Contemporary clothing brand Guess (NYSE:GES) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 3.9% year on year to $591.9 million. It made a non-GAAP profit of $0.27 per share, improving from its loss of $0.06 per share in the same quarter last year.

Is now the time to buy Guess? Find out by accessing our full research report, it's free.

Guess (GES) Q1 CY2024 Highlights:

- Revenue: $591.9 million vs analyst estimates of $574.6 million (3% beat)

- EPS (non-GAAP): $0.27 vs analyst estimates of -$0.40 ($0.67 beat)

- EPS (non-GAAP) Guidance for Q2 CY2024 is $0.43 at the midpoint, below analyst estimates of $0.65

- Gross Margin (GAAP): 41.9%, up from 40.7% in the same quarter last year

- Free Cash Flow was -$45.55 million, down from $267.8 million in the previous quarter

- Market Capitalization: $1.25 billion

Carlos Alberini, Chief Executive Officer, commented, “We are very pleased with our first quarter results, which exceeded our expectations for revenues and earnings per share. We delivered revenue growth of 4% in US dollars and 7% in constant currency, driven by a remarkable performance of our Licensing and Americas wholesale businesses and strong results in Europe and Asia. Revenues in our Americas retail business finished flat for the quarter, as we continued to experience softness in certain of our businesses in the region due to slower customer traffic. I believe our strong results this quarter once again highlight the power of our diversified business model and the strength of our brand and our global distribution.”

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE:GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

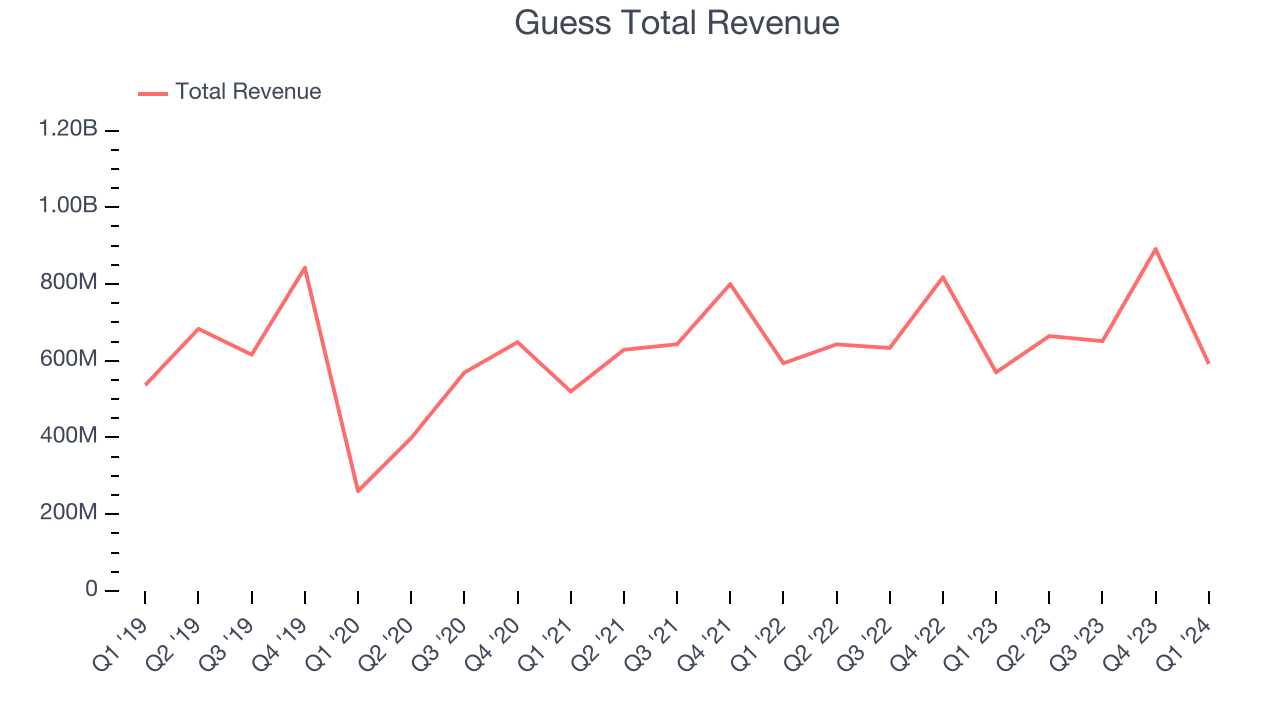

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Guess grew its sales at a weak 1.3% compounded annual growth rate. This shows it failed to expand its business in any major way.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Guess's annualized revenue growth of 2.5% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Guess reported reasonable year-on-year revenue growth of 3.9%, and its $591.9 million of revenue topped Wall Street's estimates by 3%. Looking ahead, Wall Street expects sales to grow 12.5% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

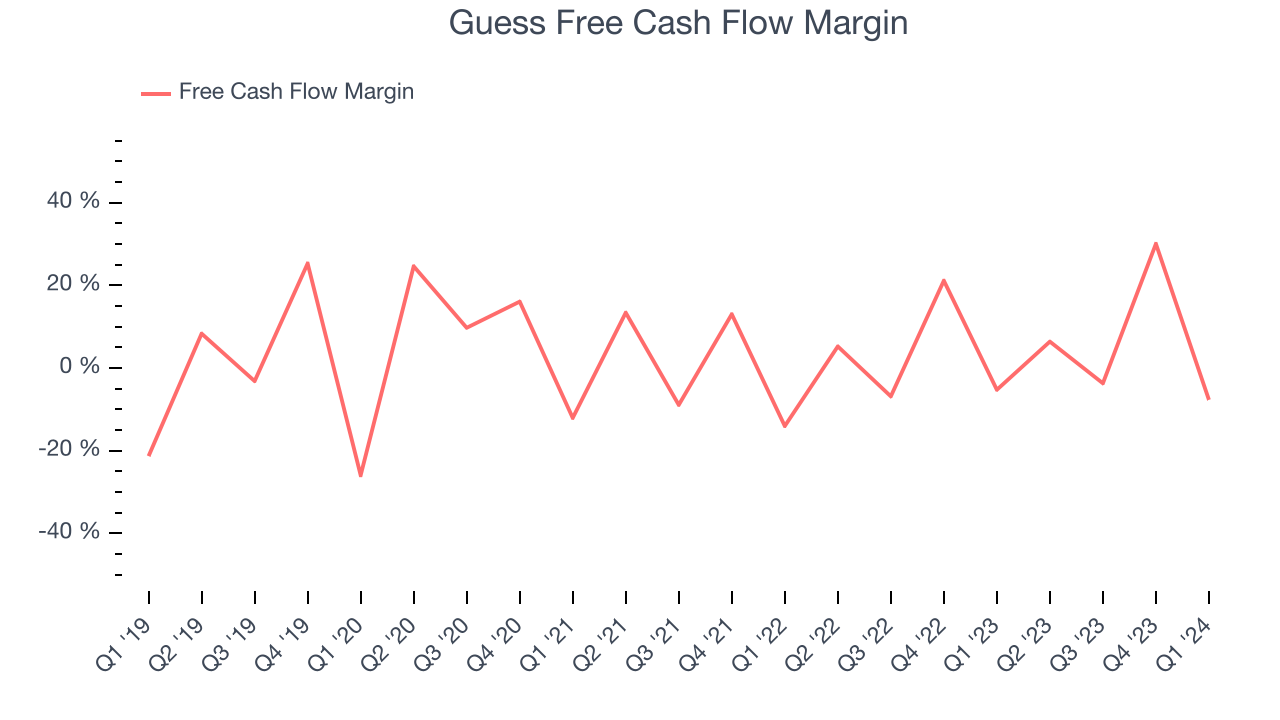

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Guess has shown weak cash profitability over the last two years, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin averaged 6.8%, subpar for a consumer discretionary business.

Guess burned through $45.55 million of cash in Q1, equivalent to a negative 7.7% margin. The company's cash burn increased meaningfully year on year while its cash conversion fell 2.4 percentage points. This dynamic shows Guess's management team spent more cash this quarter and could have been more efficient with that cash.

Key Takeaways from Guess's Q1 Results

We were impressed by how significantly Guess blew past analysts' EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. On the other hand, its earnings forecast for next quarter missed and its operating margin fell short of Wall Street's estimates. Overall, the results could have been better. The company is down 1.9% on the results and currently trades at $22.93 per share.

So should you invest in Guess right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.