Online luxury marketplace Farfetch (NYSE: FTCH) missed analyst expectations in Q4 FY2021 quarter, with revenue up 23.2% year on year to $665.6 million. Farfetch made a GAAP profit of $96.8 million, improving on its loss of $2.28 billion, in the same quarter last year.

Is now the time to buy Farfetch? Access our full analysis of the earnings results here, it's free.

Farfetch (FTCH) Q4 FY2021 Highlights:

- Revenue: $665.6 million vs analyst estimates of $673.3 million (1.13% miss)

- EPS (GAAP): -$0.23

- Free cash flow of $119.4 million, up from negative free cash flow of $78.6 million in previous quarter

- Gross Margin (GAAP): 47%, up from 46.1% same quarter last year

- Trailing 12 Months Active Consumers: 3.68 million, up 663 thousand year on year

- GMV: $1.3 billion (up 22% year on year)

José Neves, Farfetch Founder, Chairman and CEO said: “Our fourth quarter results clearly demonstrate the strong momentum behind the Farfetch platform. We exit the year having once again delivered market share capturing GMV growth in 2021 along with our first year of Adjusted EBITDA profitability. This positions Farfetch for an incredible 2022 focused on continuing to lead the online luxury fashion industry, growing faster than the runner-ups, and expanding profitability.

Inspired by the idea of allowing anyone to buy clothes from landmark boutiques of cities like Paris or Milan without having to leave their couch, Farfetch (NYSE: FTCH) is a global marketplace for luxury fashion, connecting boutiques, brands and consumers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission paying sellers, generating flywheel scale effects which feed back into further customer acquisition.

Sales Growth

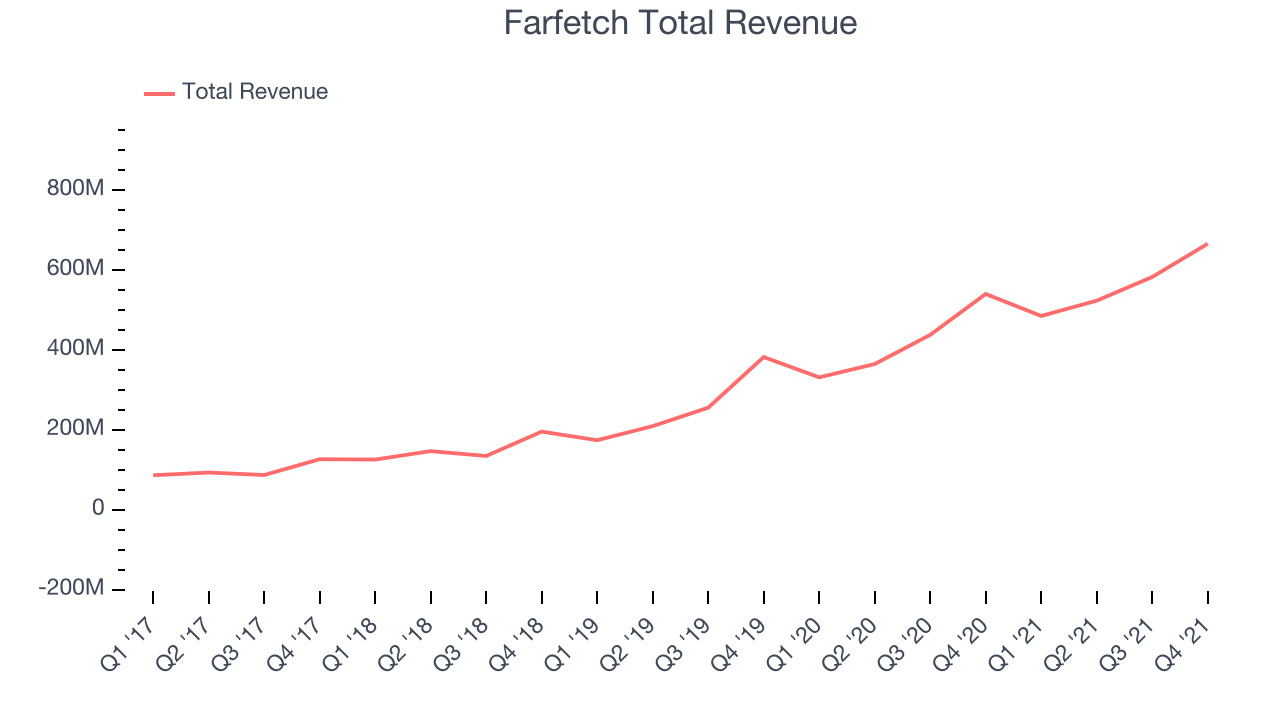

Farfetch's revenue growth over the last three years has been exceptional, averaging 57.5% annually. Farfetch may have benefited slightly from the initial impact of the pandemic bringing forward some sales, but growth rates have normalized since then.

This quarter, Farfetch reported a decent 23.2% year on year revenue growth, but this result fell short of what analysts were expecting.

There are others doing even better than Farfetch. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

Usage Growth

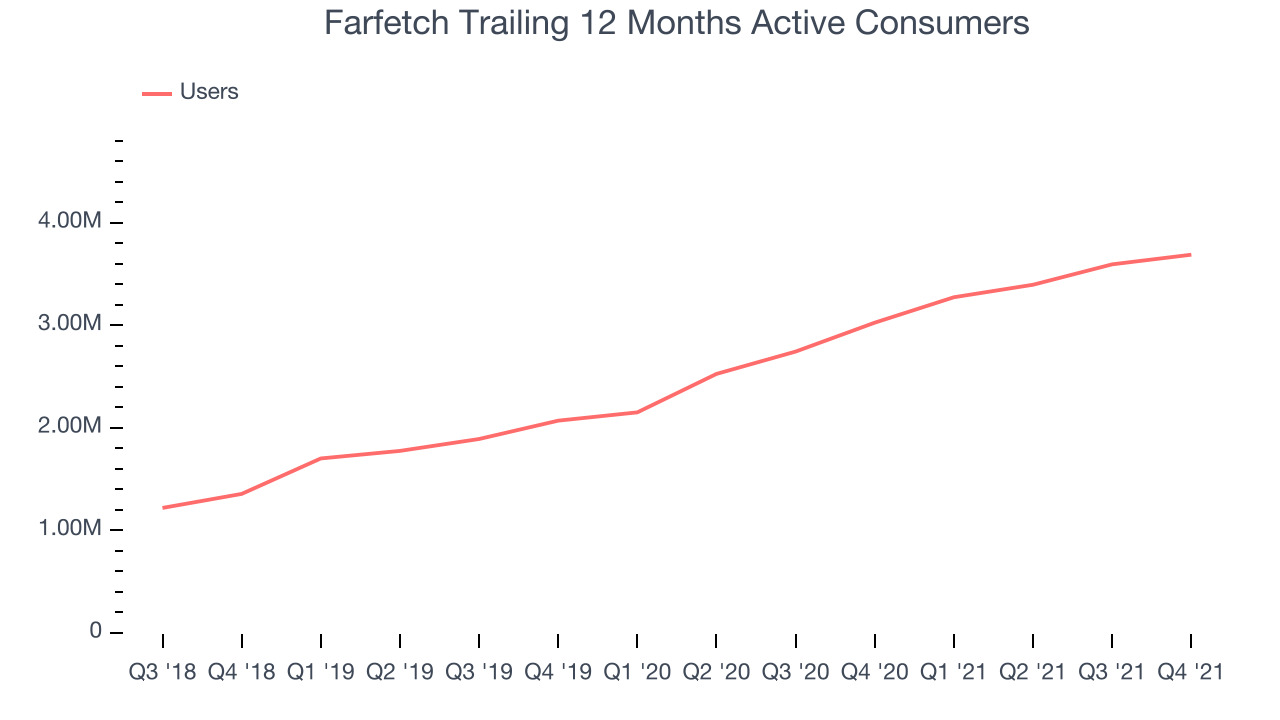

As a online marketplace, Farfetch generates revenue growth both by growing the number of buyers using the platform and how much each of those buyers spends.

Over the last two years the number of Farfetch's active buyers, a key usage metric for the company, grew 37.4% annually to 3.68 million users. This is among the fastest growth of any consumer internet company, indicating that users are excited about the offering.

In Q4 the company added 663 thousand active buyers, translating to a 21.9% growth year on year.

Key Takeaways from Farfetch's Q4 Results

Since it has still been burning cash over the last twelve months it is worth keeping an eye on Farfetch’s balance sheet, but we note that with a market capitalization of $5.29 billion and more than $1.46 billion in cash, the company has the capacity to continue to prioritise growth over profitability.

It was great to see that Farfetch’s user base is growing. And we were also glad to see good revenue growth. On the other hand, it was unfortunate to see that Farfetch missed analysts' revenue expectations. The company is up 33.7% on the results and currently trades at $20.06 per share.

Farfetch may have had an interesting quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.