Online freelance marketplace Fiverr (NYSE:FVRR) reported Q3 FY2023 results topping analysts' expectations, with revenue up 12.1% year on year to $92.53 million. On the other hand, next quarter's revenue guidance of $91.6 million was less impressive, coming in 1.9% below analysts' estimates. Turning to EPS, Fiverr made a non-GAAP profit of $0.55 per share, improving from its profit of $0.21 per share in the same quarter last year.

Is now the time to buy Fiverr? Find out by accessing our full research report, it's free.

Fiverr (FVRR) Q3 FY2023 Highlights:

- Revenue: $92.53 million vs analyst estimates of $91.09 million (1.6% beat)

- EPS (non-GAAP): $0.55 vs analyst estimates of $0.46 (19.1% beat)

- Revenue Guidance for Q4 2023 is $91.6 million at the midpoint, below analyst estimates of $93.4 million

- Free Cash Flow of $23.13 million, up 26% from the previous quarter

- Gross Margin (GAAP): 83.7%, up from 81.1% in the same quarter last year

“We continue to innovate our offerings to help our community of businesses and freelancers,” said Micha Kaufman, founder and CEO of Fiverr.

Based in Tel Aviv, Fiverr (NYSE:FVRR) operates a fixed price global freelance marketplace for digital services.

Gig Economy

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

Sales Growth

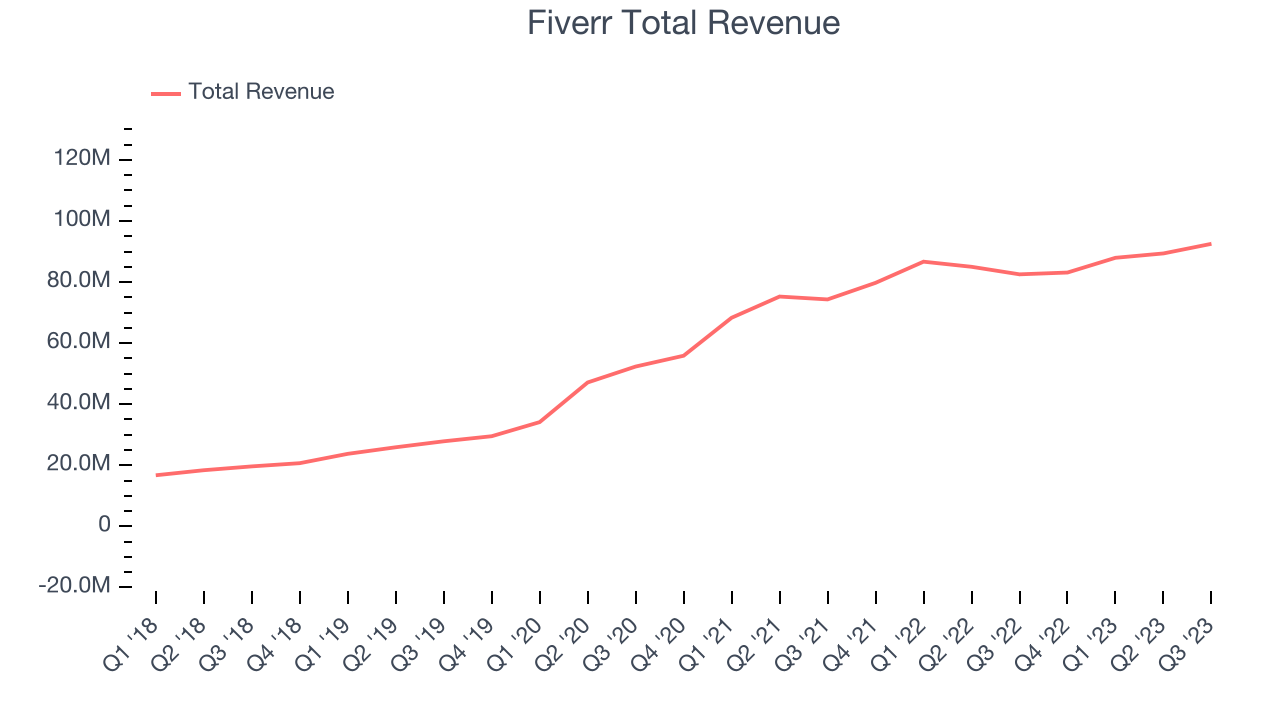

Fiverr's revenue growth over the last three years has been very strong, averaging 34% annually. This quarter, Fiverr beat analysts' estimates but reported mediocre 12.1% year-on-year revenue growth.

Guidance for the next quarter indicates Fiverr is expecting revenue to grow 10.2% year on year to $91.6 million, improving on the 4.2% year-on-year increase it recorded in the same quarter last year. Ahead of the earnings results, analysts covering the company were projecting sales to grow 13.5% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Usage Growth

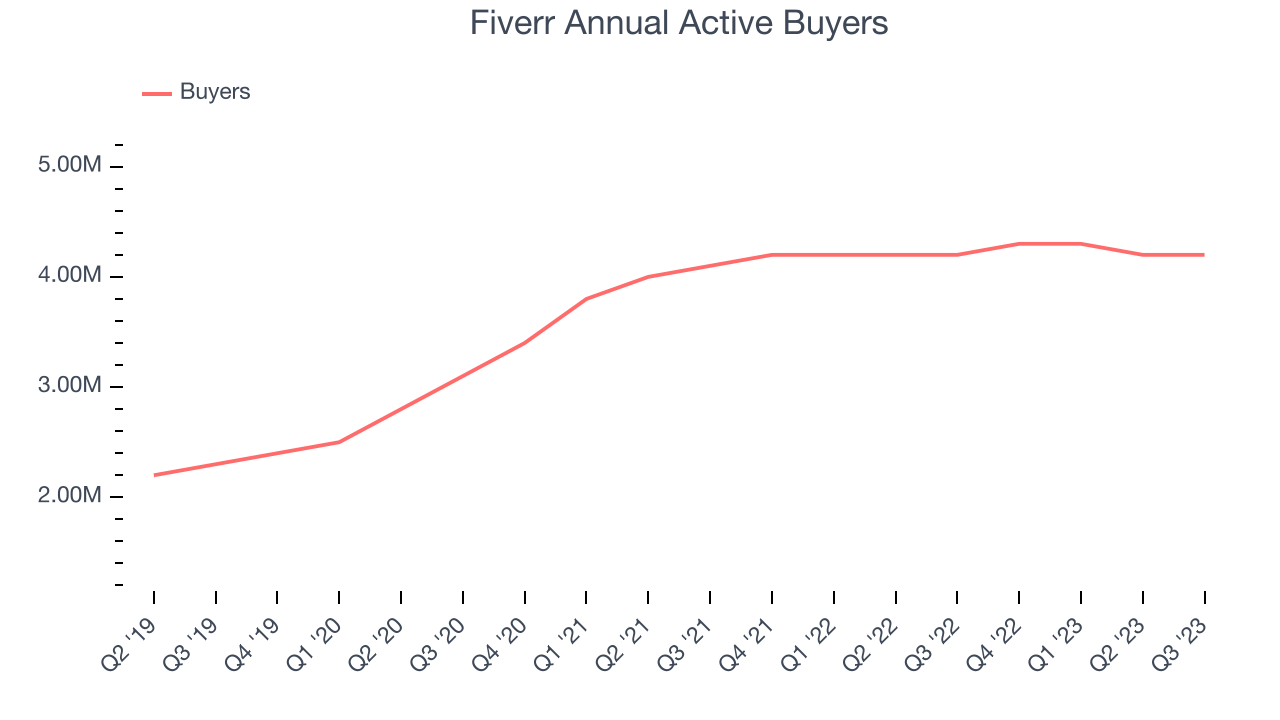

As a gig economy marketplace, Fiverr generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Over the last two years, Fiverr's active buyers, a key performance metric for the company, grew 5.8% annually to 4.2 million. This is average growth for a consumer internet company.

Key Takeaways from Fiverr's Q3 Results

With a market capitalization of $924.2 million, Fiverr is among smaller companies, but its $281.6 million cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

It was good to see Fiverr narrowly top analysts' revenue expectations this quarter. That really stood out as a positive in these results. On the other hand, its revenue guidance for next quarter underwhelmed. It noted that the guidance reflects "the volatility we experienced in our marketplace following the onset of the war in our region and the potential for increased volatility through the remainder of the year." Overall, this was a mixed quarter for Fiverr. The company is down 7.6% on the results and currently trades at $22.25 per share.

Fiverr may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.