Specialty flooring retailer Floor & Decor (NYSE:FND) fell short of analysts' expectations in Q2 FY2023, with revenue up 4.23% year on year to $1.14 billion. Unfortunately, the company's full-year revenue guidance also came in lower than expected. Floor & Decor made a GAAP profit of $71.5 million, down from its profit of $81.8 million in the same quarter last year.

Is now the time to buy Floor And Decor? Find out by accessing our full research report free of charge.

Floor And Decor (FND) Q2 FY2023 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.15 billion (1.15% miss)

- EPS: $0.66 vs analyst estimates of $0.65 (1.2% beat)

- The company dropped revenue guidance for the full year from $4.68 billion to $4.5 billion at the midpoint, a 3.95% decrease

- Free Cash Flow of $86.6 million is up from -$102 million in the same quarter last year

- Gross Margin (GAAP): 42.2%, up from 40.7% in the same quarter last year

- Same-Store Sales were down 6% year on year

- Store Locations: 203 at quarter end, increasing by 29 over the last 12 months

Tom Taylor, Chief Executive Officer, stated, “Amidst the economic challenges of rising mortgage interest rates and near-record-low existing home sales, we are pleased to deliver second-quarter diluted earnings per share of $0.66, which was above our expectations. We are focused on what we can control by executing our growth and customer service strategies at a high level and effectively managing our profitability during this challenging period where sales are modestly below our expectations. As consumers prioritize value and savings, we intend to continue to grow our market share by capitalizing on our everyday low prices and value options, trend-forward broad assortments, in-stock job lot quantities, and the exceptional customer service provided by our store associates.”

Operating large, warehouse-style stores, Floor & Decor (NYSE:FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Sales Growth

Floor And Decor is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex higher growth rates than its larger counterparts because it's growing off a smaller base.

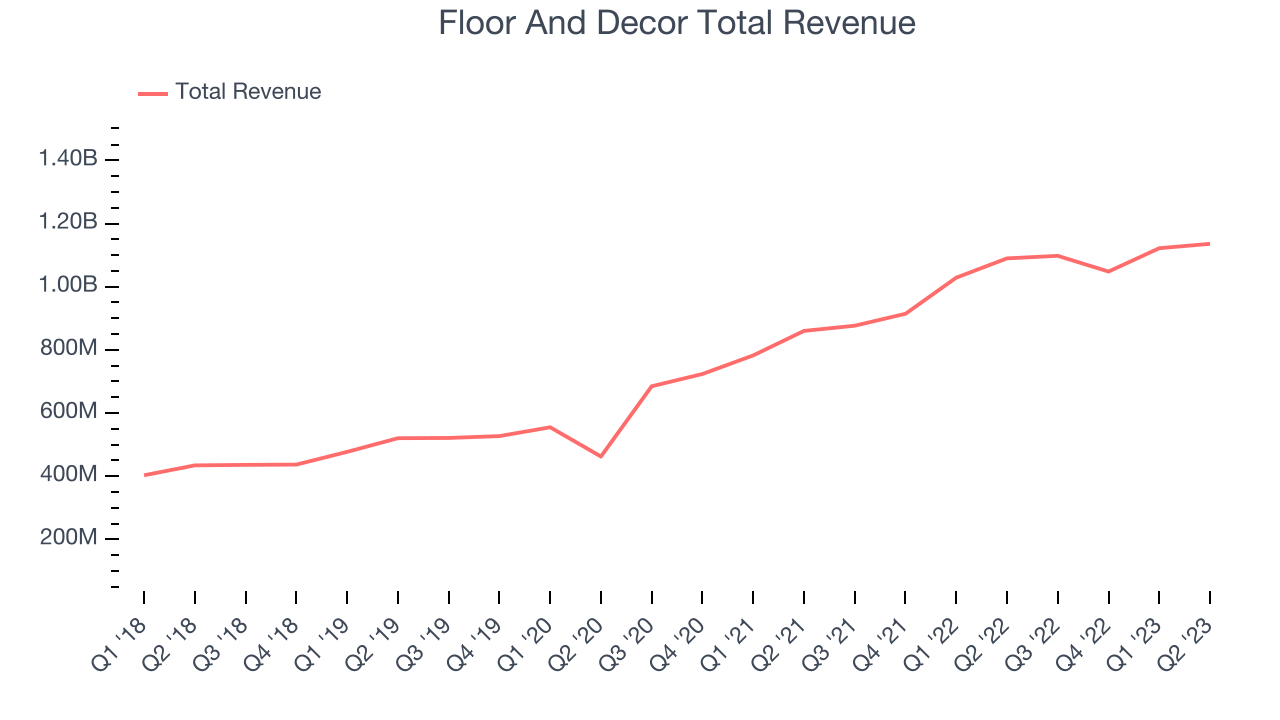

As you can see below, the company's annualized revenue growth rate of 23.9% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) has been exceptional as it's added more brick-and-mortar locations and increased sales at existing, established stores.

This quarter, Floor And Decor grew its revenue by 4.23% year on year, falling short of Wall Street's estimates.

Looking ahead, the analysts covering the company expect sales to grow 14.7% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Number of Stores

A retailer's store count plays a big influence on how much revenue it can generate.

When a retailer like Floor And Decor is opening new stores, it usually means that demand is greater than supply and it's investing for growth. Since last year, Floor And Decor's store count increased by 29 locations, or by 16.7%, to 203 total retail locations in the most recently reported quarter.

Over the last two years, the company has opened new stores rapidly and averaged 18.3% annual growth in its physical footprint. This store growth is among the fastest in the consumer retail sector. With a growing store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

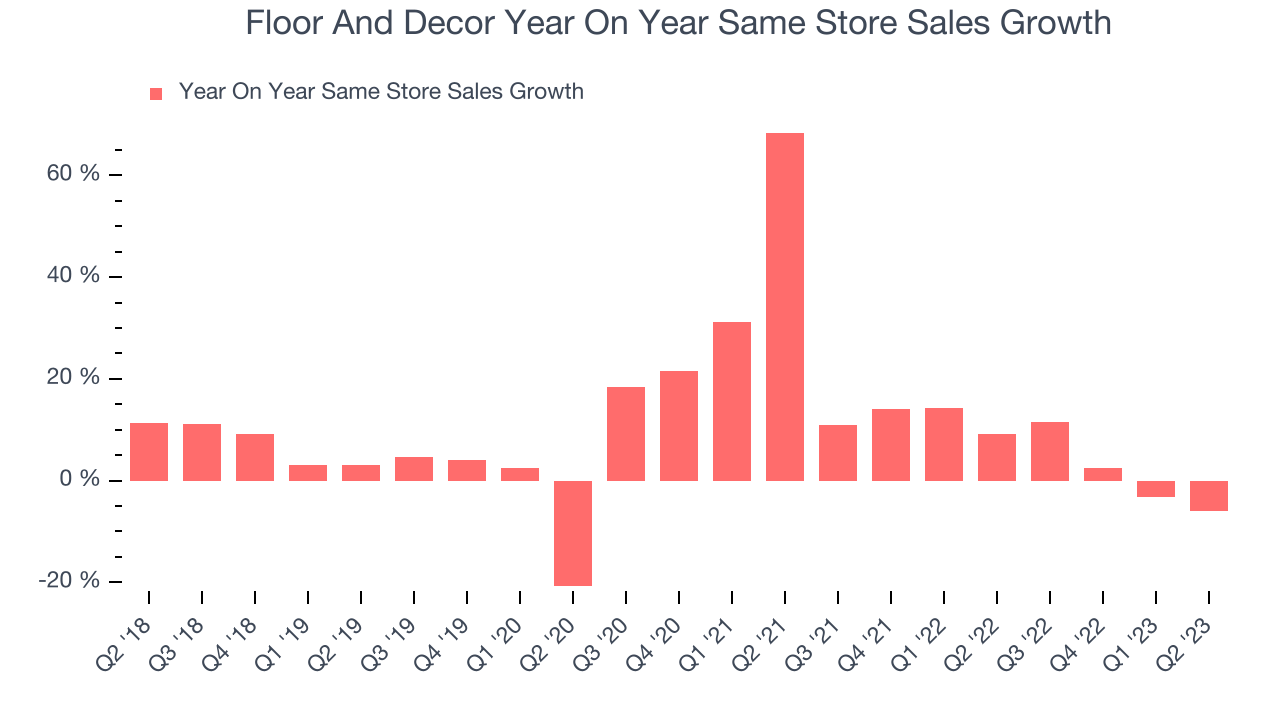

Floor And Decor's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 6.65% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Floor And Decor is reaching more customers and growing sales.

In the latest quarter, Floor And Decor's same-store sales fell 6% year on year. This decline was a reversal from the 9.2% year-on-year increase it had posted 12 months ago. A one quarter hiccup isn't material for the long-term prospects of a business, but we'll keep a close eye on the company to see if any unfavorable trends emerge.

Key Takeaways from Floor And Decor's Q2 Results

With a market capitalization of $11.9 billion, a $4.17 million cash balance, and positive free cash flow over the last 12 months, we're confident that Floor And Decor has the resources needed to pursue a high-growth business strategy.

We struggled to find many strong positives in these results. The company's full-year revenue, same-store sales, and adjusted EBITDA guidance were lowered and missed analysts' expectations. Overall, this was a mediocre quarter for Floor & Decor. The company is down 6.87% on the results and currently trades at $103.35 per share.

Floor And Decor may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.