The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how Farfetch (NYSE:FTCH) and the rest of the online marketplace stocks fared in Q1.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission paying sellers, generating flywheel scale effects which feed back into further customer acquisition.

The 4 online marketplace stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 1.03%, while on average next quarter revenue guidance was 0.7% under consensus. Technology stocks have been hit hard on fears of higher interest rates and online marketplace stocks have not been spared, with share price down 26.6% since earnings, on average.

Farfetch (NYSE:FTCH)

Inspired by the idea of allowing anyone to buy clothes from landmark boutiques of cities like Paris or Milan without having to leave their couch, Farfetch (NYSE: FTCH) is a global marketplace for luxury fashion, connecting boutiques, brands and consumers.

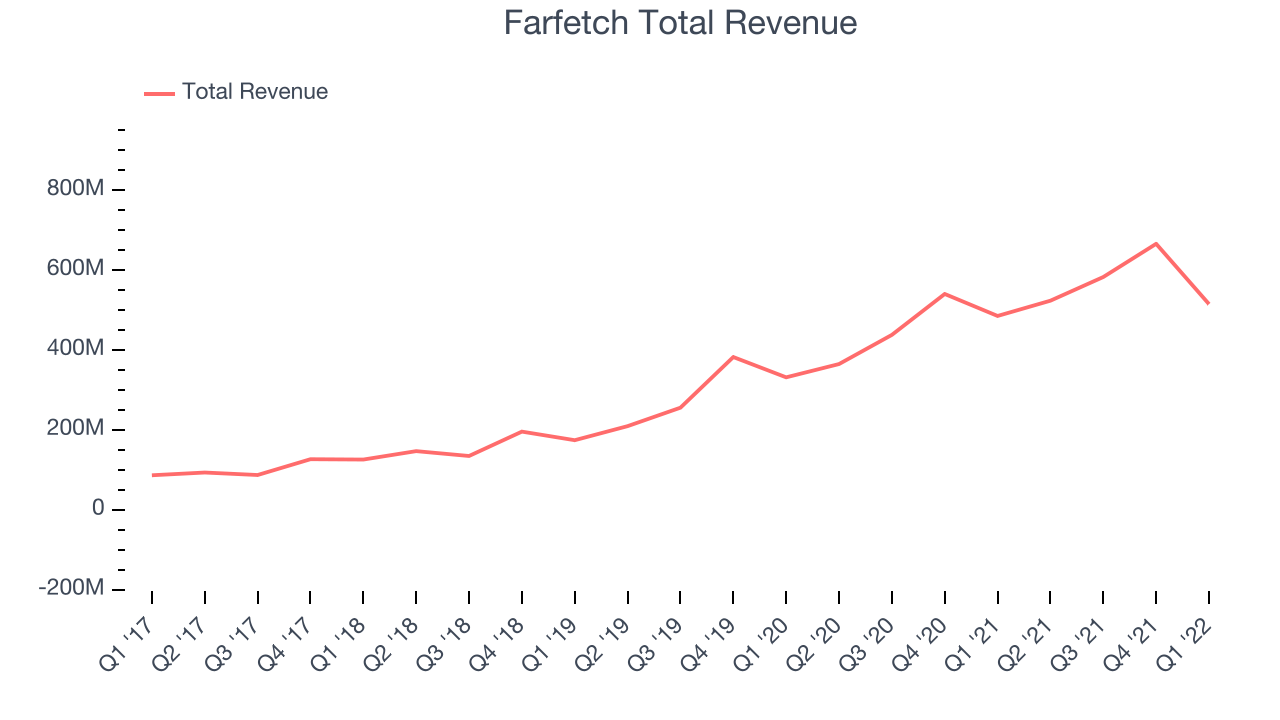

Farfetch reported revenues of $514.8 million, up 6.12% year on year, missing analyst expectations by 8.11%. It was a weak quarter for the company, with a miss of the top line analyst estimates and a slow revenue growth.

José Neves, Farfetch Founder, Chairman and CEO, said: "Our core business remains very strong, in spite of the macro events in China and ceasing operations in Russia, which impacted our performance and outlook. We are galvanized by the opportunity to focus our efforts in 2022 to further rationalize our business, aligning our fixed cost profile with lower near-term growth, which I believe will enable us to exit 2022 from a position of strength. Outside these external factors, we saw strong marketplace growth in the Americas and the Middle East, in first quarter 2022, our customer and luxury brand relations are going from strength to strength, and we continue to make progress towards our mission of building the global platform for luxury."

Farfetch delivered the weakest performance against analyst estimates of the whole group. The company reported 3.82 million active buyers, up 16.8% year on year. The stock is up 0.91% since the results and currently trades at $7.75.

Is now the time to buy Farfetch? Access our full analysis of the earnings results here, it's free.

Best Q1: Airbnb (NASDAQ:ABNB)

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

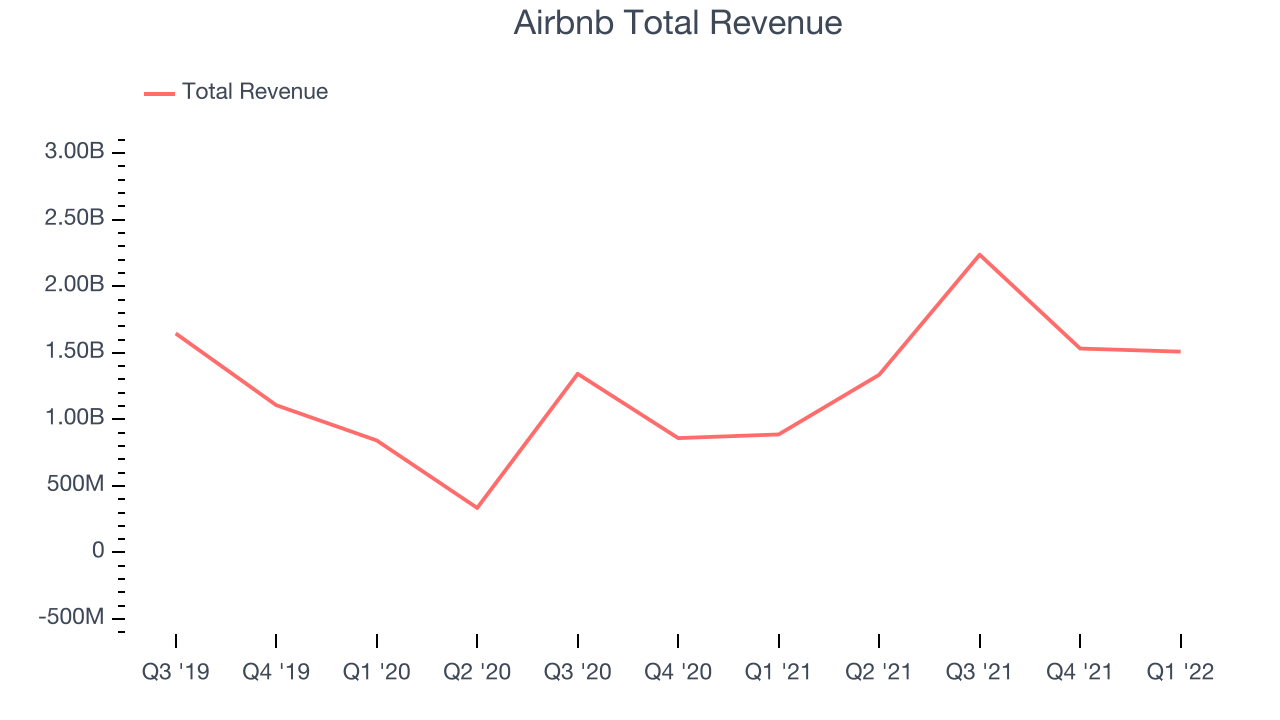

Airbnb reported revenues of $1.5 billion, up 70.1% year on year, beating analyst expectations by 3.88%. It was a stunning quarter for the company, with an exceptional revenue growth and growing number of users.

Airbnb scored the fastest revenue growth among its peers. The company reported 102.1 million nights booked, up 58.5% year on year. The stock is down 32.1% since the results and currently trades at $98.35.

Is now the time to buy Airbnb? Access our full analysis of the earnings results here, it's free.

Etsy (NASDAQ:ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $579.2 million, up 5.19% year on year, in line with analyst expectations. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

Etsy had the slowest revenue growth in the group. The company reported 95.1 million active buyers, up 4.9% year on year. The stock is down 36.3% since the results and currently trades at $69.75.

Read our full analysis of Etsy's results here.

The RealReal (NASDAQ:REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $146.7 million, up 48.4% year on year, beating analyst expectations by 7.59%. It was a very strong quarter for the company, with an exceptional revenue growth.

The RealReal achieved the strongest analyst estimates beat among the peers. The company reported 828 thousand paying users, up 20.5% year on year. The stock is down 39% since the results and currently trades at $2.69.

Read our full, actionable report on The RealReal here, it's free.

The author has no position in any of the stocks mentioned