As Q4 earnings season comes to a close, it’s time to take stock of this quarters’ best and worst performers amongst the online marketplace stocks, including Farfetch (NYSE:FTCH) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission paying sellers, generating flywheel scale effects which feed back into further customer acquisition.

The 4 online marketplace stocks we track reported a strong Q4; on average, revenues beat analyst consensus estimates by 3.99%, while on average next quarter revenue guidance was 3.59% above consensus. There has been a stampede out of high valuation technology stocks, but online marketplace stocks held their ground better than others, with share price down 6.75% since earnings, on average.

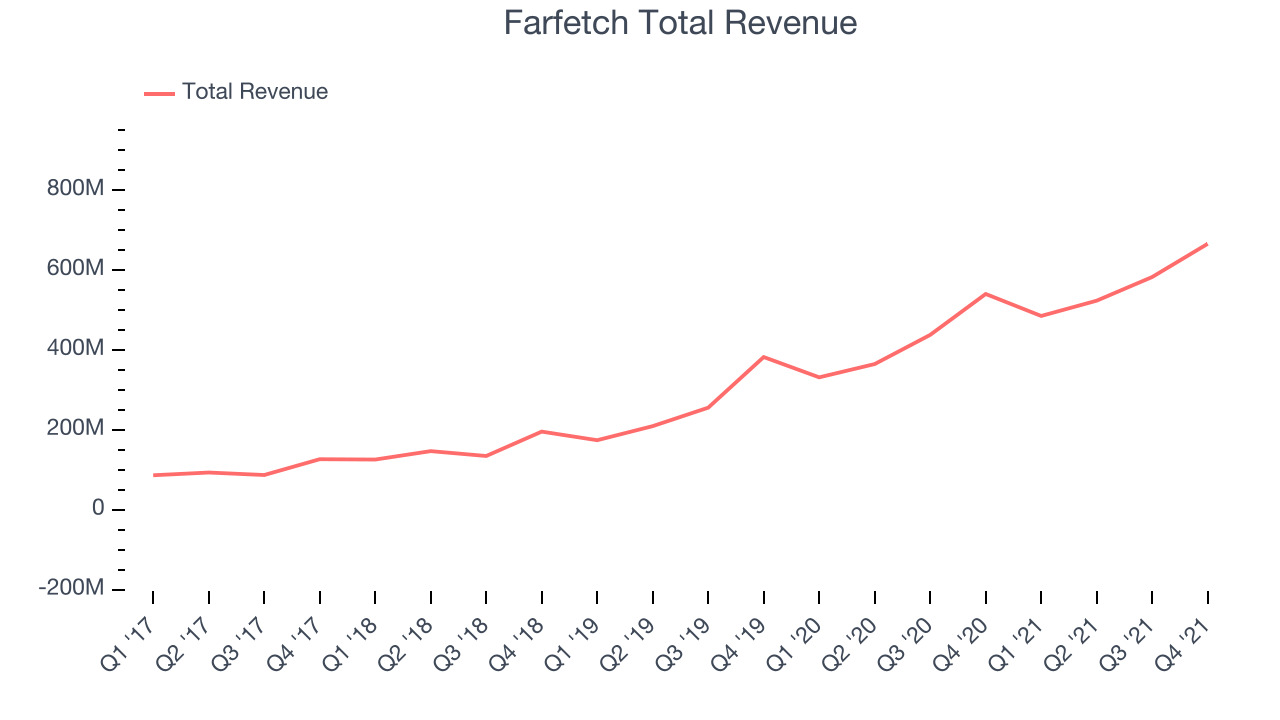

Farfetch (NYSE:FTCH)

Inspired by the idea of allowing anyone to buy clothes from landmark boutiques of cities like Paris or Milan without having to leave their couch, Farfetch (NYSE: FTCH) is a global marketplace for luxury fashion, connecting boutiques, brands and consumers.

Farfetch reported revenues of $665.6 million, up 23.2% year on year, missing analyst expectations by 1.13%. It was a slower quarter for the company, with a miss of the top line analyst estimates.

José Neves, Farfetch Founder, Chairman and CEO said: “Our fourth quarter results clearly demonstrate the strong momentum behind the Farfetch platform. We exit the year having once again delivered market share capturing GMV growth in 2021 along with our first year of Adjusted EBITDA profitability. This positions Farfetch for an incredible 2022 focused on continuing to lead the online luxury fashion industry, growing faster than the runner-ups, and expanding profitability.

Farfetch delivered the weakest performance against analyst estimates of the whole group. The company reported 3.68 million active buyers, up 21.9% year on year. The stock is down 4.33% since the results and currently trades at $14.35.

Is now the time to buy Farfetch? Access our full analysis of the earnings results here, it's free.

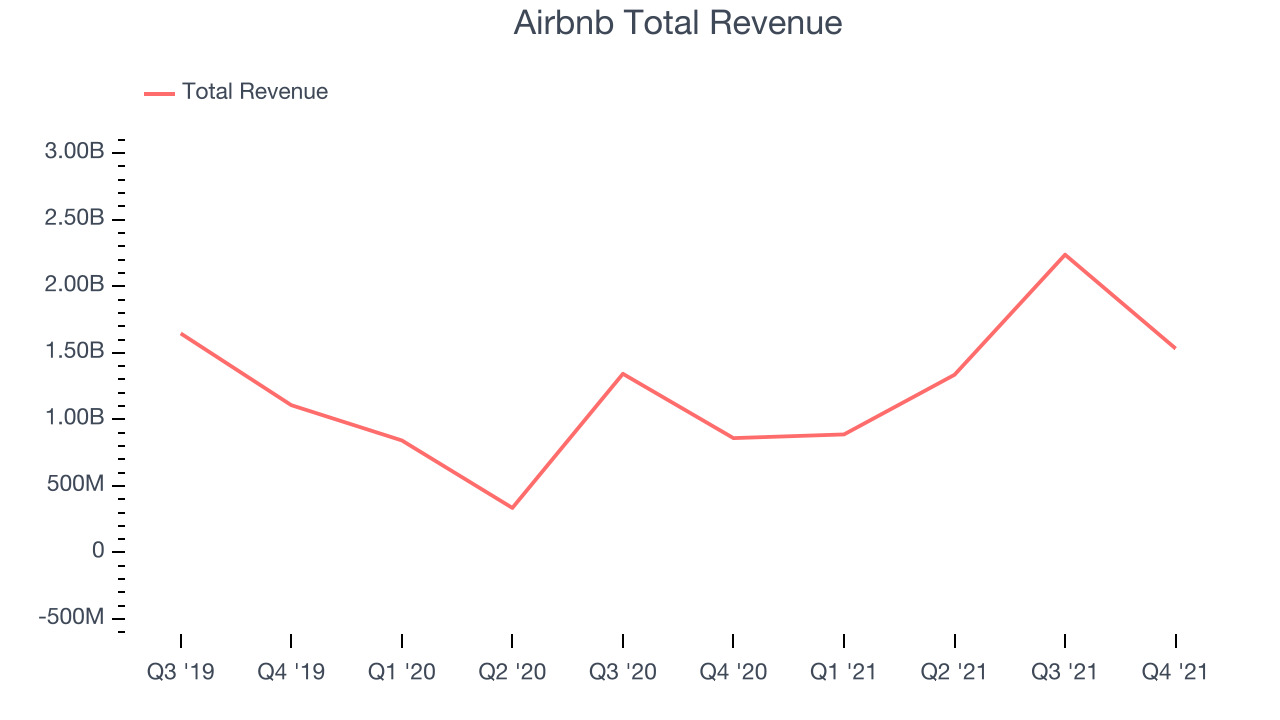

Best Q4: Airbnb (NASDAQ:ABNB)

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $1.53 billion, up 78.3% year on year, beating analyst expectations by 5.02%. It was a stunning quarter for the company, with a very optimistic guidance for the next quarter and an exceptional revenue growth.

Airbnb delivered the fastest revenue growth among its peers. The company reported 73.4 million nights booked, up 58.5% year on year. The stock is down 11.5% since the results and currently trades at $159.35.

Is now the time to buy Airbnb? Access our full analysis of the earnings results here, it's free.

Etsy (NASDAQ:ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $717.1 million, up 16.1% year on year, beating analyst expectations by 4.62%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

Etsy had the slowest revenue growth in the group. The company reported 90.1 million active buyers, up 10% year on year. The stock is down 9.25% since the results and currently trades at $116.50.

Read our full analysis of Etsy's results here.

The RealReal (NASDAQ:REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $145.1 million, up 68.2% year on year, beating analyst expectations by 7.47%. It was an impressive quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the full year.

The RealReal pulled off the strongest analyst estimates beat among the peers. The company reported 797 thousand paying users, up 22.9% year on year. The stock is down 1.96% since the results and currently trades at $6.98.

Read our full, actionable report on The RealReal here, it's free.

The author has no position in any of the stocks mentioned