B2B travel services company Global Business Travel (NYSE:GBTG) fell short of analysts' expectations in Q2 CY2024, with revenue up 5.6% year on year to $625 million. On the other hand, the company's outlook for the full year was close to analysts' estimates with revenue guided to $2.47 billion at the midpoint. It made a GAAP profit of $0.06 per share, improving from its loss of $0.23 per share in the same quarter last year.

Is now the time to buy Global Business Travel? Find out by accessing our full research report, it's free.

Global Business Travel (GBTG) Q2 CY2024 Highlights:

- Revenue: $625 million vs analyst estimates of $631.9 million (1.1% miss)

- EPS: $0.06 vs analyst estimates of -$0.03 ($0.09 beat)

- The company reconfirmed its revenue guidance for the full year of $2.47 billion at the midpoint

- Gross Margin (GAAP): 60.5%, up from 59.1% in the same quarter last year

- Adjusted EBITDA Margin: 20.3%, up from 17.9% in the same quarter last year

- Free Cash Flow of $49 million, up 104% from the previous quarter

- Transaction Value: 7.72 billion, up 375 million year on year

- Market Capitalization: $2.85 billion

Paul Abbott, Amex GBT’s Chief Executive Officer, stated: “In the second quarter, we delivered strong Adjusted EBITDA growth, significant margin expansion and accelerated Free Cash Flow, and with our recent debt refinancing, we significantly lowered interest costs. We have a solid foundation with increasingly strong customer retention, and we continue to gain share while controlling costs. This puts us well on track to deliver against our full-year revenue and Adjusted EBITDA guidance and raise our full-year Free Cash Flow guidance."

Holding close ties to American Express, Global Business Travel (NYSE:GBTG) is a comprehensive travel and expense management services provider to corporations worldwide.

Spend Management Software

The adoption of financial technology software is propelled by an ongoing drive to reduce costs. The combination of rising transaction volumes and global supply chain complexity is driving demand for cloud-based spend management platforms able to integrate the two.

Sales Growth

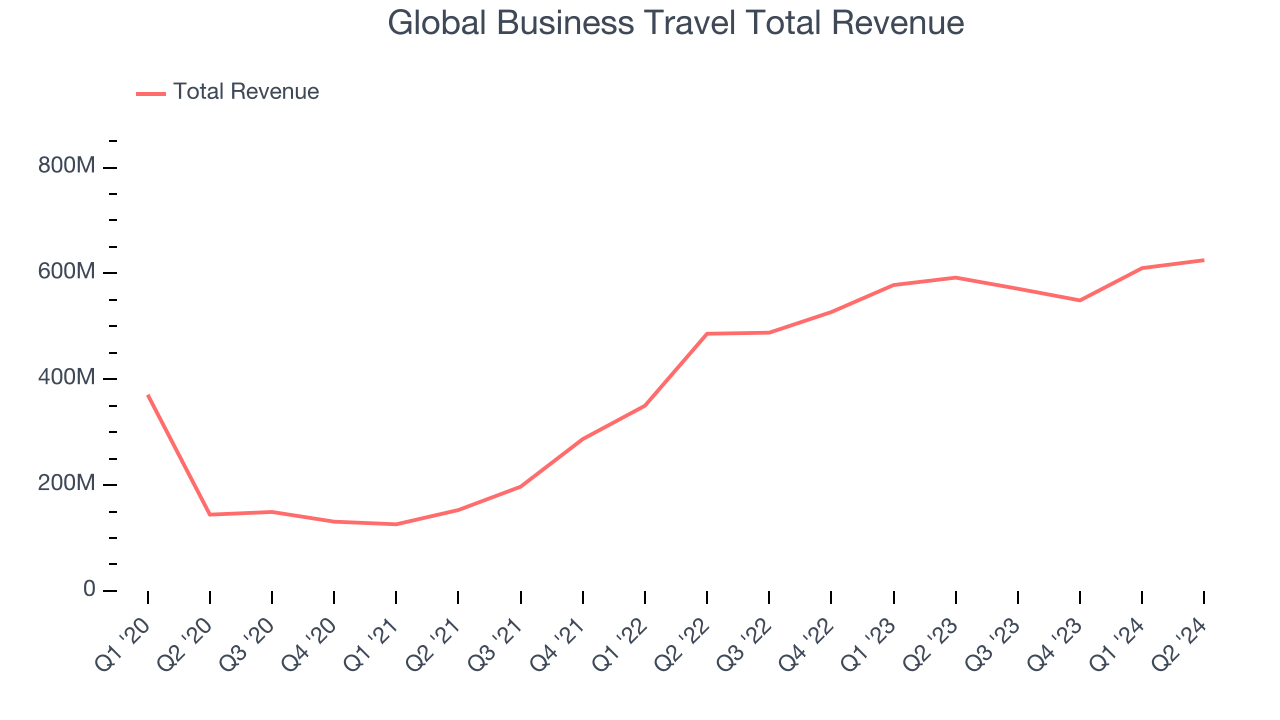

As you can see below, Global Business Travel's revenue growth has been incredible over the last three years, growing from $153 million in Q2 2021 to $625 million this quarter.

Global Business Travel's quarterly revenue was only up 5.6% year on year, which might disappoint some shareholders. Additionally, its growth did slow down compared to last quarter as the company's revenue increased by just $15 million in Q2 compared to $61 million in Q1 CY2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Looking ahead, analysts covering the company were expecting sales to grow 8.8% over the next 12 months before the earnings results announcement.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

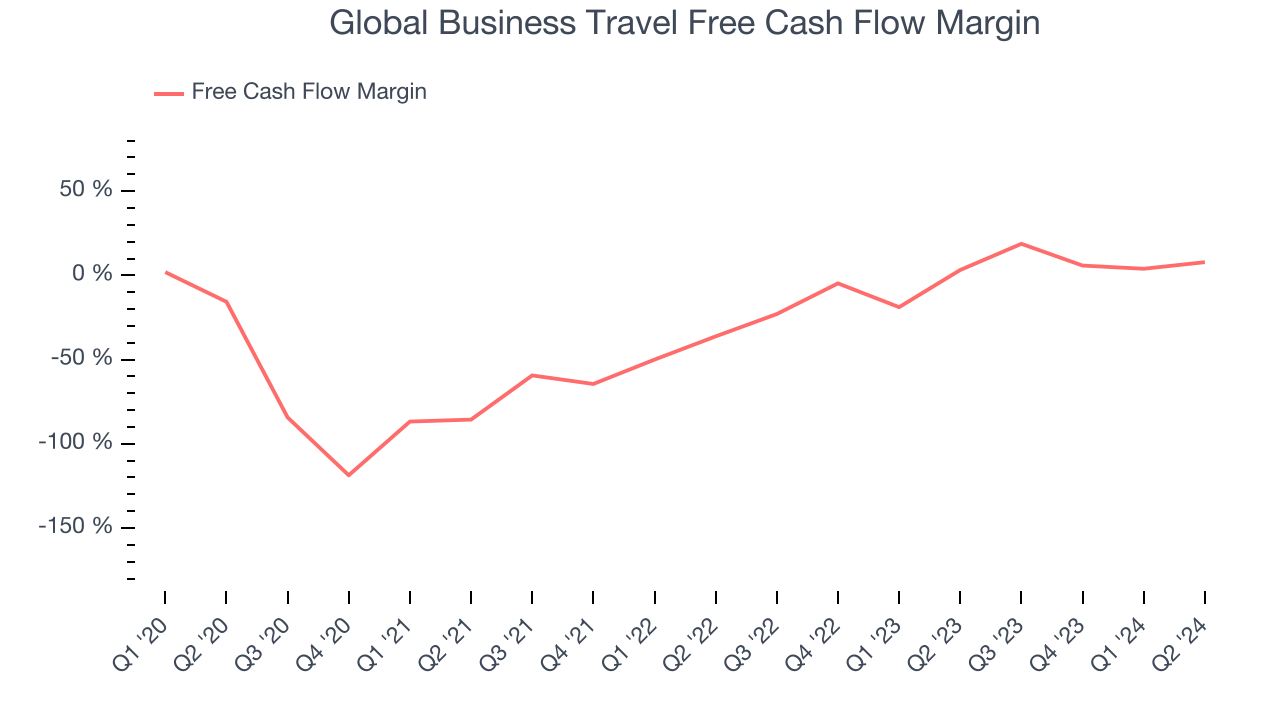

Global Business Travel has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9%, subpar for a software business.

Global Business Travel's free cash flow clocked in at $49 million in Q2, equivalent to a 7.8% margin. This quarter's result was good as its margin was 4.6 percentage points higher than in the same quarter last year, but we wouldn't read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Key Takeaways from Global Business Travel's Q2 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed analysts' expectations and its full-year revenue guidance slightly missed Wall Street's estimates. Overall, this was a mediocre quarter for Global Business Travel. The stock traded down 5.5% to $5.70 immediately after reporting.

Global Business Travel may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.