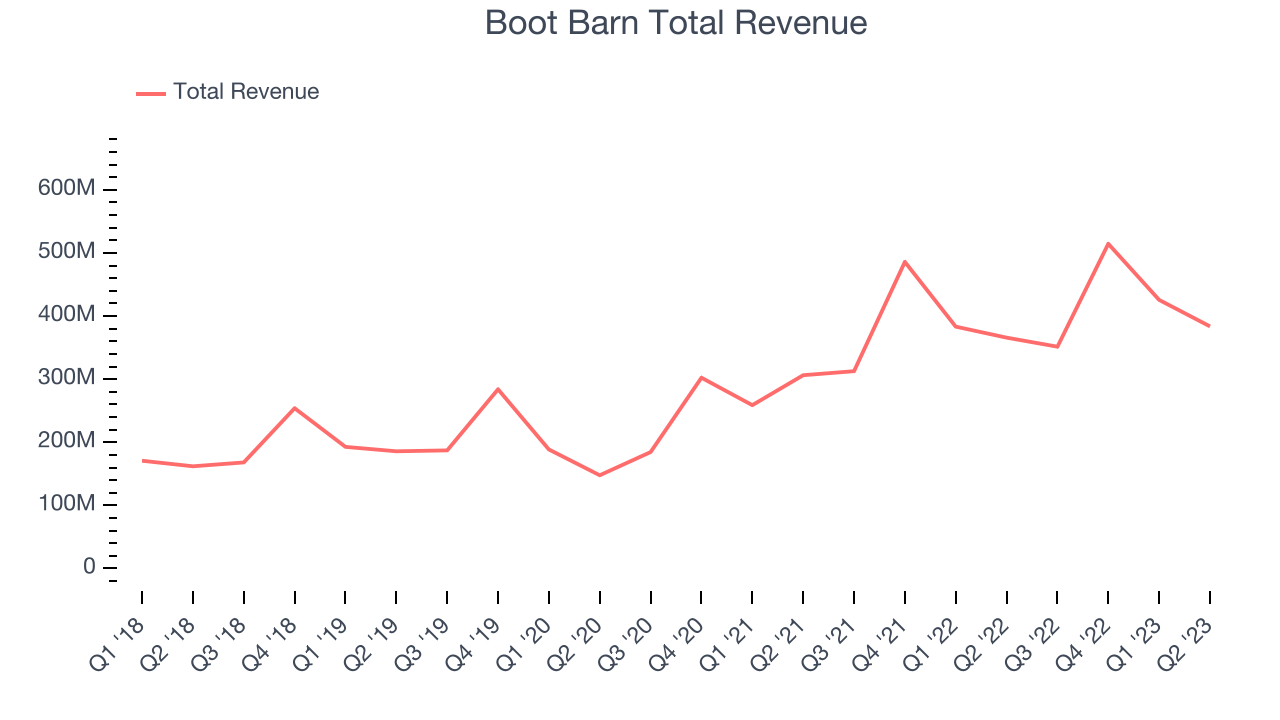

Best Q2: Boot Barn (NYSE:BOOT)

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE:BOOT) is a western-inspired apparel and footwear retailer.

Boot Barn reported revenues of $383.7 million, up 4.88% year on year, beating analyst expectations by 5.79%. It was a strong quarter for the company, with revenue and EPS surpassing analysts' expectations. Revenue guidance for the next quarter also came in ahead of consensus estimates.

Boot Barn scored the highest full year guidance raise among its peers. The stock is down 13.3% since the results and currently trades at $77.95.

Is now the time to buy Boot Barn? Access our full analysis of the earnings results here, it's free.

Genesco (NYSE:GCO)

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Genesco reported revenues of $523 million, down 2.3% year on year, beating analyst expectations by 5.18%. It was a strong quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 2.19% since the results and currently trades at $29.8.

Read our full, actionable report on Genesco here, it's free.

Ross Stores (NASDAQ:ROST)

Selling excess inventory or overstocked items from other retailers, Ross Stores (NASDAQ:ROST) is an off-price concept that sells apparel and other goods at prices much lower than department stores.

Ross Stores reported revenues of $4.93 billion, up 7.68% year on year, beating analyst expectations by 3.92%. It was a decent quarter for the company, with an impressive beat of analysts' same-store sales, revenue, and EPS expectations. EPS guidance for the next quarter and the full year also came in ahead of Wall Street's expectations.

The stock is up 0.18% since the results and currently trades at $113.13.

Read our full, actionable report on Ross Stores here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned