Auto and industrial parts retailer Genuine Parts (NYSE:GPC) fell short of analysts' expectations in Q1 CY2024, with revenue flat year on year at $5.78 billion. It made a non-GAAP profit of $2.22 per share, improving from its profit of $2.14 per share in the same quarter last year.

Genuine Parts (GPC) Q1 CY2024 Highlights:

- Revenue: $5.78 billion vs analyst estimates of $5.84 billion (0.9% miss)

- EPS (non-GAAP): $2.22 vs analyst estimates of $2.16 (2.5% beat)

- Full year EPS guidance raised to $9.88 at the midpoint vs. previous midpoint of $9.80 (1.0% beat)

- Gross Margin (GAAP): 35.9%, up from 34.9% in the same quarter last year

- Free Cash Flow of $202.6 million, up 85.2% from the same quarter last year

- Same-Store Sales were down 0.9% year on year

- Store Locations: 10,700 at quarter end, increasing by 700 over the last 12 months

- Market Capitalization: $20.09 billion

Largely targeting the professional customer, Genuine Parts (NYSE:GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

These customers include mechanics, maintenance technicians, and other industrial service professionals. However, some brands carried by Genuine Parts, such as NAPA Auto Parts cater to do-it-yourself (DIY) customers. This brand’s wide range of auto parts and accessories means that the ‘average Joe’ can find products he can work with, especially since Genuine Parts stores are staffed with knowledgeable associates willing to help any customer.

Aside from the well-known NAPA brand, Genuine Parts carries other trusted auto parts brands such as ACDelco, Bosch, and Gates. These names offer everything from spark plugs to carburetors in auto. With regards to industrial products, the company carries power transmission, electrical, and wiring products from brands such as 3M, Motion Industries, Wagner, EIS, and Inenco.

Genuine Parts stores range from 2,500 to 12,500 square feet depending on the location. These stores can be found in urban and suburban areas, often strategically placed in proximity of auto body shops and industrial parks where customers may operate. In addition to the store footprint, Genuine Parts has an e-commerce presence, launched in 1999, where customers can search and purchase products online, with options for in-store pickup or delivery.

Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Competitors offering auto and/or industrial parts include Advance Auto Parts (NYSE:AAP), AutoZone (NYSE:AZO), Grainger (NYSE:GWW), and Fastenal (NASDAQ:FAST).Sales Growth

Genuine Parts is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

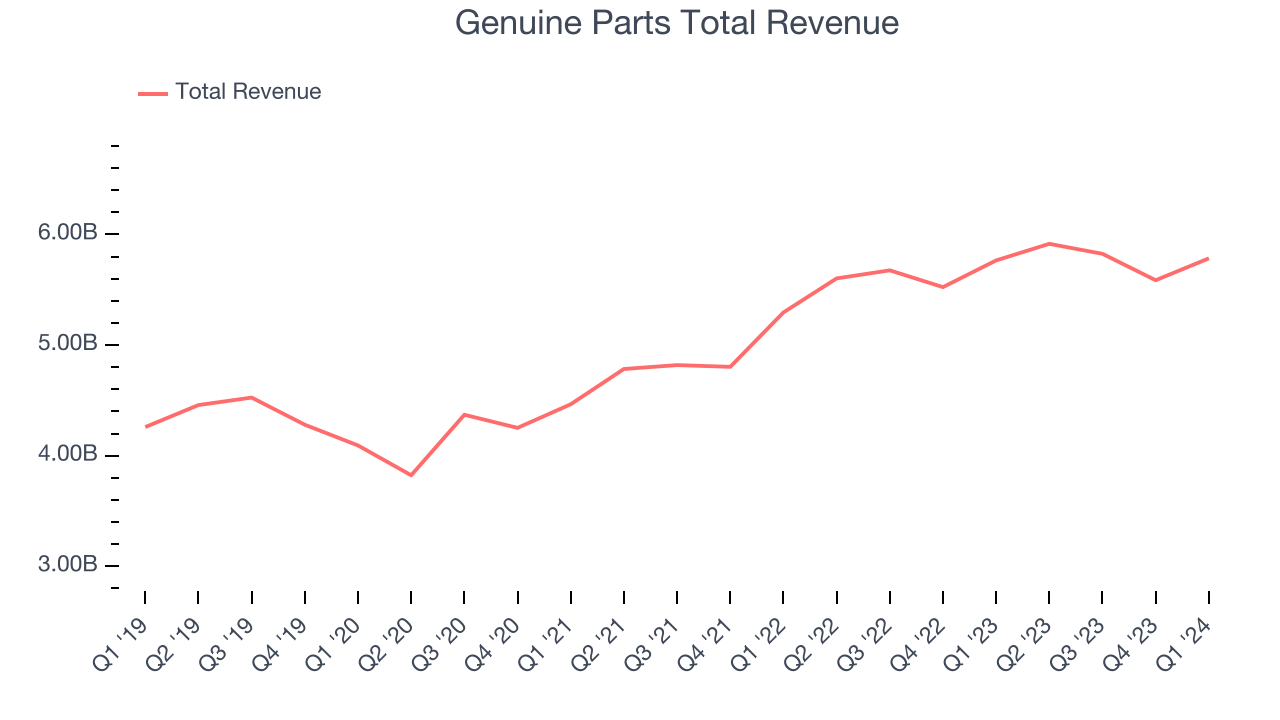

As you can see below, the company's annualized revenue growth rate of 4.7% over the last five years was weak as its store footprint remained relatively unchanged, implying that growth was driven by more sales at existing, established stores.

This quarter, Genuine Parts's revenue grew 0.3% year on year to $5.78 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 4.2% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

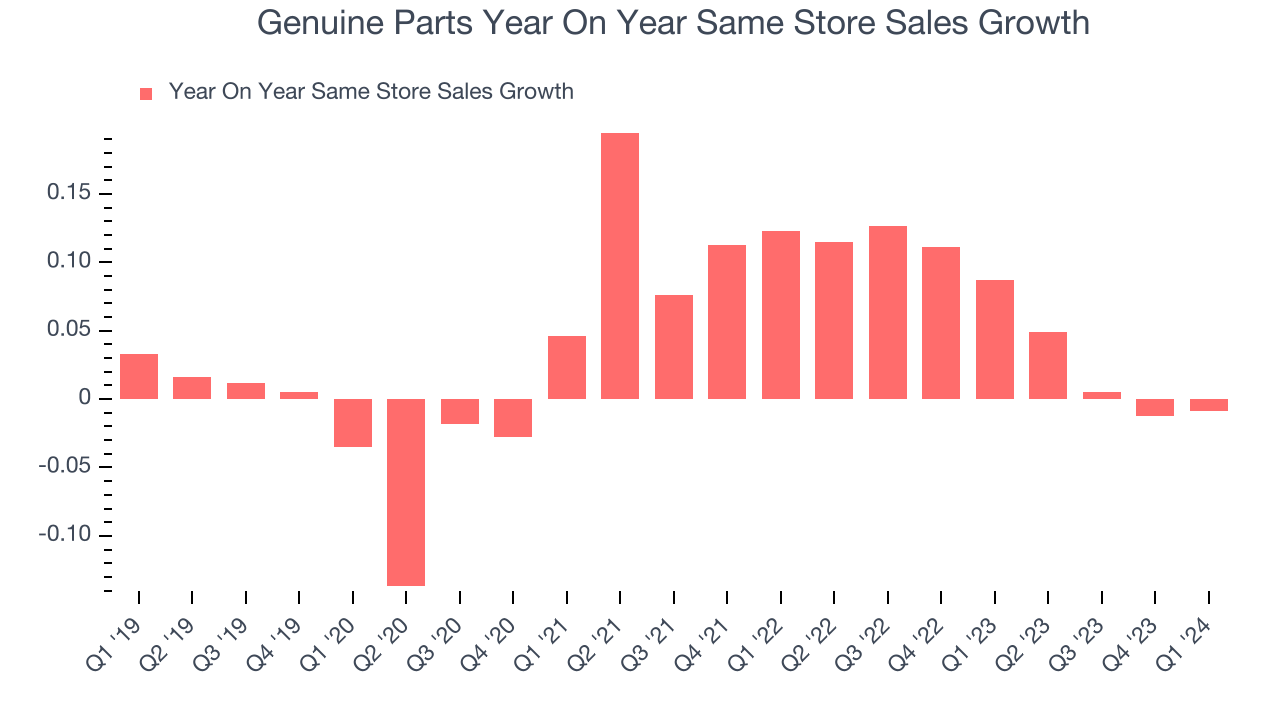

Genuine Parts's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 5.9% year on year. Given its flat store count over the same period, this performance stems from increased foot traffic at existing stores or higher e-commerce sales as the company shifts demand from in-store to online.

In the latest quarter, Genuine Parts's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 8.7% year-on-year increase it posted 12 months ago. We'll be watching Genuine Parts closely to see if it can reaccelerate growth.

Number of Stores

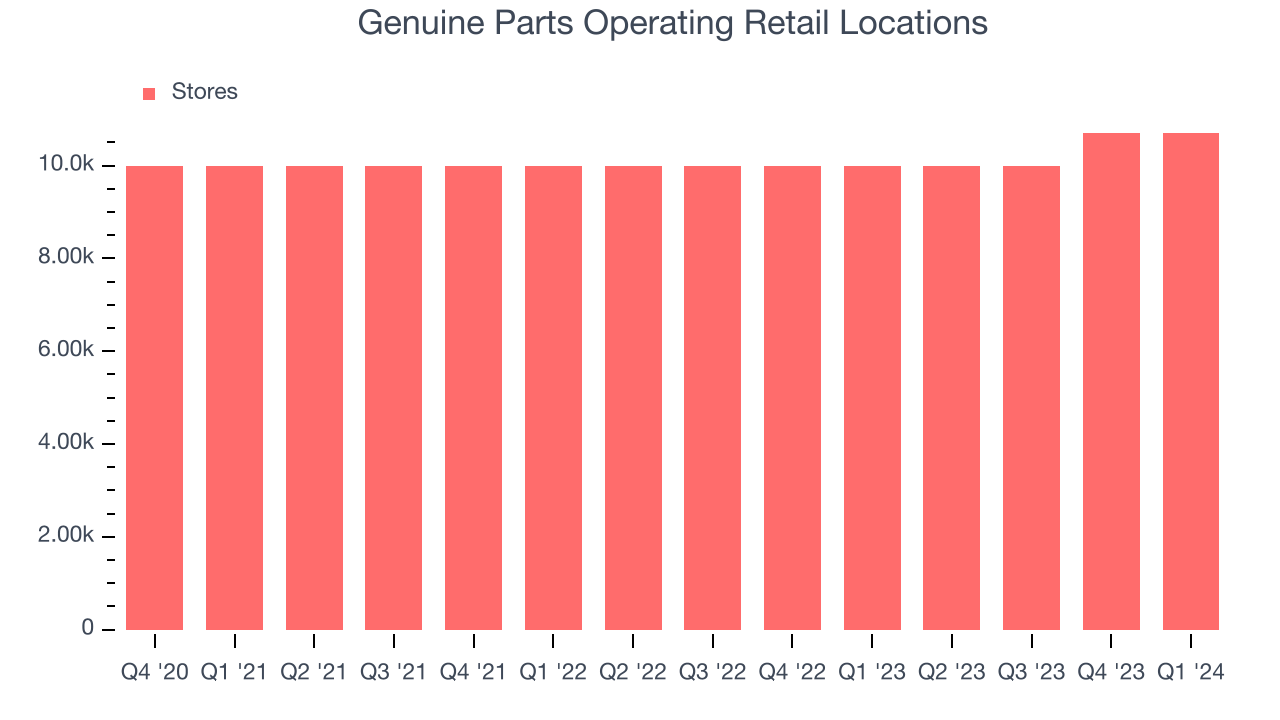

When a retailer like Genuine Parts keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. Since last year, Genuine Parts's store count increased by 700 locations, or 7%, to 10,700 total retail locations in the most recently reported quarter.

Taking a step back, the company has only opened a few new stores over the last eight quarters, averaging 1.8% annual growth in new locations. Although it's expanded its presence, this sluggish store growth lags other retailers. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Gross Margin & Pricing Power

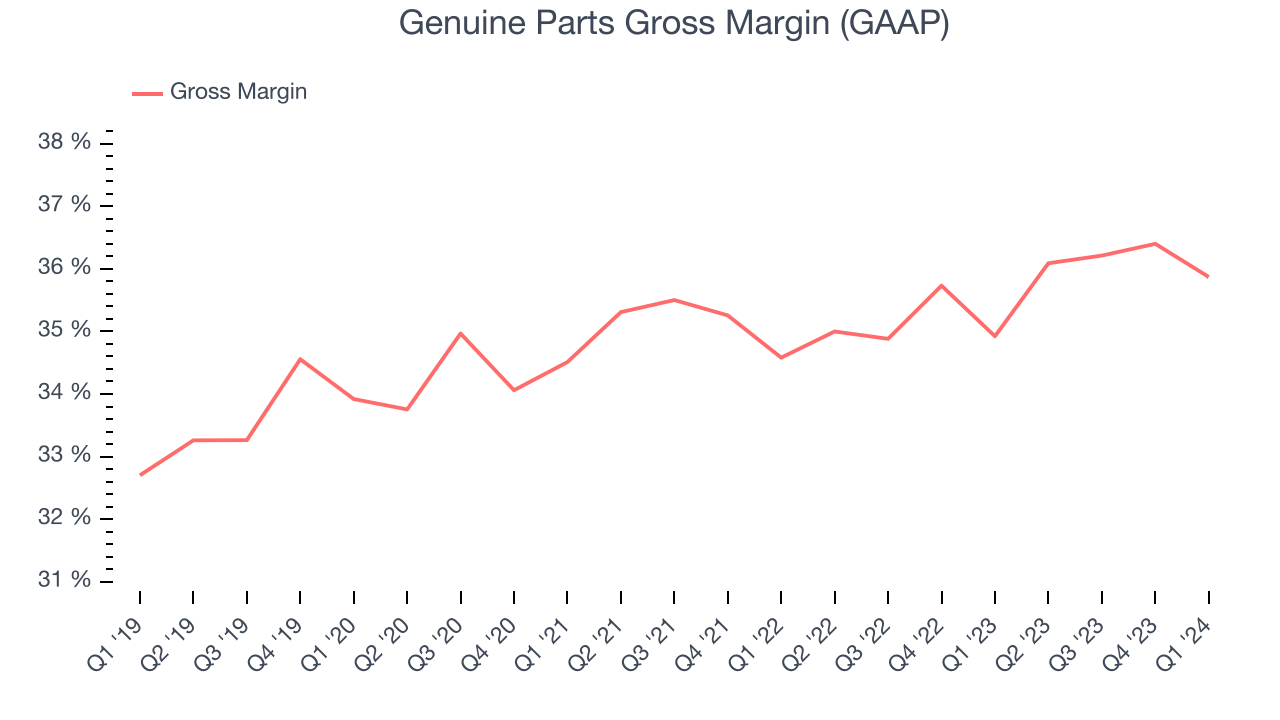

Genuine Parts's unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it's averaged a decent 35.6% gross margin over the last eight quarters. This means the company makes $0.36 for every $1 in revenue before accounting for its operating expenses.

Genuine Parts's gross profit margin came in at 35.9% this quarter, flat with the same quarter last year. This steady margin stems from its efforts to keep prices low for consumers and signals that it has stable input costs (such as freight expenses to transport goods).

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Genuine Parts generated an operating profit margin of 7.1%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Genuine Parts was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer retail business, producing an average operating margin of 7.5%. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.

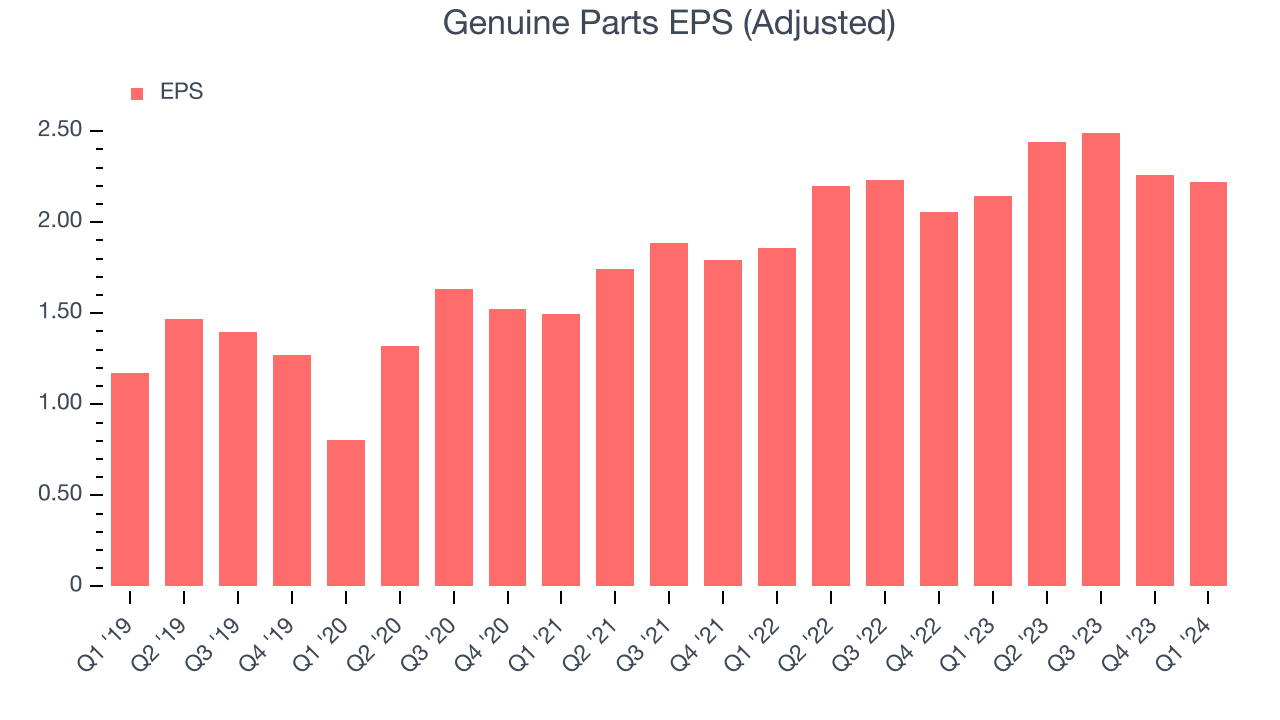

EPS

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Genuine Parts reported EPS at $2.22, up from $2.14 in the same quarter a year ago. This print beat Wall Street's estimates by 2.5%.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 5.9% year-on-year increase in EPS.

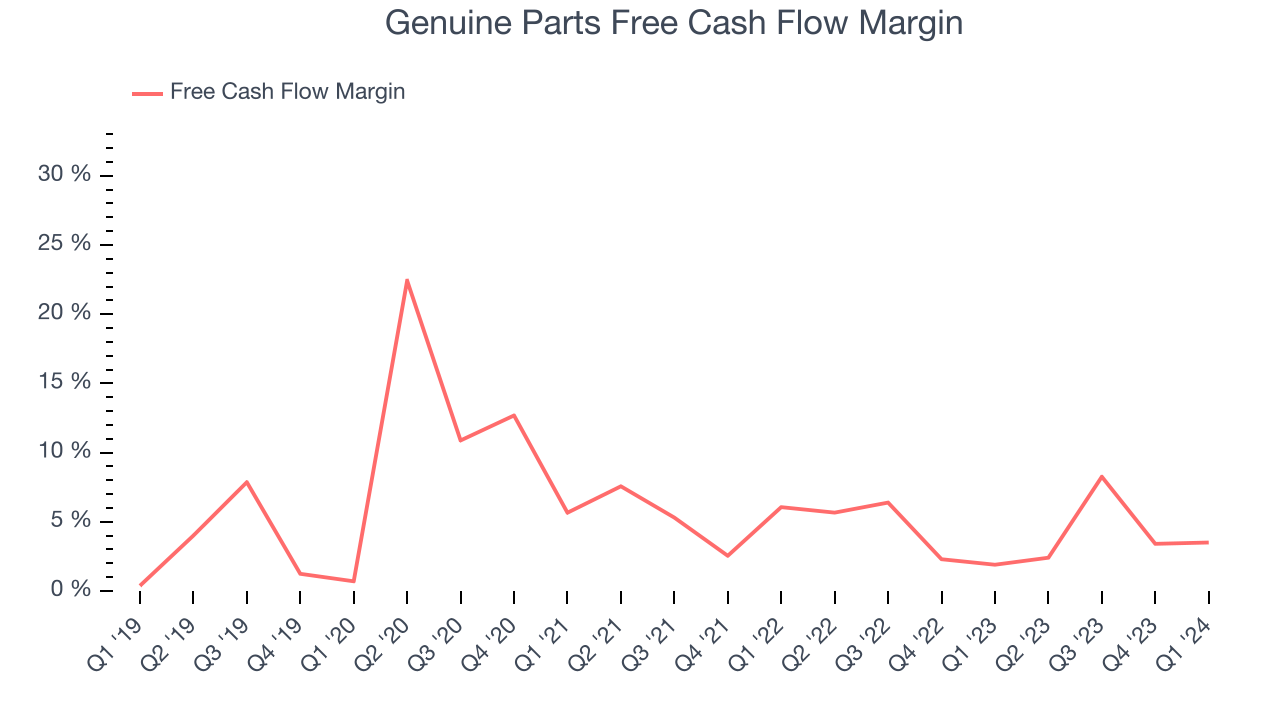

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Genuine Parts's free cash flow came in at $202.6 million in Q1, up 85.2% year on year. This result represents a 3.5% margin.

Over the last eight quarters, Genuine Parts has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 4.2%, well above the broader consumer retail sector. Furthermore, its margin has been flat, showing that the company's cash flows are relatively stable.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Genuine Parts's five-year average ROIC was 15.7%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, Genuine Parts's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Genuine Parts's ROIC averaged 1.9 percentage point increases. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Genuine Parts reported $1.05 billion of cash and $4.95 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $2.15 billion of EBITDA over the last 12 months, we view Genuine Parts's 1.8x net-debt-to-EBITDA ratio as safe. We also see its $29.92 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Genuine Parts's Q1 Results

It was good to see Genuine Parts beat analysts' gross margin expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its revenue unfortunately missed analysts' expectations. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 2.4% after reporting and currently trades at $147.44 per share.

Is Now The Time?

Genuine Parts may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Genuine Parts isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been a little slower over the last five years. And while its popular brand makes consumers more likely to purchase its products, the downside is its poor same-store sales performance has been a headwind. On top of that, its low growth in new store openings show it's focused on existing locations.

Genuine Parts's price-to-earnings ratio based on the next 12 months is 14.5x. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Genuine Parts, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $153.40 per share right before these results (compared to the current share price of $147.44).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.