The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the online marketplace stocks have fared in Q1, starting with Farfetch (NYSE:FTCH).

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission paying sellers, generating flywheel scale effects which feed back into further customer acquisition.

The 11 online marketplace stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 3.34%, while on average next quarter revenue guidance was 1.51% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital , but online marketplace stocks held their ground better than others, with the share prices up 1.44% since the previous earnings results, on average.

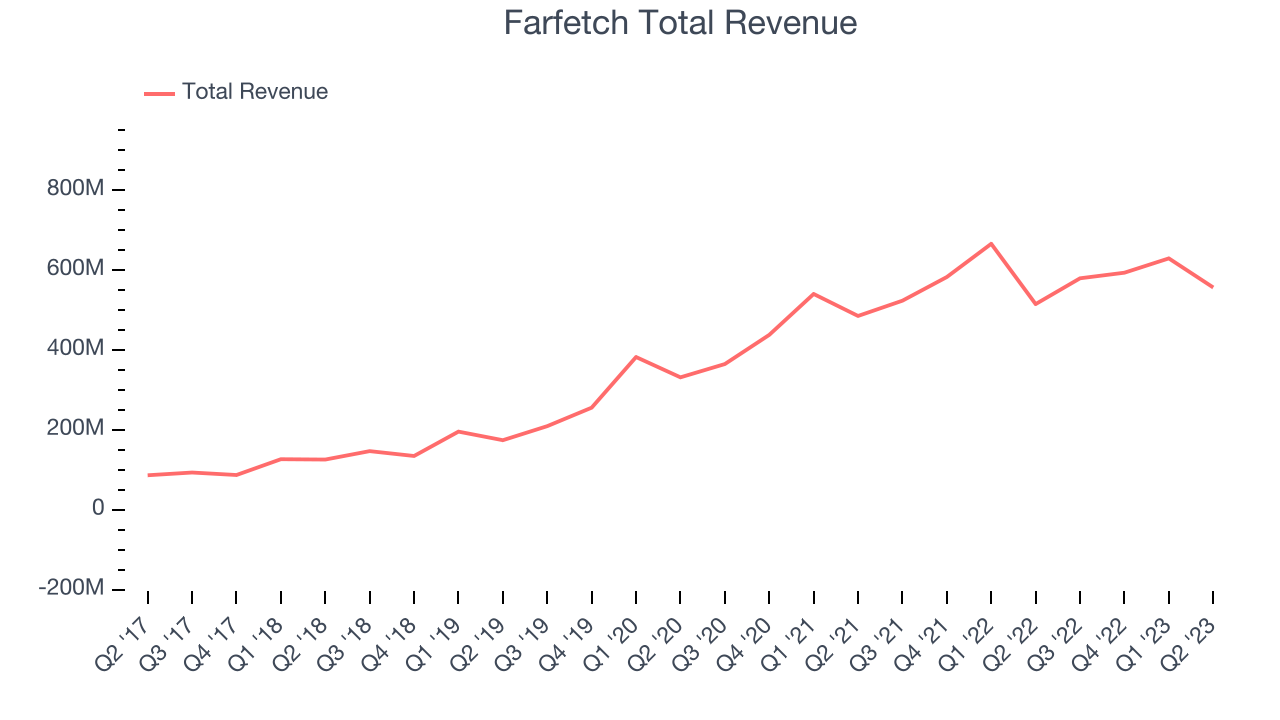

Farfetch (NYSE:FTCH)

Inspired by the idea of allowing anyone to buy clothes from landmark boutiques of cities like Paris or Milan without having to leave their couch, Farfetch (NYSE: FTCH) is a global marketplace for luxury fashion, connecting boutiques, brands and consumers.

Farfetch reported revenues of $556.4 million, up 8.08% year on year, beating analyst expectations by 7.96%. It was a decent quarter for the company, with an impressive beat of analyst estimates but slow revenue growth.

José Neves, Farfetch Founder, Chairman and CEO, said: “I am delighted to report that Farfetch was back to growth in first quarter 2023. Our first quarter results represent the first step towards achieving our plan for 2023, our Year of Execution, and demonstrate our strong execution in the face of continued macro headwinds. Our sequential improvement in GMV growth in the US and China, our two largest markets, as well as in orders across the Farfetch Marketplace, indicate the strength and resilience of our core business. This, on top of our recent launches of Ferragamo and Reebok, with Neiman Marcus Group on track for the second half of the year, and progress we are making on our profitability and cash flow initiatives, confirm we remain on track to deliver on our plan for 2023.

The stock is up 24.1% since the results and currently trades at $5.4.

Is now the time to buy Farfetch? Access our full analysis of the earnings results here, it's free.

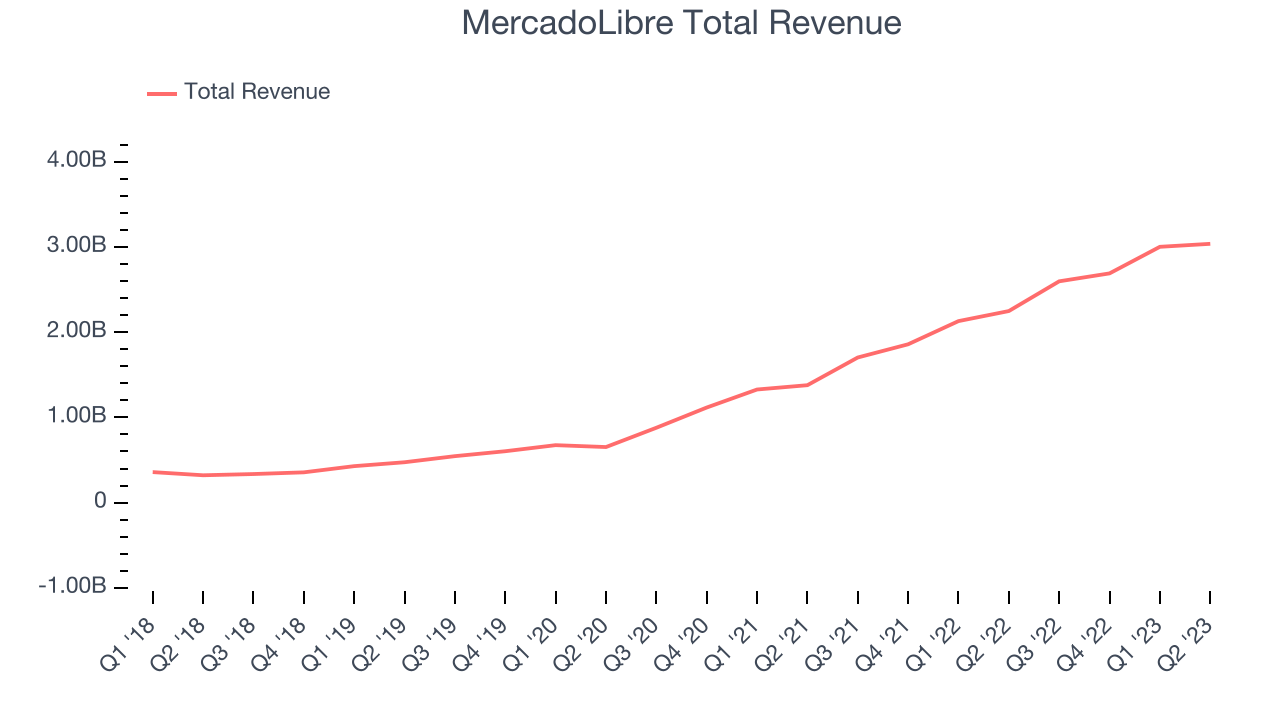

Best Q1: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) today is a one-stop e-commerce marketplace in Latin America.

MercadoLibre reported revenues of $3.04 billion, up 35.1% year on year, beating analyst expectations by 5.22%. It was a very strong quarter for the company, with growing number of users and a solid beat of analyst estimates.

MercadoLibre scored the fastest revenue growth among its peers. The company reported 101 million daily active users, up 24.7% year on year. The stock is up 0.02% since the results and currently trades at $1,283.85.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q1: The RealReal (NASDAQ:REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $141.9 million, down 3.27% year on year, missing analyst expectations by 0.36%. It was a weak quarter for the company, with underwhelming revenue guidance for the full year and slow revenue growth.

The RealReal had the weakest performance against analyst estimates and weakest full year guidance update in the group. The company reported 1.01 million paying users, up 22.5% year on year. The stock is up 13.6% since the results and currently trades at $1.5.

Read our full analysis of The RealReal's results here.

Sea Limited (NYSE:SE)

Founded in 2009 and a publicly-traded company since 2017, Sea Limited (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Sea Limited reported revenues of $3.04 billion, up 4.88% year on year, in line with analyst expectations. It was a weak quarter for the company, with declining number of users and slow revenue growth.

The company reported 37.6 million paying users, down 38.8% year on year. The stock is down 33.7% since the results and currently trades at $58.45.

Read our full, actionable report on Sea Limited here, it's free.

Airbnb (NASDAQ:ABNB)

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $1.82 billion, up 20.5% year on year, beating analyst expectations by 1.72%. It was a mixed quarter for the company, with an underwhelming revenue guidance for the next quarter.

The company reported 121.1 million nights booked, up 18.6% year on year. The stock is down 9.35% since the results and currently trades at $115.14.

Read our full, actionable report on Airbnb here, it's free.

The author has no position in any of the stocks mentioned