Golf equipment and apparel company Acushnet (NYSE:GOLF) fell short of analysts' expectations in Q2 CY2024, with revenue flat year on year at $683.9 million. On the other hand, the company's outlook for the full year was close to analysts' estimates with revenue guided to $2.48 billion at the midpoint. It made a GAAP profit of $1.11 per share, improving from its profit of $1.09 per share in the same quarter last year.

Is now the time to buy Acushnet? Find out by accessing our full research report, it's free.

Acushnet (GOLF) Q2 CY2024 Highlights:

- Revenue: $683.9 million vs analyst estimates of $709.8 million (3.7% miss)

- EPS: $1.11 vs analyst expectations of $1.17 (5.5% miss)

- The company reconfirmed its revenue guidance for the full year of $2.48 billion at the midpoint

- Gross Margin (GAAP): 54.4%, up from 53.5% in the same quarter last year

- Adjusted EBITDA Margin: 19.2%, in line with the same quarter last year

- Free Cash Flow of $196.8 million is up from -$116.8 million in the previous quarter

- Market Capitalization: $4.23 billion

Producer of the acclaimed Titleist Pro V1 golf ball, Acushnet (NYSE:GOLF) is a design and manufacturing company specializing in performance-driven golf products.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

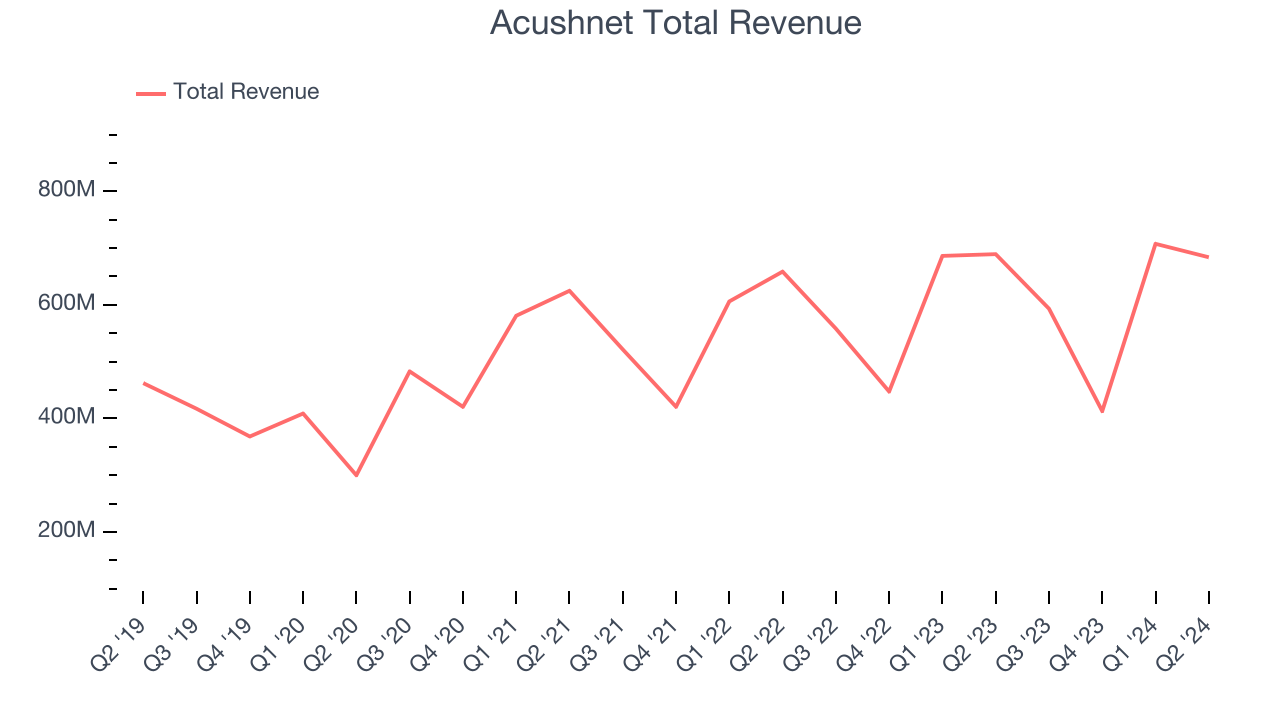

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Unfortunately, Acushnet's 8.3% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Acushnet's recent history shows its demand slowed as its annualized revenue growth of 4.2% over the last two years is below its five-year trend.

We can dig further into the company's revenue dynamics by analyzing its three most important segments: Titleist Balls, Titleist Clubs, and FootJoy, which are 36.2%, 26%, and 23% of revenue. Over the last two years, Acushnet's Titleist Balls (golf balls) and Titleist Clubs (golf clubs) revenues averaged year-on-year growth of 9.3% and 8.8% while its FootJoy revenue (apparel) averaged 4.3% declines.

This quarter, Acushnet missed Wall Street's estimates and reported a rather uninspiring 0.8% year-on-year revenue decline, generating $683.9 million of revenue. Looking ahead, Wall Street expects sales to grow 5.9% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

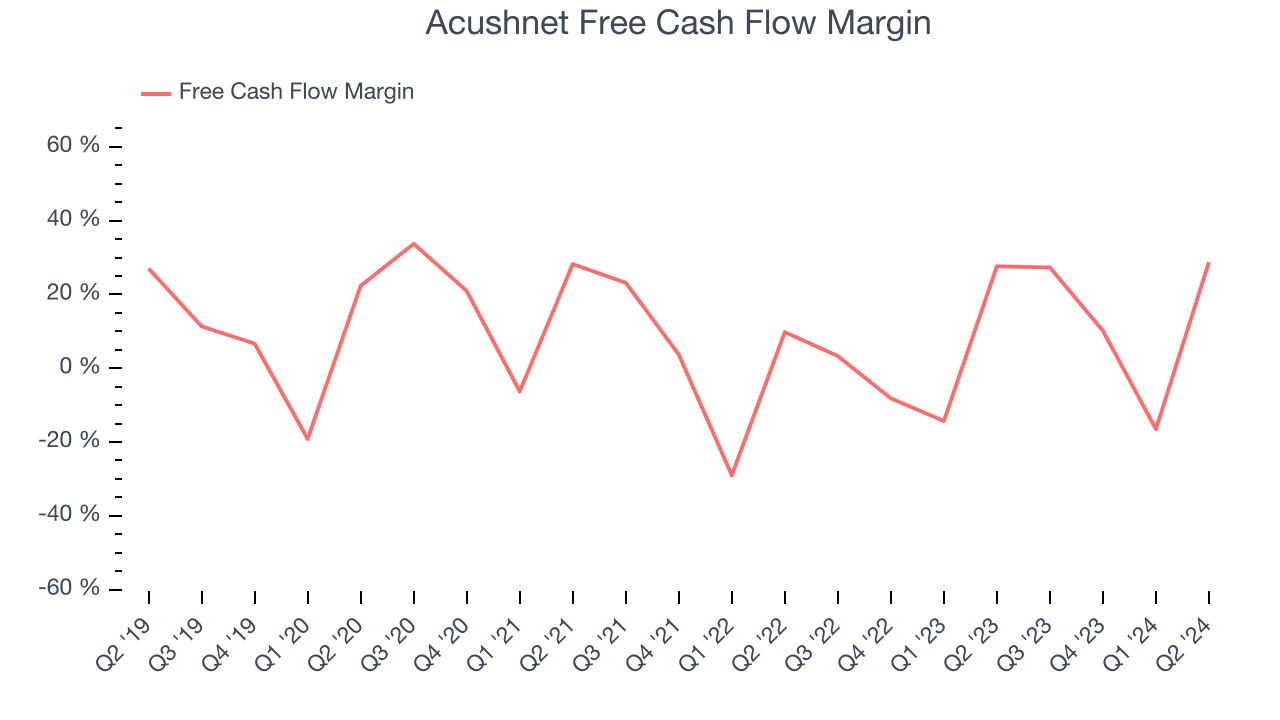

Acushnet has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.5%, subpar for a consumer discretionary business.

Acushnet's free cash flow clocked in at $196.8 million in Q2, equivalent to a 28.8% margin. This quarter's result was good as its margin was 1.1 percentage points higher than in the same quarter last year, but we wouldn't read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Acushnet's cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 11.8% for the last 12 months will increase to 13.3%, giving it more money to invest.

Key Takeaways from Acushnet's Q2 Results

We struggled to find many strong positives in these results. Its revenue and EPS unfortunately missed Wall Street's estimates due to underperformance in its Titleist Balls segment. Overall, this quarter could have been better. The stock remained flat at $66.50 immediately following the results.

Acushnet may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.