Industrial conglomerate General Electric (NYSE:GE) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 5.8% year on year to $9.84 billion. Its non-GAAP profit of $1.15 per share was also 1.3% above analysts’ consensus estimates.

Is now the time to buy General Electric? Find out by accessing our full research report, it’s free.

General Electric (GE) Q3 CY2024 Highlights:

- Revenue: $9.84 billion vs analyst estimates of $9.38 billion (4.9% beat)

- EPS (non-GAAP): $1.15 vs analyst estimates of $1.13 (1.3% beat)

- Management raised its full-year EPS (non-GAAP) guidance to $4.28 at the midpoint, a 4.9% increase

- Operating Margin: 18.5%, up from 17.2% in the same quarter last year

- Free Cash Flow Margin: 18.3%, down from 22.2% in the same quarter last year

- Market Capitalization: $210.6 billion

Company Overview

One of the original 12 companies on the Dow Jones Industrial Average, General Electric (NYSE:GE) is a multinational conglomerate providing technologies for various sectors including aviation, power, renewable energy, and healthcare.

General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

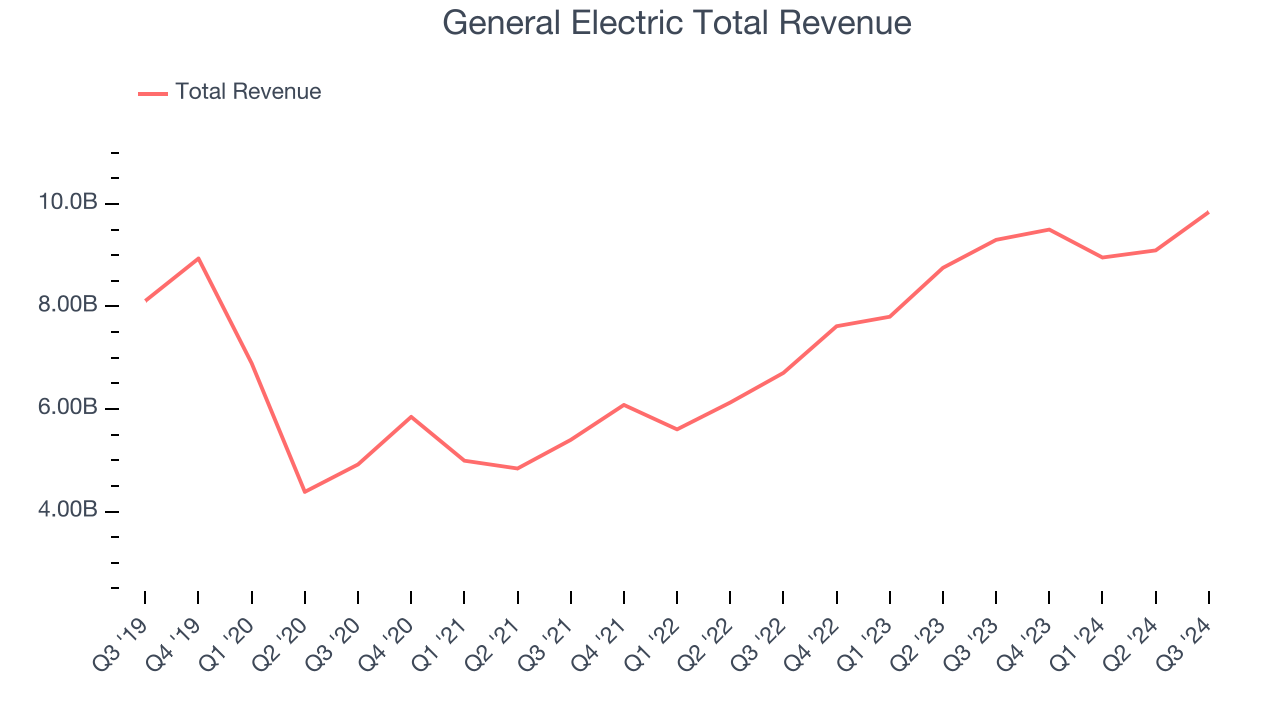

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Regrettably, General Electric’s sales grew at a sluggish 2.9% compounded annual growth rate over the last five years. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. General Electric’s annualized revenue growth of 23.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated. General Electric’s recent history shows it’s one of the better General Industrial Machinery businesses as many of its peers faced declining sales because of cyclical headwinds.

This quarter, General Electric reported year-on-year revenue growth of 5.8%, and its $9.84 billion of revenue exceeded Wall Street’s estimates by 4.9%.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and illustrates the market thinks its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

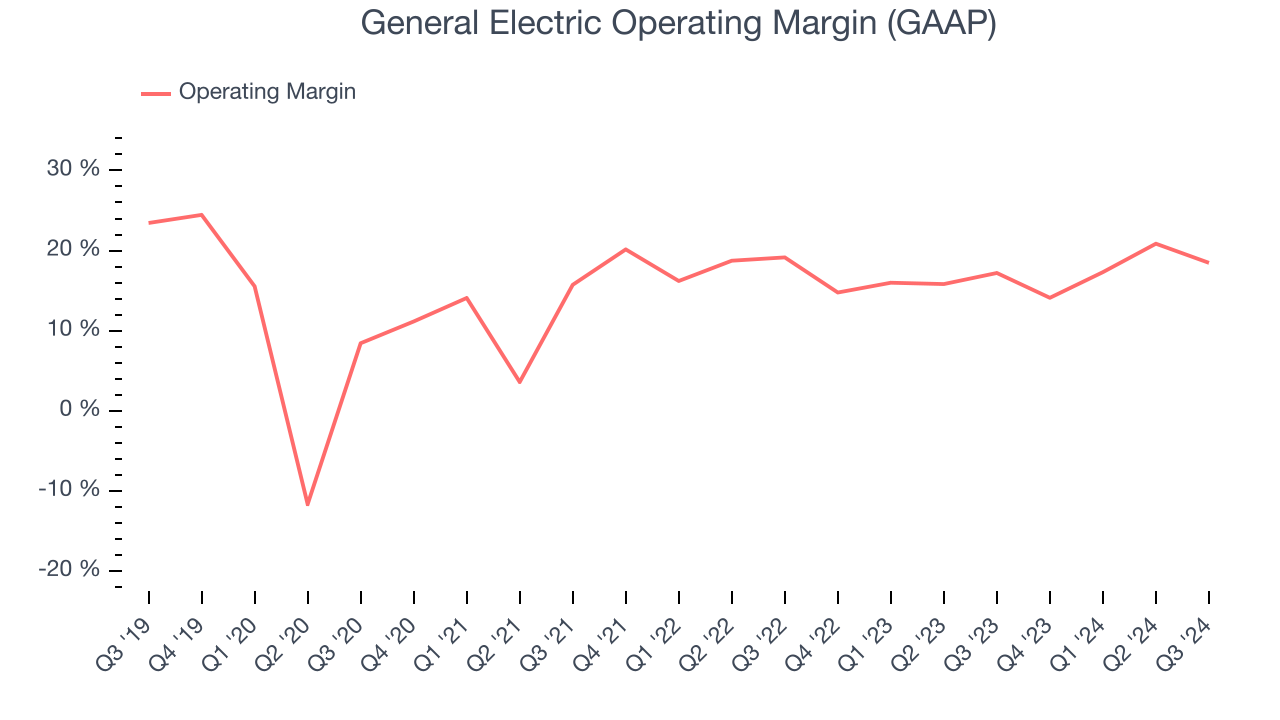

Operating Margin

General Electric has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.6%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, General Electric’s annual operating margin rose by 5.1 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q3, General Electric generated an operating profit margin of 18.5%, up 1.3 percentage points year on year. The increase was a welcome development and shows its expenses recently grew slower than its revenue, leading to higher efficiency.

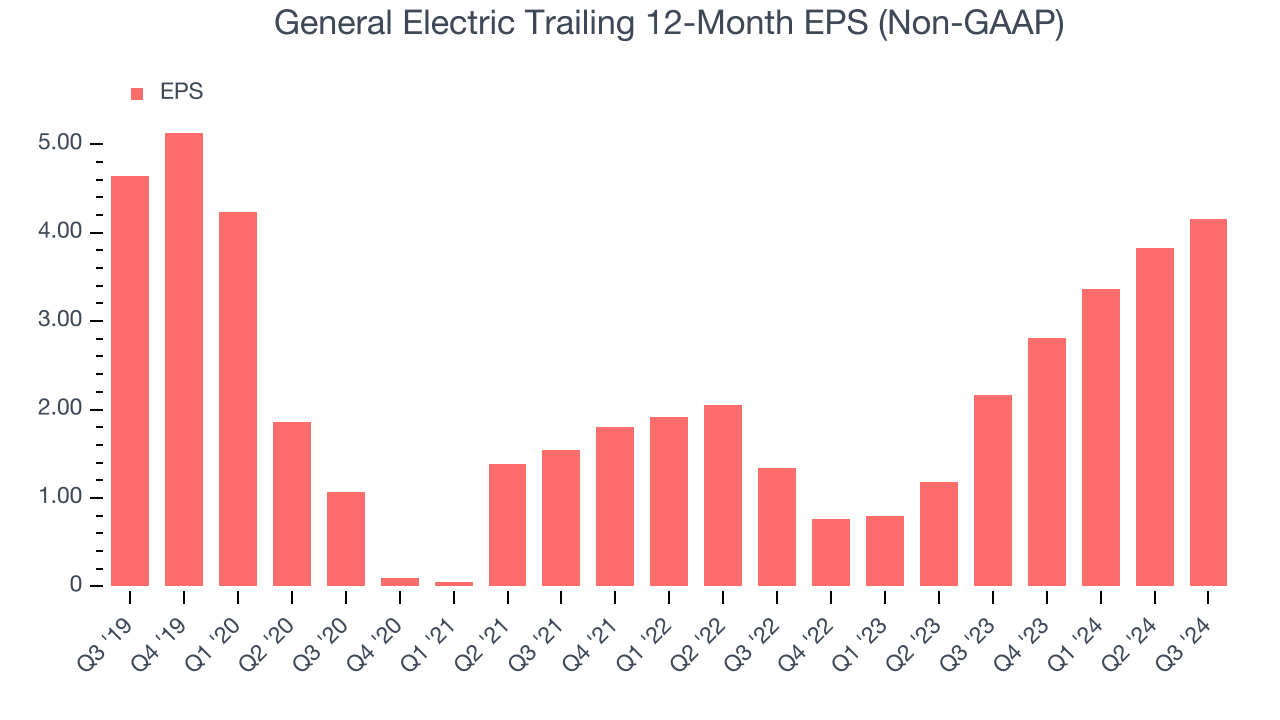

Earnings Per Share

Analyzing long-term revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for General Electric, its EPS declined by 2.2% annually over the last five years while its revenue grew by 2.9%. However, its operating margin actually expanded during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For General Electric, its two-year annual EPS growth of 75.8% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, General Electric reported EPS at $1.15, up from $0.82 in the same quarter last year. This print beat analysts’ estimates by 1.3%. Over the next 12 months, Wall Street expects General Electric’s full-year EPS of $4.15 to grow by 15.5%.

Key Takeaways from General Electric’s Q3 Results

We were impressed by how significantly General Electric blew past analysts’ revenue expectations this quarter. We were also glad it raised its full-year EPS guidance, which exceeded Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics performing well. However, buy-side expectations (called "whisper numbers") going into the quarter were higher than sell-side analysts' published numbers - the stock was up ~90% YTD before the earnings release. As a result, shares traded down 7.8% to $179.11 immediately following the results because investors were expecting an even better quarter.

Is General Electric an attractive investment opportunity at the current price?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock.We cover that in our actionable full research report which you can read here, it’s free.