As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the e-commerce software stocks, starting with GoDaddy (NYSE:GDDY).

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 4 e-commerce software stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 3.33%, while on average next quarter revenue guidance was 0.1% above consensus. There has been a stampede out of high valuation technology stocks and while some of the e-commerce software stocks have fared somewhat better, they have not been spared, with share price declining 19.1% since earnings, on average.

Slowest Q3: GoDaddy (NYSE:GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

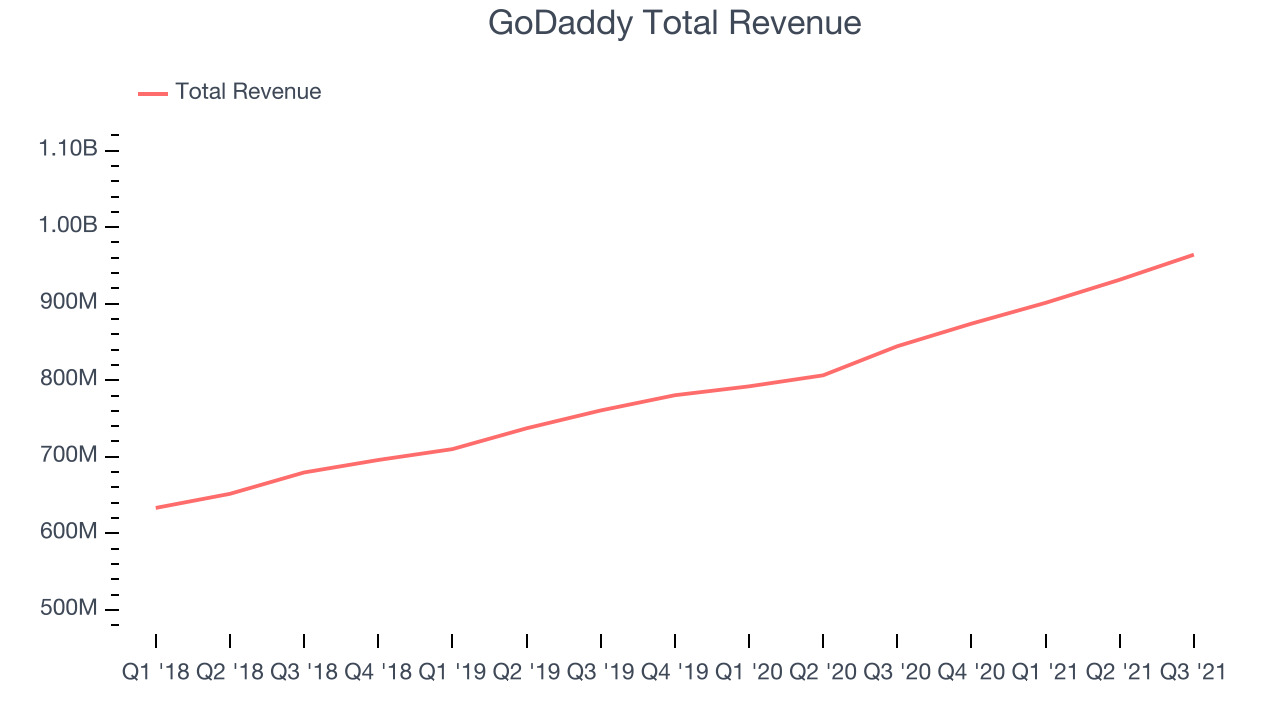

GoDaddy reported revenues of $964 million, up 14.1% year on year, beating analyst expectations by 1.92%. It was a weaker quarter for the company, with a decent beat of analyst estimates but a slow revenue growth.

"GoDaddy stepped out on the commerce stage in a big way with the hardware and payments offerings we launched in Q3," said GoDaddy CEO Aman Bhutani, "New solutions like these, combined with a consistent, cash-generative business, give us confidence in our ability to pursue new opportunities and drive profitable growth at scale."

GoDaddy delivered the slowest revenue growth of the whole group. The stock is up 13.8% since the results and currently trades at $80.08.

Read our full report on GoDaddy here, it's free.

Best Q3: BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

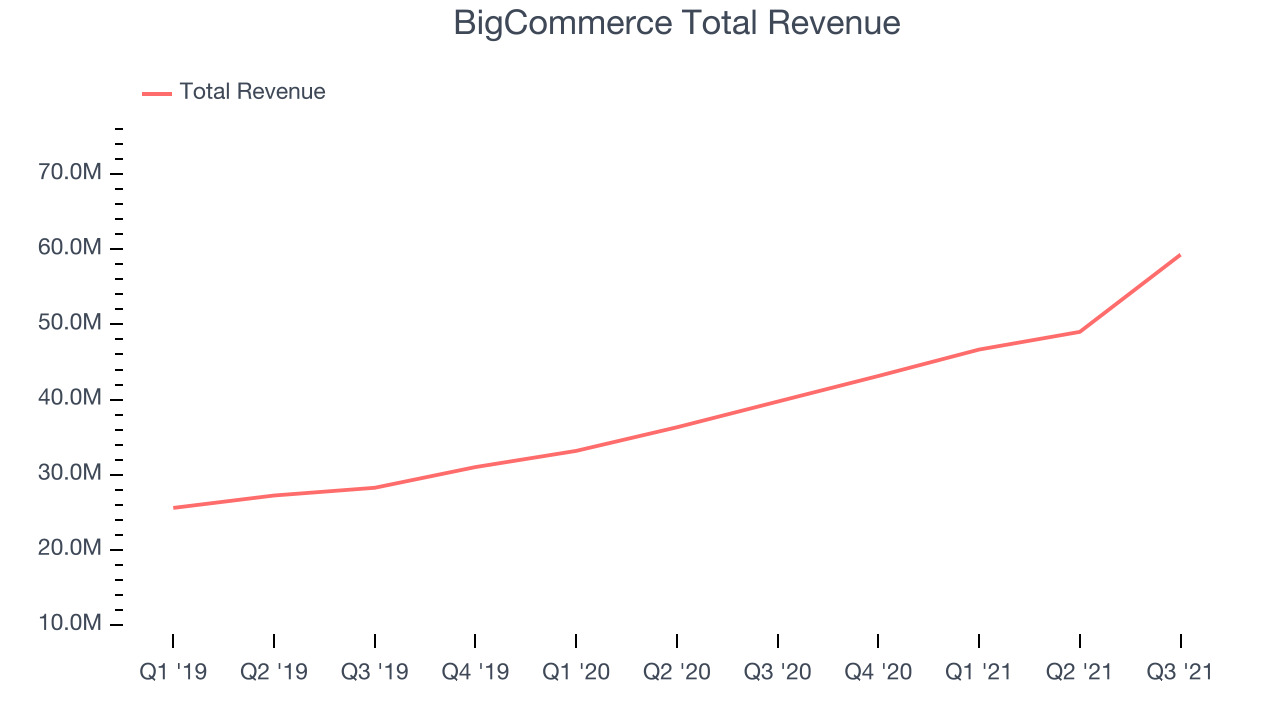

BigCommerce reported revenues of $59.2 million, up 49.2% year on year, beating analyst expectations by 8.09%. It was a very strong quarter for the company, with accelerating growth in large customers and an exceptional revenue growth.

BigCommerce scored the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 1,392 enterprise customers paying more than $2,000 annually to a total of 12,378. The stock is down 26.2% since the results and currently trades at $34.52.

Is now the time to buy BigCommerce? Access our full analysis of the earnings results here, it's free.

Squarespace (NYSE:SQSP)

Founded in New York City in 2003, Squarespace (NYSE:SQSP) is a platform for small businesses and creators to build their digital presences online.

Squarespace reported revenues of $200.9 million, up 23.7% year on year, beating analyst expectations by 1.53%. It was a weaker quarter for the company, with a decent beat of analyst estimates but an underwhelming revenue guidance for the next quarter.

Squarespace had the weakest performance against analyst estimates in the group. The stock is down 38.3% since the results and currently trades at $29.34.

Read our full analysis of Squarespace's results here.

Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ:WIX) offers a free and easy to operate website building platform.

Wix reported revenues of $320.7 million, up 26.2% year on year, beating analyst expectations by 1.77%. It was a decent quarter for the company, with a solid revenue growth.

Wix had the weakest full year guidance update among the peers. The stock is down 25.9% since the results and currently trades at $154.

Read our full, actionable report on Wix here, it's free.

The author has no position in any of the stocks mentioned