Video game retailer GameStop (NYSE:GME) fell short of analysts' expectations in Q4 CY2023, with revenue down 19.4% year on year to $1.79 billion. It made a non-GAAP profit of $0.22 per share, improving from its profit of $0.16 per share in the same quarter last year.

GameStop (GME) Q4 CY2023 Highlights:

- Revenue: $1.79 billion vs analyst estimates of $2.05 billion (12.5% miss)

- EPS (non-GAAP): $0.22 vs analyst expectations of $0.30 (25.4% miss)

- Gross Margin (GAAP): 23.4%, up from 22.4% in the same quarter last year

- Free Cash Flow was -$18.7 million, down from $326.6 million in the same quarter last year

- Market Capitalization: $4.62 billion

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE:GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

Over time, physical consoles and cartridges have lost some relevance, as more games are delivered digitally. In response, GameStop established a digital storefront on its website where customers can purchase digital game downloads and in-game content. When a customer makes a purchase, they receive a digital code that can be redeemed on the platform of their choice, such as Xbox Live. GameStop also offers the option to purchase digital content in-store, where employees can help customers navigate the process and answer any questions they may have.

The core customer of GameStop is typically a young, male gamer looking for the latest video games and accessories. Stores also offer trade-in opportunities for customers who want to sell or exchange used games and consoles for store credit. The size of an average GameStop store is small, around 1,500 square feet. They are located in malls or shopping centers alongside other mass market retailers. The stores are laid out with displays of the latest video games and consoles at the front of the store, while used games and accessories are often located toward the back.

GameStop's competitors include other video game retailers like Best Buy and Walmart, as well as online retailers like Amazon and digital gaming platforms like Steam. Some of these competitors, like Best Buy and Walmart, are public companies, while others, like Steam, are private.

One interesting fact about GameStop is that the company was at the center of a trading frenzy in early 2021 when a group of amateur investors on Reddit drove up the price of GameStop's stock

Electronics & Gaming Retailer

After a long day, some of us want to just watch TV, play video games, listen to music, or scroll through our phones; electronics and gaming retailers sell the technology that makes this possible, plus more. Shoppers can find everything from surround-sound speakers to gaming controllers to home appliances in their stores. Competitive prices and helpful store associates that can talk through topics like the latest technology in gaming and installation keep customers coming back. This is a category that has moved rapidly online over the last few decades, so these electronics and gaming retailers have needed to be nimble and aggressive with their e-commerce and omnichannel investments.

Competitors offering video games and video game accessories include Best Buy (NYSE:BBY), Walmart (NYSE:WMT), and Amazon.com (NASDAQ:AMZN).Sales Growth

GameStop is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

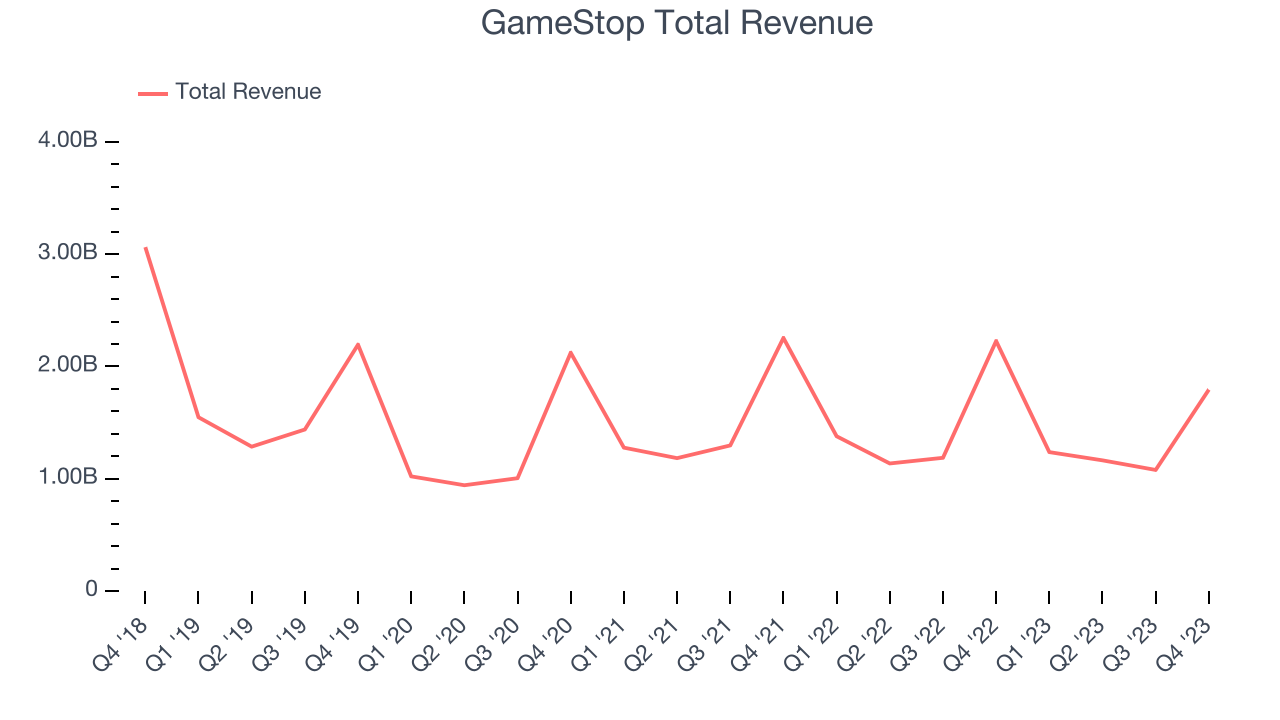

As you can see below, the company's revenue has declined over the last four years, dropping 5% annually as its store count and sales at existing, established stores have both shrunk.

This quarter, GameStop missed Wall Street's estimates and reported a rather uninspiring 19.4% year-on-year revenue decline, generating $1.79 billion in revenue. Looking ahead, Wall Street expects revenue to decline 1.4% over the next 12 months.

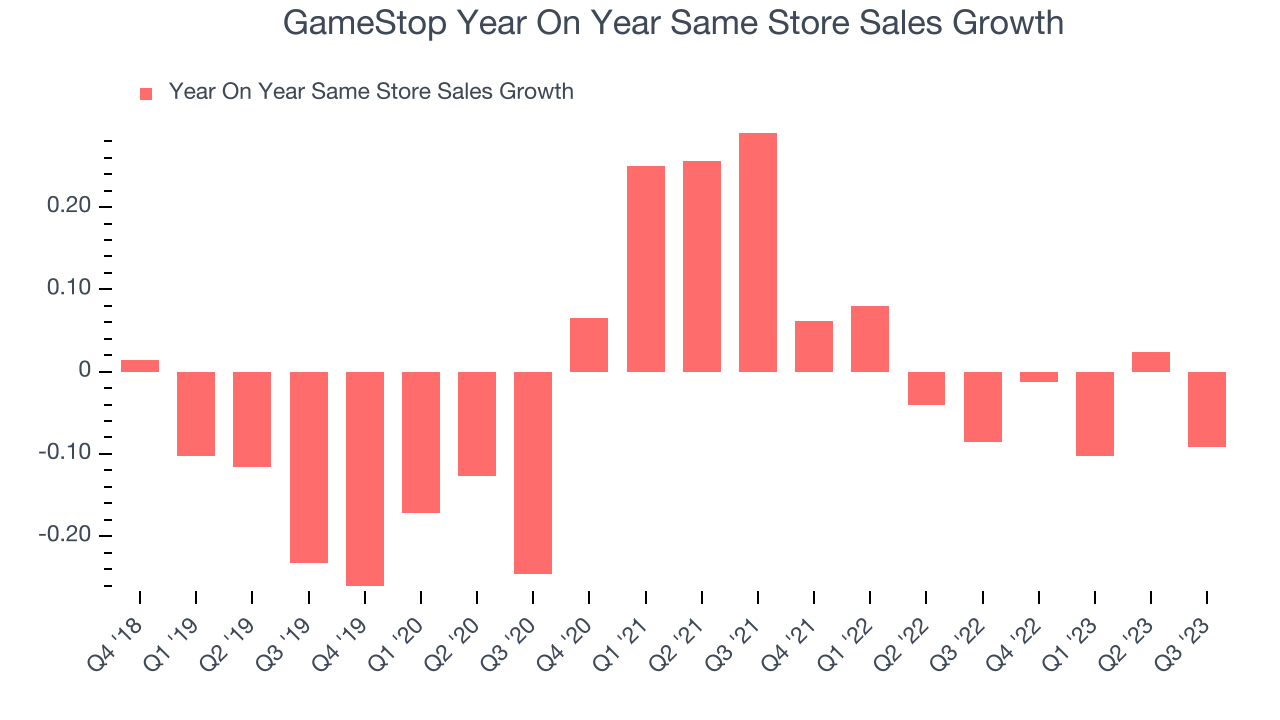

Same-Store Sales

GameStop's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 3.2% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

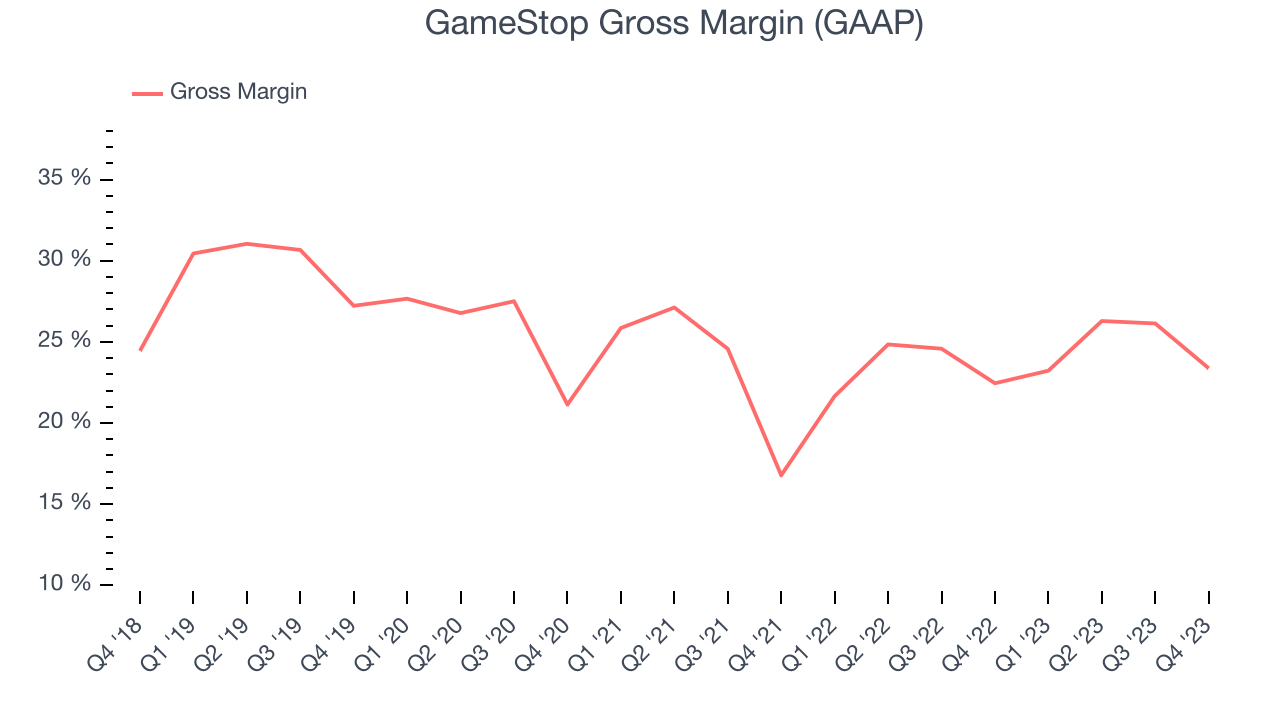

Gross Margin & Pricing Power

GameStop has poor unit economics for a retailer, leaving it with little room for error if things go awry. As you can see below, it's averaged a 23.8% gross margin over the last two years. This means the company makes $0.24 for every $1 in revenue before accounting for its operating expenses.

GameStop produced a 23.4% gross profit margin in Q4, flat with the same quarter last year. This steady margin stems from its efforts to keep prices low for consumers and signals that it has stable input costs (such as freight expenses to transport goods).

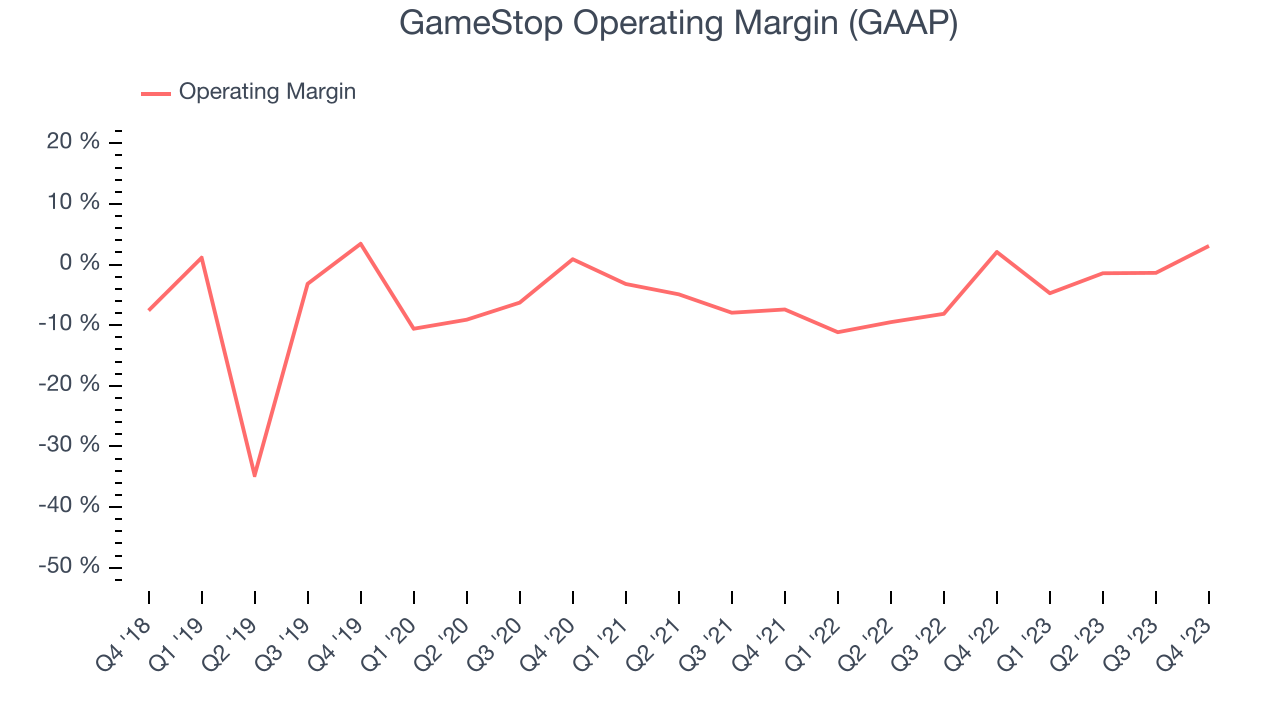

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q4, GameStop generated an operating profit margin of 3.1%, up 1 percentage points year on year. This increase was encouraging, and we can infer GameStop was more disciplined with its expenses or gained leverage on fixed costs because its operating margin expanded more than its gross margin.

Although GameStop was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 3.1% over the last two years. This performance isn't ideal as unprofitable publicly traded companies are a minority in the consumer retail sector. However, GameStop's margin has improved, on average, by 4.6 percentage points year on year, an encouraging sign for shareholders. The tide could be turning.

Although GameStop was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 3.1% over the last two years. This performance isn't ideal as unprofitable publicly traded companies are a minority in the consumer retail sector. However, GameStop's margin has improved, on average, by 4.6 percentage points year on year, an encouraging sign for shareholders. The tide could be turning.EPS

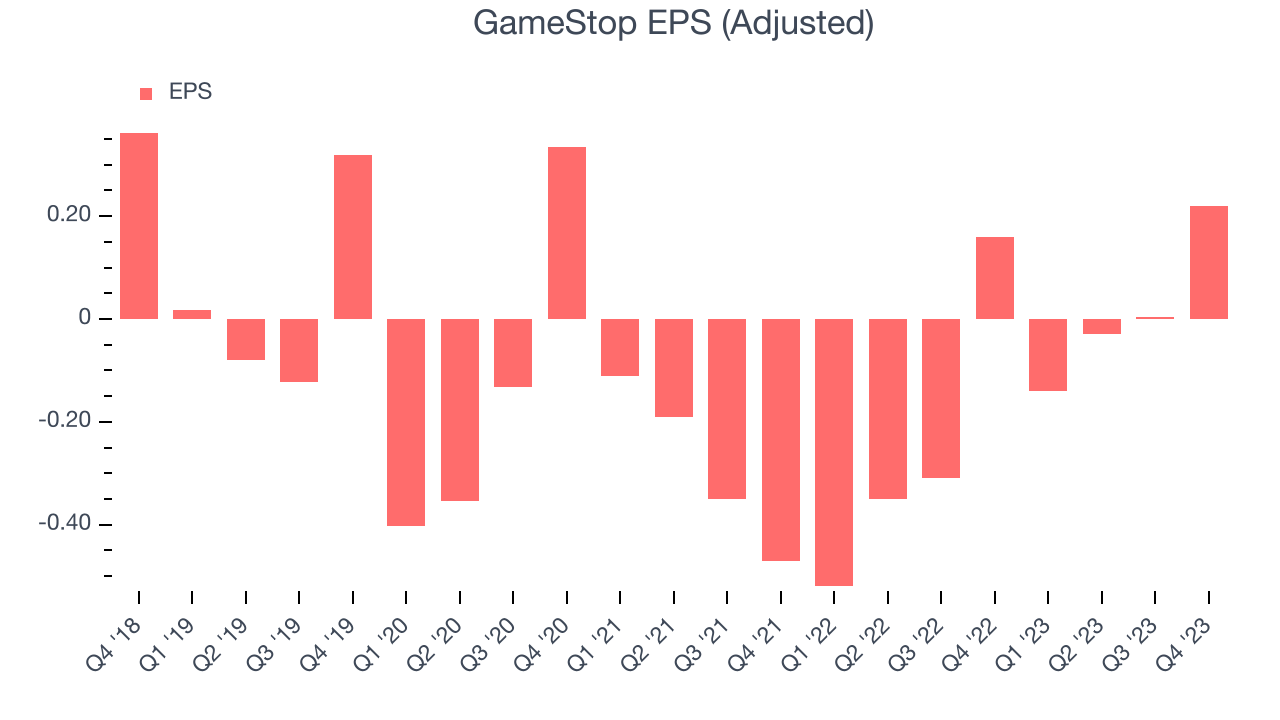

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, GameStop reported EPS at $0.22, up from $0.16 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2019 and FY2023, GameStop's adjusted diluted EPS dropped 60.5%, translating into 20.7% annualized declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 125% year-on-year increase in EPS.

Cash Is King

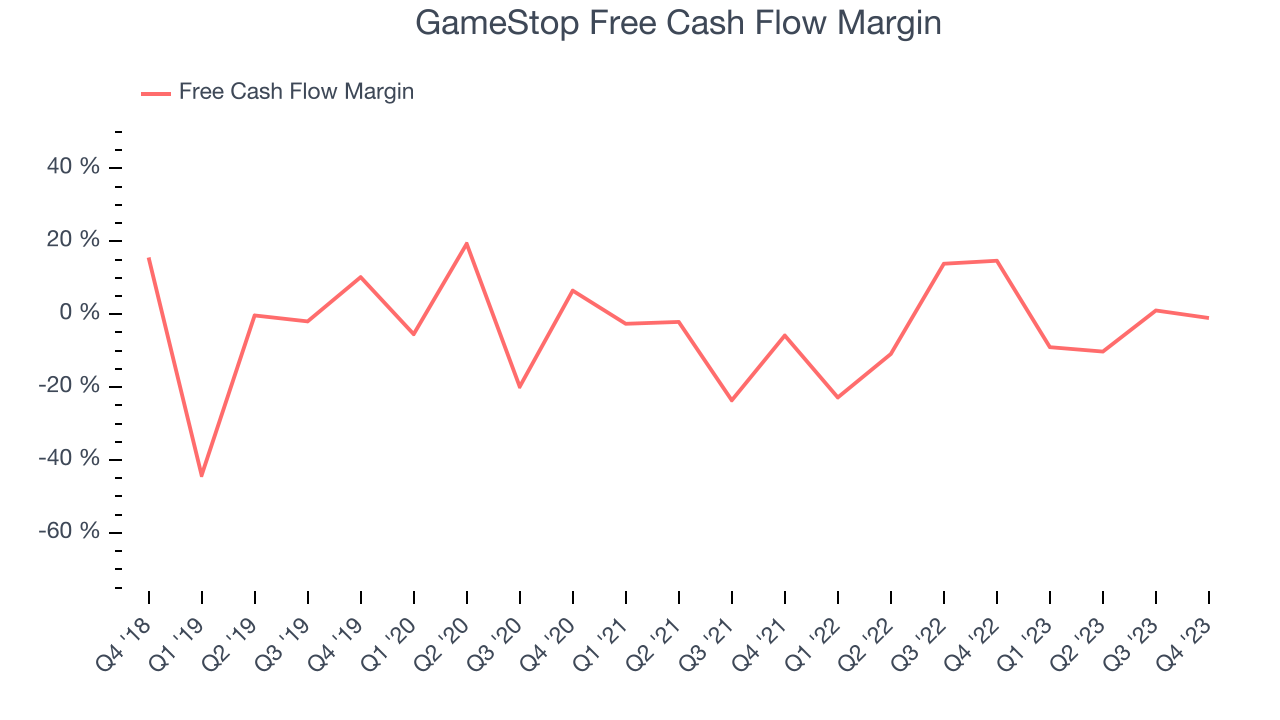

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

GameStop burned through $18.7 million of cash in Q4, representing a negative 1% free cash flow margin. The company shifted to cash flow negative from cash flow positive in the same quarter last year, which happened for several reasons including (but not limited to) the stockpiling of inventory in anticipation of higher demand or unforeseen, one-time events.

Over the last two years, GameStop's capital-intensive business model and demanding reinvestment strategy have consumed many company resources. Its free cash flow margin has averaged negative 1.7%, weak for a consumer retail business. Furthermore, its margin has averaged year-on-year declines of 5.4 percentage points. This drop came from higher operational or borrowing costs as it opened fewer stores, common in consumer retail. We've no doubt shareholders would like to see an improvement soon.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

GameStop's five-year average ROIC was negative 26.7%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer retail sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, GameStop's ROIC averaged 3.7 percentage point increases each year. This is a good sign and we hope the company can continue to improving.

Key Takeaways from GameStop's Q4 Results

We struggled to find many strong positives in these results. GameStop's revenue unfortunately missed analysts' expectations, driven by significant underperformance in its software segment ($465m of revenue vs estimates of $670m). Because the company's software products have higher profit margins than its hardware products, it missed Wall Street's estimates on nearly every profitability metric. The company also didn't provide any guidance and said it would not host a conference call today to discuss the results, which raises an eyebrow. Overall, this was a bad quarter for GameStop. The company is down 17% and currently trades at $12.89 per share.

Is Now The Time?

GameStop may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of GameStop, we'll be cheering from the sidelines. Its revenue has declined over the last four years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its relatively low ROIC suggests it has struggled to grow profits historically. On top of that, its operating margins reveal poor profitability compared to other retailers.

GameStop's price-to-earnings ratio based on the next 12 months is 129.5x. While we've no doubt one can find things to like about GameStop, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $6 per share right before these results (compared to the current share price of $12.89), implying they didn't see much short-term potential in GameStop.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.