Live sports and TV streaming service fuboTV (NYSE:FUBO) reported Q2 CY2024 results topping analysts' expectations, with revenue up 25% year on year to $391 million. It made a non-GAAP loss of $0.04 per share, improving from its loss of $0.17 per share in the same quarter last year.

Is now the time to buy fuboTV? Find out by accessing our full research report, it's free.

fuboTV (FUBO) Q2 CY2024 Highlights:

- Revenue: $391 million vs analyst estimates of $368.3 million (6.2% beat)

- Adjusted EBITDA: ($11) million vs analyst estimates of ($20.6) million (large beat)

- EPS (non-GAAP): -$0.04 vs analyst estimates of -$0.08

- Gross Margin (GAAP): 12.6%, up from 7.5% in the same quarter last year

- Adjusted EBITDA Margin: -2.8%, up from -9.8% in the same quarter last year

- Free Cash Flow was -$35.3 million compared to -$67.39 million in the previous quarter

- Domestic Subscribers: 1.45 million at quarter end

- Market Capitalization: $392.8 million

Originally launched as a soccer streaming platform, fuboTV (NYSE:FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

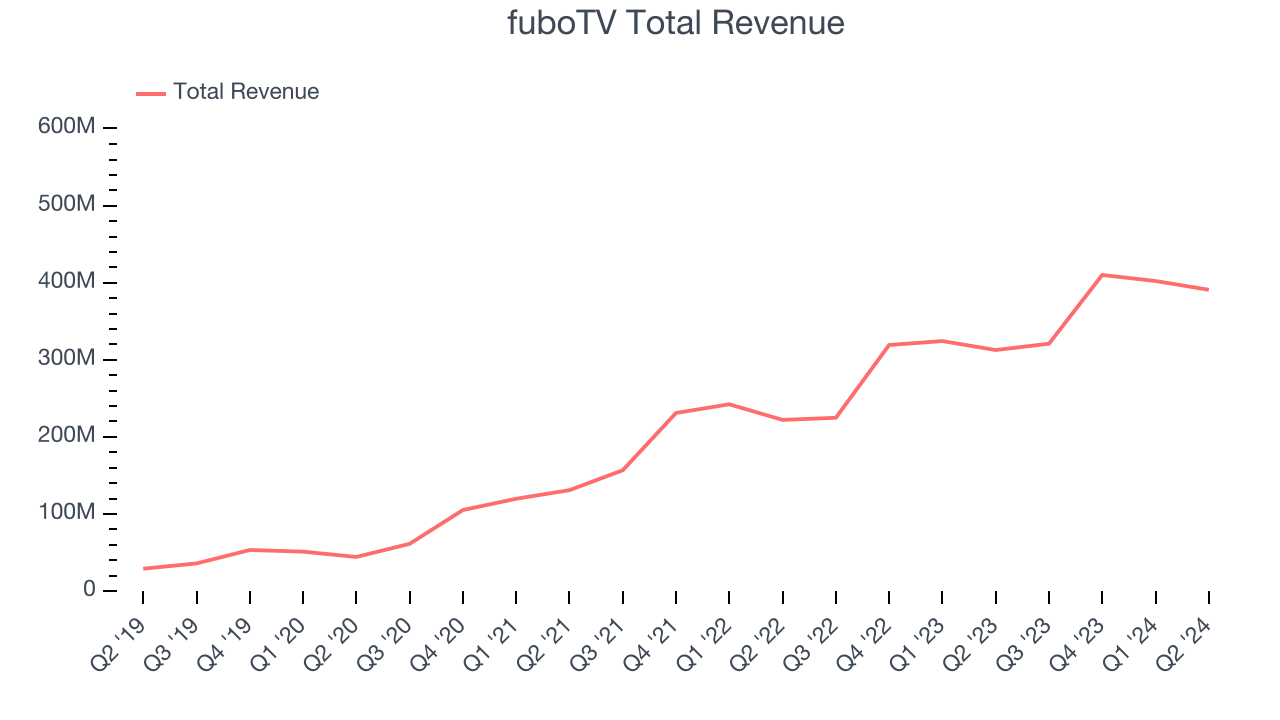

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Thankfully, fuboTV's 71.9% annualized revenue growth over the last five years was incredible. This shows it expanded quickly, a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. fuboTV's annualized revenue growth of 33.7% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, fuboTV reported remarkable year-on-year revenue growth of 25%, and its $391 million of revenue topped Wall Street estimates by 6.2%. Looking ahead, Wall Street expects sales to grow 8.7% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

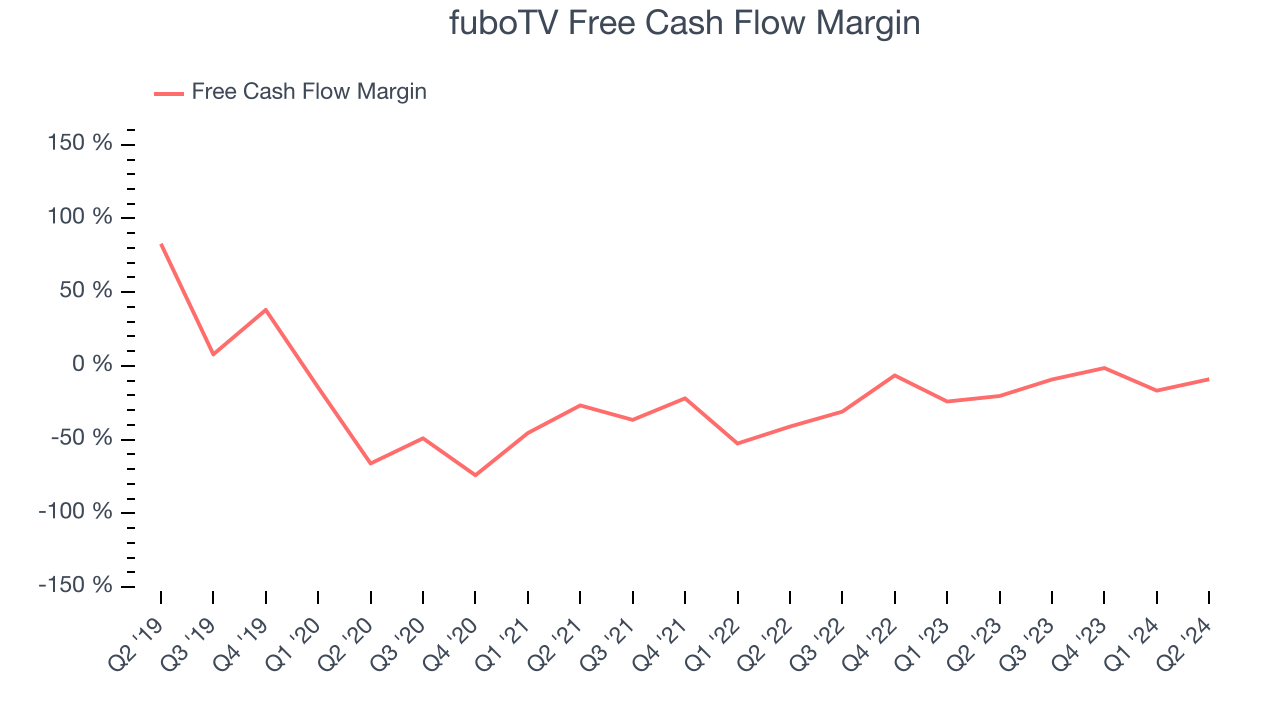

Over the last two years, fuboTV's demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin was among the worst in the consumer discretionary sector, averaging negative 13.7%.

fuboTV burned through $35.3 million of cash in Q2, equivalent to a negative 9% margin. The company's cash burn decreased by 44.7% year on year while its free cash flow margin climbed 11.4 percentage points. This relationship shows fuboTV's management team brought in more revenue this quarter despite spending less cash - a mark of higher short-term efficiency.

Over the next year, analysts predict fuboTV will continue burning cash, albeit to a lesser extent. Their consensus estimates imply its free cash flow margin of negative 9.1% for the last 12 months will increase to negative 2%.

Key Takeaways from fuboTV's Q2 Results

We were impressed by how significantly fuboTV blew past analysts' adjusted EBITDA expectations this quarter, and margins are getting better year over year. We were also excited its revenue outperformed Wall Street's estimates. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock traded up 11.8% to $1.47 immediately following the results.

fuboTV may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.