Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q4 now behind us, let’s have a look at ForgeRock (NYSE:FORG) and its peers.

Cybersecurity continues to be one of the fastest growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 10 cybersecurity stocks we track reported a strong Q4; on average, revenues beat analyst consensus estimates by 5.66%, while on average next quarter revenue guidance was 3.48% above consensus. Tech stocks have had a rocky start in 2022, but cybersecurity stocks held their ground better than others, with the share price up 14.2% since earnings, on average.

Weakest Q4: ForgeRock (NYSE:FORG)

Founded in Norway by former Sun Microsystems engineers, ForgeRock (NYSE:FORG) offers software as a service that helps companies secure and manage the identity of their customers and employees.

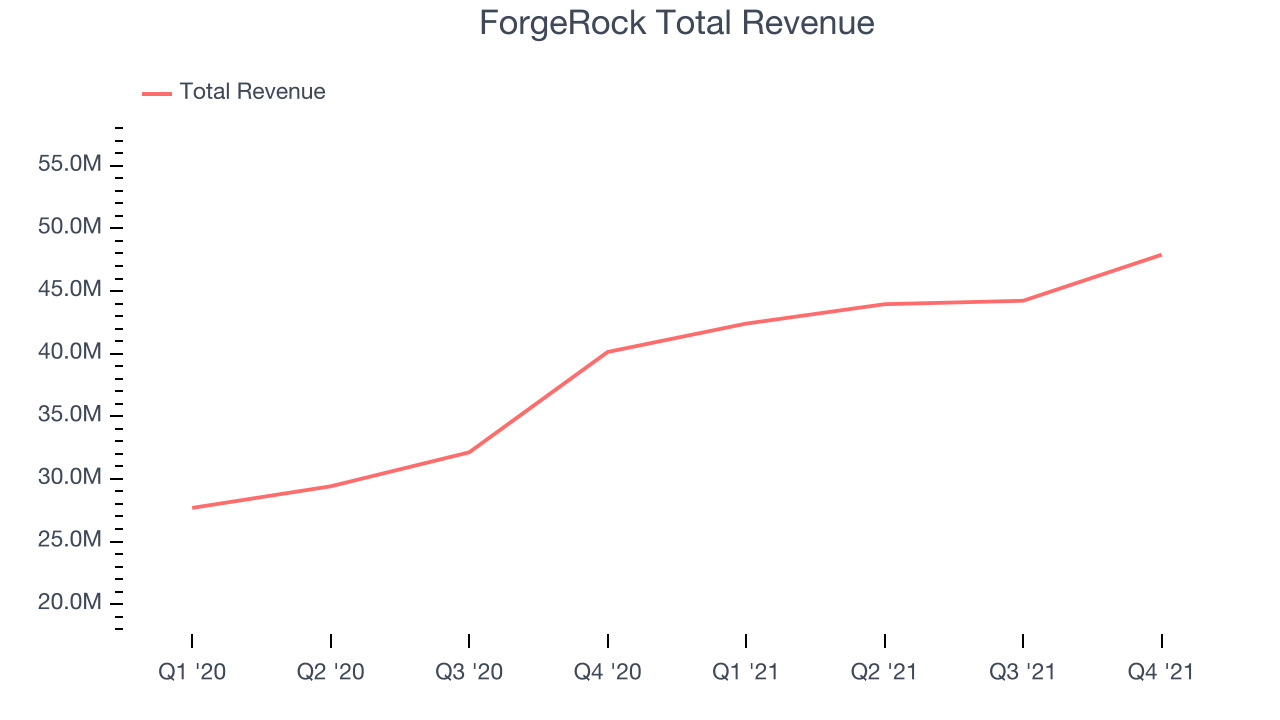

ForgeRock reported revenues of $47.9 million, up 19.3% year on year, beating analyst expectations by 1.69%. It was a mixed quarter for the company, with a decent beat of the top-line results but guidance for the next quarter below analysts' estimates.

“It was a momentous year for ForgeRock that was capped off with exceptional acceleration in ARR growth and we’re raising the bar for growth in 2022," said Fran Rosch, CEO of ForgeRock.

ForgeRock delivered the weakest full year guidance update of the whole group. The stock is up 32.6% since the results and currently trades at $21.98.

Read our full report on ForgeRock here, it's free.

Best Q4: SailPoint (NYSE:SAIL)

Started by Mark McClain after his previous identity management company got acquired by Sun Microsystems, SailPoint (NYSE:SAIL) provides software for organizations to manage the digital identity of employees, customers, and partners.

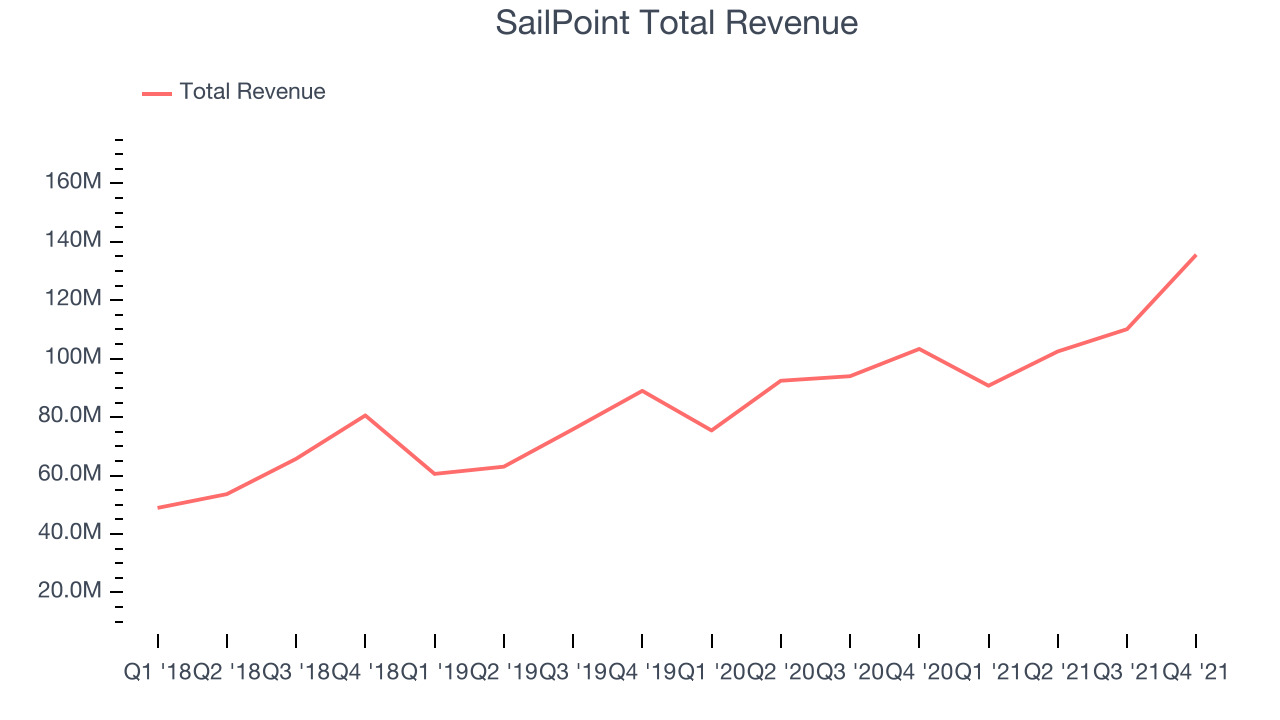

SailPoint reported revenues of $135.5 million, up 31.2% year on year, beating analyst expectations by 19.1%. It was an exceptional quarter for the company, with a significant improvement in gross margin compared to the previous quarter and an impressive beat of analyst estimates.

SailPoint achieved the strongest analyst estimates beat among its peers. The stock is up 21.4% since the results and currently trades at $50.24.

Is now the time to buy SailPoint? Access our full analysis of the earnings results here, it's free.

Palo Alto Networks (NYSE:PANW)

Founded in 2005 by a cybersecurity engineer Nir Zuk, Palo Alto Networks makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches and malware threats.

Palo Alto Networks reported revenues of $1.31 billion, up 29.5% year on year, beating analyst expectations by 2.74%. It was a solid quarter for the company, with a strong top line growth and guidance for the next quarter above analysts' estimates.

The stock is up 29.7% since the results and currently trades at $617.

Read our full analysis of Palo Alto Networks's results here.

SentinelOne (NYSE:S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $65.6 million, up 119% year on year, beating analyst expectations by 8.15%. It was a strong quarter for the company, with a decent beat of analysts' estimates and a very optimistic guidance for the next quarter.

SentinelOne delivered the fastest revenue growth among the peers. The company added 104 enterprise customers paying more than $100,000 annually to a total of 520. The stock is up 27.6% since the results and currently trades at $39.40.

Read our full, actionable report on SentinelOne here, it's free.

CrowdStrike (NASDAQ:CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $431 million, up 62.6% year on year, beating analyst expectations by 4.51%. It was a strong quarter for the company, with an exceptional revenue growth and guidance for the next quarter above analysts' estimates.

CrowdStrike delivered the highest full year guidance raise among the peers. The company added 1,638 customers to a total of 16,325. The stock is up 32.4% since the results and currently trades at $225.25.

Read our full, actionable report on CrowdStrike here, it's free.

The author has no position in any of the stocks mentioned