Specialty flooring retailer Floor & Decor (NYSE:FND) missed analysts' expectations in Q1 CY2024, with revenue down 2.2% year on year to $1.10 billion. On the other hand, the company's outlook for the full year was close to analysts' estimates with revenue guided to $4.69 billion at the midpoint. It made a GAAP profit of $0.46 per share, down from its profit of $0.66 per share in the same quarter last year.

Floor And Decor (FND) Q1 CY2024 Highlights:

- Revenue: $1.10 billion vs analyst estimates of $1.11 billion (1.5% miss)

- EPS: $0.46 vs analyst estimates of $0.44 (5.1% beat)

- The company reconfirmed its revenue guidance for the full year of $4.69 billion at the midpoint

- Gross Margin (GAAP): 42.8%, up from 42.4% in the same quarter last year

- Free Cash Flow of $35.82 million, down 67.7% from the same quarter last year

- Same-Store Sales were down 11.6% year on year (miss vs. expectations of down 10.9% year on year)

- Store Locations: 225 at quarter end, increasing by 31 over the last 12 months

- Market Capitalization: $11.7 billion

Operating large, warehouse-style stores, Floor & Decor (NYSE:FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

While other home improvement retailers sell flooring products in addition to a whole host of other categories such as paint, appliances, lumber, and even plants, Floor & Decor is focused largely

The core customer is both the do-it-yourself (DIY) homeowner as well as the professional contractor. The DIY shopper values the ability to touch and feel products as well as the helpful sales associates trained strictly in flooring. For the professional contractor, Floor & Decor’s vast selection and high in-stock positions mean they don’t have to shop around to find everything they need, allowing them to maximize time devoted to their projects. There are also loyalty programs and volume discounts for Pros.

The company has a vertically integrated business model, which means they control every aspect of the supply chain from product development to procurement to distribution. Since Floor & Decor deals directly with manufacturers (competitors often use buying agents and middlemen), they can keep prices extremely competitive. It also allows the company to introduce new products and respond to trends in a more timely manner.

Home Improvement Retailer

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Competitors offering flooring products and materials include LL Flooring (NYSE:LL), Tile Shop (NASDAQ:TTSH), Home Depot (NYSE:HD), and Lowe’s (NYSE:LOW).Sales Growth

Floor And Decor is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

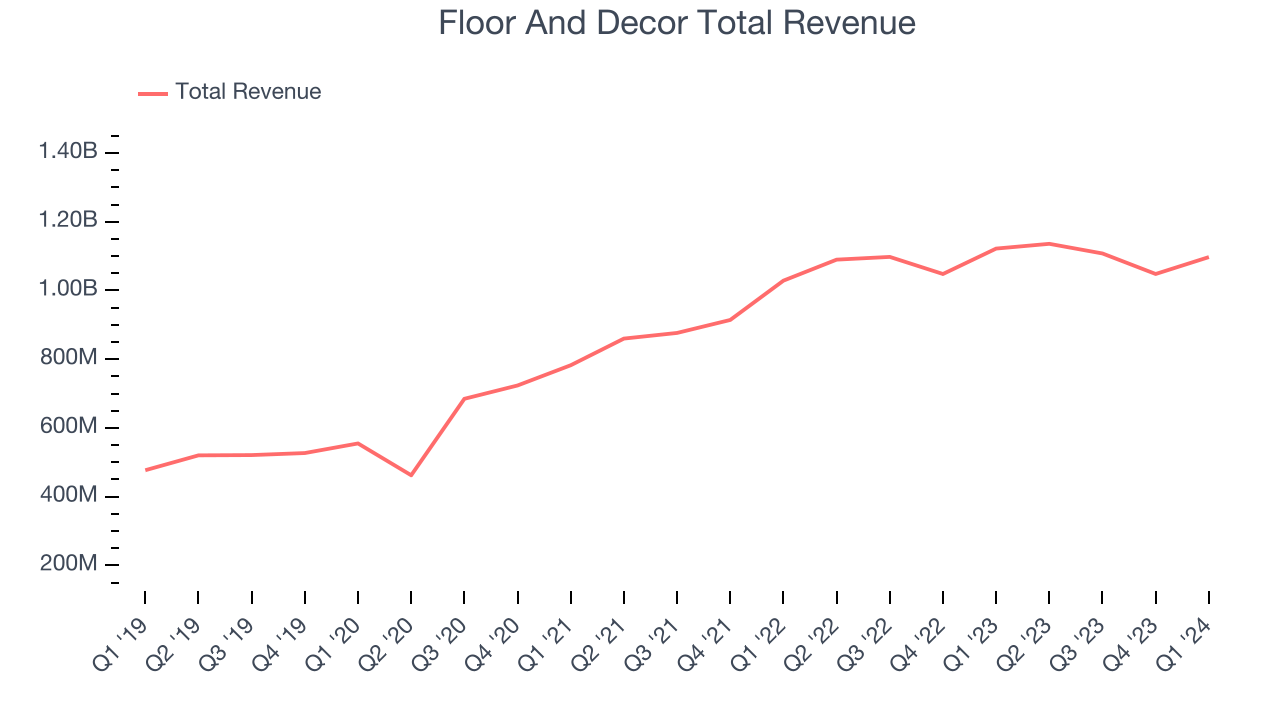

As you can see below, the company's annualized revenue growth rate of 19.7% over the last five years was excellent as it added more brick-and-mortar locations and expanded its reach.

This quarter, Floor And Decor missed Wall Street's estimates and reported a rather uninspiring 2.2% year-on-year revenue decline, generating $1.10 billion in revenue. Looking ahead, Wall Street expects sales to grow 10.8% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

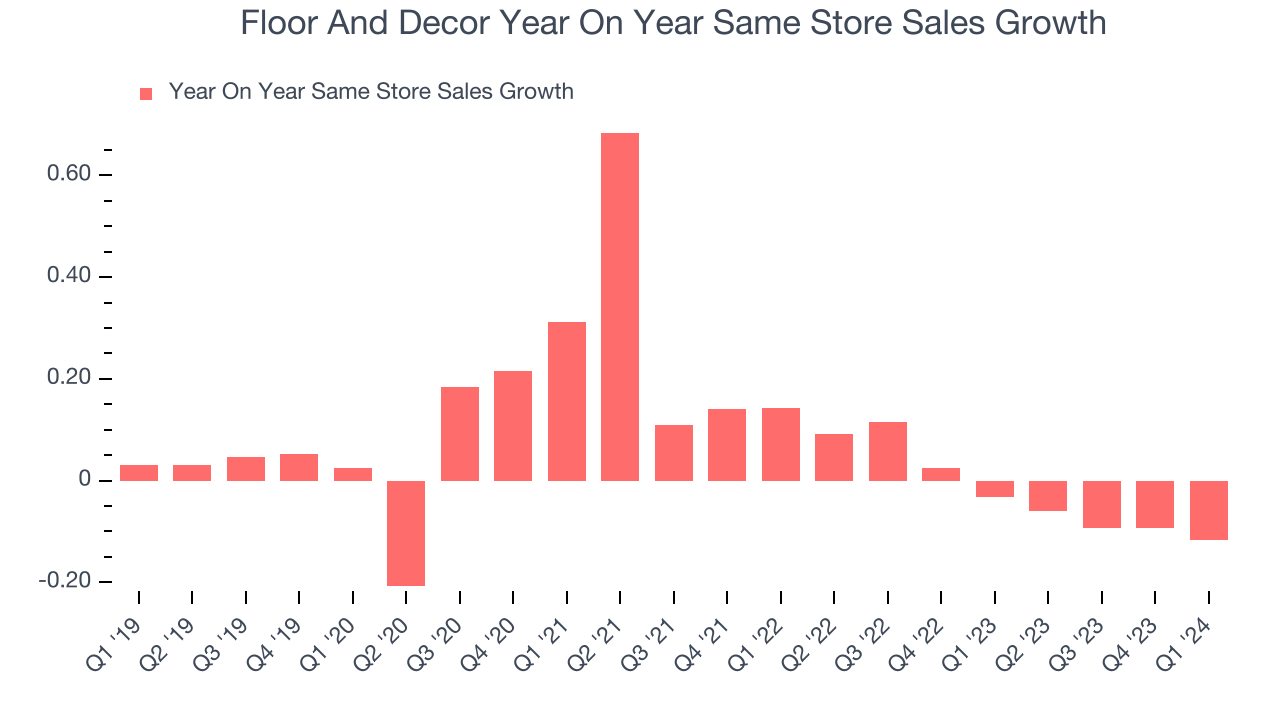

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Floor And Decor's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 2% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Floor And Decor's same-store sales fell 11.6% year on year. This decrease was a further deceleration from the 3.3% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Number of Stores

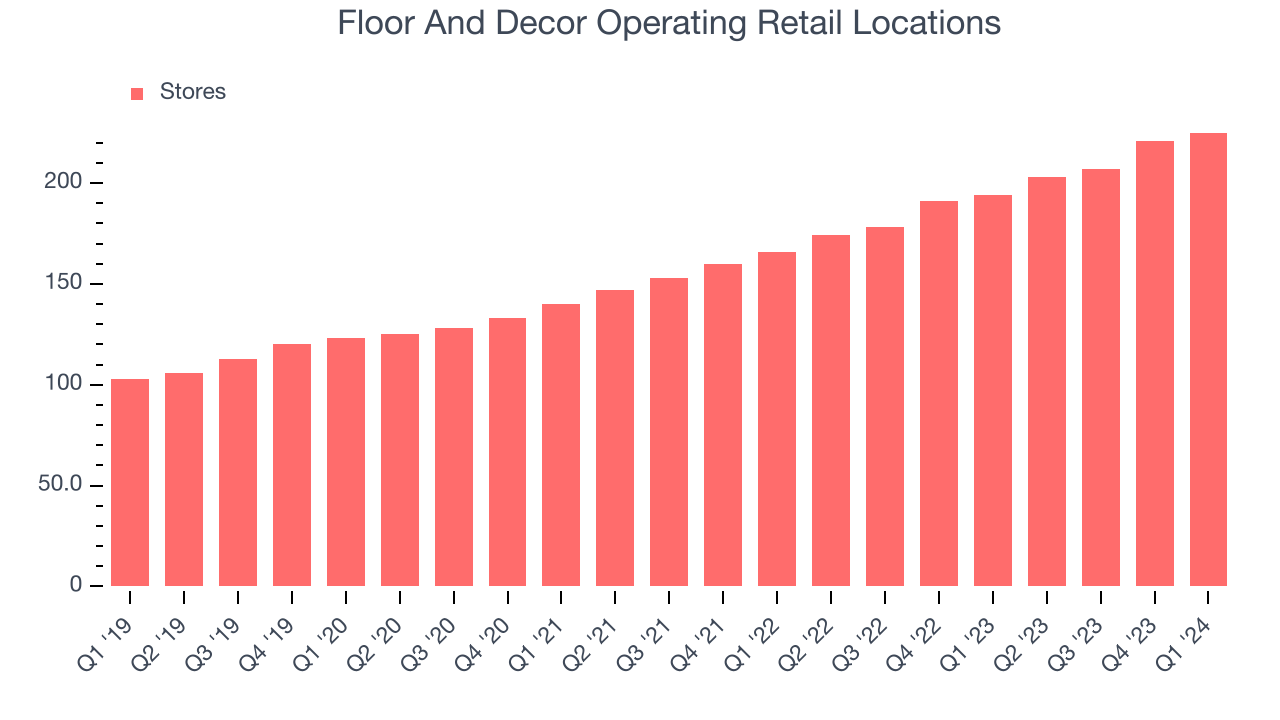

A retailer's store count often determines on how much revenue it can generate.

When a retailer like Floor And Decor is opening new stores, it usually means it's investing for growth because demand is greater than supply. Floor And Decor's store count increased by 31 locations, or 16%, over the last 12 months to 225 total retail locations in the most recently reported quarter.

Over the last two years, the company has rapidly opened new stores, averaging 16.9% annual growth in its physical footprint. This store growth is among the fastest in the consumer retail sector and gives Floor And Decor an opportunity to become a large company over time. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Gross Margin & Pricing Power

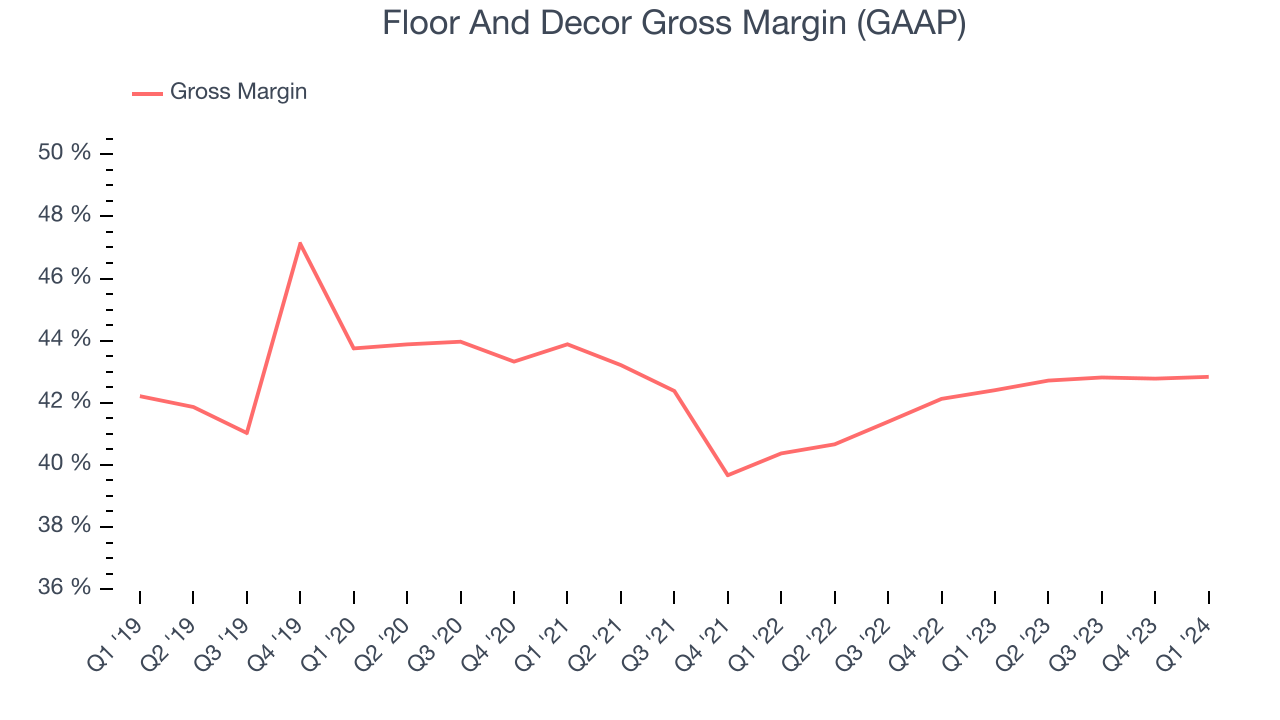

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

Floor And Decor has good unit economics for a retailer, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it's averaged a healthy 42.2% gross margin over the last two years. This means the company makes $0.42 for every $1 in revenue before accounting for its operating expenses.

Floor And Decor's gross profit margin came in at 42.8% this quarter, flat with the same quarter last year. This steady margin stems from its efforts to keep prices low for consumers and signals that it has stable input costs (such as freight expenses to transport goods).

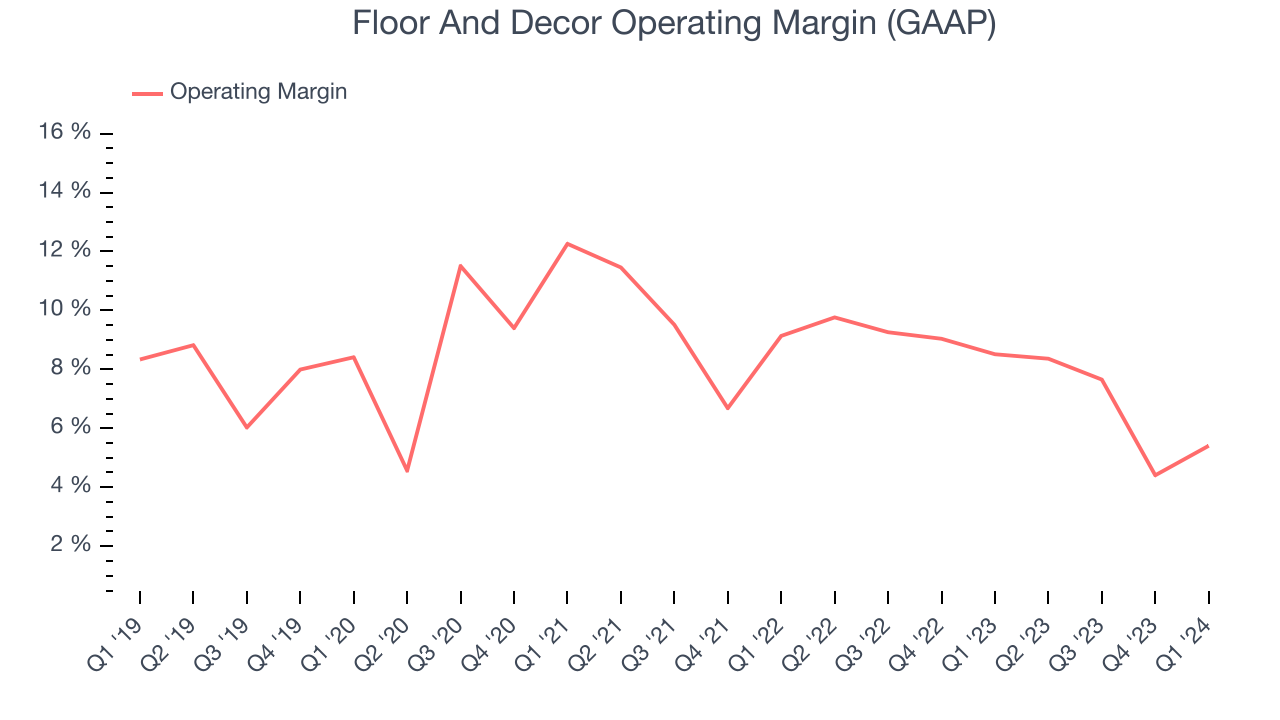

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Floor And Decor generated an operating profit margin of 5.4%, down 3.1 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by weaker cost controls or operating leverage on fixed costs.

Zooming out, Floor And Decor was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer retail business, producing an average operating margin of 7.8%. On top of that, Floor And Decor's margin has slightly declined, on average, by 2.6 percentage points year on year. This shows Floor And Decor has faced some speed bumps.

Zooming out, Floor And Decor was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer retail business, producing an average operating margin of 7.8%. On top of that, Floor And Decor's margin has slightly declined, on average, by 2.6 percentage points year on year. This shows Floor And Decor has faced some speed bumps.EPS

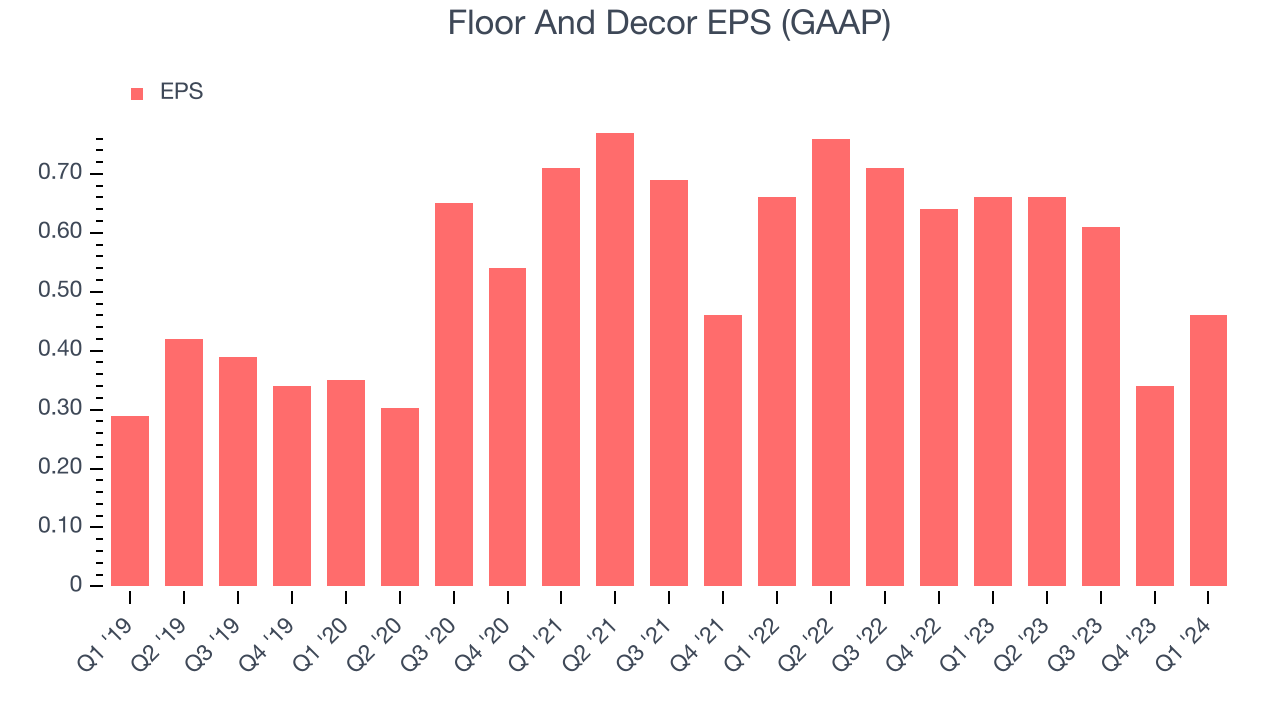

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Floor And Decor reported EPS at $0.46, down from $0.66 in the same quarter a year ago. This print beat Wall Street's estimates by 5.1%.

Over the next 12 months, however, Wall Street is projecting Floor And Decor's EPS to stay flat.

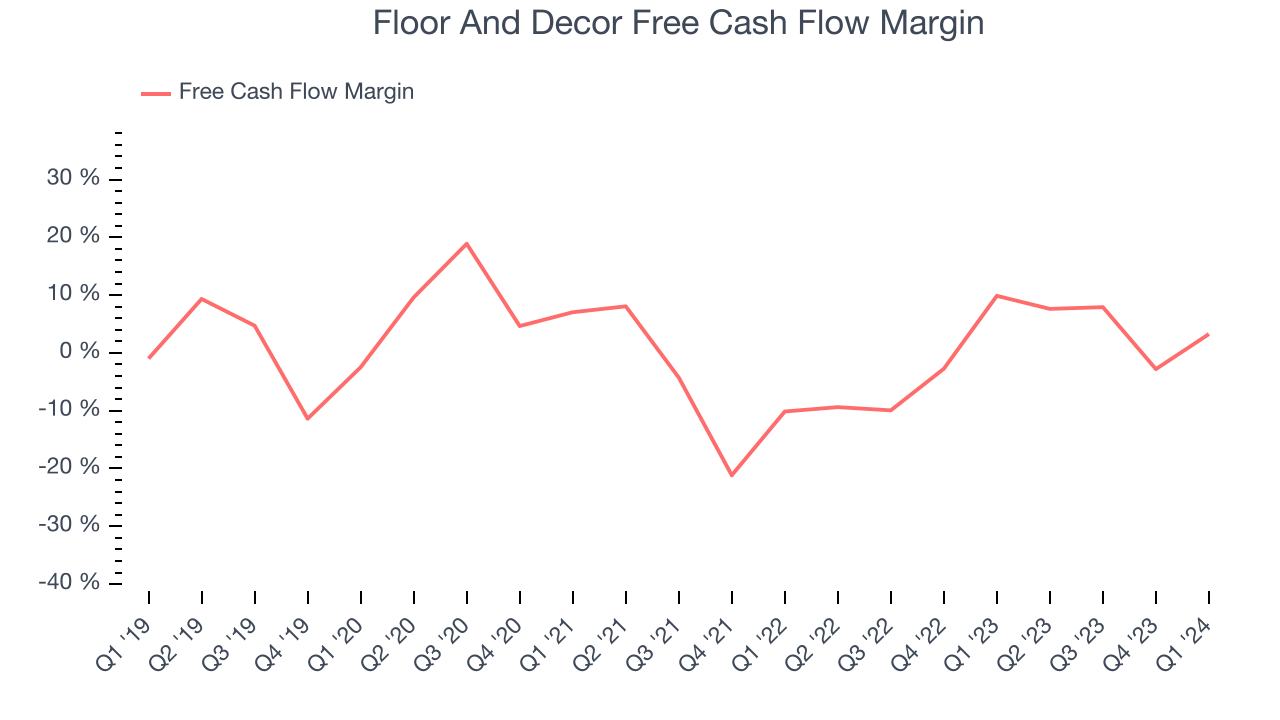

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Floor And Decor's free cash flow came in at $35.82 million in Q1, down 67.7% year on year. This result represents a 3.3% margin.

Over the last eight quarters, Floor And Decor has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 0.6%, subpar for a consumer retail business. However, its margin has averaged year-on-year increases of 7.1 percentage points, a great result that should improve its prospects.

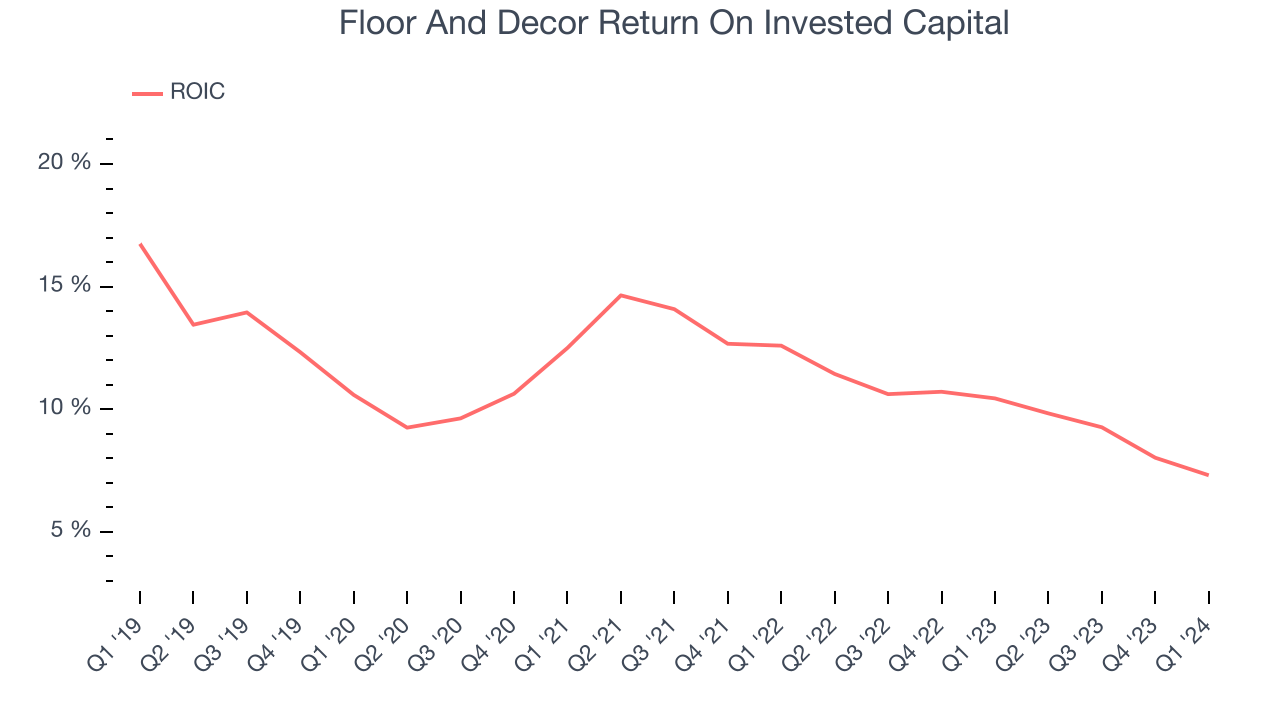

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Floor And Decor's five-year average ROIC was 10.7%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Floor And Decor's ROIC averaged 2.7 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Floor And Decor reported $57.43 million of cash and $326.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $524.5 million of EBITDA over the last 12 months, we view Floor And Decor's 0.5x net-debt-to-EBITDA ratio as safe. We also see its $3.08 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Floor And Decor's Q1 Results

It was encouraging to see Floor And Decor slightly top analysts' EPS expectations this quarter. We were also happy its gross margin narrowly outperformed Wall Street's estimates. On the other hand, its revenue unfortunately missed analysts' expectations on worse-than-expected same store sales declines. Also, its full-year earnings guidance missed Wall Street's estimates. Overall, this was a mediocre quarter for Floor And Decor. The company is down 2.5% on the results and currently trades at $110 per share.

Is Now The Time?

When considering an investment in Floor And Decor, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Floor And Decor isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been exceptional over the last five years, its shrinking same-store sales suggests it'll need to change its strategy to succeed. And while its new store openings have increased its brand equity, the downside is its relatively low ROIC suggests it has struggled to grow profits historically.

Floor And Decor's price-to-earnings ratio based on the next 12 months is 53.7x. We can find things to like about Floor And Decor and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $113.43 per share right before these results (compared to the current share price of $110).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.