Maritime shipping company Genco (NYSE:GNK) reported Q2 CY2024 results topping analysts' expectations, with revenue up 75.6% year on year to $107 million. It made a GAAP profit of $0.54 per share, improving from its profit of $0.27 per share in the same quarter last year.

Is now the time to buy Genco? Find out by accessing our full research report, it's free.

Genco (GNK) Q2 CY2024 Highlights:

- Revenue: $107 million vs analyst estimates of $74.77 million (43.2% beat)

- EPS: $0.54 vs analyst expectations of $0.56 (4.2% miss)

- Gross Margin (GAAP): 46.5%, down from 61.2% in the same quarter last year

- EBITDA Margin: 37.1%, down from 49.2% in the same quarter last year

- Free Cash Flow of $28.82 million, similar to the previous quarter

- owned vessels: 43, down 1 year on year

- Market Capitalization: $764.9 million

John C. Wobensmith, Chief Executive Officer, commented, “During the second quarter, we drew on our sizeable drybulk fleet and leading commercial platform to generate strong earnings for the benefit of shareholders, while taking steps to further execute our value strategy. We continued to return significant capital to shareholders and have now declared 20 consecutive dividends, representing $5.915 per share, or 33% of our stock price. During the quarter, we also continued to create value through our fleet renewal program, divesting older, non-core assets at firm prices, the proceeds of which we intend to redeploy towards high specification vessels to further modernize the fleet and enhance earnings power.”

Headquartered in NYC, Genco (NYSE:GNK) is a shipping company that transports dry bulk cargo along worldwide maritime routes.

Marine Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

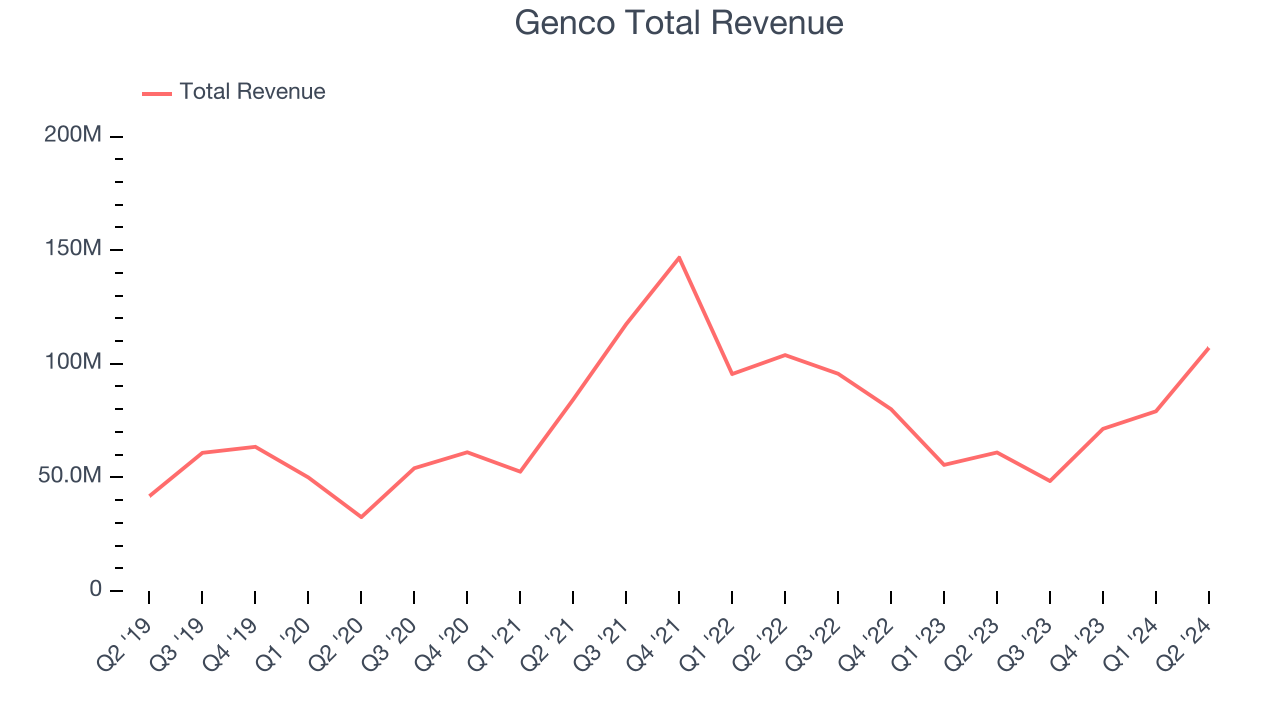

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one tends to grow for years. Over the last five years, Genco grew its sales at a mediocre 6.1% compounded annual growth rate. This shows it couldn't expand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Genco's history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 18.8% annually. Genco isn't alone in its struggles as the Marine Transportation industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Genco reported magnificent year-on-year revenue growth of 75.6%, and its $107 million of revenue beat Wall Street's estimates by 43.2%. Looking ahead, Wall Street expects revenue to decline 2.2% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

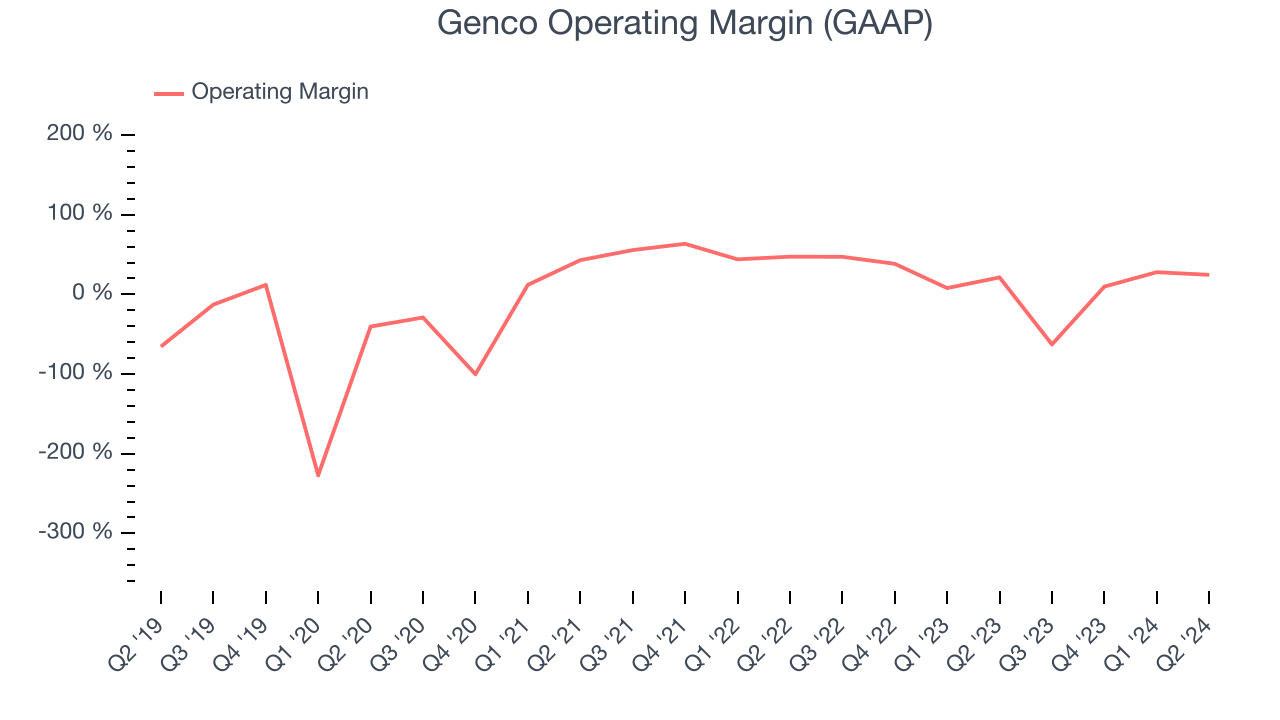

Operating Margin

Genco has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.6%. This result isn't surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Genco's annual operating margin rose by 69.5 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q2, Genco generated an operating profit margin of 24.6%, up 3.2 percentage points year on year. This increase was encouraging, and since the company's gross margin actually decreased, we can assume it was recently more efficient because its operating expenses like sales, marketing, R&D, and administrative overhead grew slower than its revenue.

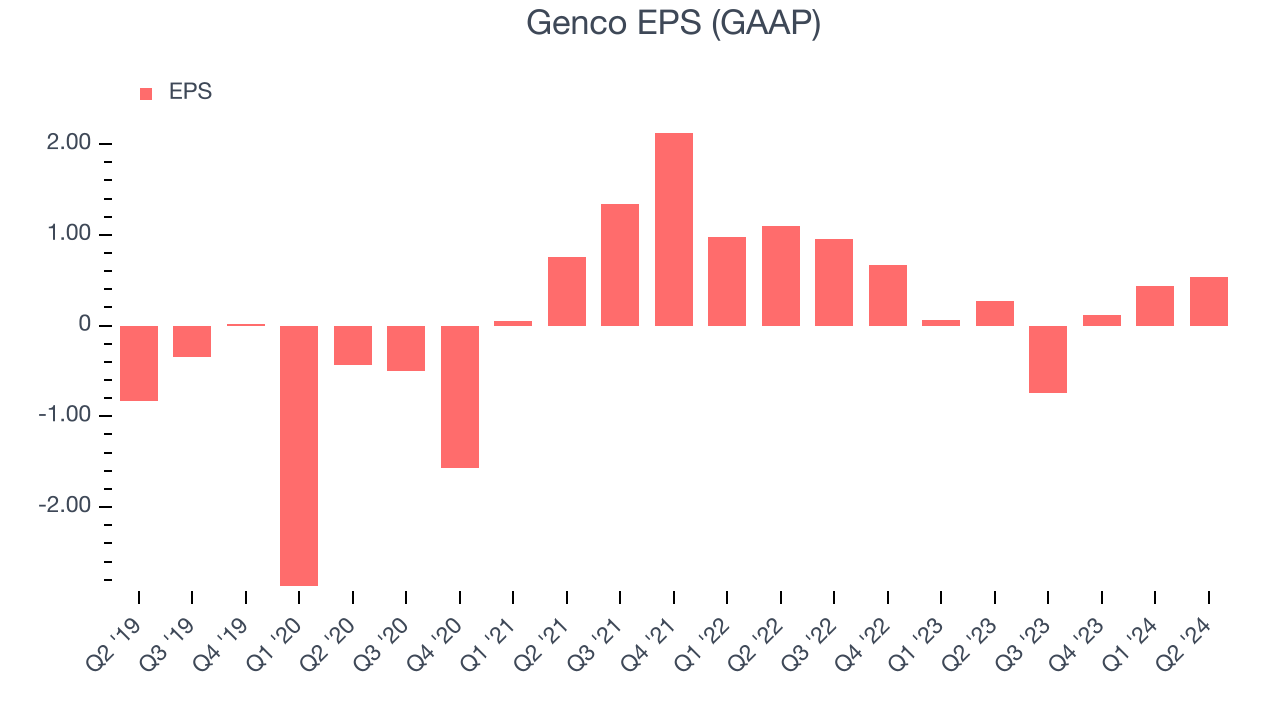

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Genco's full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it's at a critical moment in its life.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. Sadly for Genco, its EPS declined more than its revenue over the last two years, dropping by 75.3%. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

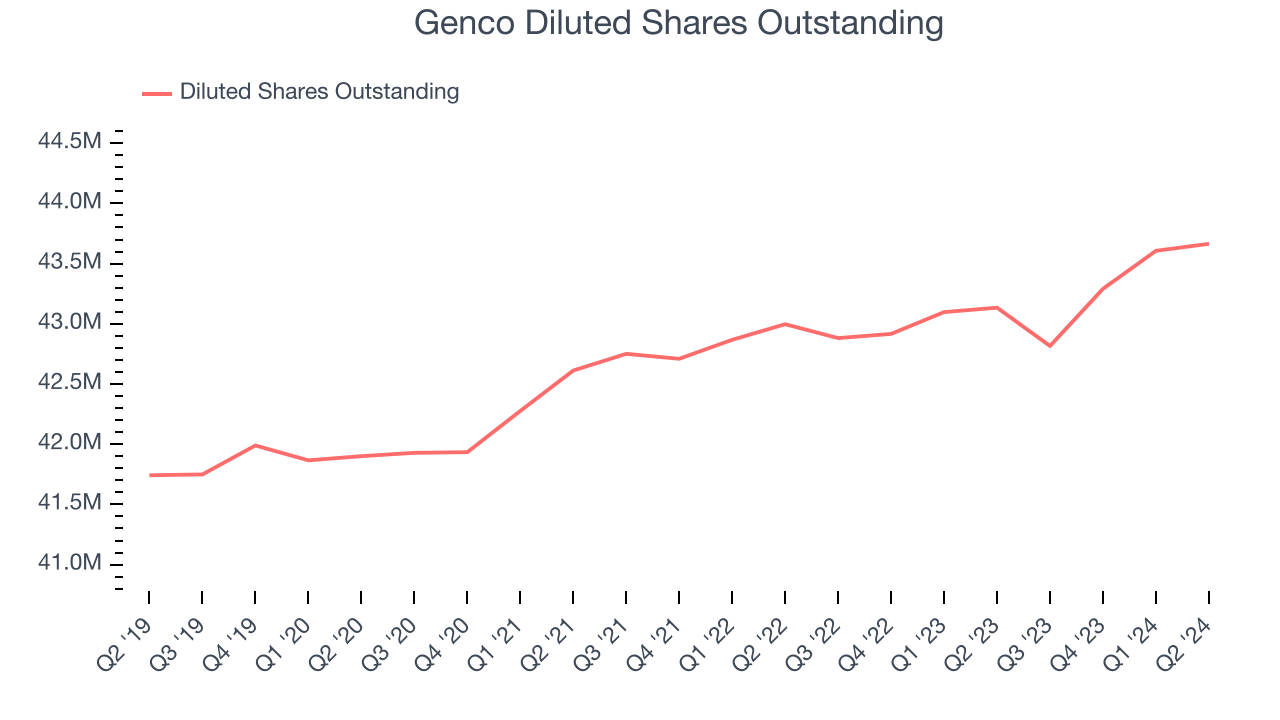

Diving into the nuances of Genco's earnings can give us a better understanding of its performance. While we mentioned earlier that Genco's operating margin improved this quarter, a two-year view shows its margin has declined 22.8 percentage points while its share count has grown 1.6%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q2, Genco reported EPS at $0.54, up from $0.27 in the same quarter last year. Despite growing year on year, this print missed analysts' estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Genco to grow its earnings. Analysts are projecting its EPS of $0.34 in the last year to climb by 344% to $1.50.

Key Takeaways from Genco's Q2 Results

We were impressed by how significantly Genco blew past analysts' revenue expectations this quarter. On the other hand, its EPS missed. Zooming out, we think this was a mixed quarter. The stock traded up 2.5% to $18.30 immediately after reporting.

So should you invest in Genco right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.