Golf equipment and apparel company Acushnet (NYSE:GOLF) announced better-than-expected results in Q1 CY2024, with revenue up 3.1% year on year to $707.6 million. The company expects the full year's revenue to be around $2.48 billion, in line with analysts' estimates. It made a GAAP profit of $1.35 per share, down from its profit of $1.36 per share in the same quarter last year.

Acushnet (GOLF) Q1 CY2024 Highlights:

- Revenue: $707.6 million vs analyst estimates of $689.1 million (2.7% beat)

- EPS: $1.35 vs analyst estimates of $1.24 (9.2% beat)

- The company reconfirmed its revenue guidance for the full year of $2.48 billion at the midpoint

- Gross Margin (GAAP): 53.4%, in line with the same quarter last year

- Free Cash Flow was -$116.8 million, down from $41.97 million in the previous quarter

- Market Capitalization: $4.00 billion

Producer of the acclaimed Titleist Pro V1 golf ball, Acushnet (NYSE:GOLF) is a design and manufacturing company specializing in performance-driven golf products.

Acushnet was founded in 1910 and has consistently focused on improving the golfing experience with high-quality equipment, influencing the standards for producing and using golf gear.

Although many people may not know Acushnet, it is recognized in the golf industry for its well-known brands such as Titleist and FootJoy. These brands offer an array of golf equipment, including balls, clubs, apparel, and accessories.

Sales of golf products are the primary source of revenue for Acushnet, and its goods are sold using a mixture of direct-to-consumer channels and collaborations with distributors. The company invests in research and development it improve its equipment, partnering with professional players to gather feedback for product development. Acushnet targets golfers who value superior equipment and has established a strong reputation, especially with its Titleist brand.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the golf equipment market include Topgolf Callaway (NYSE:MODG), Mizuno (TYO:8022), Nike (NYSE:NKE), Johnson Outdoors (NASDAQ:JOUT), and private companies TaylorMade, Ping, and Srixron.Sales Growth

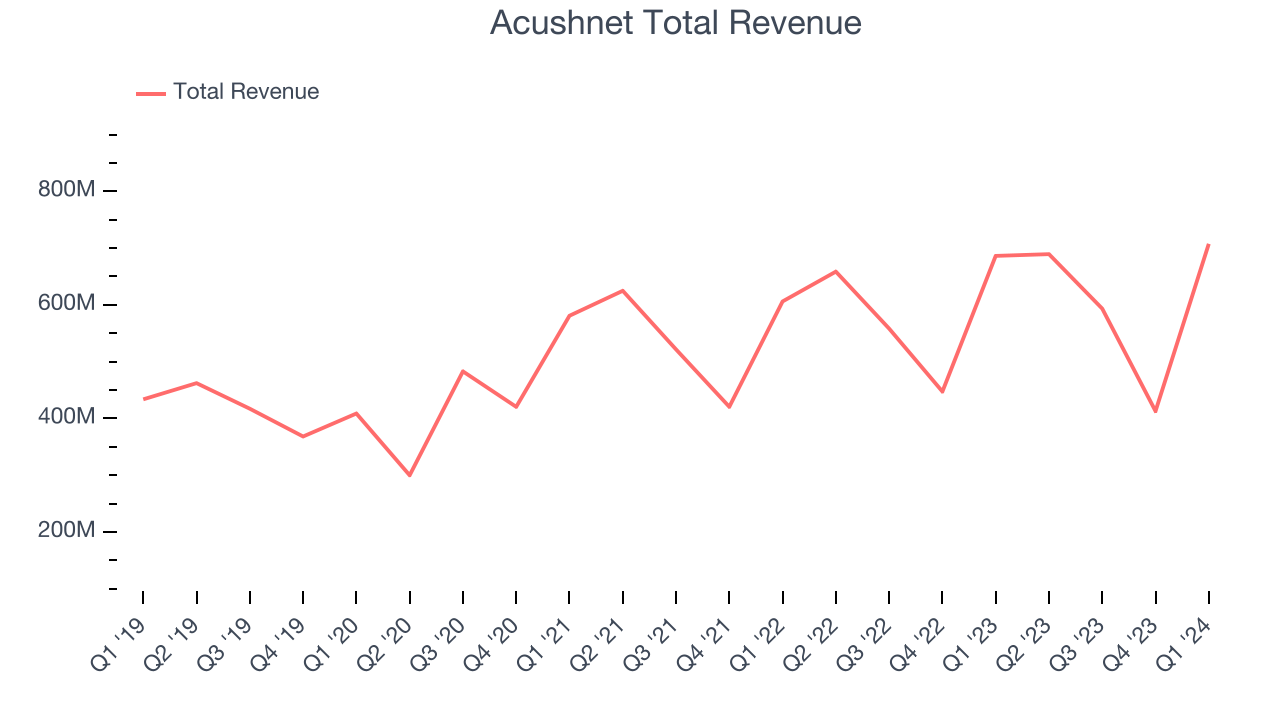

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Acushnet's annualized revenue growth rate of 8.1% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Acushnet's recent history shows the business has slowed as its annualized revenue growth of 5.2% over the last two years is below its five-year trend.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Acushnet's recent history shows the business has slowed as its annualized revenue growth of 5.2% over the last two years is below its five-year trend.

We can better understand the company's revenue dynamics by analyzing its three most important segments: Titleist Balls, Titleist Clubs, and FootJoy, which are 29.4%, 28.8%, and 27.2% of revenue. Over the last two years, Acushnet's Titleist Balls (golf balls) and Titleist Clubs (golf clubs) revenues averaged year-on-year growth of 8.7% and 10.4% while FootJoy (apparel) averaged 3.2% declines.

This quarter, Acushnet reported reasonable year-on-year revenue growth of 3.1%, and its $707.6 million of revenue topped Wall Street's estimates by 2.7%. Looking ahead, Wall Street expects sales to grow 4.9% over the next 12 months, an acceleration from this quarter.

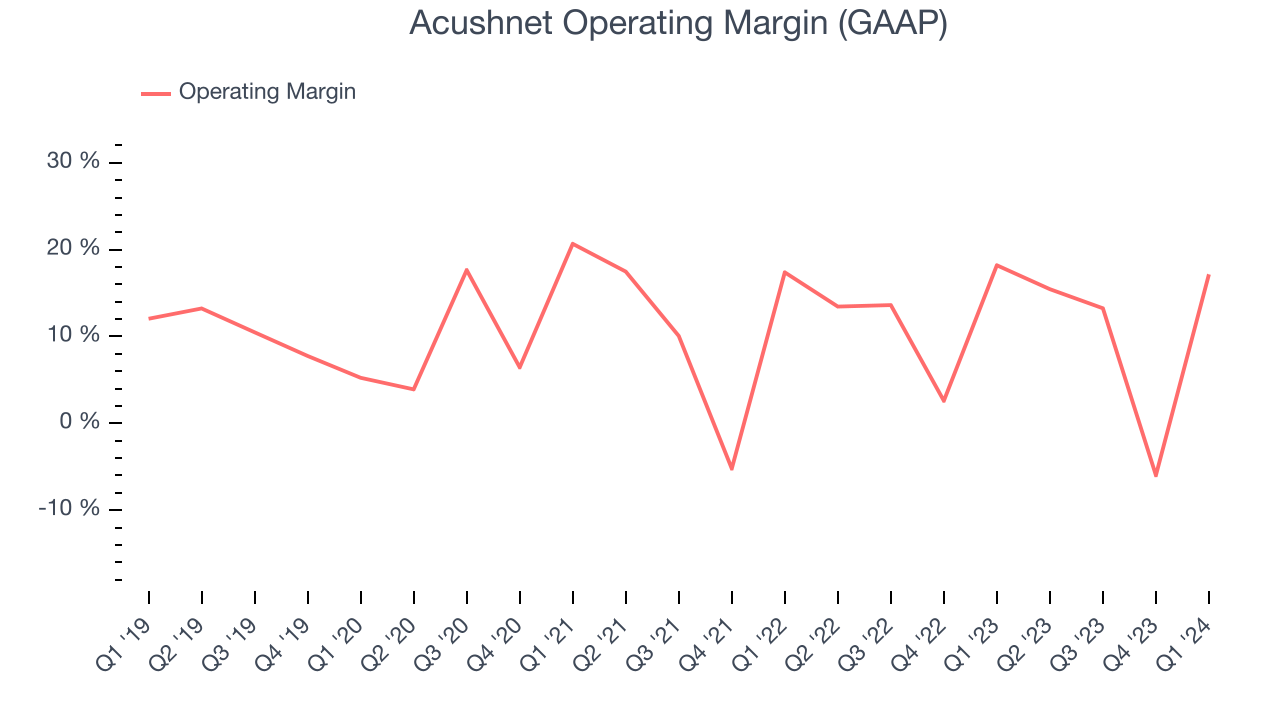

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Acushnet has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 12.3%, higher than the broader consumer discretionary sector.

In Q1, Acushnet generated an operating profit margin of 17.2%, down 1 percentage points year on year.

Over the next 12 months, Wall Street expects Acushnet to become more profitable. Analysts are expecting the company’s LTM operating margin of 11.7% to rise to 13.2%.EPS

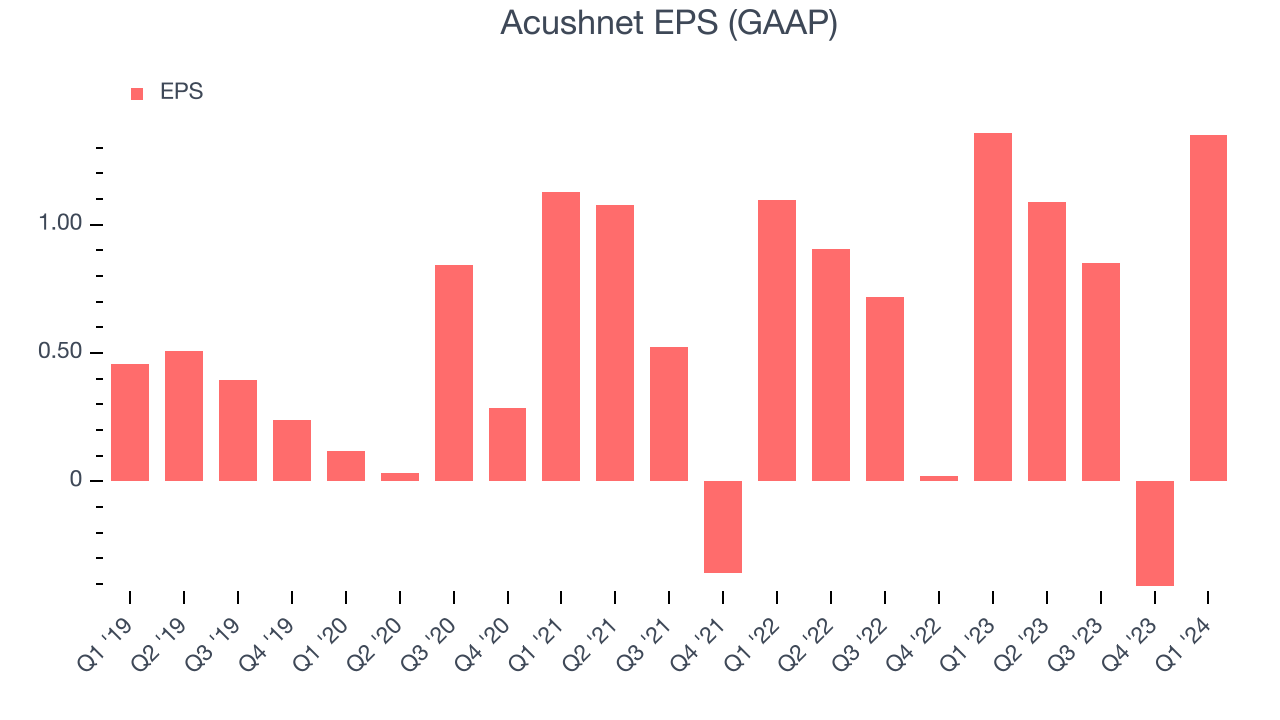

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Acushnet's EPS grew 133%, translating into a remarkable 18.5% compounded annual growth rate. This performance is materially higher than its 8.1% annualized revenue growth over the same period. Let's dig into why.

While we mentioned earlier that Acushnet's operating margin declined this quarter, a five-year view shows its margin has expanded 5.1 percentage points while its share count has shrunk 14.9%. Improving profitability and share buybacks are positive signs as they juice EPS growth relative to revenue growth.In Q1, Acushnet reported EPS at $1.35, in line with the same quarter last year. This print beat analysts' estimates by 9.2%. Over the next 12 months, Wall Street expects Acushnet to grow its earnings. Analysts are projecting its LTM EPS of $2.88 to climb by 21.4% to $3.49.

Cash Is King

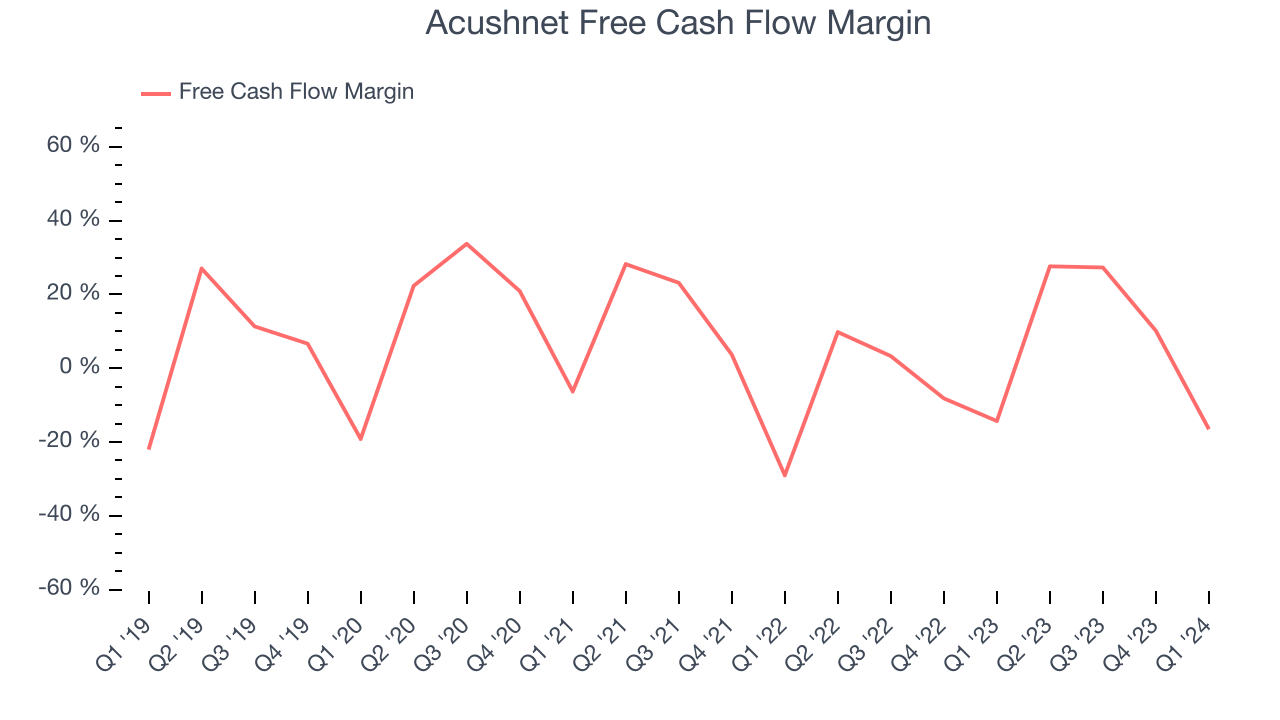

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Acushnet has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 4.8%, subpar for a consumer discretionary business.

Acushnet burned through $116.8 million of cash in Q1, equivalent to a negative 16.5% margin, reducing its cash burn by 19% year on year.

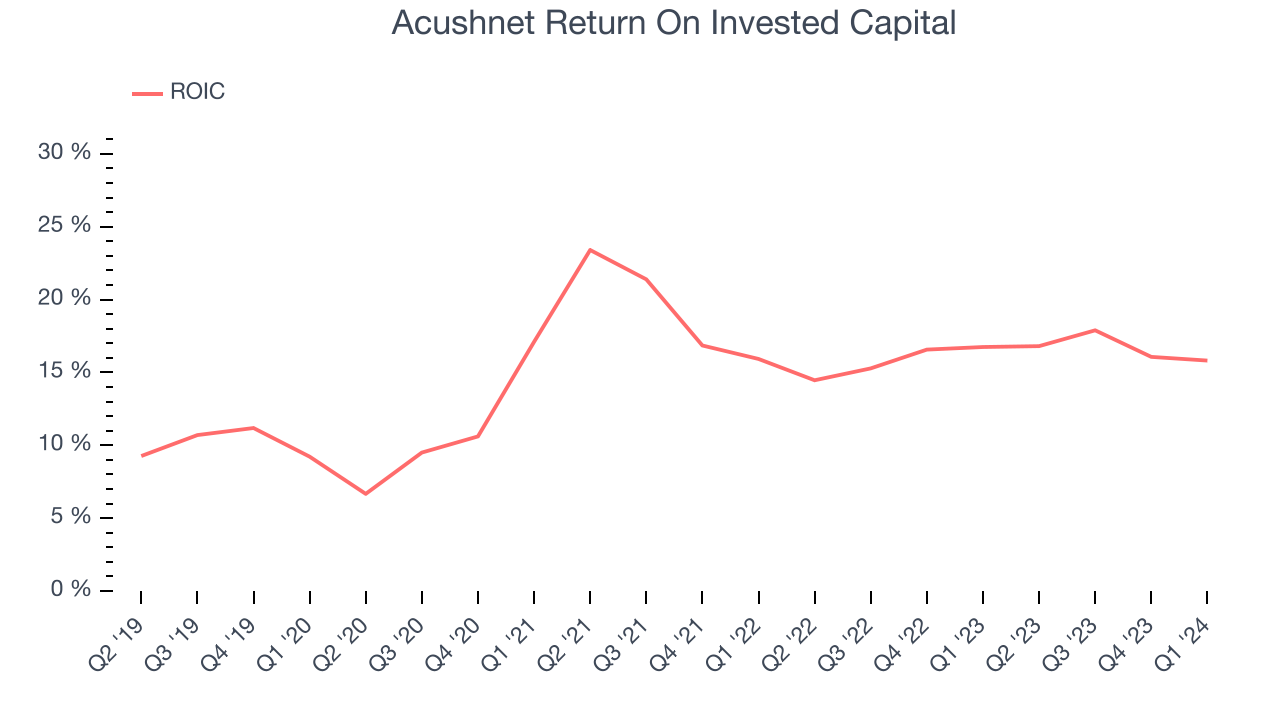

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Acushnet's five-year average return on invested capital was 15%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Acushnet's ROIC averaged 3.1 percentage point increases. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Acushnet reported $48.72 million of cash and $864.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $383 million of EBITDA over the last 12 months, we view Acushnet's 2.1x net-debt-to-EBITDA ratio as safe. We also see its $18.32 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Acushnet's Q1 Results

It was good to see Acushnet beat analysts' revenue expectations this quarter. We were also glad its EPS outperformed Wall Street's estimates. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is flat after reporting and currently trades at $63.65 per share.

Is Now The Time?

Acushnet may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Acushnet, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, unfortunately, its low free cash flow margins give it little breathing room.

Acushnet's price-to-earnings ratio based on the next 12 months is 16.2x. While there are some things to like about Acushnet and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $70.63 per share right before these results (compared to the current share price of $63.65).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.