Video game retailer GameStop (NYSE:GME) reported Q2 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 2.45% year on year to $1.16 billion. The company didn’t provide any forward revenue guidance. Turning to EPS, GameStop made a non-GAAP loss of $0.03 per share, improving from its loss of $0.35 per share in the same quarter last year.

Is now the time to buy GameStop? Find out by accessing our full research report, it's free.

GameStop (GME) Q2 FY2023 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $1.14 billion (1.97% beat)

- EPS (non-GAAP): -$0.03 vs analyst estimates of -$0.14

- Free Cash Flow was -$119 million compared to -$124 million in the same quarter last year

- Gross Margin (GAAP): 26.3%, up from 24.8% in the same quarter last year

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE:GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

After a long day, some of us want to just watch TV, play video games, listen to music, or scroll through our phones; electronics and gaming retailers sell the technology that makes this possible, plus more. Shoppers can find everything from surround-sound speakers to gaming controllers to home appliances in their stores. Competitive prices and helpful store associates that can talk through topics like the latest technology in gaming and installation keep customers coming back. This is a category that has moved rapidly online over the last few decades, so these electronics and gaming retailers have needed to be nimble and aggressive with their e-commerce and omnichannel investments.

Sales Growth

GameStop is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

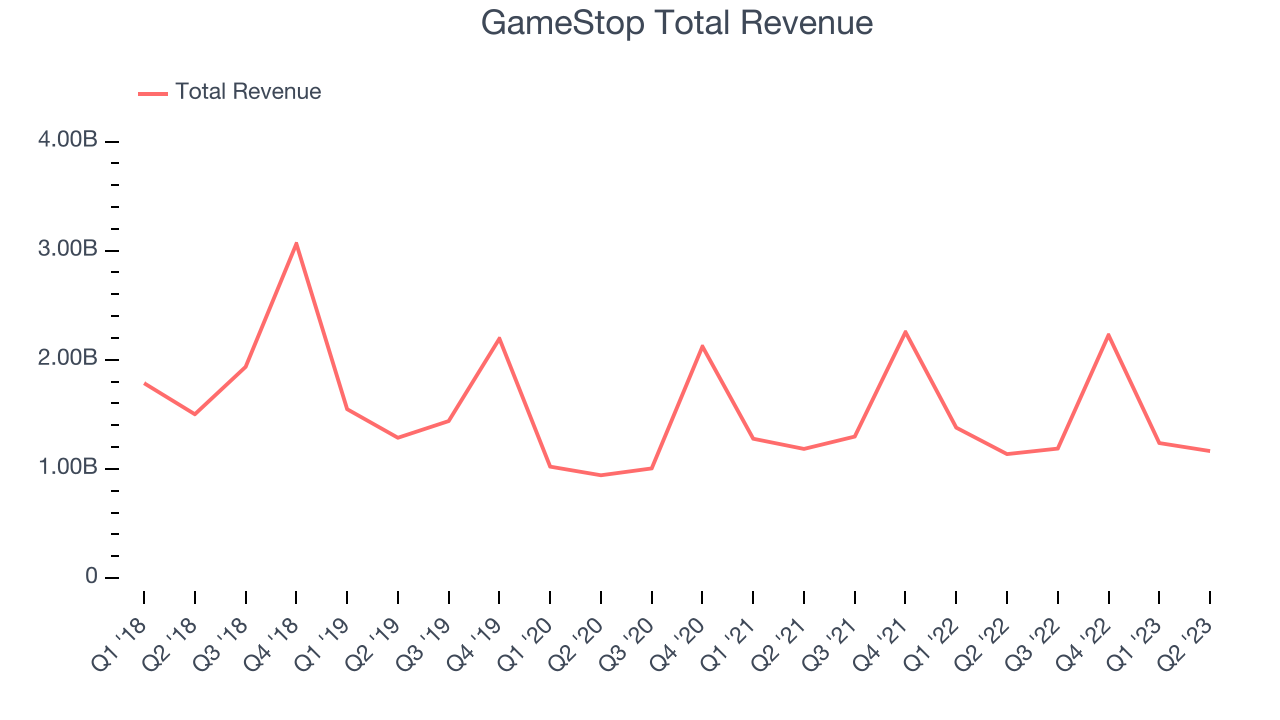

As you can see below, the company's revenue has declined over the last four years, dropping 7.18% annually.

This quarter, GameStop reported decent year-on-year revenue growth of 2.45% and its revenue of $1.16 billion topped Wall Street's expectations by 1.97%. Looking ahead, Wall Street expects revenue to decline 3.26% over the next 12 months.

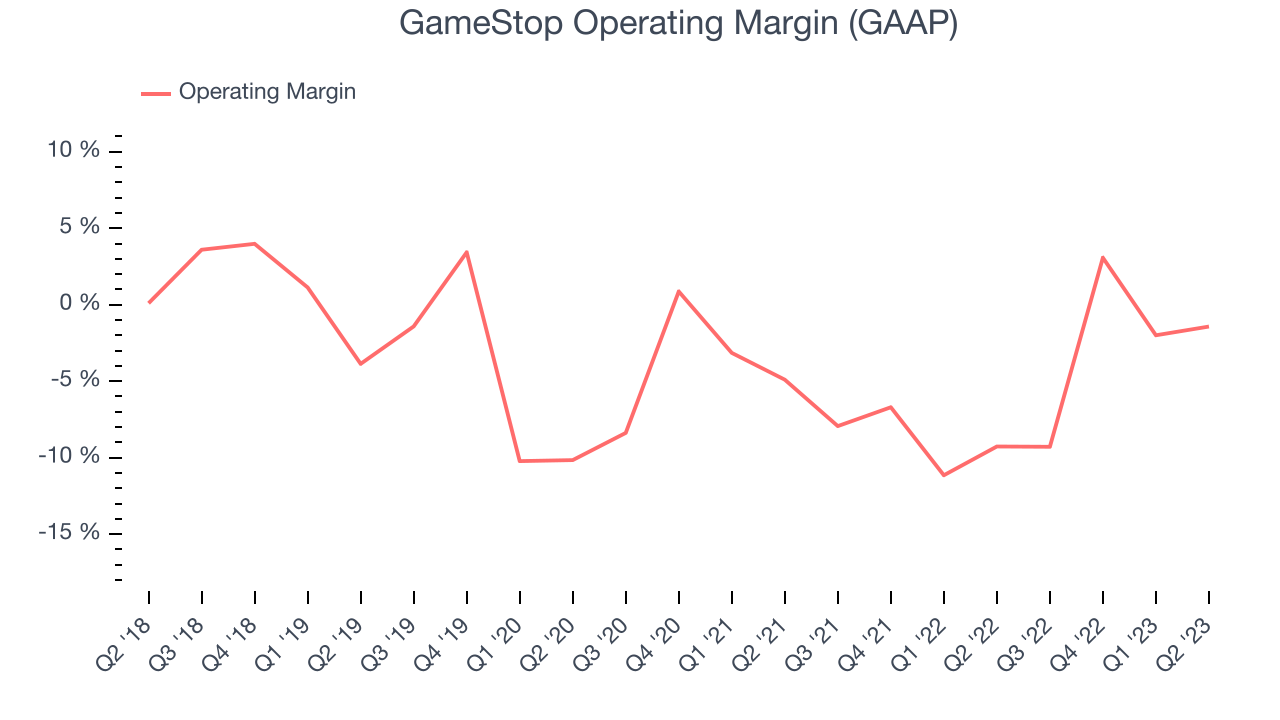

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses that keep the lights on, including wages, rent, advertising, and other administrative costs.

In Q2, GameStop generated an operating profit margin of negative 1.43%, up 7.8 percentage points year on year. This increase was encouraging, and we can infer that GameStop was more disciplined with its expenses or gained leverage on fixed costs because its operating margin expanded more than its gross margin.

Unprofitable publicly traded companies are few and far between in the consumer retail sector, and over the last two years, GameStop has been one of them. Its high expenses have contributed to an average operating margin of negative 5.59%. However, GameStop's margin has improved, on average, by 6.4 percentage points year on year, an encouraging sign for shareholders. The tide could be turning.

Unprofitable publicly traded companies are few and far between in the consumer retail sector, and over the last two years, GameStop has been one of them. Its high expenses have contributed to an average operating margin of negative 5.59%. However, GameStop's margin has improved, on average, by 6.4 percentage points year on year, an encouraging sign for shareholders. The tide could be turning.The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Key Takeaways from GameStop's Q2 Results

With a market capitalization of $5.85 billion, GameStop is among smaller companies, but its $1.19 billion cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

We were impressed by how significantly GameStop blew past analysts' EPS expectations this quarter. That really stood out as a positive in these results. The company also beat Wall Street's revenue estimates, driven by outperformance in its hardware and accessories segment. The stock is up 1.33% after reporting and currently trades at $19.02 per share.

So should you invest in GameStop right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.